Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I think the bidding war is over...

NTO board has recommended shareholders accept the $2.17 bid from Potentia which could rise to $2.25 upon reaching certain conditions.

This is a U-turn from the recommendation to accept the Alludo mid at $2.15. Given that Alludo's bid was "best and final" they are legally unable to make another bid.

So, unless there is a 3rd party bid from left field it seems that Potentia will be acquiring Nitro Software.

I have sold my shares today on market at $2.19 and will place a sell order on Strawman to reflect this.

Sadly, I thought the company's latest results were quite encouraging with good momentum in sales and a good trajectory of heading towards cash flow positivity and profitability which I am sure that Potentia will be able to benefit from in the years to come.

Disc: Sold today and will sell on Strawman today.

I think I've finally got across everything that's happening in this takeover bid.

There are 2 bidders, Alludo and Potentia, who are fighting over control of Nitro.

- Potentia currently own around 20% of all shares

- Alludo own around 16% (after some shares have accepted the takeover offer below)

Part 1 - Alludo Scheme

- As part of the Alludo takeover offer, there were 2 concurrently running offers to takeover NTO as a business.

- The Alludo Scheme was based on a vote which was undertaken last week of which they needed 75% of the shares on issue to vote YES to their scheme and thus allow them to takeover all of NTO shares at $2.15 per share.

- The vote did not reach 75% and thus the Scheme did not pass.

Part 2 - Alludo Takeover offer

- Concurrently running with the Scheme offer was a takeover offer at the same offer price of $2.15 per share.

- Shareholders can accept the offer and be given $2.15 per share with the closing date of March 3rd.

- The takeover offer will go through if 50.1% of all shares have accepted the offer by the closing date.

- If the takeover goes through, those who haven't accepted the offer may hold shares in a privately listed company which may reduce liquidity.

- A further update was given in that if Alludo hold 50.1% of shares by February 10th (tomorrow) then the takeover will go through.

- The latest update suggests that currently around 16% of shares have accepted the Alludo offer.

- This offer has been the boards recommendation.

Part 3 - Potentia Takeover

- The opposing bidder to Alludo has been Potentia Capital

- Their current bid is $2.00 per share and thus has not been recommended by the board.

- They have made this bid without any due diligence material and have continuously requested that material be provided.

- They have also stated that a bid of between $2.20 - $2.30 may be possible if due diligence material is provided.

- The latest update is that due diligence material has been provided up until February 22nd.

- Alludo and the Nitro board have suggested that Potentia may not have the financial backing to make this bid however they did provide material yesterday to suggest that a bid is financially possible.

- Alludo statement today suggests that the noise around a further bid is designed to distract from the current Alludo takeover offer.

I have decided to sell half of my shares at the $2.15 (on market) in my IRL portfolio (Strawman remains untouched). The other half I will likely hold for now in case Potentia do indeed make another bid. If not, then most likely will accept the $2.15 offer by Alludo before the closing date.

Disc: Held IRL and on Strawman.

The bidding war looks like it's over.

Hot off the press today: https://takeovers.gov.au/media-releases/tp23-006

Potentia could have increased the offer price, but instead referred the perceived unfairness re process for arbitration.

I doubt that they'll come back with a higher offer, and given the Board are recommending sell to Alludo at $2.15, I've sold my whole IRL holding today at a few cents above that.

I expect the price will drift back to just below $2.15 in coming days.

Seems like we have a good old fashioned bidding war between Potentia and Alludo for control of Nitro Software.

Last week NTO received confirmation that Potentia Capital had upped their bid to $2.00 per share of NTO, matching the Alludo bid but offering a scrip alternative. This bid was subject to access to due diligence material which Potentia have mentioned may subsequently increase the price for future bids.

Announcement from Potentia Capital here

NTO had the weekend to think over this bid and this morning released an announcement that Alludo had increased their bid to $2.15 per share provided that NTO did not give due diligence material to Potentia. The NTO board have subsequently continued to recommend shareholders accept the offer from Alludo and reject/ignore the Potentia Capital bid.

