Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

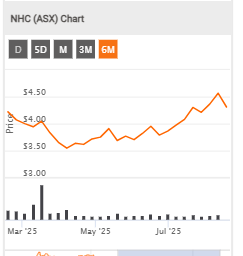

Valuation 22 Oct 2025, fair price $5.90, price at time of writing $3.80

TLDR

- I’ve dug into New Hope as a result of Gaurav Sodhi at Intelligent Investor putting a Buy on the company, as well as recent supporting posts on Strawman by @Rocket6 and @PhilO.

- I agree with @Bear77’s recent caution about assuming the large dividends will continue to flow from New Hope. But I still see the possible upside being much larger than the risks for New Hope.

- Weighing equally across bull, bear and base cases, I get a current fair price around $5.90 and estimate a 5-year ROI of 19% pa. To achieve a required rate of return of 15% I get a buy price of $4.70 or less.

- At the current price around $3.80, New Hope is a buy for me.

Bull case

- New Hope is widely regarded as a well run company with respected management, a cost base in the lowest quartile of miners, producing high quality coal.

- Two new mines have only recently started contributing revenue, with output expected grow roughly 40% over the next 5 years.

- Expenses and capex are expected to decline in the coming years.

- Coal prices have dropped substantially over the last 3 years, impacting the profitability and viability of many competitors, potentially reducing competition and helping create a floor around coal prices.

- The dividend of 15c in the last half year annualises to a fully franked yield of 7.5%.

- Soul Patts is the major owner with almost 40% of shares. And the Millner family (Robert Millner is Chair of Soul Patts, Robert and Thomas Millner are Directors of New Hope) own another $60m (2%), with ownership increasing in the last year.

- Although forecasting that the percentage contribution of coal to total global energy supply will decline, the International Energy Agency expects that absolute demand for coal in total tonnes will remain relatively stable over the next 20 years. In particular, Asia has a fleet of relatively young low emission coal-fired power stations requiring good quality coal.

- The coal industry has come through a trough of sentiment associated with heightened concerns about ESG and climate change. However, many are predicting that the energy transition will be slower than the market is currently pricing, and negative ESG sentiment is softening.

- The 2022 spike coal price and share price (as a result of a perfect storm of post-Covid recovery and shortages, weather impacts on mines, and the Ukraine war commencing) show the possible extreme upside for coal miners and shareholders.

- Despite a recent drop in coal prices, FY25 was tremendously profitable for New Hope with 24% statutory NPAT.

- New Hope has an exceptional balance sheet with only 11% debt:equity.

- Shares outstanding have changed little, increasing roughly 10% over the last 15 years.

- The PE of 8 is low compared to other industries, and only slightly above a longer-term average around 7 for New Hope.

- Bull case valuation:

- Note: prices in this post are in A$ unless specifically stated as US$.

- Let’s assume New Hope hit their output targets of 14m tonne in FY28 and 15mt in FY30 (40% growth over FY25).

- Say during that time coal prices get back to a recent peak around US$150 ($225) /tonne (25% growth over FY25, and $45/t higher than FY25; this is still way below the Covid/Ukraine peak above $600/t).

- That would be revenue around $1.8b x 1.4 x 1.25 = $3.15b.

- Say costs stay flat with efficiencies offsetting inflation. Earnings could be $64/t (FY25 earnings) + $45/t = ~$110/t (50% net margin) and FCF could be $27/t (FY25 FCF) + $45/t = ~$70/t (30% FCF yield).

- With revenue of $3.1b, NPAT $1.5b, 10% dividend, PE of 7, and 0% dilution, the FY30 market cap will be around $11b with a FY30 share price around $13. Discounting 10% we get a current fair price of $11.80, and a 5-year ROI of 36% pa.

Bear case

- Coal is a dying industry at the frontline in the battle against climate change. There are significant risks that governments and investors impose tightening constraints and costs on the activities of coal miners.

- At current coal prices, having already dropped roughly 10% from FY25 levels, the recent dividend yield of 7.5% is unsustainable.

