Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Neurizon has been on a bit of a journey this year, and as a consequence are in an interesting spot if you like a good pharmaceutical speculation. They are finally about to commence in the Healey ALS Platform trial, and are in the middle of scraping together equity funds to see them through it, as required.

The Healey ALS Platform is not your average trial, it is a head-to-head multi-round trial set up for the ALS community to efficiently and ethically identify their best candidates by running multiple candidates all sharing a placebo group. Should Neurizon emerge showing the same improved survival and biomarker signal as it has already shown on a small number of patients, then things should get interesting at the other end.

Neurizon Raises $5m via Institutional Placement

Highlights:

· Firm commitments secured to raise $5m through the issue of new fully paid ordinary shares at $0.12 per share

· In addition, the Board and management will subscribe for $0.2m under the Placement, $130,000 of which is subject to shareholder approval

· The Placement was strongly supported by both new and existing institutional investors

· Strengthened balance sheet supports preparation for entry into the HEALEY ALS Platform Trial in Q4 CY25, pending FDA clearance of Company’s IND

· Placement proceeds will also be used to advance pre-clinical programs, GMP manufacturing, regulatory filings and working capital

It is a 18% discount to existing SP but it has put $5.2 Million into the coffers which certainly helps

Latest news from Nurizon

Neurizon Secures R&D Tax Incentive Advance & Overseas Finding Approval for NUZ-001

Highlights:

· Neurizon® has been awarded an Advance and Overseas Finding from AusIndustry for eligible overseas R&D expenditure for NUZ-001 for the 2025, 2026 and 2027 financial years

· Covers all NUZ-001 development costs in ALS and other neurodegenerative diseases — spanning pre-clinical, manufacturing, regulatory, and clinical programs, including the HEALEY ALS Platform Tria

l · The 43.5% cash rebate for eligible R&D expenditure accelerates timelines, further de-risks the NUZ-001 development program towards approval, and provides a significant source of non-dilutive funding

· For FY2025, an estimated total R&D Tax Rebate of AUD$5.6 million is expected to be received in Q4 CY2025

So NUZ will receive a 43.5% grant for all R&D on NUZ-001 including the Healy ALS platform trial which will certainly help the cashflow the only problem is that they have to find the cash first,

On Friday 7th of March Amylex revealed that phase III data for its ALS drug Rylevrio failed to outperform a placebo.

612 patients were involved in the study and there was no significant difference found on the all important ALSFRS -R. Rylevrio had a significant drop out rate due to diarrhea side-effects. Unfortunately this drug has been one of the only available candidates for the treatment of ALS and the lack of efficacy is a major blow for patients suffering from this condition.

A voluntary withdrawal from the market is likely by Amylex in the next few weeks. The share price plummeted by 70% on Friday.

Pharm Aust’s now has a huge opportunity if it’s drug can pass successfully through Phase II/III trials starting in June. Rylevrio was seen as a potential $1 billion drug annually and in 2023 had $400 million revenue after just 4 qrtrs.

Phase II/III will see MPL compared for efficacy against a placebo. All 12 Phase I patients have now converted to the MPL open label trial.

Results were released after market and possible impact to PAA share price is not known. If PAA is successful MPL just became one of the only potential future treatments for ALS and likely a whole lot more valuable as an asset.

BULL CASE for Pharm Aust Ltd

This week is a pivotal week for Pharm Aust Ltd (PAA) with Phase I data readout for their only human drug Monepantel (MPL) for treatment of motor neurone disease (MND). Specifically the subtype of the disease amyotrophic lateral sclerosis (ALS) the same one renowned for affecting Steven Hawking.

I discovered this recently through another biotech investor and trader and started a quick DD. I admit I have jumped in immediately with a small investment given the timing and the fact that the Phase I data will be released this week. Straw investors already on the case include @Quiltman , @secondtake88, and @mmff . Congrats to these investors with some incredible returns noted on Strawman.

I took a bite at .32 and last week the stock ended at .38c. On successful approval I expect at least 100% rise further from here.

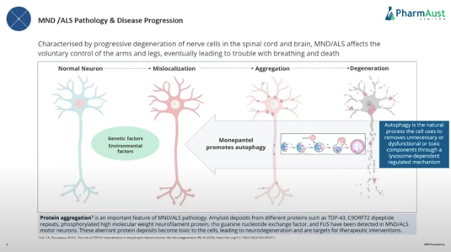

ALS is a debilitating and life limiting condition. Mean survival time is between 2-5 years from diagnosis. Although some manage to live longer. The condition affects the motor neurons that pass messages from the brain to our muscles. It affects pathways to our extremities, our speech, swallowing and eventually breathing.

