Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I had never heard of this company and there is only one straw; about management by @Magneto

Here is a summary of why it might be a good investment

Redox has achieved a phenomenal revenue CAGR of 12% over the three decades to end June 2024, driven by its strategy of diversifying revenue across new product groups, thereby capturing greater market share in the core markets of Australia and New Zealand, and more recently, expanding the business in offshore markets, including Southeast Asia and the United States.

Sourcing from its network of over 1,000 chemical suppliers Redox continues to expand its product portfolio, with over 5,000 available stock keeping units across a diverse range of industries and end-customer uses. This one-stop-shop approach supports the firm’s strategy to grow share of spending per customer, leading to above gross domestic product revenue growth.

Redox also expands its customer base via small bolt-on acquisitions of other distributors and introducing them to its expanded product range to grow share of spending. It completed three such transactions in fiscal 2024. We expect the company to continue to make small acquisitions in other distributors thereby providing opportunities to enter new product categories and industry sub-sectors.

Globally, we expect further expansion to focus on the US. Redox entered North America in 2015, where it has broad geographic coverage. We estimate the US is the world’s second largest chemicals market, after China. But although Redox has had success in winning large volume customers in the US, such as in the beverage industry, we anticipate Redox to remain a small player within these regions. Small and midsize US customers offer better margins, and this is where Redox is seeking to grow market share. We think this will be slow going given the competitive dynamic in the US and estimate group gross margins to ease to historical averages over our 10-year forecast period as its sales are more skewed to lower margin customers while the business grows in the US.

Important points from this years announcement

Net Profit Decline

• Net profit after tax fell by 14.6%, from $90.2 million in FY24 to $77.1 million in FY25. The primary driver here was margin normalisation and increased costs, not a reduction in sales revenue.

• Although revenue grew by 9.4% to $1,243.8 million, cost and margin pressures outweighed the gains, translating into lower profit available to each share.

Gross Margin and Operating Expenses

• The gross profit margin declined to 21.6% (down from 23.4%), largely due to higher-low volume, low-margin fertiliser sales, and the impact of acquisitions of lower-margin businesses.

• Underlying operating expenses increased by 16.3%, reflecting higher distribution, storage, administrative costs, increased wages, and additional headcount from recent acquisitions.

• There were also increased costs from integrating new businesses and from persistent inflationary pressures on wages and warehousing.

Acquisitions and Other Non-Recurring Items

• Redox completed three acquisitions during the year (Oleum, Auschem, Molekulis), increasing costs in the short term before realising full benefits and synergies, which also contributed to the reduction in earnings available per share.

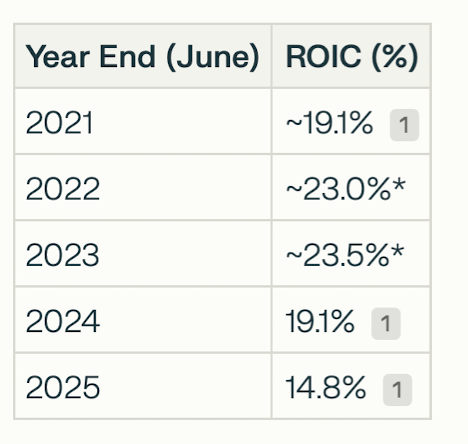

I have tabulated historical ROIC and EPS and the thesis would revolve around a return to these levels after the last few years of higher CAPEX to build out warehouses and some larger acquisitions than is usual.

Integral to this assumption is the high degree of insider ownership (About 70% of the company stocks are tightly held by the Coneliano founding family) which I believe would support this as they will look through short term reductions in profitability to the benefit of medium-long term shareholders. As such it has gone on my watch list to revisit in a year or two when hopefully we will see this come into effect. I don't imagine it to shoot the lights out but as a low risk compounder would suit my near-retirement "risk adjusted return" .

full announcement here

NOT HELD

Market Cap of $1.249B at todays price $2.39 (IPO $2.55)

