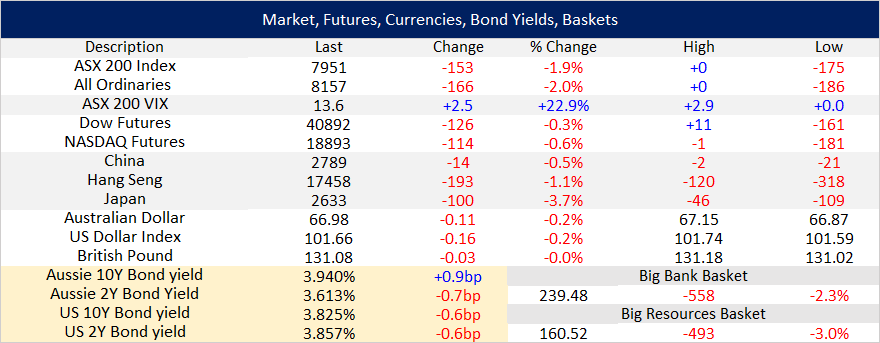

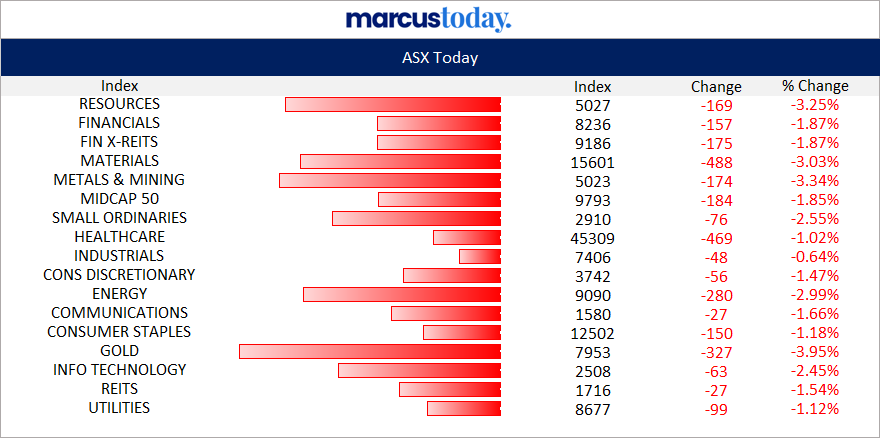

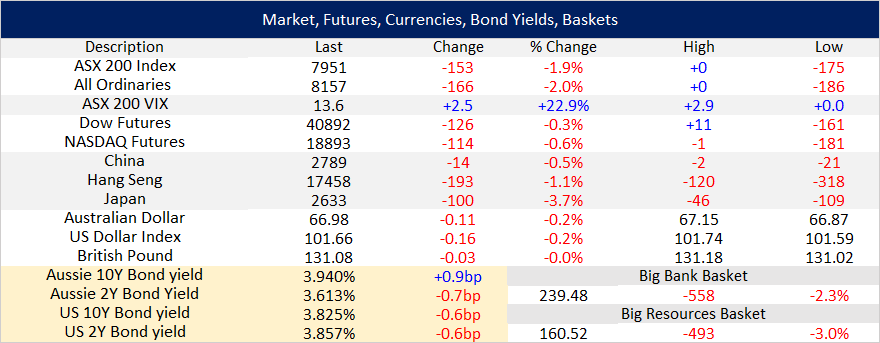

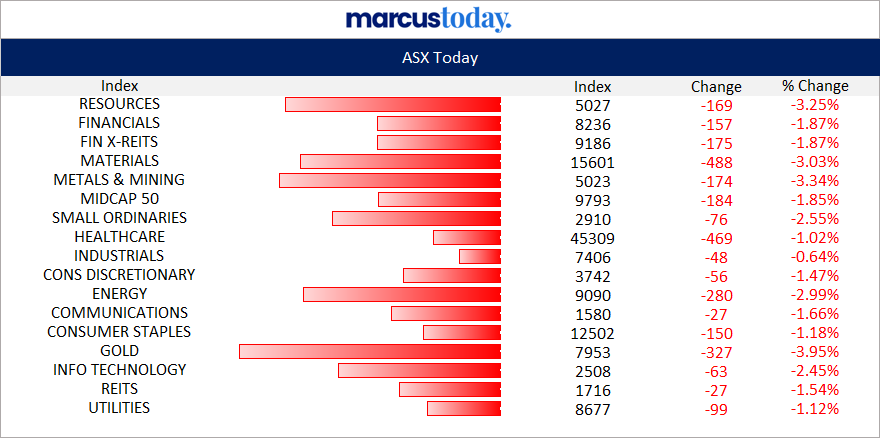

Perhaps both. Today, Wednesday 4th September 2024, the ASX got smashed and every sector was in the red, following falls in the US on their Tuesday (Monday was a public holiday over there for Labor Day).

But not ResMed, or FPH either; both made new 12-month highs today:

Tables sourced from: https://marcustoday.com.au/

Below, not many on the left side (12 month highs) but they ran out of room for the 12 month lows (on the right):

After Industrials, Healthcare was the second least worst sector today, and we have those two CPAP providers heading up the new 12-month high share price list. As well as IXI - the iShares Global Consumer Staples ETF that tracks the performance of the S&P Global 1200 Consumer Staples (Sector) Capped Index, so the sort of thing that people turn to when the world goes pear-shaped - even in a zombie apocalypse, they'll still be selling tins of baked beans I suppose.

Health care and consumer staples are generally considered "defensive" sectors" - so "risk off" sectors, when people just aren't feeling the optimism around the near-term potential of share-markets.

Only thing is - when you look at the charts of ResMed and Fisher & Paykel Healthcare, they do NOT look like defensive stocks, they looks very much like growth stocks - their one year charts are all bottom left to top right.

One year ago, I was arguing that while Ozempic and the like did NOT present a major threat to the future viability and growth of ResMed, I wouldn't invest in them because I felt that people would always be searching for better options for their OSA treatment, due to the invasive nature of CPAP and the drawbacks of being connected to a machine via a tube while you sleep. In short, I felt that CPAP as an industry was ripe for disruption by any tech that was easier to use.

So I thought that future competition from something other than CPAP - for OSA specifically - was the thing that concerned me, so I was never going to be a RMD or FPH investor.

Well, here we are, less than a year later and I'm using a Phillips DreamStation CPAP machine connected to a ResMed mask every night after being diagnosed with severe OSA (just shy of 60 episodes per hour, so around 1 per minute on average) and it's fair to say, tending towards the possibility of having a little rethink about my earlier assumptions and opinions...