05-Feb-2024:

Here's what the MoM boys had to say about it all today in their podcast:

Red5 Dangles the Carrot for Genesis in $2.2Bn Merger with Silver Lake | Daily Mining Show - YouTube

Chapters:

0:00:00 Preview

0:00:00 Introduction

0:01:08 Silver Lake's alternative marketing strategies

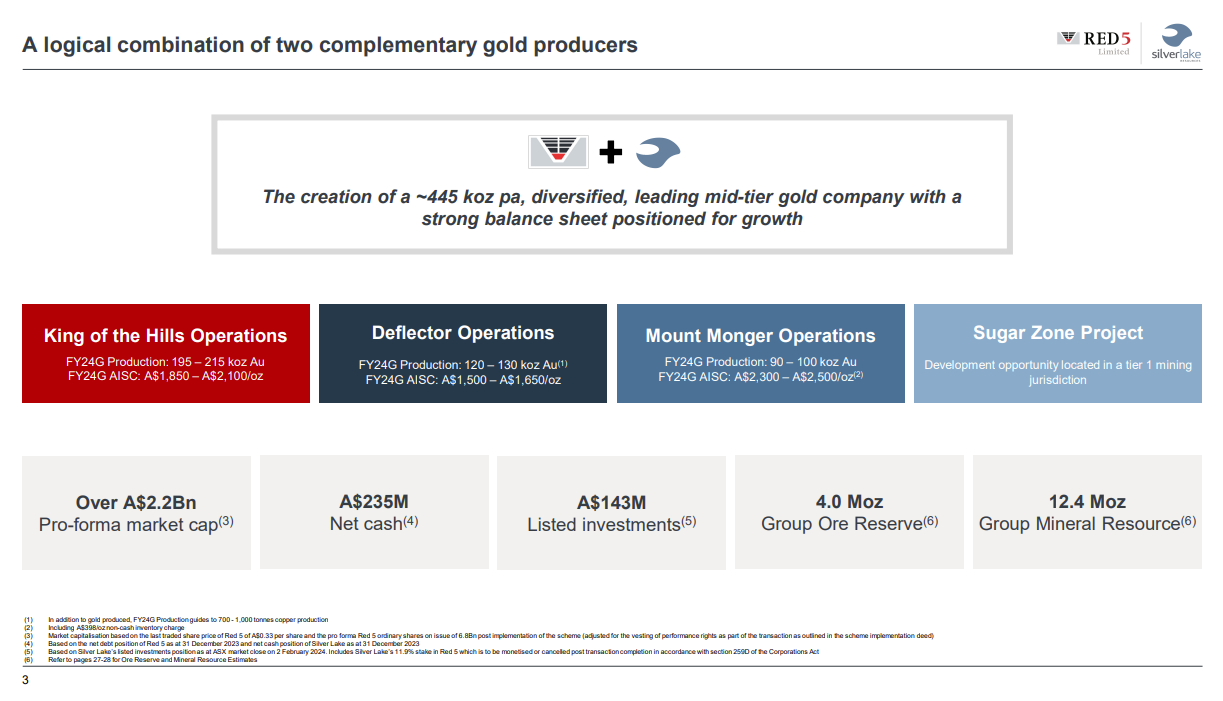

