Underlying EBITDA5 of $93.4 million for the quarter, a 39.9 per cent reduction from the previous quarter driven by lower sales volumes at Bengalla Mine, which were impacted by logistics constraints and significant weather events in the Hunter Valley. >>>>>>>>>> so next quarter i expect a good result!!!

Highlights1 •

Twelve-month moving average TRIFR2 was 3.22 at the end of the quarter, an improvement from 3.65 at the end of the previous quarter.

• Group saleable coal production of 10.7Mt for the 2025 financial year, 18.1 per cent higher than the 2024 financial year, and within guidance range, following a strong operational performance at New Acland Mine.

• Bengalla Mine achieved an FOB3 cash cost (excluding state royalties) of $76.5 per sales tonne for the 2025 financial year, comfortably within guidance range and a reduction of 1.7 per cent on the previous financial year.

• Average realised sales price of $131.3/t 4 achieved for the quarter, an 11.0 per cent decrease from the previous quarter driven by lower API-5 index pricing and a larger proportion of highash sales in order to manage contractual commitments and stockpile balances.

• Underlying EBITDA5 of $765.8 million for the 2025 financial year.

• Underlying EBITDA5 of $93.4 million for the quarter, a 39.9 per cent reduction from the previous quarter driven by lower sales volumes at Bengalla Mine, which were impacted by logistics constraints and significant weather events in the Hunter Valley.

• Cash generated from operating activities was $570.8 million for the 2025 financial year, with available cash6 of $707.3 million as at 31 July 2025.

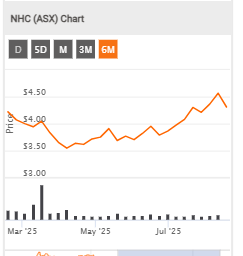

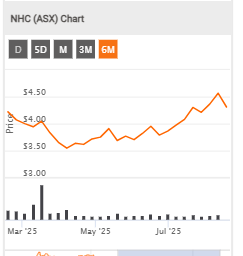

Grossed up Dividend yield: 13.51% which is very nice at $4.33 ..which is close to my purchase price!!

But the Free cash flow looks to be digressing so this is Hold or Sell for me.

3yr return incl dividend is 11%pa