Announcement from Alludo Capital here

Announcement from NTO in response to both bids here

Shares are trading above the $2.15 offer price and so the market potentially thinks that Potentia may make a further bid. Will be interesting to see who blinks first. I think there must be some internal board stoush between NTO and Potentia given that they are the largest shareholder at almost 20% ownership.

Disc: Held IRL and on Strawman (may decide to sell soon)

Nitro Software announced that it has rejected Potentia Capital’s takeover offer of $1.80 per share as it undervalued the company.

A bid was made subsequently by Alludo for $2 per share in which the board have recommended be accepted. They have said that they recommend share holders accept any bid of at least $2 per share.

Alludo have 21 days of exclusivity for due diligence.

It remains to be seen how Potentia Capital will proceed as they own 20% of shares outstanding and have stated that they will not vote yes to any proposal that doesn’t include them taking over the company.

Current share price is above $2 so the market may think that Potentia Capital may return with a superior offer.

Full announcement here

Disc: Held IRL and on Strawman

The bidding war is on.

Current SP above the KKR offer, so the market thinks more is to come.

Potentia Capital have returned with an improved bid of $1.80 per share (up from their previous offer of $1.61). They currently hold around 20% of shares in NTO and have stated that they will be voting against any competing offer.

Full Announcement here

Disc: Held IRL and on Strawman

Following on from @mikebrisyStraw,

NTO released a statement this afternoon that they were in discussions with several third parties relating to a takeover. This comes after media speculation out of The Australian that there were potentially US based suitors that were interested. And according to the article, NTO were running a discreet sale with final bids on Friday. (On a side note, the article also referred to them as "Nitro Payments"...)

Link to the article here (sorry it's behind a paywall)

Link to NTO announcement here

Disc: Held IRL and on Strawman

$NTO reported its quarterly results today.

Reported Highlights

• ARR at 30 September 2022 up 51% to US$55.2 million.

• Cash receipts from customers up 26% YoY to US$17.7 million.

• Revenue for nine months to 30 September 2022 up 33% to US$49.1 million.

• Cash of US$29.2 million at 30 September 2022, with no debt.

• 2022 Guidance reaffirmed.