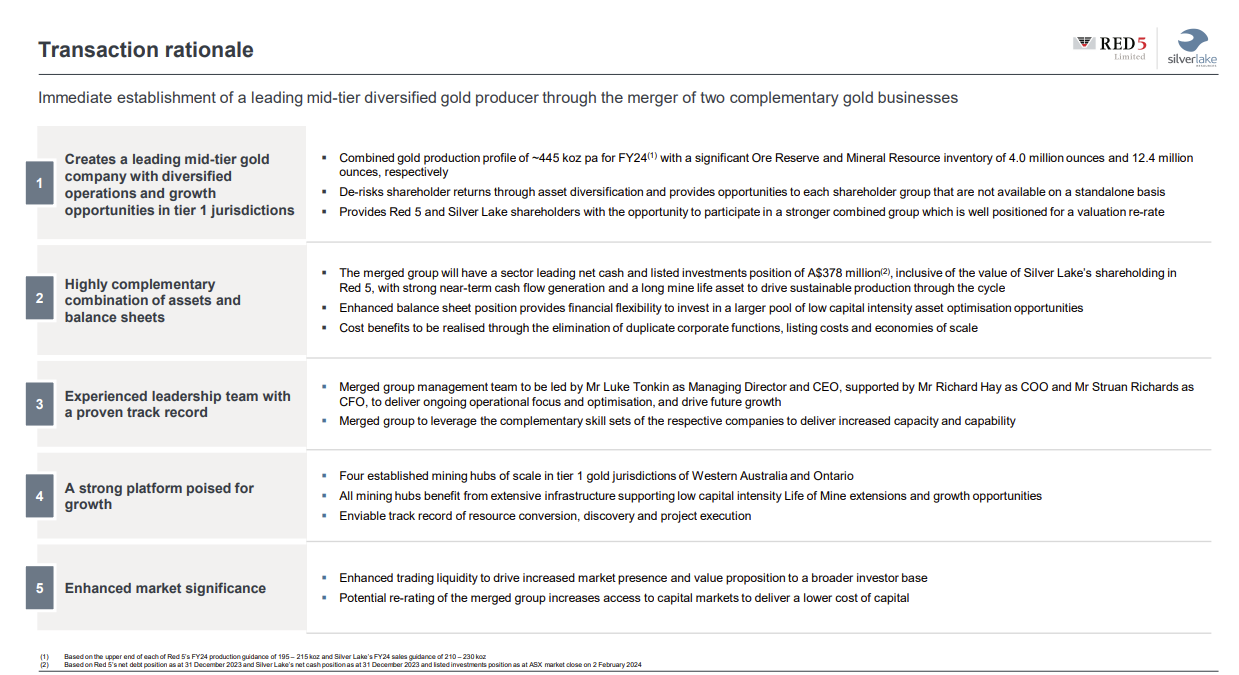

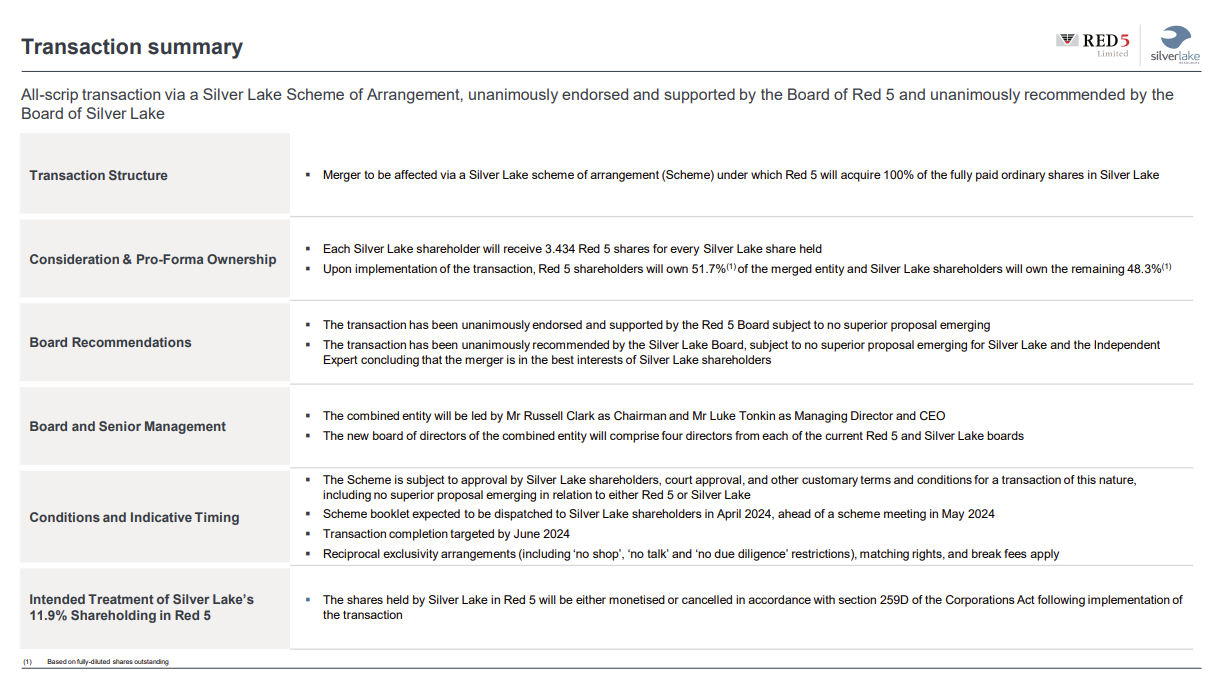

0:07:02 Red 5 MERGING with Silver Lake Resources

0:43:00 Potential Lynas and MP Materials merger

0:44:29 Centaurus get Environmental approvals

0:45:09 Silvercorp/Orecorp update

0:45:36 New Copper producer on the ASX

The short version:

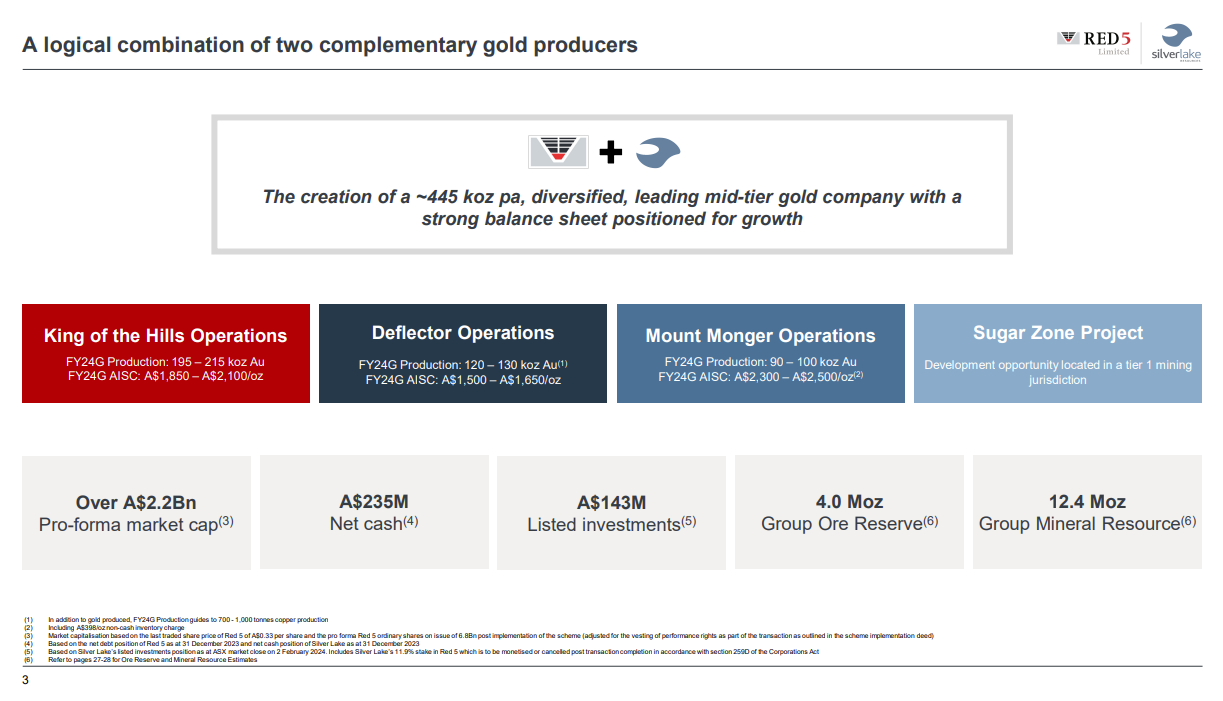

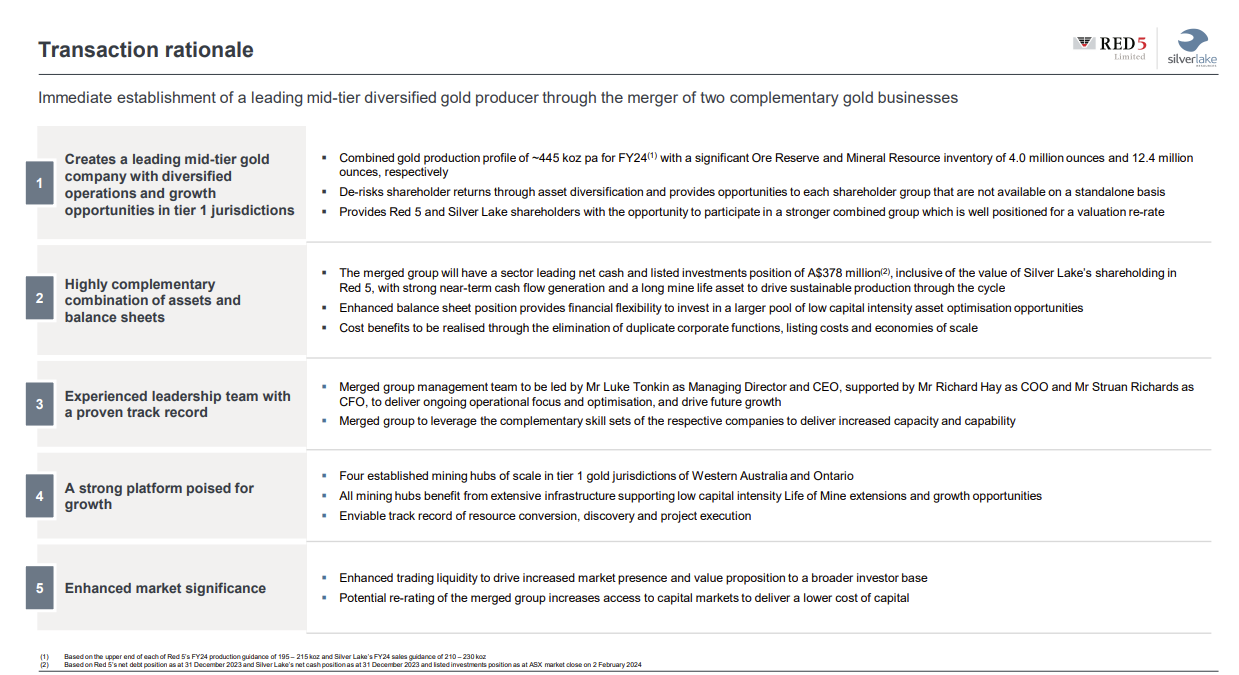

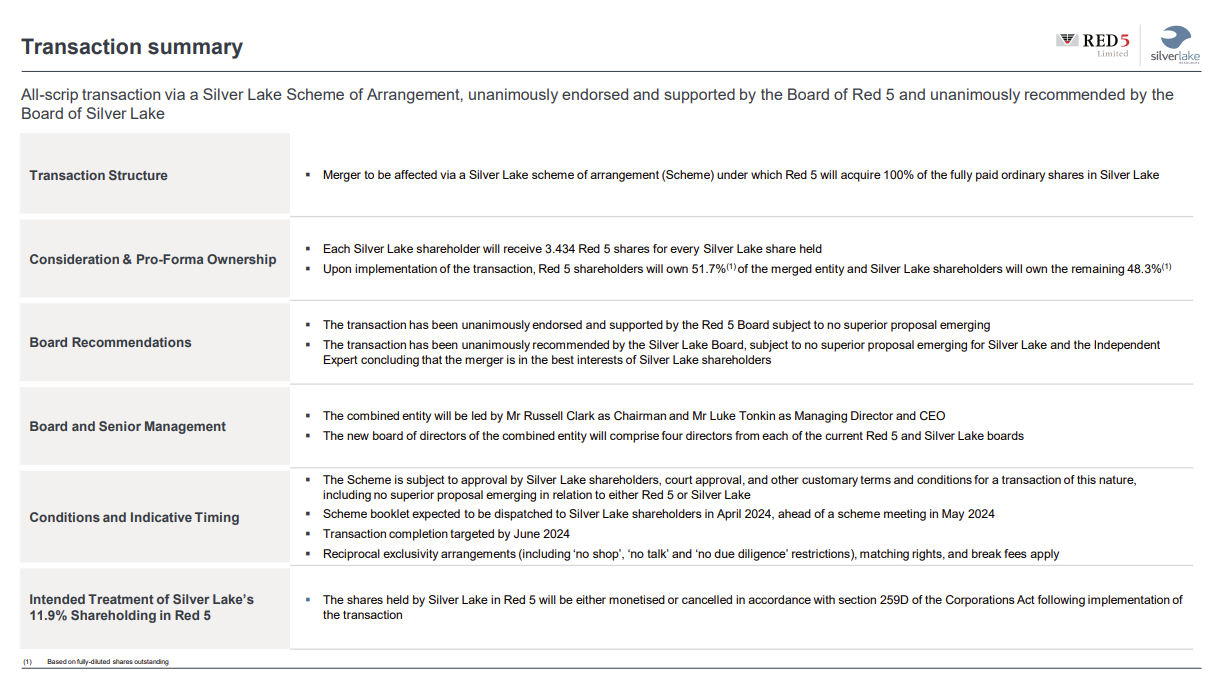

The best thing about SLR is their large cash balance. The worst thing about RED is their debt and lack of cash, and to a lesser extent their out-of-the-money hedgebook. Putting the two companies together certainly makes sense for RED, as they need SLR's cash, and SLR will have better prospects to spend their cash on than they appear to have currently - in terms of exploration spending in