Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

06-May-2025: Platinum-PTM-Funds-Under-Management---30-April-2025.PDF

See also: Platinum-(PTM)-Funds-Under-Management---April-2024.PDF (12 months ago)

And: Platinum-(PTM)-Funds-Under-Management---May-2023.PDF (23 months ago - that's as far back as Commsec would let me go).

History of declining FUM and large outflows:

- April 2023: FUM: $18.44 Billion, with net outflows of $324 million in May 2023.

- April 2024: FUM: $13.75 Billion, with net outflows of approximately $1.65 billion that month.

- April 2025: FUM: $9.65 Billion, with net outflows of approximately $243 million that month.

So their Funds Under Management have almost halved in two years; it's like a slow motion version of what happened over at MFG, so not as volatile, but still nasty.

Here's their 5 year chart:

PTM is a fund manager, and they do well if the globally-focused funds that they manage also do well, because they can charge performance fees on any outperformance (vs their benchmark, usually the MSCI ex-Australia index) in addition to their ongoing base management fees.

PTM's funds have struggled, in part because while Hamish Douglass over at MFG (back in the day, when he was still at MFG and seen as - and was - the driving force behind MFG) backed big US tech, Kerr Neilson (who had the financial backing of George Soros back then) - the founder of Platinum Asset Management - put most of Platinum's chips on Asia, and more specifically China, and that hasn't worked out so well for Kerr or his successor at Platinum Asset Management, Andrew Clifford, in recent years, so underperformance means less performance fees means less profits for the manager (PTM) which is made worse by declining FUM where even the base management fees have been declining as the funds they manage have almost halved over the past two years.

This is of course driven by continuing redemptions (people pulling money out of Platinum funds), a trend which is only likely to continue as the value of ETFs becomes more and more obvious.

Disc: Not held, although I held both MFG and PTM, as well as some of their funds in prior years - not for a few years now however.

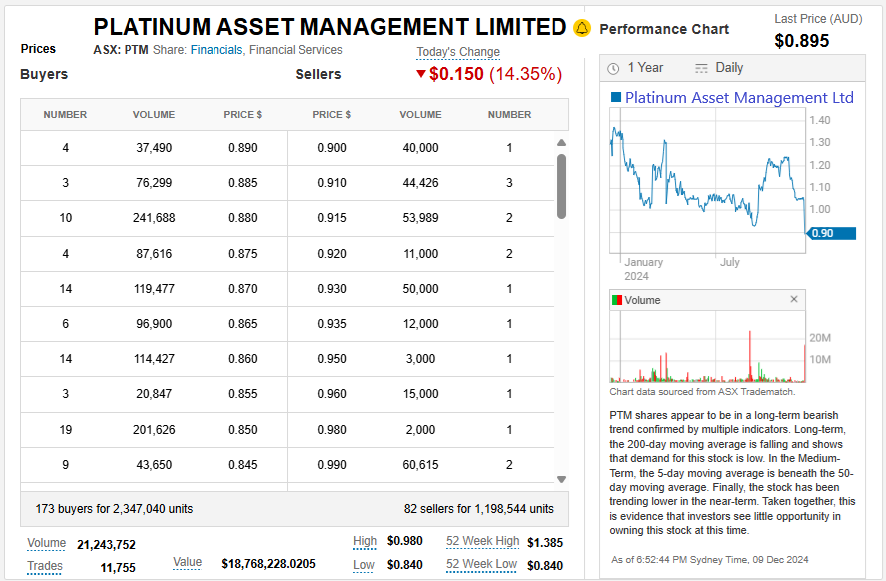

Platinum Asset Management (PTM -14.4%) reports it is no longer in discussions with Regal. Now below its pre-bid price.