My observations

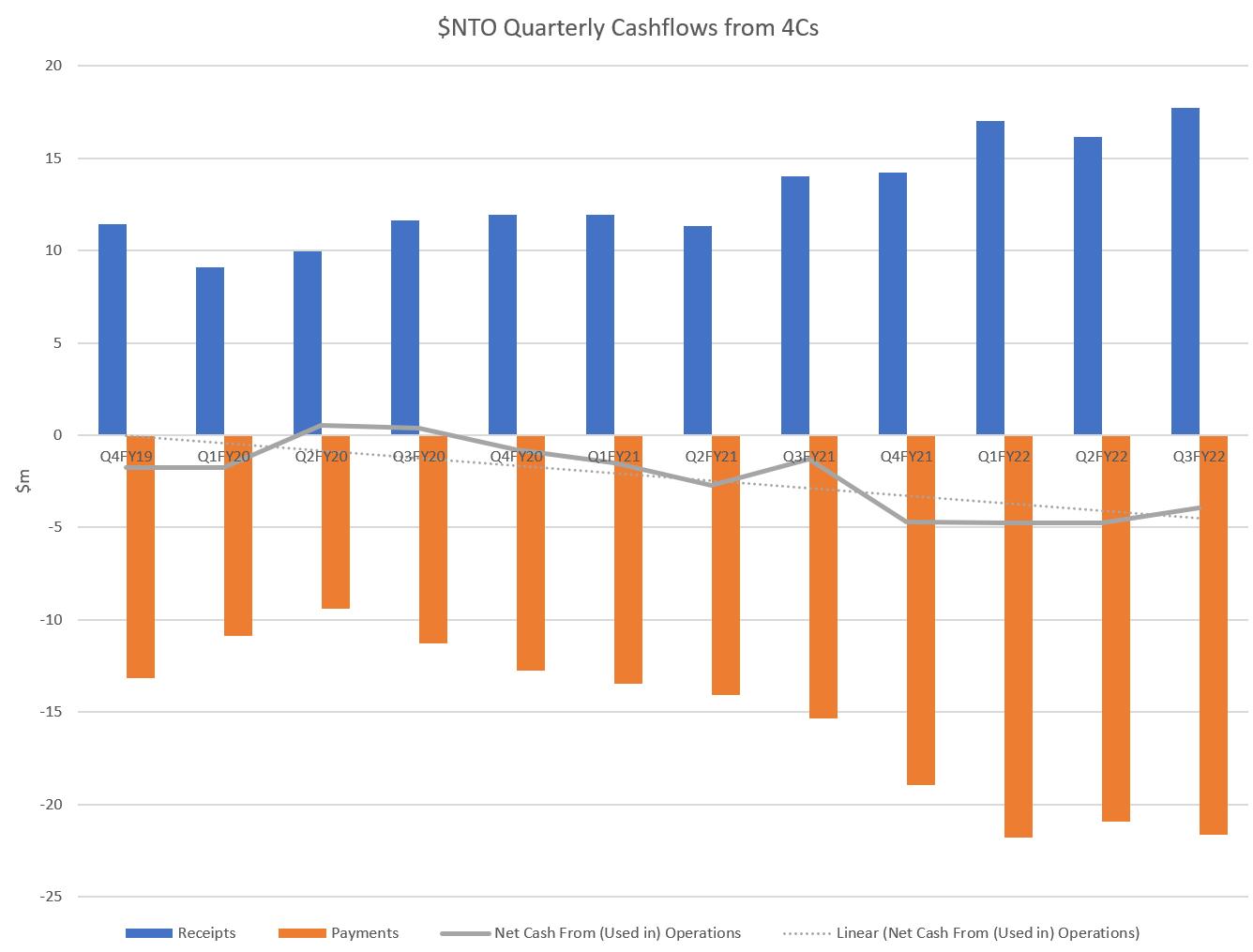

I attach my usual 4C analysis, having removed investing casflow and FCF, as the size of historical acquisitions makes it hard to see what's going on. We've had a few quarters now of simplified results - minimal investing and financing cashflows, so OpCF tells the overall story quite well.

In terms of growth, $NTO appears to be a reliable performer, and effort over the last year to reset the cost base is bearing fruit. Staff and Management costs slightly down while receipts are up, so that these items make up only 89% of receipts - dipping below 100% for the first time.

Recurring cash outflows are $2m lower than reported payments, due to the impact of acquisition related payments and restructuring costs. If true, the long run negative trend of increasing negative OpCF may have turned the corner in the last 3Qs. The problem is, that these costs can come back without a lot of management discipline.

Their presentation says $NTO is committed to being cash flow positive in 2H FY23, which made me at first fall off my chair, until I realised that we are still in FY22 for them, as they report Jan-Dec.

I believe this is do-able for them, but I want to see if ARR and revenue growth hold up while they drive to deliver on that commitment. So I can't invest.

I suspect by that time I'll have missed the boat, and they will have been taken out by private money happy to take the punt and be a bit more ruthless with management and board overheads just to tip things a little further in their favour. This is an emerging trend for the best of the ASX tech stocks that look like making it through the inflection point.

What anchors my reservation is that I am yet to be convinced that $NTO can become highly profitable in a field where they are competing against Adobe and Docusign, notwithstanding the impressive set of logos they continue to add.

Disc: Not held in RL and SM

Nitro Software has unanimously rejected the takeover from Potentia Capital at a share price of $1.58 per share as they believe it significantly undervalues their business.

Full Announcement here

Disc: Held IRL and on Strawman

Offer at $1:58 from Potential Capital

wonder if it will draw any others out…

Chasing M&A is a lottery but i found this interesting from ADBE CEO. ADBE is a great company but sign off/pDF is a bit weaker than their other areas.

Shantanu Narayen

I think as it relates to your M&A question, and then David could certainly answer the other one, clearly valuations to your point have changed quite a bit. And the first thing I'll start off by saying is, we're really pleased with our portfolio. If you look at some of the new initiatives, and we've touched on that, whether it's Adobe Express, whether it's the real time CDP customer journey analytics, what we're doing with things on the web, including PDF, we feel really good. I do feel Alex that there are going to be a number of small single product companies that are probably not going to survive, what's happening. And the valuation sort of multiple changing is actually I think, good for a larger company like Adobe. So I, it doesn't feel like we need anything, but we will always be on the lookout for things that are additive, that are adjacent, and that will provide great shareholder value and our metrics associated with ensuring great technology, great cultural fit, and adjacency remain. But we have so much going on within the company that we're excited about our current portfolio, clearly, things will be more reasonable in terms of M&A as well

Well I have been a holder for a couple of years but I've decided to sell and I don't sell easily (at least I think I don't).

