Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Thought I'd spend some time diving into the latest news about CIB.

As announced recently, CIB (Craig International Ballistics) received a 30m order from the Australian government to supply anti ballistic armour for ADF

Also covered in smallcaps

PPK has a 45% interest in CIB. So that 30m order (ie: "expected revenue") is less than 15m to PPK which is currently half the market cap.

The share price initially rallied on the news before falling back to the price before the announcement. Looks like that was an opportunity for bag holders to get out.

I'm guessing there is lots of skepticism on whether CIB can deliver the order and book revenue. We also don't know the timing of the revenue.

To find out why this happened, I decided to go through the annual reports which paint a less glowing picture of CIB

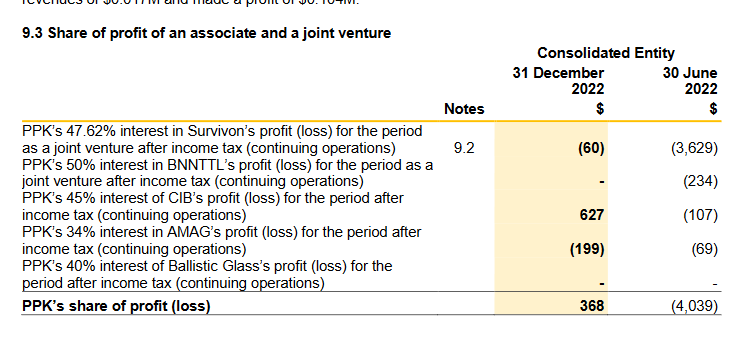

2022 half year

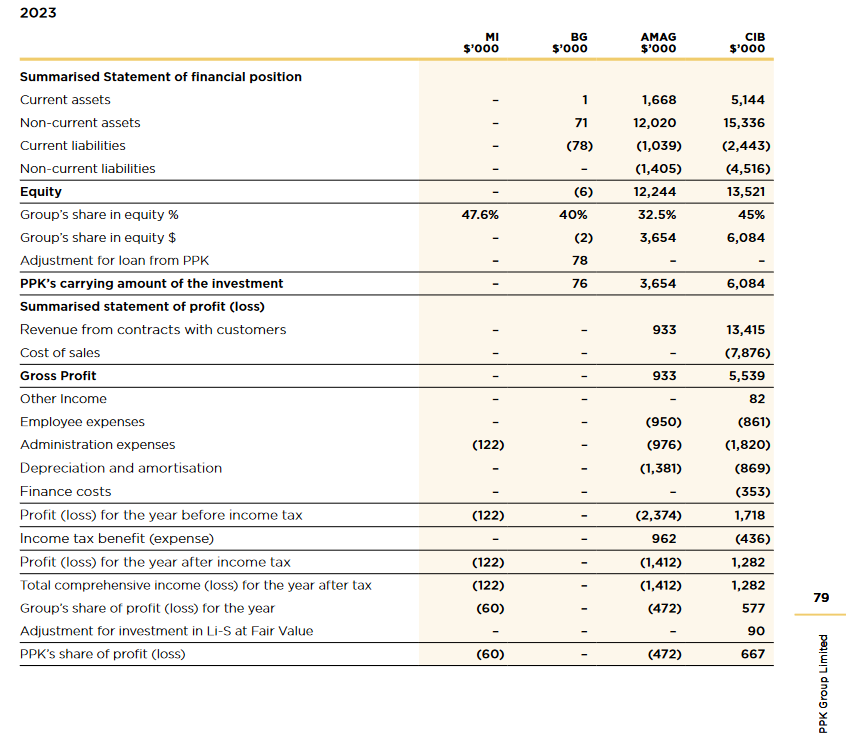

2023 FY (Aug 2023)

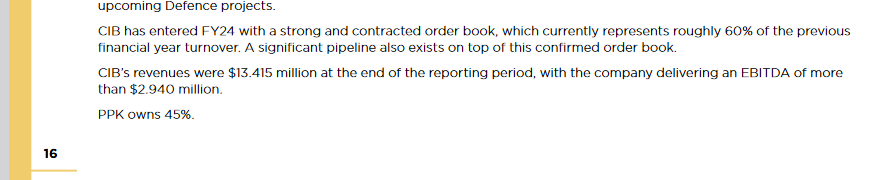

Pretty good so far... EBITDA of 2.9m on revenue of 13m and PAT of 1.282m

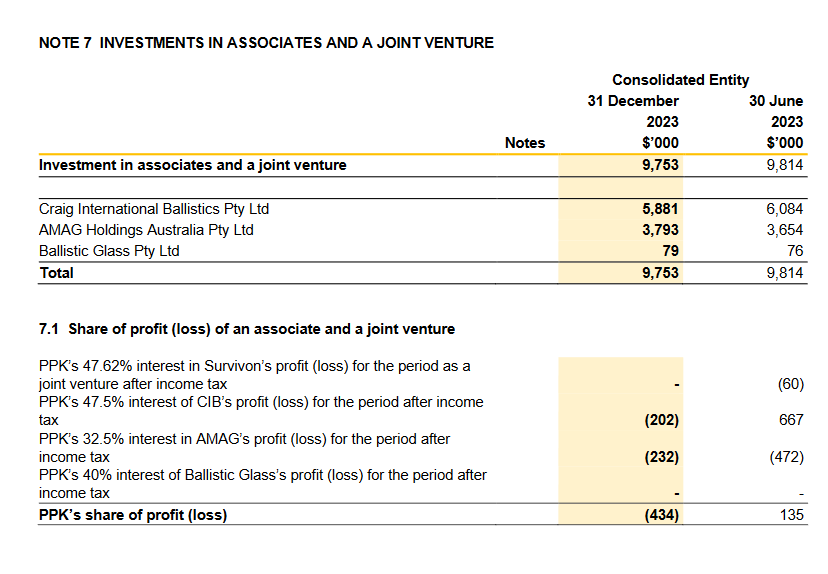

HY 24 31 dec 2023

Not so good. Somehow Craig made a loss here which is not good for PPK although this was before the 30m order.

Don't know much about the founder of Craig International Ballistics. But he has been in this game for 21 years and started out from the bottom. So not much experience on the corporate side. Plus the business is based on the Gold Coast

Despite the 30m order (which has no timing on revenues), I'd probably give this one a pass for now. And perhaps I wasted a few hours here in the process!

But the contrarian in me still thinks it is a buy if some of that order materialises into revenue (and push PPKs share of CIB back to profit)

An interesting day for PPK to say the least, up 30% on no news and looks to have been given a speeding ticket so has been placed in a trading halt. When I logged into my account this evening and saw this I was rather perplexed but after clicking on the trading halt announcement it is in relation to Li-S Energy (ASX code LIS), which from memory I believe PPK owns around 40% of.