09-Dec-2024: PTM - End-of-Regal-discussions,-special-dividend--turnaround.PDF

Not the Chrissy Present PTM shareholders were hoping for. Shows that buying into companies based on M&A arbitrage doesn't always work out. PTM were bought up based on the 17th September announcement of the Non-binding-indicative-proposal-from-Regal-Partners-Limited-for-PTM.PDF but today with the disclosure that Regal have walked away from the deal after a shortened period of DD, PTM, the manager of the Platinum managed funds, has dropped -14.35% and is now trading below the level it was pre-bid.

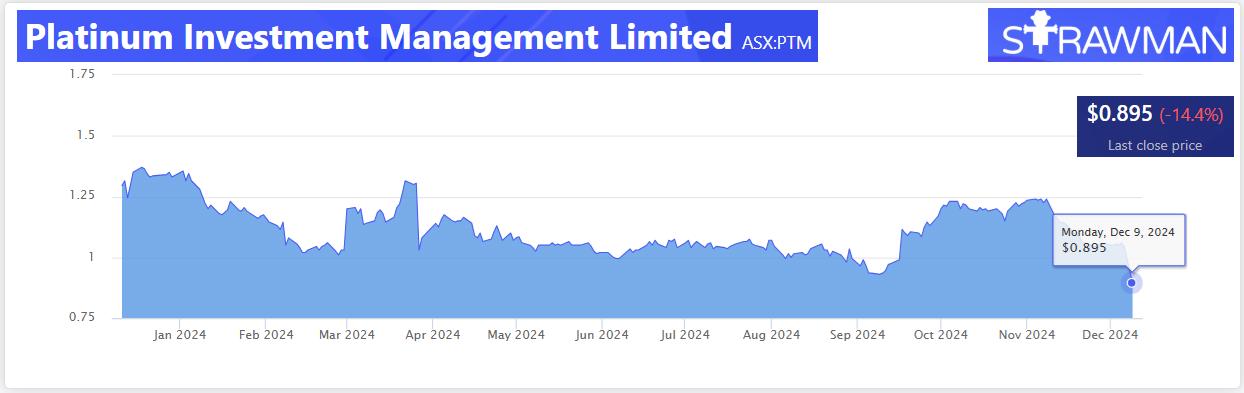

It's not been a positive experience for PTM shareholders this past year:

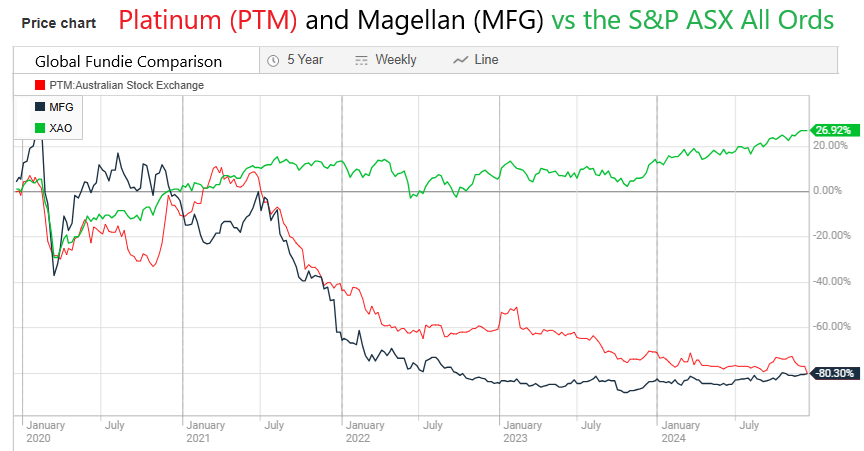

But it's been worse for anybody who's been holding PTM or MFG since mid-2021.

While the All Ords Accumulation Index (XAO) has put on +27% in 5 years, both Magellan Financial Group (MFG) and Platinum Asset Management (PTM) are both down -80% over the same period. It's just taken PTM twice as long to get there. MFG were already down -80% in July 2022, then they went even lower and have now come back up to ONLY being down -80% over 5 years once again.