Early symptoms include:

-Muscle twitches, cramps

-Tight stiff muscles

-Muscle weakness

-Slurred and nasal speech

-Difficulty chewing and swallowing

The cause of the disease is still not understood. There appears to be a small genetic inheritance component.

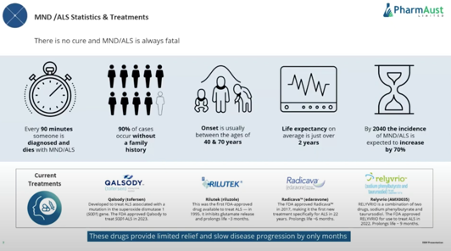

Prevalence rates in the US for MND are quoted as approximately 300,000. Roughly 30,000 people have ALS. (see rates here)

About Pharm Aust

Shares on issue: 386 million

Market cap $131 M

CEO: Dr Michael Thurn (position held for 6 months) involved in Botanix

Pharmaceuticals previously.

Monepantel (MPL) Origin

Repurposed vet medication for de-worming sheep.

Human anti-cancer and neurodegenerative potential recognised.

How MPL works in brief

My Investment Interest

· Likely upcoming Orphan Drug Designation with FDA.

· Very limited treatment options currently available.

· Quick Approval with FDA due to life-threatening condition

· High drug price tag on approval

· Combined phase 2/3 study pending phase I results – meaning 1 more study before potential approval and sales.

· Phase 2/3 combined study cost estimated at between $20 and $30 million- n=210 patients. FDA has agreed to global enrolment for study and drug is already produced and placebo is currently being made and ready to roll out. Commencement planned for June 2024. Study duration 24 week for provisional approval and 48 weeks for full approval

· All 12 participants in phase I study are still alive following 15 months on MPL – well tolerated, minimal side effects and all rolling over on compassionate grounds to remain on drug.

· 1 in 1000 or 0.1% chance of all 12 patients surviving for 15 months. The question is how much have their symptoms progressed?

· Looking for a SOC score of less than -1.24 anything lower and will have a survival rate improvement of more than 9 months which is where there competitor Rylevrio sits with their phase 3 study.

o Look for -1.0 or better

· Attractive licencing or acquisition target for larger pharmaceutical

· Mode of action of activating autophagy -applications in Alzheimers, Parkinsons’ and other neurodegenerative conditions

Brief look at competitors

This is a quick straw and by no means a deep dive into the 4 drugs available for MND/ ALS currently.

The current drugs are reported to extend life by as little as 3 months to as much as 9 months. As you can see current drugs for this disease are not outstanding.

1.Qalsody (Toferson)

– gained FDA approval in 2023

2.Rilutek (Riluzole)

– gained FDA approval in 1995

-prolongs life by 3 months

3. Radicava (edaraone)

-gained FDA approval in 2017

-prolongs life by 6 months

-IV formulation that the company has tried to develop into an oral form and this has failed FDA likely to remove approval as results failed in a large study.

4.Relyvrio (AMX 0035 combination of sodiumphenyl butyrate and taurursodiol)

-gained FDA approval in 2023

-prolongs life by 9 months

-Study run on 87 patients

-Drug price US$158,000

-granted accelerated approval

I had heard about Relyvrio through my Neuren Pharmaceuticals research. It is a drug with severe side-effects with a 50% attrition rate due to severe diarrhea. The drug received accelerated approval and its phase 3 read out is due next qrt. Michael Thurn stated in the latest EGM that the drug is likely to fail phase 3 due to side-effects and discontinuation. It is currently treating 3600 patients in the US.

So 2 drugs may have FDA approval rescinded.

Amylex Case Study for Market Cap

CEO Michael Thurn states that Amylex is the best case study for PAA. Off the back of its Phase 2 study, involving 87 patients Amylex had a Market cap of US$2.5 billion. This was the only drug this company had.

Hence the argument that PAA should have a similar market capitalisation if Phase I are more successful than Relyvrio. Only 1 more 24 week study is needed before potential accelerated FDA approval and revenue.