I'd say the big hike in price either comes down to someone leaking some good news or people trying to front-run a positive announcement for LIS. If it is bad news, well could be some carnage once the halt is removed.

Dale McNamara is currently Executive Director – Global Mining and likely (he is targetted to be) the CEO of the soon to be spun out of the group, PPK Mining.

McNamara is running as a candidate in the seat of Hunter for the House of Reps and has aligned himself with One Nation on the back of ON being "the only party left supporting coal".

Hunter is listed as a key seat, although it has been held by Labor since 1972. Last election ON received 3-something percent of the vote. It's likely McNamara will be sitting in the CEO seat in July (the targetted spin out date for PPK Mining), rather than making taxpayer backed trips to the nation's capital.

Incorrectly in my mind, PPK has always been a mining services company with their CoalTram and other underground diesel vehicles, and equipment. I was surprised to learn that the board has been seeking to dispose of the mining equipment (PPKME) division as it “would be in the best interests of shareholders and PPKME’s employees.”

PPK will then be solely a company focused on the technology incubation and commercialisation of primarily university-based projects such as the patented Boron Nitride Nanotubes that from Deakin Uni.

It appears there were negotiations with several parties, a sale was not concluded, so PPKME is to be spun out as a separate unlisted public company and PPK will not retain any shareholding. Finexia Securities is to be engaged to operate an off market buy/sell facility to ensure liquidity and conclude the process before the end of the financial year

It is unlikely PPKME will be as lucrative as the Li-S Energy spin out (initially was) late last year. PPK regains a touch over 50% holding.