Both of these Australian fund managers who specialise in overseas sharemarket investments have ended up falling by the same amount but 5 years ago they had very different perspectives on where the best returns could be made. At that time Hamish Douglass (MFG's co-founder and CIO - Chief Investment Officer - at that time) was still flying high at Magellan and insisting that there were far better risk-adjusted returns to be made in US tech stocks and fast food franchises than there were in Asia, particularly China, where he said there were elevated risks, whereas PTM's founder, Kerr Neilson had stepped down as CEO of PTM in 2018 and was replaced by Andrew Clifford, the CIO of Platinum who adopted both roles, and Clifford strongly believed that the majority of the companies that Magellan were investing in were far too expensive, and there was far more value to be found in Asia, particularly in China.

On the surface it seemed like MFG were growth investors and PTM were value investors, but the reality is never quite that simple.

Kerr Neilson appeared to share Clifford's views, however Kerr later resigned from the Board of Platinum Asset Management in 2022.

What changed between the end of 2019 and mid-2021 was firstly that Hamish decided to break his "no China investments" rule and make some large investments in Tencent and Alibaba, and then the Chinese central government cracked down on those companies and others where they felt the billionaire founders and managers were getting too bold and acting like they lived in and were operating in a democracy where their own views were valuable and could be freely shared, even when those views were critical of some Chinese Central Government policies. Those Chinese tech billionaires were reminded that was certainly not the case. Spin-outs and IPOs were blocked. Billionaires like Jack Ma went missing for months. And Chinese tech stocks got smashed, and the entire Chinese sharemarket went into a deep slump as a result.

In Magellan's case, there were also other factors, like Hamish making some big bets on what turned out to be losing positions in the US at the same time, but the Chinese tech stock "correction" affected both Magellan and Platinum.

Platinum continued to underperform their global peers, and Magellan went from being consistent outperformers to becoming underperformers.

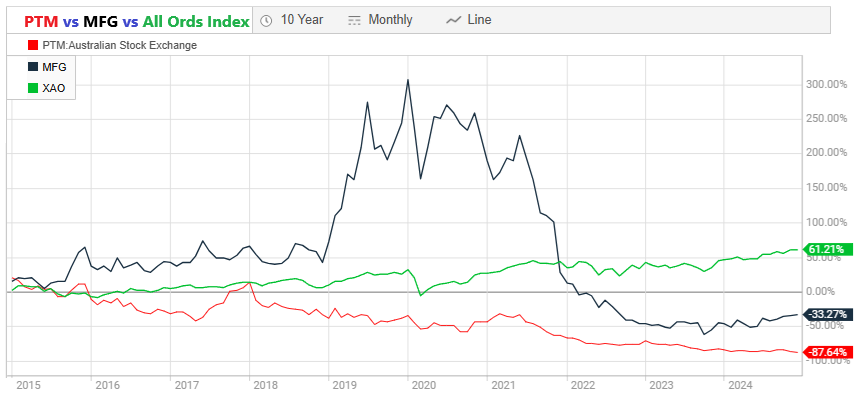

With Magellan, it was a more bumpy ride over 10 years, with highs and lows, whereas Investors in Platinum over the past decade have had a less eventful and more calm ride down to lower and lower share prices.

And now Regal have had a look under their bonnet and didn't much like what they saw, so have walked.

I have been invested in both PTM and MFG at various times, and have made money and lost money on both. The losses have outweighed the gains however, so with the benefit of hindsight I should have stayed well away from both.

They used to scan well because they had really high ROE, because as fund managers they have relatively fixed costs, and when their FUM was increasing the extra Funds Under Management just increased the bottom line profits without increasing costs. However the bottom line with both of them depended on them outperforming so they could charge performance fees on top of their base management fees, and their profitability declined as their FUM declined. It's a competitive sector, and people want to back winners in terms of which of the underlying funds they invest in, so companies that don't consistently outperform are always going to struggle as they lose FUM.

It's not a sector I invest in these days. Lessons learned.