I had never heard of this company and there is only one straw; about management by @Magneto

Here is a summary of why it might be a good investment

Redox has achieved a phenomenal revenue CAGR of 12% over the three decades to end June 2024, driven by its strategy of diversifying revenue across new product groups, thereby capturing greater market share in the core markets of Australia and New Zealand, and more recently, expanding the business in offshore markets, including Southeast Asia and the United States.

Sourcing from its network of over 1,000 chemical suppliers Redox continues to expand its product portfolio, with over 5,000 available stock keeping units across a diverse range of industries and end-customer uses. This one-stop-shop approach supports the firm’s strategy to grow share of spending per customer, leading to above gross domestic product revenue growth.

Redox also expands its customer base via small bolt-on acquisitions of other distributors and introducing them to its expanded product range to grow share of spending. It completed three such transactions in fiscal 2024. We expect the company to continue to make small acquisitions in other distributors thereby providing opportunities to enter new product categories and industry sub-sectors.

Globally, we expect further expansion to focus on the US. Redox entered North America in 2015, where it has broad geographic coverage. We estimate the US is the world’s second largest chemicals market, after China. But although Redox has had success in winning large volume customers in the US, such as in the beverage industry, we anticipate Redox to remain a small player within these regions. Small and midsize US customers offer better margins, and this is where Redox is seeking to grow market share. We think this will be slow going given the competitive dynamic in the US and estimate group gross margins to ease to historical averages over our 10-year forecast period as its sales are more skewed to lower margin customers while the business grows in the US.

Important points from this years announcement

Net Profit Decline

• Net profit after tax fell by 14.6%, from $90.2 million in FY24 to $77.1 million in FY25. The primary driver here was margin normalisation and increased costs, not a reduction in sales revenue.

• Although revenue grew by 9.4% to $1,243.8 million, cost and margin pressures outweighed the gains, translating into lower profit available to each share.

Gross Margin and Operating Expenses

• The gross profit margin declined to 21.6% (down from 23.4%), largely due to higher-low volume, low-margin fertiliser sales, and the impact of acquisitions of lower-margin businesses.

• Underlying operating expenses increased by 16.3%, reflecting higher distribution, storage, administrative costs, increased wages, and additional headcount from recent acquisitions.

• There were also increased costs from integrating new businesses and from persistent inflationary pressures on wages and warehousing.

Acquisitions and Other Non-Recurring Items

• Redox completed three acquisitions during the year (Oleum, Auschem, Molekulis), increasing costs in the short term before realising full benefits and synergies, which also contributed to the reduction in earnings available per share.

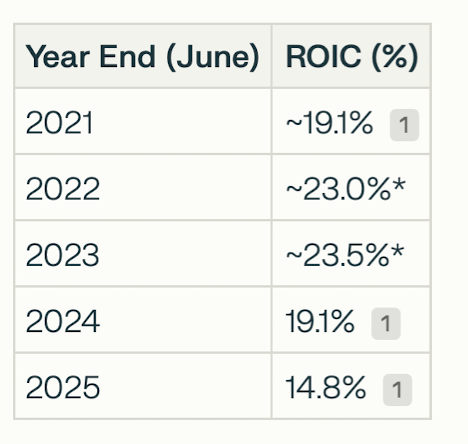

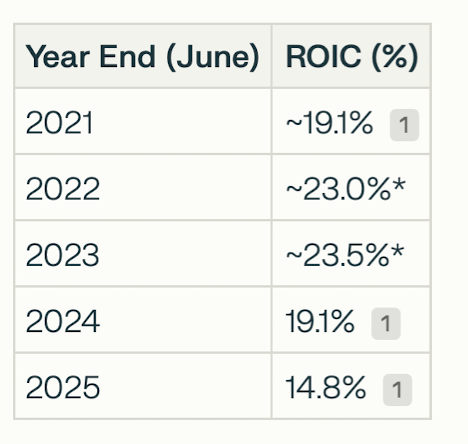

I have tabulated historical ROIC and EPS and the thesis would revolve around a return to these levels after the last few years of higher CAPEX to build out warehouses and some larger acquisitions than is usual.

Integral to this assumption is the high degree of insider ownership (About 70% of the company stocks are tightly held by the Coneliano founding family) which I believe would support this as they will look through short term reductions in profitability to the benefit of medium-long term shareholders. As such it has gone on my watch list to revisit in a year or two when hopefully we will see this come into effect. I don't imagine it to shoot the lights out but as a low risk compounder would suit my near-retirement "risk adjusted return" .

full announcement here

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02981275-2A1615057&v=4a466cc3f899e00730cfbfcd5ab8940c41f474b6

NOT HELD