The bottom line for me is they are not growing quickly enough nor do they have a significant competitive advantage against the gorillas. The difference in pricing is so small as discussed on Babygiants that I just don't see how they compete, and if they're not profitable now...

In any case, wish holders all the best but time has come for me to concede - thesis broken.

I won't repeat the excellent summary on today's 4C posted by @BoredSaintbut I will add my bearish perspective.

Nothstanding reasonable revenue growth and a continuing impressive, growing client list, is it game over for $NTO as a business? Despite the measures touted by Sam in today's update to drive towards CF break even, the quartlerly cashflows trend below doesn't lie. Receipts down and Q'ly Operaing Cash Burn steady at $4-5m.

My conclusion is simple. The behemoth's of Adobe and Docusign mean that $NTO is late to the party, insufficiently differentiated and hasn't figured out how to make money. It certaintly doesn't have pricing power in a competitive and inflationary environment, and is now focused on cash out with falling receipts. I don't see a way back. SELL (I sold IRL on 4-May-2021, but have kept on the watch list for over a year in case the business could scale successfully.)

Valuation Perspective: $20-40m? (cash on balance sheet less costs to wind up the business).

Disc: Not Held on SM or IRL

Exhibit: Cash Flows from 4C Statements

Nitro Software released their FY22 Q2 Quarterly and 4C this morning. From their release:

- ARR at 30 June 2022 up 52% YoY to US$51.5 million

- Cash receipts from customers up 43% to US$16.2 million

- Strong financial position, with cash of US$35.2 million at 30 June 2022 and no debt.

NTO are expecting to be Cash Flow positive in 2H FY23 (4 quarters time). They are burning around US$6-7m per quarter so hopefully should be able to make it to breakeven without another raise.

They also revised guidance for FY22:

Management have noted the decrease in ARR guidance to general macro economic environment which is slowing growth. However they are implementing a cost cutting strategy which is expected to improve EBIDTA.

Probably the most disappointing aspect of the announcement was that the Connective acquisition is only expected to have synergies of US$1m now after they stated it was expecting US$2.5m at the last report. Total revenue added from the Connective Acquisition for the half was US$3.3m which is not great for a business which they acquired (and raised capital) for $US80m. They did state that the sales team have been taking longer than expected to sell the Connective products to new customers, so hopefully there is more uptake in the near future.

Full Report here

Investor Presentation here

Disc: Held IRL and on Strawman

Nitro Software released their Q1 quarterly and cash flow (they report on a calendar year basis). From their release (note these figures are in $USD):

- Annual Recurring Revenue (ARR) excluding Connective at 31 March 2022 up 40%; including Connective up 61%.

- SaaS subscription revenue reached 72% of total revenue, vs 61% in Q1 2021.

- Record cash receipts from customers up 42% to US$17.0 million.

- Strong financial position, with cash of US$42.1 million at 31 March 2022 and no debt .

- Integration of Connective progressing well and on schedule, with key milestones relating to the combined go-to-market team and product roadmap achieved.

- Nitro ranked as a top three vendor in global eSign market by leading technology analyst firm GigaOm .

- Updated guidance for improved FY2022 Operating EBITDA based on lower operating expenditures, reflecting enhanced business efficiencies:

- FY2022 Operating EBITDA loss between US$15 million and US$18 million (previously US$18 million - US$21 million);

- No change to ARR and Revenue guidance.

- Nitro expects to move toward a cash flow breakeven profile in 2H 2023.

On a cash flow basis the company is still burning around $5m per quarter although they have said they will look to move into cash flow breakeven in 2H 2023 (In around 5 quarters time) so hopefully they will have the cash to sustain until then without having to raise.