highly prospective areas. And it will frustrate the hell out of Raleigh Finlayson at Genesis (GMD) who wants Leonora all to himself (or within his company, Genesis Minerals). Luke Tonkin might not have stopped the Gwalia sale from going through (from SBM to GMD), but he might just end up with RED, unless this deal gets trumped by Raleigh/GMD with a better deal.

For my longer post about this in the "Gold as an investment" thread - click here.

Luke Tonkin, above, the MD/CEO of SLR, will keep his job and be the MD/CEO of this larger new merged entity if the scheme is implemented and RED acquire SLR. RED's current MD, Mark Williams (pictured below), and RED's CFO, David Coyne, will both lose their jobs.

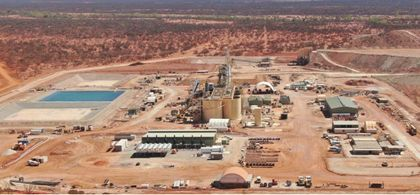

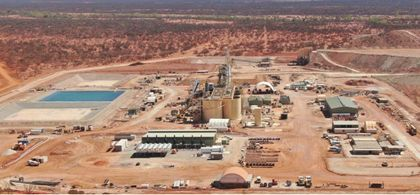

Below, RED's KOTH mill and underground mine:

Red 5 KOTH goes back underground - Australian Mining [7-Apr-2022]

Disc: I do not hold RED or SLR shares. I hold GMD shares, who may also be interested in RED, as I discussed here earlier tonight.