Thought I'd spend some time diving into the latest news about CIB.

As announced recently, CIB (Craig International Ballistics) received a 30m order from the Australian government to supply anti ballistic armour for ADF

Also covered in smallcaps

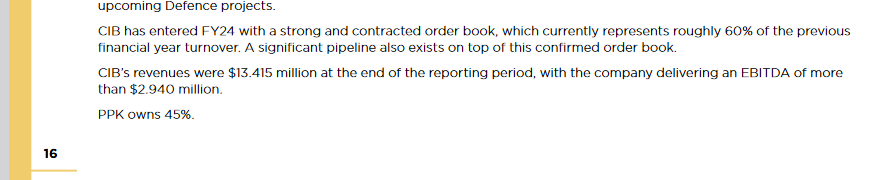

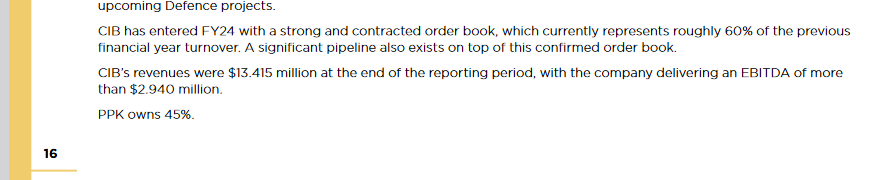

PPK has a 45% interest in CIB. So that 30m order (ie: "expected revenue") is less than 15m to PPK which is currently half the market cap.

The share price initially rallied on the news before falling back to the price before the announcement. Looks like that was an opportunity for bag holders to get out.

I'm guessing there is lots of skepticism on whether CIB can deliver the order and book revenue. We also don't know the timing of the revenue.

To find out why this happened, I decided to go through the annual reports which paint a less glowing picture of CIB