Interesting resources

EGM

https://m.youtube.com/watch?v=8l39adr1tCY&t=9s&pp=2AEJkAIB

MTOR pathways drugs- fascinating origin story

https://radiolab.org/podcast/dirty-drug-and-ice-cream-tub

Proactive interview with CEO - Michael Thurn

https://m.youtube.com/watch?si=OhutnOq_osfqRrdm&v=RBd6euPX7Gc&feature=youtu.be

Company is currently working on oral liquid for patients who can’t swallow. This will extend IP and add further protection.

Summary

I find the case for PAA and MPL compelling. It meets my interest in rare disease treatments that have a chance of an accelerated pathway through the FDA. It will hopefully slow progression of ALS and improve quality of life. The investment should be attractive to large pharmaceuticals and based on the case of Amylex the $131 million dollar Australian market cap seems woefully undervalued if there is successful Phase I read out this week.

Remember watch for a less than -1.24 points per month decline on the ALSFRS-R score which would imply that MPL slows the disease by more than its nearest competitor Relyvrio.

Leiden University Testing Indicates Monepantel and Monepantel Sulphone SARS-CoV-2 Antiviral Activity

- Previously PAA reported to shareholders that monepantel (MPL) and monepantel sulfone (MPLS) demonstrate antiviral activity in cultured cell infection models of SARSCoV-2, the virus causing COVID-19

- Leiden University Medical Center (LUMC) has generated indicative data that MPL and MPLS again demonstrate antiviral activity in non-human primate systems

- High insolubility of MPL in these systems was challenging and required several analyses

- LUMC is now moving forward and transitioning to human cultured cells

DISC: I hold

Epichem Licensing Agreement to Develop Waste to Fuels Technology

- Epichem has entered into a license agreement with Thermaquatica for the Oxidative Hydrothermal Dissolution (OHD) technology

- Epichem will research, develop and promote the novel, innovative, disruptive technology using Flow Reaction

- Epichem will continue to seek government and project grant funding to accelerate the initiative

...Epichem OHD will advance the novel, disruptive and innovative OHD technology using biomass/feedstock flow reactor material science. The flow reactor is a world-first with its potential to turn a wide range of waste and biomass feedstock into valuable fuels, fine chemicals, agricultural growth stimulants and ethanol....

The flow reactor has the potential to convert:

- Plastics into renewable fuels

- Coal into diesel or agricultural biostimulants (diesel, fine chemicals and biostimulants)

- Rubber tyres into liquid fuels/valuable chemical products

- Trees into cellulosic ethanol/fine chemicals

- Leftover stock or crops into liquid fuel – cellulosic ethanol and agricultural biostimulants.

Disc: I hold...bought as a SC Health Stock...only a month ago they called themselves "a clinical stage oncology company". Also Scherobi added a post "History" a month ago

Still very happy to hold

Phase IIb Clinical Trial Studying Monepantel in Pet Dogs with Treatment Naïve B Cell Lymphoma

~ Recruitment for the trial has commenced

~ Several dogs have already been successfully recruited and have started treatment with MPL tablets

~ Six pet dogs currently treated on a compassionate basis with MPL tablets

15 February 2021 – Perth, Australia: PharmAust Ltd (ASX:PAA), a clinical-stage oncology company, is pleased to provide an update on its Phase IIb trial testing the effects of monepantel upon pet owners’ dogs with treatment naïve B cell lymphoma.

Recruitment for the trial has commenced and several dogs have been successfully recruited and have started treatment with MPL tablets.

Six dogs not eligible for the trial have commenced compassionate treatment with MPL tablets.

PharmAust will be pleased to update the market when a sufficient number of dogs with meaningful trial endpoints have completed their treatment regimen

Disc: I hold

Update: Monepantel COVID-19 Testing in the Netherlands

~ Leiden University continues to evaluate monepantel in their anti-Covid19 systems

~ Experimental work affected by global supply chain shortages

~ Timing not affecting PharmAust’s overall clinical development plans

PharmAust Ltd (ASX:PAA), a clinical-stage oncology company, is pleased to provide further information on work being conducted in the Netherlands investigating the effects of monepantel upon coronavirus infections.

The coronavirus pandemic has been severely affecting global supply chains and consequently performing experiments in many parts of the world, including the Netherlands, has proven problematic. Tests using monepantel and monepantel sulfone as Covid-19 antivirals, however, continue at Leiden University and PharmAust will be pleased to update the market when results come to hand.

DISC: I hold