- With any further drops in coal prices, the impact on earnings, and especially FCF, is proportionally much higher. Assuming other costs remain unchanged, a further drop in coal prices of $10 (only a 6% decline) could wipe out all FCF.

- Global coal prices are traded in US$, so any further decline in US$:A$ will impact revenues and have an outsized impact on margins (but of course the opposite is true if the US$ strengthens).

- Coal prices are commoditised. Other than a low cost base, New Hope has no moat.

- Bear case valuation:

- Perhaps New Hope misses its own targets and instead achieves a more conservative output of 13mt in FY30 as suggested by Morningstar (about 20% overall growth or 4% pa).

- Say coal prices continue to drop 2% a year to around US$95 ($145) /t (a little above the average of 2016-2021 pre-Covid/Ukraine spike; 20% and $35/t below FY25). It is unlikely that prices could fall much below this amount given it would mean a large majority of miners (maybe 3/4) would be operating at a loss.

- That would be roughly a no-growth scenario, so FY30 revenue remains around $1.8b same as FY25.

- Say costs stay flat with efficiencies offsetting inflation. Earnings could be $30/t (~20% net margin) and FCF could be $0. Dividend will be driven by FCF so could be postponed.

- With revenue of $1.8b, NPAT $360m, no dividend, PE of 7, and 10% dilution, the FY30 market cap will be around $2.5b with a FY30 share price around $2.7. Discounting 10% we get a current fair price around $1.85, and a 5-year ROI of -5% pa.

Base case

- My base case sits between the above bull and bear cases, with a FY30 revenue around $2.4b, 35% NPAT of around $830m, and a sustainable dividend around 5%.

- Weighing equally across these bull, bear and base cases, I estimate a FY23 market cap around $6.4b, and a FY30 share price around $7.50. Discounting 10% pa I get a current fair price around $5.90 and a 5-year ROI of 19% pa. To achieve a required rate of return of 15% I get a buy price of $4.70 or less.

- There are significant risks, but a bull case upside of achieving 4x outweighs the bear case risks of capital shrinking 50%.

- At the current price around $3.80, New Hope is a buy for me.

I ran various DCF scenarios to provide some awareness of share price movement based on modifications to the model. Most of these consistently returned a share price in excess of $7.00, but noting the nature of the industry (unpopular, out of favour and slowly dying) I have modified the model to ensure a margin of safety, which I will include below.

Within my DCF I forecast out three years, with shares outstanding recorded as 850m and terminal growth rate of 2%. I have used an aggressive discount rate for safety (15%) and dialled back the growth a little (8% p/a -- conservative noting their output of 10.7m should reach close to or exceed 15m in a few years time). This gives me a current share price of $5.50.

Took a position in New Hope this week, with the share price under $4. @PhilO I agree with much of what you have said. This is a magnificent business -- perhaps a little boring/big for me as a typical small cap investor -- but history supports that boring businesses can be the best ones.

For transparency, my satellite portfolio is where I keep my smaller (market cap) positions. This doesn't fit the bill for that. I have been wanting to buy New Hope for well over a year now for my super portfolio (typically consists of my larger cap holdings like Codan, Jumbo, MinRes and the like). New Hope finds a home amongst those.

Thesis: relates to their growing output, lowering costs and top class management team.

The industry for obvious reasons is unpopular and outdated, and we shouldn't see any new investment into coal mines outside of the key few existing players. On that note, New Hope are one of a very small few coal players that are seeking to increase production. Coincidentally this probably means New Hope won't trade at a premium, but I expect them to spit out loads of cash over the next few years and continue to benefit from a lack of widespread investment in the sector and a slow-to-innovate federal government. I don't like the fact we are so reliant on coal as a country, but this doesn't change the fact that we are.

In FY25, New Hope's saleable output was 10.7m tonnes. Conservatively, this will increase a few million tonnes over the next few years. With rising production and operating leverage kicking in as they grow/expand, dividends are likely to be well supported. But that relates to the current market position where coal prices are in the toilet (having decreased) and most competitors are struggling to make a buck -- all while New Hope continue to print cash, with output growing and costs expected to continue to decrease. Consequently, with a net cash position of around 450m, risk is very low here, but there is plenty of blue sky opportunity ahead with any subsequent improvement of the cycle or supply issues. In the meantime, let's assume a 10% fully franked dividend yield (or similar) while I wait for said blue skies. Not bad, right?