Valuing these companies is so difficult at the moment given rising interest rates and inflation however on some basic metrics this is currently trading on a Fwd P/S of around 3.6x (after yesterdays 20% rise) which for a company which is growing its top line at around 30% a year doesn't seem outrageous to me.

Probably the only red flag for me is they did spend $80mil US to acquire Connective late last year and raised $140m AUD which they have stated will only result in synergies of around $2.5m in revenue. The acquisition was probably necessary however in order to compete with Adobe and Docusign on the eSign space.

Disc: Held IRL and on Strawman.

Currently there is a big re-rate in SaaS and Tech business especially those which are not yet profitable. NTO recorded around US$51m (AUD$65m) in Revenue for FY21 and have guided for $US65m (AUD$88m) in Revenue for FY22.

Looking at a P/S chart (this is from TradingView so not sure how accurate it is exactly) we can see since their IPO in 2019 there was quite a large P/S multiple expansion in line with a lot of other SaaS stocks in the US which caused the share price to increase. I feel like the latest decline in this sector has a lot to do with a decrease in the multiple that the market is willing to pay for these types of businesses. However as seen on the chart below, the re-rate is starting to get close to March 2020 lows.

The chart above is based on the historic P/S. I'm going to base my valuation at a P/S of 4x which is around March 2020 lows and take the midpoint figure between FY21 Revenue and FY22 Revenue guidance. This gives me a valuation of $1.26.

I have previously purchased shares in this company at higher levels and also participated in the CR to fund the acquisition of Connective late last year. I still see a substantial growth pathway in the next 5-10 years so am willing to hold through the current volatility. If the market is more generous in the future towards SaaS style businesses then I can see a re-rate in the near future. If not then I believe the revenue growth and progress towards profitability should allow for this re-rate to still occur.

Disc: Held IRL and on Strawman.

Nitro Software (NTO) released their Quarterly Result today. From their release:

• Annual Recurring Revenue (‘ARR’) at 31 December 2021 excluding the Connective acquisition was US$40.1 million, an increase of 41% vs. 31 December 2020, in line with guidance. ARR at 31 December 2021 including Connective was US$46.2 million.

• FY2021 revenue excluding Connective was approximately US$50.7 million, an increase of 26% compared to FY2020, at the top end of the upgraded guidance range. FY2021 revenue including Connective was approximately US$50.9 million.

• Transition to a SaaS business model continues, with subscription revenue now comprising 71% of total revenue in Q4 2021, compared to 58% in Q4 2020. In the larger Business sales channel, 88% of revenue in Q4 2021 was subscription, with this transition being effectively completed in FY2021.

• Successfully completed a A$140.0 million capital raise through the combination of an institutional placement and a retail entitlement offer.

• Successfully completed the €70.0 million acquisition of Connective, which closed on 20 December 2021, with robust post-acquisition integration activities ongoing.

• Cash and cash equivalents of US$48.2 million including Connective as at 31 December 2021 with no debt, providing a strong financial position to pursue growth opportunities.

FY2021 Outlook Operating EBITDA loss is expected to be within the range of US$7.5 million to US$8.0 million, compared to the updated EBITDA loss guidance range of US$8.0million to US$10.0 million provided on 27 October 2021.

Operating EBITDA guidance is upgraded given the overperformance on revenue. ARR, Revenue and Operating EBITDA guidance for FY2022 will be provided on 24 February 2022 along with Nitro’s audited results for the year ended 31 December 2021.

Personal Thoughts:

We will get more detail when they release their full year results in February but seems like NTO are tracking along nicely but just getting hit with the overall market sentiment towards software and technology companies. They are still EBIDTA negative although they did manage to beat their guided EBIDTA loss range which is a good sign. Revenue was also at the top end of guidance.

Will reassess when they release their FY22 guidance next month.

Disc: Held IRL and on Strawman

eSign Acquisition and A$140 Million Capital Raising

Nitro today announced the acquisition of Connective NV for around $81 million USD in an all cash deal funded by a capital raising of $140 million AUD.

From the release:

- The Acquisition is in line with Nitro’s product-driven strategy targeting the high-growth US$17 billion eSigning market.