Management Bio's

Ian H Campbell - Non-Executive Chair

Ian has significant expertise across the corporate sector with 30 years’ experience as a Partner of Ernst & Young and predecessor firms. Ian has served as an Independent Director and Chairman of the Audit Committee on the boards of Gloria Jeans Coffees International Pty Limited, Green’s Foods Holdings Pty Limited, Bigstone Capital Pty Limited and Riskflo Associates Limited. He was also a Partner in the board search practice at Talent Partners. Ian currently serves as Non-Executive Chairman on the board of Kip McGrath Education Centres Limited, an ASX-listed education provider, and as Non-Executive Director and Chairman of the Audit Committee of CVC Limited, an ASX-listed investment company. He is also the Chairman of the Finance Committee of The Bridge Church Sydney. Ian is a Fellow of Chartered Accountants Australia and New Zealand, a Member of the Australian Institute of Directors and has been an Independent Non-Executive Director of Redox since 2009.

Raimond Coneliano - Chief Executive Officer and Managing Director

After having served as a Director on the Board of Redox for 9 years and sitting on the People and Safety Committee, Raimond has recently been appointed Chief Executive Officer and Managing Director, replacing Robert Coneliano. Raimond is a skilled negotiator and relationships expert, he has overseen the development of Redox’s largest bulk product lines and brokered the Company’s biggest trades over his 27+ year career. He has led the sales team through acquisitions, into new markets, new products, and broken sales records. A collaborative, cross-functional leader who takes pride in facilitating growth through his extensive industry knowledge. His passion and verve for connecting customers to our global network of suppliers while delivering industry best service shines through in every animated discussion.

Renato Coneliano - Executive Director and Marketing Director

Renato joined Redox in 1980. He has had many roles over time including both sales and product management responsibilities, as well as Joint Managing Director in 2022. He was instrumental in developing the supply chain and identifying critical suppliers, building these relationships through extensive overseas travel. As Marketing Director, he controls Product Management processes at Redox, controlling open positions, reducing risks, and ensuring that Redox has the market information that adds value to the supply chain. With a focus on gaining new agencies, he facilitates and assists marketing staff in seeking supply partners where shared values and common goals align for mutual benefit. Renato has been a Director of Redox since 1986 and served on the Audit and Risk Management Committee and Governance and Nominations Committee.

Mary Verschuer - Non-Executive Director

Mary has significant experience in executive leadership roles with responsibility for manufacturing, supply chain management and sales and marketing. Mary was the President of the Minerals and Metals division for Schenck Process, a German private equity owned business, and was Vice President of the Asian division of Huhtamaki, a Finnish listed niche packaging business. Mary previously served on the board of ASX-listed Nuplex, a leading global resins business, and THC Global, an ASX-listed medicinal cannabis business. Mary currently serves as Non-Executive Director, Deputy Chair and Chair of Audit and Risk on the board of ASX-listed MaxiPARTS, and as a NED and Chair of Audit and Risk with Forestry Corporation of NSW. Additionally, Mary is Chair of The Infants Home, a not-for-profit provider of early education and care. Mary also mentors CEOs with the CEO Institute and Kilfinan Australia. Mary’s key qualifications include a Bachelor of Applied Science (Chemistry) from UTS, a Master of Science and Society from UNSW, a Master of Business Administration from Macquarie University, and a Master of Arts (Research Methods) from Macquarie University.

Garry Wayling - Non-Executive Director

Garry has over 30 years of experience in the professional services sector. Garry was an Audit Partner for 11 years with Arthur Andersen Sydney and then an Audit Partner in the Strategic Growth division at Ernst & Young until 2010. Garry then held roles as Chief Financial Officer and Managing Director for ASX-listed resources companies. Garry was Independent Director and Chair of the Audit and Risk Committee of ASX-listed OneVue Holdings Limited, and Independent Director of its subsidiary Trustee companies MAP Funds Management Ltd and Diversa Limited. Garry was also an Independent Director and Chair of the Audit and Risk Committee of ASX-listed Inabox Group Limited. He also served 10 years as an Independent Director and Chair of the Audit and Risk Committee for Odyssey House (NSW) retiring in March 2023 at the end of his tenure. Garry is currently the Executive Director of The Australian Olympic Foundation Limited. Garry’s key qualifications include a Bachelor of Commerce degree from UNSW, ACA and GAICD.