Perhaps strategically, this is also a bit of a hedge in an increasingly expensive market. That said, I still expect this to deliver market-beating returns.

Valuation wise, a trailing PE of 8x seems reasonable to me. Without any major hiccups in terms of risks (mentioned below), my DCF returned a share price in excess of $7.00 using various scenarios. As above, i think New Hope is attractive at these levels.

Risks include infrastructure and weather related events, regulatory/environmental risk and commodity volatility.

Disc - held

I'm really not excited about mining, particularly coal mining and I get the ethical concerns. But seriously, the relative value here at the moment compared to other parts of the market is too high to ignore.

Take New Hope: it currently pays what looks like a relatively sustainable dividend yield of around 10%, even with coal prices subdued. Production is set to double, backed by proven management and it has a sensible balance sheet.

I think investing is about breaking one's rules selectively..Looking at valuations in other parts of the market, this is one of those times.

Underlying EBITDA5 of $93.4 million for the quarter, a 39.9 per cent reduction from the previous quarter driven by lower sales volumes at Bengalla Mine, which were impacted by logistics constraints and significant weather events in the Hunter Valley. >>>>>>>>>> so next quarter i expect a good result!!!

Highlights1 •

Twelve-month moving average TRIFR2 was 3.22 at the end of the quarter, an improvement from 3.65 at the end of the previous quarter.

• Group saleable coal production of 10.7Mt for the 2025 financial year, 18.1 per cent higher than the 2024 financial year, and within guidance range, following a strong operational performance at New Acland Mine.

• Bengalla Mine achieved an FOB3 cash cost (excluding state royalties) of $76.5 per sales tonne for the 2025 financial year, comfortably within guidance range and a reduction of 1.7 per cent on the previous financial year.

• Average realised sales price of $131.3/t 4 achieved for the quarter, an 11.0 per cent decrease from the previous quarter driven by lower API-5 index pricing and a larger proportion of highash sales in order to manage contractual commitments and stockpile balances.

• Underlying EBITDA5 of $765.8 million for the 2025 financial year.

• Underlying EBITDA5 of $93.4 million for the quarter, a 39.9 per cent reduction from the previous quarter driven by lower sales volumes at Bengalla Mine, which were impacted by logistics constraints and significant weather events in the Hunter Valley.

• Cash generated from operating activities was $570.8 million for the 2025 financial year, with available cash6 of $707.3 million as at 31 July 2025.

Grossed up Dividend yield: 13.51% which is very nice at $4.33 ..which is close to my purchase price!!

But the Free cash flow looks to be digressing so this is Hold or Sell for me.

3yr return incl dividend is 11%pa

New Hope Corporation Limited (NHC) is involved in the exploration, development, production and processing of coal, oil and gas, as well as marketing and logistics. With an Average Daily Trade of $7,293,000 it's a large cap stock.

- Price/Operating Cash is very low at 4.20

- growth/PE > 1.5

- Yield>Bank Debt

- Financial health is consistent

This meeting looks to be a standard AGM .. no hybrid video link.

Climate Activists could on the march

R. Miller - Acquired 300,000 Ordinary Shares ...So Total holding ~ 5,522,000 comes in at x $5.5 = $30,371,000

21/09/22: Next Pay the Divi 56cps Ex- divi 25/10/22

Near term trade price $6.50 ( bear case )

1/ Guess Q4 2023 Bear Trend Case Trade Multiple of 5 x

So Calculated Price ~ $8

2/ Q4 2023 on this trend with a tail wind with Macro instability Trade multiple accelerates to 10 x

Calculated Price ~ $17

Dividend 56cps = 31 + 25 > divi + Special divi ( Ex-Dividend 24th Oct.) .A rise in fuel prices increased the underlying cost base by 23%, while the average sales price increased 178% over the same period. We expect inflation to be a headwind into 2023. However, our focus is security of supply and maximising margins

Its a hotty, Good while the demand is there. FINANCIAL RESULTS RELEASE (markitdigital.com)

New South Wales Operations – 80% Owned: Sales volumes were 5.2% higher than previous quarter with a significant amount of coal stockpiled due to Hunter Valley logistics constraints during the month of July. This significant stockpile balance will provide a strong sales runway for the new financial year.