- Connective’s market-leading solutions significantly accelerate and enhance Nitro’s eSign, eID and document workflow capabilities.

- The combination of Connective’s leading high-trust eSign capabilities and Nitro’s global go-to-market power positions Nitro to become the third global player in the enterprise eSign market.

- Connective is forecast to achieve Annual Recurring Revenue (‘ARR’) of ~US$6.1 million as at 31 December 2021 and FY2021 revenues of ~US$7.1 million.

- Connective’s trusted market-leading technology will be available to all of Nitro’s 12,000+ business customers worldwide, providing annualised run-rate revenue synergies of ~US$2.5 million by December 2022.

- The Acquisition will be funded by a A$140 million fully underwritten capital raising (‘Equity Raising’) comprising an A$80 million Institutional Placement and a A$60 million Accelerated Non-Renounceable Entitlement Offer (‘ANREO’).

- Nitro reaffirms its updated FY2021 guidance (ex-Acquisition) in relation to ARR, revenue and operating EBITDA (loss) provided on 27 October 2021.

The acquisition gives Nitro the opportunity to cross sell into eSigning capabilities and also increases their European exposure. Will be interesting to see how much market share they will be able to capture. I'm assuming the top 2 global players they are referring to are Adobe and Docusign which are substantially larger in size than Nitro. They also trade on much higher multiples than Nitro. Increasing eSigning will give them another vertical in which to increase revenues and hopefully profits in the future. And more importantly increases their access into enterprise level clients.

DISC: Held IRL and on Strawman

Nitro H1 market update and 4C (attached) shows good growth with a small increase in guidance and some changes to SaaS metric definitions.

H1 Update (Note NTO is a 31 Dec year end):

· ARR at $33.8m, up 56% PcP – tracking very nicely

· Subscription revenue now 63% of total revenue, up from 53% at the end of FY20 and 48% PcP shows good progress of SaaS business model.

· Cash of $38.8m, down $3.0m from previous quarter driven by -$2.7m operating cash flows. Customer cash receipts have been relatively flat for the past 4 quarters, I will be looking for this to lift in line with sales in coming quarters or questions will need to be answered.

· June: acquisition of PDFpen, adding Mac, iPad and iPhone capabilities to our platform and opening up new market opportunities

· July: Nitro Sign is commercial availability as a standalone subscription product, for the first time.

· Nitro also launched a Nitro Sign integration with Salesforce this month to accelerate the closing of sales contracts and other critical agreements

· Guidance:

o ARR reaffirmed at $39-42m FY21

o Revenue increased to $47-50m from $45-49m

o EBITDA loss decrease to -$9-11m from -$11-13m due to higher revenue expectation

Changes in SaaS Metric Definitions

· ARR is now the total value of subscription revenue contracts, that are in effect at the end of the reporting period, expressed on an annualised basis rather than a multiple of 12 for the last months subscription revenue. This gives a small uplift where ARR grows over the last month of the year which it has, but not a significant variance.

· GRR (Gross Retention Rate) was previously calculated as a % of the customers who renewed in the reporting period from those due for renewal but now includes all customers. Due to the fact that most Nitro subscription agreements are 3 years this now includes a lot more customers and significantly improves the metric reported (eg from 85% to 95% for FY20). This seems more appropriate.

· NRR (Net Retention Rate) similar to the ARR change, the end of period rather than last month of period is taken as the comparative. Little change in results from this.

Another very strong result from NTO and I will leave my current valuation of $6.32 unchanged until we get the half year accounts in late August. I hold NTO and have no plans to change my holding currently

NTO announced today (28/6/21) the acquisition of PDFpen for $6m in cash which provides PDF productivity applications for Mac, iPhone and iPad. The transaction is expected to complete on or before 9 July 2021 and FY21 guidance has been reaffirmed (note 31 Dec year end).

“Nitro’s Productivity Platform already supports certain key mobile and tablet use cases, with eSigning available on any device with a web browser and Nitro Pro compatible with Microsoft Surface devices. The addition of PDFpen extends native PDF productivity to Mac, iPhone and iPad users everywhere.”

A modest and seemingly strategically important acquisition points to this being a good thing. NTO’s first acquisition since IPO in Dec19 so organic growth and their core product remain the focus of management which I like to see.