Other projects on the books include:

White Graphene – not yet out of commercialisation/ in to corporatisation stage, although a collaboration agreement has been signed with Sun Metals in Korea to develop industrial coatings. This is a ~63% holding.

Advanced Mobility Analytics – an AI road safety platform which has seen sales in 3x north American cities as well as locally in Sydney. This is a ~24% ownership.

Craig International Ballistics – a body armour division that provides equipment to both law enforcement and defence. PPK as a 45% stake.

Survivon – an antiviral company where PPK has ~47% stake.

Late last year in a shareholder update the chair indicated they believe 2022 will be the most value creating year in history. The market sure does not believe that to be the case if the share price is anything of a measure.

Some of the businesses are interesting individually, but collectively they are a mismatch. For this reason, it does not make sense to carve out PPKME, possibly other than it cannot be polished into something shiny.

I will watch with passing interest from the sidelines to see if they can get any more of these businesses commercialised.

10-Sep-2020: Deakin University BNNTs Found To Be of Highest Purity

Deakin’s Boron Nitride Nanotubes (BNNT) are pure and industry-ready

--- click on link for the full announcement ---

I like the BNNT side of PPK, but I don't like some other parts of their business - and they are quite diversified. I do however follow them due to their ability to produce BNNTs very cheaply, and if they can scale up that production, and find some customers to buy it off them... Things could get very interesting!

10-June-2020: COVID-19 and Market Update

While there still exists uncertainty in the economy, and there is a possibility of disruption to specific industries, it is very positive that all of PPK’s businesses continued to operate during the COVID-19 pandemic and that no staff tested positive. It has been a challenge to interpret and follow government restrictions, guidance across three states and adapt our work practices to align with the requirements of our staff and customers.

BNNT TECHNOLOGY LIMITED (BNNTTL) UPDATE

BNNT Technology Limited has three distinct strategies.

Firstly, as outlined from Day 1, to produce Boron Nitride Nanotubes (BNNT) in pure grade and in commercial quantities. Production levels from a single furnace on a single shift are now running at 10 grams per day and at 99% purity.

This combination can be simply scaled up to produce far larger quantities of BNNT from multiple production units operating in multiple shifts. BNNTTL has recently ordered additional plant and equipment to move to a two plant multi shift operation to increase the production of 99% purity BNNT.

BNNTTL’s scientists and engineers are continuously working on improvements in both batch production techniques and continuous production. Continuous production means a production unit producing BNNT essentially around the clock, without having to cool down and then reheat the production unit for each batch of production.

Whilst continuous production has not yet been achieved it remains a key focus. By scaling up existing batch production to produce commercial quantities of BBNT there is inevitably a higher cost and elongated time frame.

The Second and Third strategies for BNNTTL relate to the demand side. BNNTTL is currently supplying pure grade BNNT to select parties who are trialling the infusion or blending into their component production processes. BNNT has multiple attractions because of its immense strength, lightness, conductivity and radiation qualities. Its previous unavailability has meant that many businesses have been very interested but simply unable to source enough high quality product to test. They now can – and are, with BNNT supplied by BNNTTL.

To encourage further demand stimulation, PPK has taken a direct interest in two upstream applications which are hugely exciting because of their potential size.

One is in the ballistic armaments sector– PPK acquired 45% of Craig International Ballistics on 16 December 2019. The rationale for this investment is to profit from selling BNNT and secondly by participating in the potential upside by mixing BNNT into established product verticals with a game-changing upside.

A second investment is through PPK’s interest in Lithium Sulphur (Li-S) Battery production.

PPK’s market update of 24 March 2020 advised of the application of research for flexible Lithium Sulphur Batteries (Li-S) using BNNT. Deakin holds a 25% interest, BNNTTL a 10% interest and PPK a 65% interest.

This project has been scoped and Deakin has contracted resources to meet the two-year timeline with initial funding to Deakin already provided. Li-S Energy has engaged Novus Capital Limited to raise a minimum $2.000 million to a maximum of $3.250 million on behalf of Li-S Energy, the company incorporated to run this joint venture. As of today’s date the minimum subscription of $2.000 million has been met.