Bridgeport Energy Oil prices continued to remain high during the quarter, with an average realised price of A$162/bbl. During the quarter, Bridgeport sold 64,974 bbl of oil.

This one smoking along. Keep the Fe furnaces hot. also WHC,SMR, YAL

Quarterly link > 2924-02555973-2A1392172 (markitdigital.com)

Highlights

• Underlying EBITDA1 of A$645m for the quarter following further strengthening of coal prices, and final unaudited Underlying EBITDA1 of approximately A$1.56bn.

• Chuwar Coal Mine fully rehabilitated with Queensland Government accepting surrender of the Mining Lease and Environmental Authority.

• Closing cash and cash equivalents A$815m following the investment of $94.4m into Malabar Resources Limited2 and closing receivables of A$504m.

• Thermal coal prices reaching record highs following the Russian invasion of Ukraine and concerns around global energy security. Quarterly gC NEWC finishing at US$404.99/t.

• Strong operational performance at Bengalla despite uncontrollable adverse weather impacting production and impeding operation of the Hunter Valley logistics chain early July.

An off the wall idea for the Strawman community, I would welcome comment on is my investment in NHC which I have had for a few years now. They have just provided a Q3 update which has lower production than I assumed (due to weather and Covid) but sales are at higher coal prices – with cash produced for the quarter about where I assumed (case of 2 wrongs make a right…)

Todays Announcement:Quarterly-Activities-Report.PDF

Valuation A$4.41 details: NHC_Analysis.pdf

Valuation Apr22

Base Thesis: NHC is an established coal producer with a significant reserves of quality coal that is low cost to extract (lowest quartile producer). Demand for coal will continue to decline but the supply will fall faster as financing for new coal mines dries up and existing mines deplete, this will place a floor under coal prices and increase margins of established quality producers such as NHC for up to the next decade. NHC has an opportunity to provide shareholders superior cash retunes through dividends despite a steady decline to the business and industry. Leadership and management are very experienced and long term commercially and investor return focused and I trust they will extract maximum shareholder value for the business.

Coal Price: The principal determinant of profitability for NHC is the price of coal, with break even around US$60/t (at current FX rates). In the decade to mid-2021 price was between US$50-120/t but it has spiked as high as US$400/t recently and is currently US$265/t. The current price is unlikely to persist, but we are also unlikely to see sustained periods of a price below US$100/t due to supply limitations and a systematic reliance on coal that will take many years to reduce and is likely to reduce more slowly than supply reduces.

Risks: In addition to the price of coal, the A$ movements change margins with a stronger A$ reducing revenues in A$ but costs fixed in A$. The introduction of a carbon tax or other significant regulatory constrains on production or margins could impact the investment, but they are likely to impact other producers as well and generally such changes favour well established incumbents like NHC. Hence while climate policy impacts are expected, they are considered in the investment thesis and in fact required for it to play out, so it will come down to the balance of favourable Vs unfavourable impacts, but an assumption of a zero-terminal value in 10 years is needed to balance superior margins in the meantime.

Cash Flows: Taking the current elevated coal price into consideration NHC is likely to produce around $A1b in free cash flows in FY22, wiping out it’s debt and produce large dividends to shareholders. Going forward, assuming 10mt average coal production and sales at an average price of US$100/t and FX rate of A0.80 for the next decade, free cash flows will be around $350-380m.

Valuation: Assuming high payout of free cash and operations terminate in 10 years, a total of $4.19 in fully franked dividends could be paid out over the next 10 years. The present value of this at a 10% discount is A$4.41

Disc: I own NHC