BULL CASE for Pharm Aust Ltd

This week is a pivotal week for Pharm Aust Ltd (PAA) with Phase I data readout for their only human drug Monepantel (MPL) for treatment of motor neurone disease (MND). Specifically the subtype of the disease amyotrophic lateral sclerosis (ALS) the same one renowned for affecting Steven Hawking.

I discovered this recently through another biotech investor and trader and started a quick DD. I admit I have jumped in immediately with a small investment given the timing and the fact that the Phase I data will be released this week. Straw investors already on the case include @Quiltman , @secondtake88, and @mmff . Congrats to these investors with some incredible returns noted on Strawman.

I took a bite at .32 and last week the stock ended at .38c. On successful approval I expect at least 100% rise further from here.

ALS is a debilitating and life limiting condition. Mean survival time is between 2-5 years from diagnosis. Although some manage to live longer. The condition affects the motor neurons that pass messages from the brain to our muscles. It affects pathways to our extremities, our speech, swallowing and eventually breathing.

Early symptoms include:

-Muscle twitches, cramps

-Tight stiff muscles

-Muscle weakness

-Slurred and nasal speech

-Difficulty chewing and swallowing

The cause of the disease is still not understood. There appears to be a small genetic inheritance component.

Prevalence rates in the US for MND are quoted as approximately 300,000. Roughly 30,000 people have ALS. (see rates here)

About Pharm Aust

Shares on issue: 386 million

Market cap $131 M

CEO: Dr Michael Thurn (position held for 6 months) involved in Botanix

Pharmaceuticals previously.

Monepantel (MPL) Origin

Repurposed vet medication for de-worming sheep.

Human anti-cancer and neurodegenerative potential recognised.

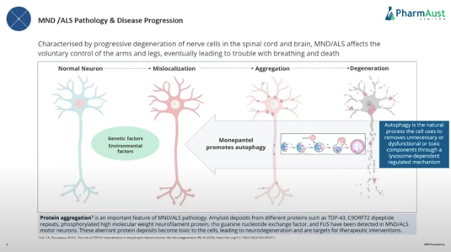

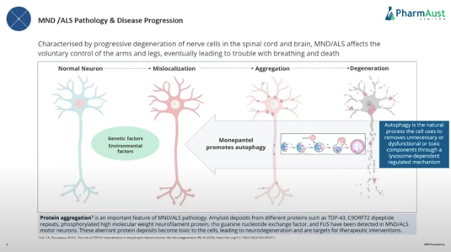

How MPL works in brief

My Investment Interest

· Likely upcoming Orphan Drug Designation with FDA.

· Very limited treatment options currently available.

· Quick Approval with FDA due to life-threatening condition

· High drug price tag on approval

· Combined phase 2/3 study pending phase I results – meaning 1 more study before potential approval and sales.

· Phase 2/3 combined study cost estimated at between $20 and $30 million- n=210 patients. FDA has agreed to global enrolment for study and drug is already produced and placebo is currently being made and ready to roll out. Commencement planned for June 2024. Study duration 24 week for provisional approval and 48 weeks for full approval

· All 12 participants in phase I study are still alive following 15 months on MPL – well tolerated, minimal side effects and all rolling over on compassionate grounds to remain on drug.

· 1 in 1000 or 0.1% chance of all 12 patients surviving for 15 months. The question is how much have their symptoms progressed?

· Looking for a SOC score of less than -1.24 anything lower and will have a survival rate improvement of more than 9 months which is where there competitor Rylevrio sits with their phase 3 study.

o Look for -1.0 or better

· Attractive licencing or acquisition target for larger pharmaceutical

· Mode of action of activating autophagy -applications in Alzheimers, Parkinsons’ and other neurodegenerative conditions

Brief look at competitors

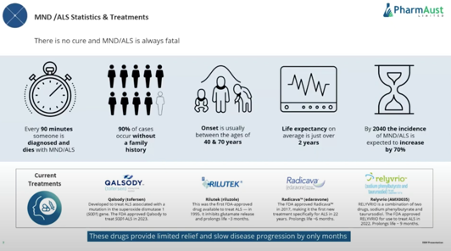

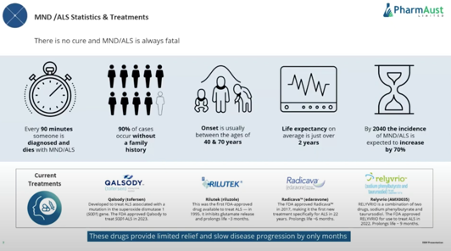

This is a quick straw and by no means a deep dive into the 4 drugs available for MND/ ALS currently.

The current drugs are reported to extend life by as little as 3 months to as much as 9 months. As you can see current drugs for this disease are not outstanding.

1.Qalsody (Toferson)

– gained FDA approval in 2023

2.Rilutek (Riluzole)

– gained FDA approval in 1995

-prolongs life by 3 months

3. Radicava (edaraone)

-gained FDA approval in 2017

-prolongs life by 6 months

-IV formulation that the company has tried to develop into an oral form and this has failed FDA likely to remove approval as results failed in a large study.

4.Relyvrio (AMX 0035 combination of sodiumphenyl butyrate and taurursodiol)

-gained FDA approval in 2023

-prolongs life by 9 months

-Study run on 87 patients

-Drug price US$158,000

-granted accelerated approval

I had heard about Relyvrio through my Neuren Pharmaceuticals research. It is a drug with severe side-effects with a 50% attrition rate due to severe diarrhea. The drug received accelerated approval and its phase 3 read out is due next qrt. Michael Thurn stated in the latest EGM that the drug is likely to fail phase 3 due to side-effects and discontinuation. It is currently treating 3600 patients in the US.

So 2 drugs may have FDA approval rescinded.

Amylex Case Study for Market Cap

CEO Michael Thurn states that Amylex is the best case study for PAA. Off the back of its Phase 2 study, involving 87 patients Amylex had a Market cap of US$2.5 billion. This was the only drug this company had.

Hence the argument that PAA should have a similar market capitalisation if Phase I are more successful than Relyvrio. Only 1 more 24 week study is needed before potential accelerated FDA approval and revenue.

Interesting resources

EGM

https://m.youtube.com/watch?v=8l39adr1tCY&t=9s&pp=2AEJkAIB

MTOR pathways drugs- fascinating origin story

https://radiolab.org/podcast/dirty-drug-and-ice-cream-tub

Proactive interview with CEO - Michael Thurn

https://m.youtube.com/watch?si=OhutnOq_osfqRrdm&v=RBd6euPX7Gc&feature=youtu.be

Company is currently working on oral liquid for patients who can’t swallow. This will extend IP and add further protection.

Summary

I find the case for PAA and MPL compelling. It meets my interest in rare disease treatments that have a chance of an accelerated pathway through the FDA. It will hopefully slow progression of ALS and improve quality of life. The investment should be attractive to large pharmaceuticals and based on the case of Amylex the $131 million dollar Australian market cap seems woefully undervalued if there is successful Phase I read out this week.

Remember watch for a less than -1.24 points per month decline on the ALSFRS-R score which would imply that MPL slows the disease by more than its nearest competitor Relyvrio.