The minimum capital raised will entitle investors to own 6.15% of the company and, if the maximum capital is raised, then the investors will be entitled to 9.10% of the company.

CRAIG INTERNATIONAL BALLISTICS (CIB) UPDATE

Craig International Ballistics (CIB) has also been impacted by supply chain disruptions with a number of key raw material suppliers in South America and Europe either temporarily closed or operating at a reduced manufacturing capability throughout March to May. Although the manufacturing plants of those key raw material suppliers are now operational, logistic disruptions remain. The cost of air transport is substantially higher than what was previously considered normal. Mitigation strategies were implemented in early March to purchase additional stock and shift all material sourcing to sea freight logistics.

As a result of supplier shutdowns and longer sea freight transit times, some small customer orders originally planned for delivery within the 2020 financial year have now been scheduled for the first quarter of the 2021 financial year, however, there have been no contracts lost.

Importantly, the Australian Federal Government recently announced the initial $1.000 million contract to CIB for the Australian Defence Force (ADF) to receive 750 sets of soft armour inserts to replace in-service armour using world-first body armour technology that will provide superior protection, is significantly lighter than the current soft armour and offers greater comfort for Australian troops.

PPK MINING EQUIPMENT (PPKME) UPDATE

The underground coal mining industry has been impacted by three COVID-19 events in the past two months including:

- companies changing their operations to protect employees resulting in higher costs;

- international economies having slowed considerably resulting in lower demand for coal from some regions; and

- an increase in political and economic tensions between China and the US and Australia.

As a consequence PPKME has been impacted with revenues lower than budgeted in the last two months. It has seen a rapid slowdown with mines reducing labour, operating costs and capital budgets under review. However, there is still optimism from PPKME’s major customers for expansion and reopening of ‘care and maintenance’ mines in the near term.

Worldwide supply chain disruption has also delayed completion of the newly designed 12 seat personnel vehicle but the final components are now in transit for assembly and testing in PPKME’s Tomago site in the coming weeks. Despite these impacts, as of 30 April 2020 PPKME has achieved its 10th month of positive EBITDA and continues to generate free-cash flow.

PPK GROUP OUTLOOK

It is still difficult to provide accurate financial year end forecasts, however PPK expects the following outcomes:

- PPKME revenues should be similar to that of the 2019 financial year and deliver a positive EBITDA in the range of $3.800 million to $4.400 million;

- The EBITDA from associates or joint ventures in the second half of the financial year should be comparable to that of the first half of the financial year, except for additional research, legal and COVID-19 costs that are being incurred in these new ventures;

- Corporate expenses for the second half of the financial year will be significantly higher than those incurred for the first half of the financial year due to the establishment of new BNNT application projects, additional research, COVID-19 costs and additional staff costs for expanding the BNNT joint venture program;

- The second half of the financial year will include legal and professional costs of more than $0.600 million in total to defend a claim in the Supreme Court of NSW as disclosed in previous years accounts;

- As a result, PPK Group will incur a modest overall loss of less than $1.000 million to June 30 2020 including $2.000 million worth of accounting standard adjustments under AASB 16;

- PPK Group will end the financial year with a positive cash bank balance, no debt and an undrawn $4.000 million financing facility provided by NAB;

- At this stage, as the business continues to generate free cash, PPK is confident of declaring a dividend, albeit a final decision will not be made until financial statements are completed and audited.

While the prospective 30 June 2020 financial results may not look as positive as hoped, there is significant momentum that the financial benefits from the acquisition of BNNT Technology Limited will be forthcoming in the near future. With continued interest in the usage of BNNT in new application projects, there are multiple potential sources of revenue to come from investment in these applications with new investment partners, as well as the sale of BNNT via BNNT Technology Limited itself.

PPK Management and Board are excited at the potential and look forward to the year ahead.

For further information contact:

Robin Levison Executive Chairman of PPK Group Limited On 07 3054 4500.

--- ends ---

Disclosure: I hold a small position in PPK.

07-May-2020: In his Monthly Report for April 2020, EGP Capital's Concentrated Value Fund's Tony Hansen devoted almost 5 pages to PPK. Definitely worth reading!!

PPK was the 7th largest position in EGP Capital's Concentrated Value Fund (CVF) at the end of April.