$NTO reported its quarterly results today.

Reported Highlights

• ARR at 30 September 2022 up 51% to US$55.2 million.

• Cash receipts from customers up 26% YoY to US$17.7 million.

• Revenue for nine months to 30 September 2022 up 33% to US$49.1 million.

• Cash of US$29.2 million at 30 September 2022, with no debt.

• 2022 Guidance reaffirmed.

My observations

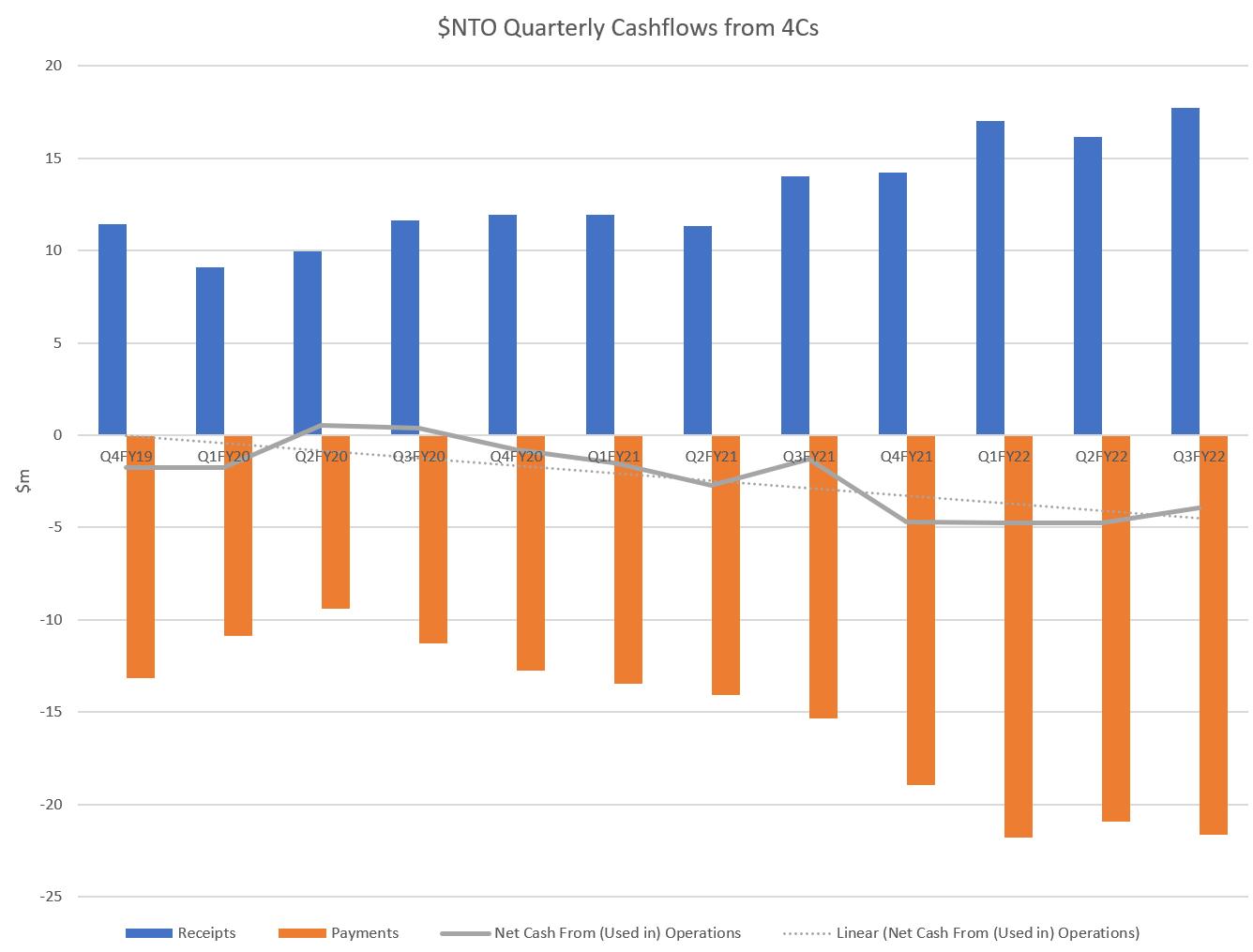

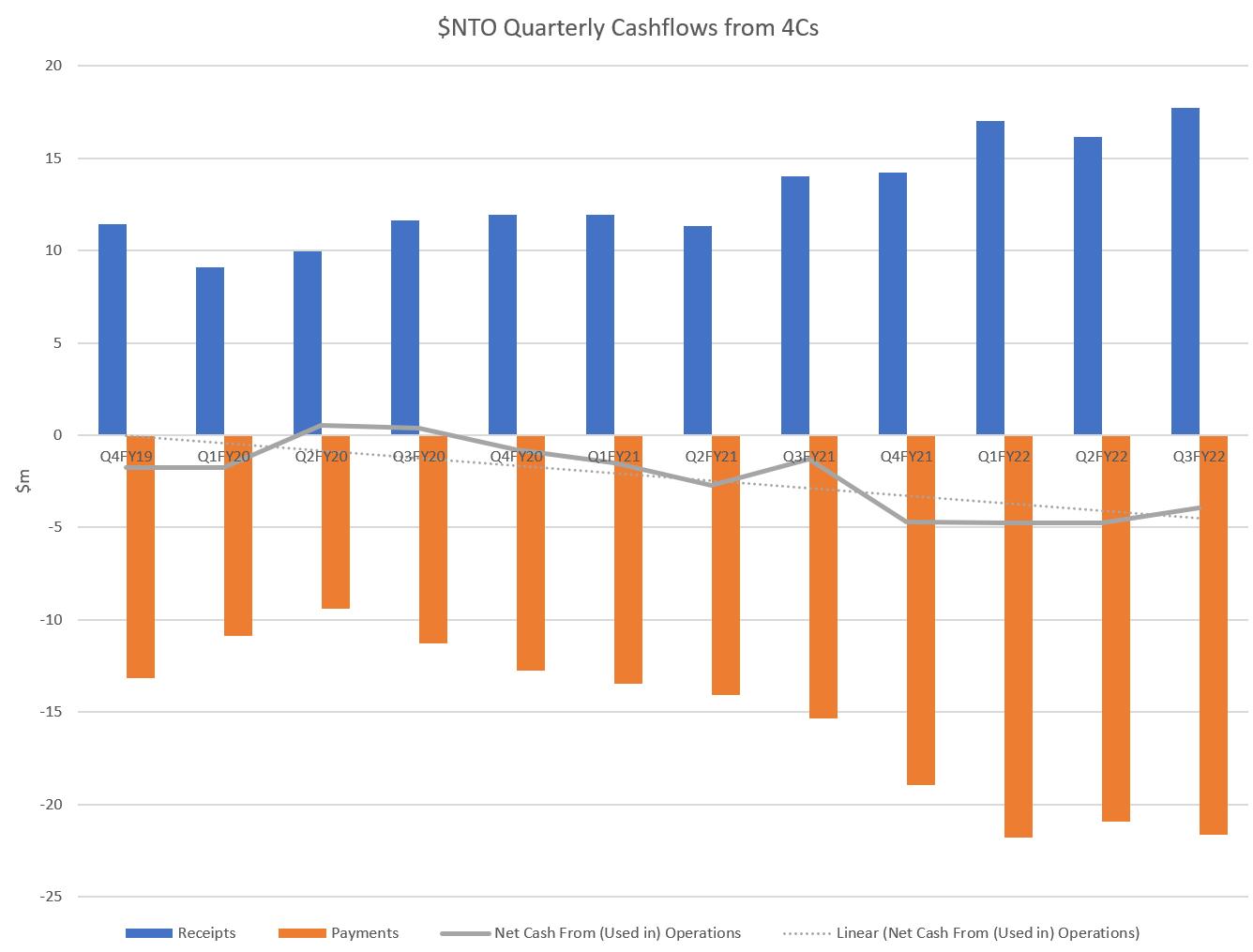

I attach my usual 4C analysis, having removed investing casflow and FCF, as the size of historical acquisitions makes it hard to see what's going on. We've had a few quarters now of simplified results - minimal investing and financing cashflows, so OpCF tells the overall story quite well.

In terms of growth, $NTO appears to be a reliable performer, and effort over the last year to reset the cost base is bearing fruit. Staff and Management costs slightly down while receipts are up, so that these items make up only 89% of receipts - dipping below 100% for the first time.

Recurring cash outflows are $2m lower than reported payments, due to the impact of acquisition related payments and restructuring costs. If true, the long run negative trend of increasing negative OpCF may have turned the corner in the last 3Qs. The problem is, that these costs can come back without a lot of management discipline.

Their presentation says $NTO is committed to being cash flow positive in 2H FY23, which made me at first fall off my chair, until I realised that we are still in FY22 for them, as they report Jan-Dec.

I believe this is do-able for them, but I want to see if ARR and revenue growth hold up while they drive to deliver on that commitment. So I can't invest.

I suspect by that time I'll have missed the boat, and they will have been taken out by private money happy to take the punt and be a bit more ruthless with management and board overheads just to tip things a little further in their favour. This is an emerging trend for the best of the ASX tech stocks that look like making it through the inflection point.

What anchors my reservation is that I am yet to be convinced that $NTO can become highly profitable in a field where they are competing against Adobe and Docusign, notwithstanding the impressive set of logos they continue to add.

Disc: Not held in RL and SM