My valuation of $6.32 stands until more detail is available, but assuming that the acquisition is value accretive then it offers upside opportunity on the current valuation.

NTO continues to rotate to subscription (ARR) from perpetual revenue, I see no reason to update my previous valuation of $6.32 as things are on track, highlights:

· ARR up 66% YOY

· SaaS now 61% of revenue Vs 53% at 31 Dec.

· $41.8m cash and no debt – strong balance sheet

· FY21 guidance maintained (note 31 Dec year end)

· time spent by Nitro Pro users up 160% year-on-year.

· Operating cashflow -$1.5m due to increased investment in growth (personnel, Nitro’s product suite and sales strategy – as well as performance-based bonuses).

Market has taken the news positively, NTO up 9% so far today.

05-Feb-2021: Wilsons Equity Research: Nitro Software Limited (NTO): Initiating at Overweight: Expecting an Explosive Future

Analysts:

- Ross Barrows, [email protected], Tel. +61 3 9640 3854

- Cameron Halkett, [email protected], Tel. +61 2 8247 3162

Initiating at Overweight: Expecting an Explosive Future

We initiate coverage of Nitro Software Limited (“Nitro”) with an Overweight rating and a $3.70 Target Price (+21% TSR). Nitro is a US-headquartered, Australian-listed, global document productivity software company that aims to drive digital transformation. Nitro is well placed to capitalise on the strong secular trend of the automation of business workflows, which includes document management and digital signatures. This medium-term macro trend accelerated materially in 2020 given the volume of employees and customers alike working from home. There is a tectonic shift towards all-things-digital and with ‘the Genie not going back into the bottle’, we expect ongoing, robust demand.

Key Points

- Four Reasons to Buy Nitro –

- The expedited migration to digital workflows which will result in increased demand for document management and digital signature services that Nitro offers;

- Nitro‘s Productivity Suite, which offers both Document Management and Digital Signatures features, is a differentiating factor from its two dominant, incumbent competitors, Adobe and DocuSign;

- Nitro’s Total Addressable Market (“TAM”) of ~US$5.5bn could increase by US$1bn-US$10bn with the Nitro Sign standalone product; and

- Revenue upside risk, to be determined by Nitro’s success in transitioning free Nitro Sign customers into paying customers and cross-selling into its existing customers.

- Forecasts & Guidance –

- We are forecasting FY21e ARR of $40.2m (+45% pcp.), Revenue of $48.2m (Consensus: $46.0m), and EBITDA of -$7.0m (Consensus -$7.5m). Our revenue forecasts reflect strong growth in Nitro subscriptions and our EBITDA forecasts factor in FY21 being a year of continued investment.

- Target Price & Valuation –

- Our $3.70 target price reflects a Dec year-end FY22e EV/Sales of 10x which is a -44% discount to the average of its global peers, Adobe and DocuSign but a +50% premium to the average of its domestically listed, but global peers, Bigtincan and Whispir. With Nitro’s core business (Subscription) set to encompass ~80% of the revenue mix by FY22e and growing at a CAGR of 43% FY19e-23e, we believe NTO warrants a premium valuation to local peers.

Catalysts & Risks

- Catalysts:

- Ongoing acceleration in subscription sales (both new customers and fast migration of perpetual customers);

- Pricing traction to reduce the discount to competitors;

- Financially and strategically accretive M&A.

- Risks:

- Lack of scale in the US and other markets;

- Subscription growth not meeting expectations;

- unsuccessful and/or ineffective M&A.

Nitro Software Limited (NTO)

- Recommendation: OVERWEIGHT

- 12-mth target price (AUD): $3.70

- Share price @ 04-Feb-21 (AUD): $3.07 ($2.64 on 01-Apr-21)

- Forecast 12-mth capital return: 20.5%

- Forecast 12-mth dividend yield: 0.0%

- 12-mth total shareholder return: 20.5%

- Market cap: $584m

- Enterprise value: $541m

- Shares on issue: 190m

- ASX 300 weight: n/a

- Median turnover/day: $1.9m

Click on the link at the top for the full report.

Valuation Detail attached - using Nitro