Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Seems like a big restructure with Ken Hancock terminated with immediate effect a couple of weeks back

Not sure what happened here. Ken Hancock also has a significant holding so there could be some large drawdowns soon.

For those interested in the competitive landscape of soil carbon capture and what RLF Agtech is up against. This article is on the non listed LoamBio which is backed by Gronk Ventures.

https://www.smartcompany.com.au/industries/agribusiness/loam-bio-orange-new-facility-scale-up/

There are many others too when you do a search on soil carbon capture.

Main point here is they raised 100m in funding which is significant for a private company and why we need to look at both private and public companies to get a real sense of the competitive landscape and why the companies we invest in aren't getting customers or not achieving financial metrics.

I also feel not many investors including myself do enough of this

Quite surprising there are so many players

RLF is below the seed raising. Now 0.095

Have exited RLF and moved on since they did not to act on my email I found in the quarterly last year on the quarterly cash calculation (see previous straw).

Some however may see value at this price given the seed raising price. However it would also be best to do some research on the current and future state of the CCU market.

Spotted a clerical error in the quarterly

Should be putting a NA here as op cashflows for this quarter was positive. I guess they weren't used to seeing a positive quarter.

RLF Agtech confirmed the mistake when I emailed them but not sure if they are going to re-release the quarterly.

Wonder if the drop and rise last few days was caused by some misreading the figures.

[held]

CBA ordered 50000 ACCUs which is worth 1.8m if the expected market price is $36

They made a 1.0m prepayment for those units NOW to help fund the development of the ACCS soils project in exchange for the ACCUs. I guess they will pay whatever is left once the development completes and the market is established.

So in reality it is actually not much and explains what happened after the announcement.

I think the news didn't need a trading halt with such a small amount unless they anticipated the negotiations might get protracted.

[held]

RLF in a trading halt

Looks quite interesting

[held]

One part that really caught attention, 2 quarters of funding left

To be fair, RLF highlighted the 3rd quarter is usually lower cashflow receipts as shown in the graph

There's more in the quarterly that I won't comment but highlighting and understanding the orange flags.

Until then, looks like cashflow is a bit lumpy and borderline until the next quarter when they expect a bumper result.

[held]

In a nutshell RLF AgTech manufactures nutrition products to produce more resilient plants and crops.

Currently RLF AgTech products uses their proprietary proton delivery technology to make crops more resilient while produce more yield and less fertiliser. Starting to gain traction in other regions outside Australia via South East Asia.

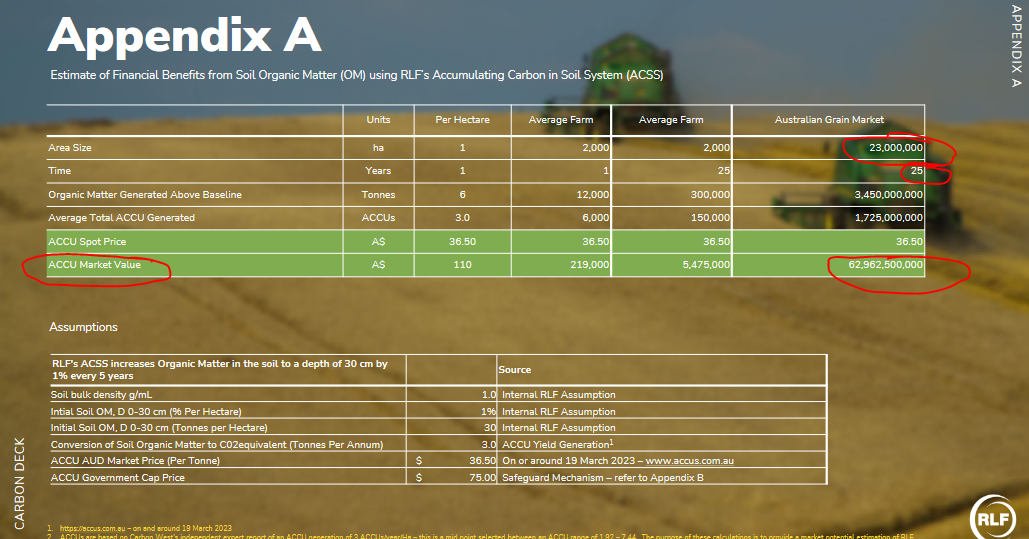

They are also working on a more ambitious venture via subsidiary RLF Carbon to use Carbon sequestration to help farmers increase crop yields through use of ACCS (Accumulating carbon in soil system) with the "potential" to earn carbon credits via ACCUs (Accumulated Carbon Credit Units). I would say "potential" as the ACCU market has not been implemented yet.

The company listed in April 22 and the CEO Ken Hancock appears to have a substantial holding under his name and also under several entities in the name RLF Global and RLF Pty.

Last half yearly seems to show a constant high cash burn. Diving deeper though this seems to have "slowed" in the latest quarterly and cash generation / customer receipts are kicking in.

IPO price of 0.20 and is currently stuck in that range after a dip in the middle.

With the background out of the way, time to outline a few risks which was the main aim of this post:

- Target market is Agriculture which as we know from our experience is Elders is a hugely cyclical industry and not recession-proof as one would think. So not sure if they can sustain cash generation although their product offering is quite unique.

- Target growth geography is so far around South East asia region particularly China, Vietnam and other parts before going to Europe and Americas. So obvious risk is China if tensions escalate.

- Market for ACCUs is still under development and won't know until Oct 2023 or later. For now they RLF Carbon forecasts a price of $36.50 p/t.

- Measuring the actual yield using their accumulated carbon in soil system product versus base yield without to calculate carbon captured may be a bit tricky but I think this is how they calculate it?

- Definition of "market value" of 25 years and 23m Ha grain market is questionable. I think they multiplied the annual revenue generated from 23m Ha of crop production by 25 years when I think they should have applied the time value of money for each year to get "market value". Or use different terminology such as total revenue or total addressable market. Maybe it is a little thing but attempting to generate a bit of excitement? See strategic launch slide below