In a nutshell RLF AgTech manufactures nutrition products to produce more resilient plants and crops.

Currently RLF AgTech products uses their proprietary proton delivery technology to make crops more resilient while produce more yield and less fertiliser. Starting to gain traction in other regions outside Australia via South East Asia.

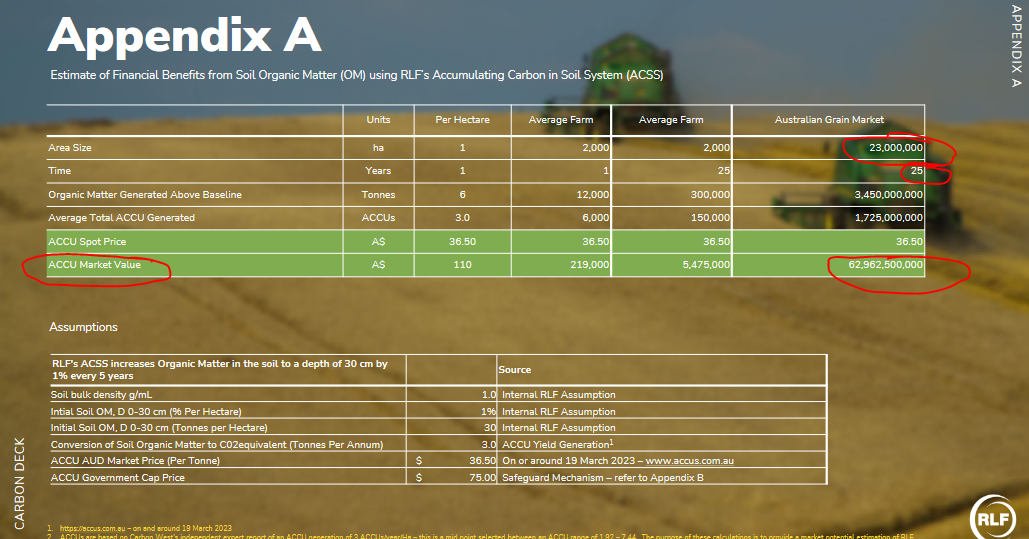

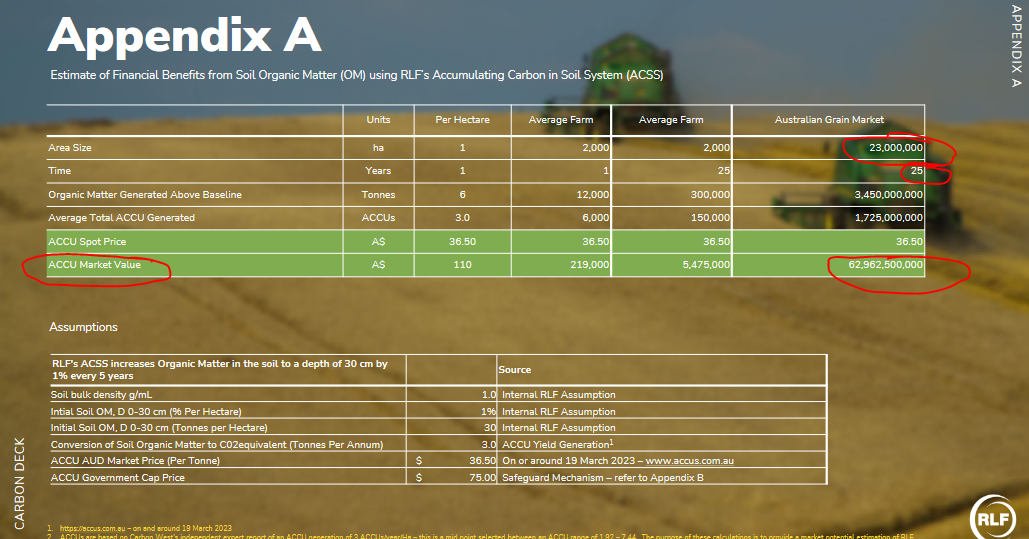

They are also working on a more ambitious venture via subsidiary RLF Carbon to use Carbon sequestration to help farmers increase crop yields through use of ACCS (Accumulating carbon in soil system) with the "potential" to earn carbon credits via ACCUs (Accumulated Carbon Credit Units). I would say "potential" as the ACCU market has not been implemented yet.

The company listed in April 22 and the CEO Ken Hancock appears to have a substantial holding under his name and also under several entities in the name RLF Global and RLF Pty.

Last half yearly seems to show a constant high cash burn. Diving deeper though this seems to have "slowed" in the latest quarterly and cash generation / customer receipts are kicking in.

IPO price of 0.20 and is currently stuck in that range after a dip in the middle.

With the background out of the way, time to outline a few risks which was the main aim of this post:

- Target market is Agriculture which as we know from our experience is Elders is a hugely cyclical industry and not recession-proof as one would think. So not sure if they can sustain cash generation although their product offering is quite unique.

- Target growth geography is so far around South East asia region particularly China, Vietnam and other parts before going to Europe and Americas. So obvious risk is China if tensions escalate.

- Market for ACCUs is still under development and won't know until Oct 2023 or later. For now they RLF Carbon forecasts a price of $36.50 p/t.

- Measuring the actual yield using their accumulated carbon in soil system product versus base yield without to calculate carbon captured may be a bit tricky but I think this is how they calculate it?

- Definition of "market value" of 25 years and 23m Ha grain market is questionable. I think they multiplied the annual revenue generated from 23m Ha of crop production by 25 years when I think they should have applied the time value of money for each year to get "market value". Or use different terminology such as total revenue or total addressable market. Maybe it is a little thing but attempting to generate a bit of excitement? See strategic launch slide below