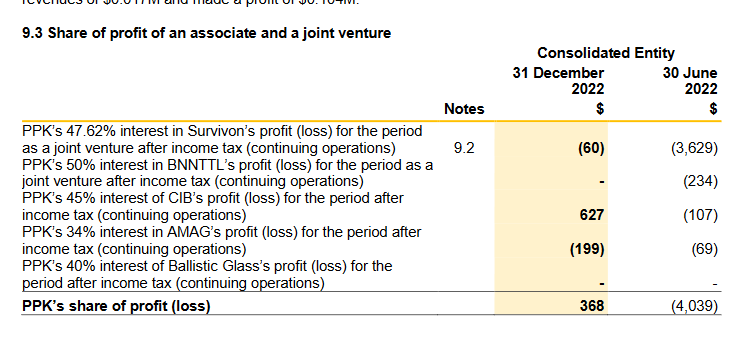

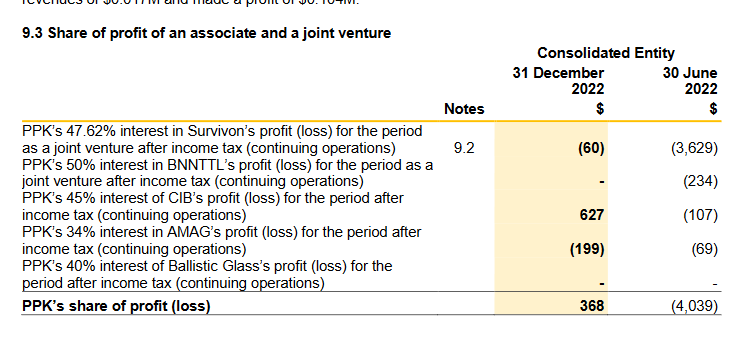

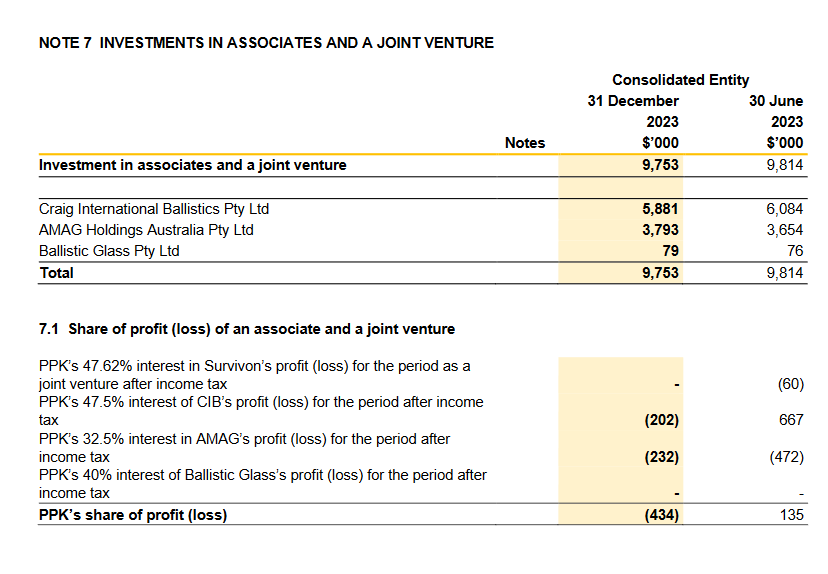

2022 half year

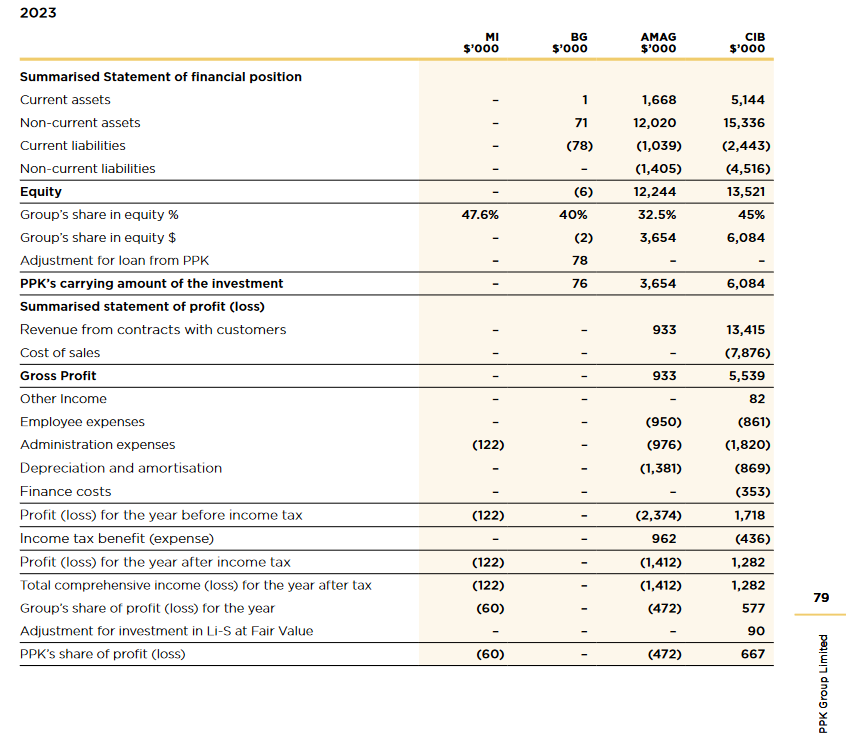

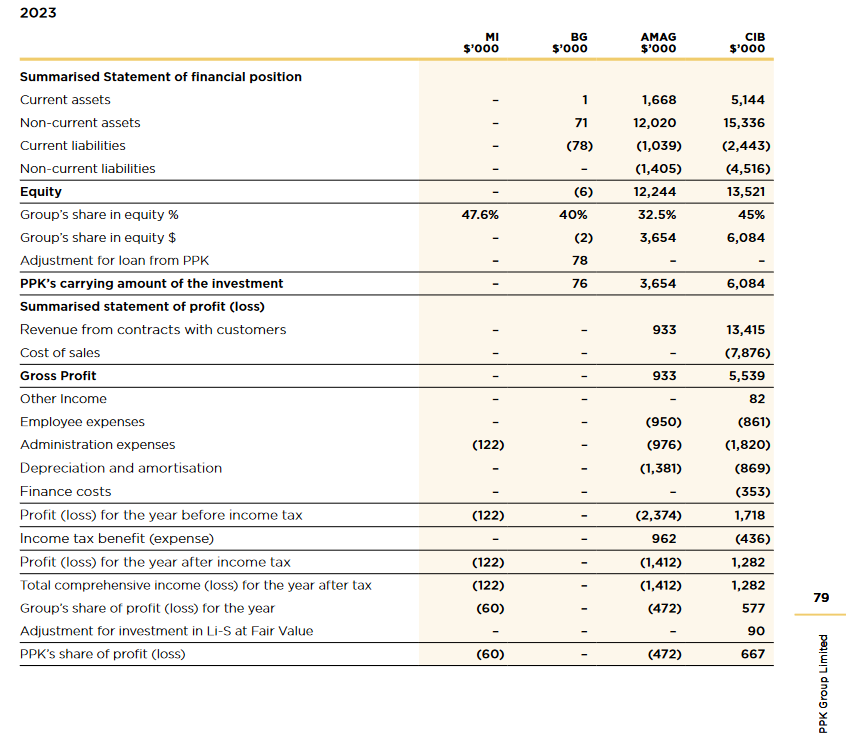

2023 FY (Aug 2023)

Pretty good so far... EBITDA of 2.9m on revenue of 13m and PAT of 1.282m

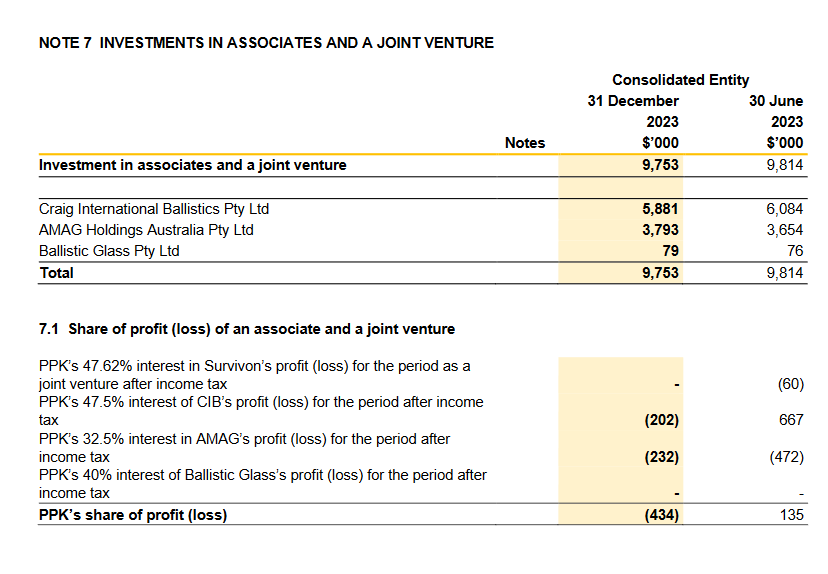

HY 24 31 dec 2023

Not so good. Somehow Craig made a loss here which is not good for PPK although this was before the 30m order.

Don't know much about the founder of Craig International Ballistics. But he has been in this game for 21 years and started out from the bottom. So not much experience on the corporate side. Plus the business is based on the Gold Coast

Despite the 30m order (which has no timing on revenues), I'd probably give this one a pass for now. And perhaps I wasted a few hours here in the process!

But the contrarian in me still thinks it is a buy if some of that order materialises into revenue (and push PPKs share of CIB back to profit)