Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Happy New Year to all StrawPeople.

I am taking a short break this afternoon from my Extended Summer Retreat on the Sunshine Coast (hence my radio silence on this forum over recent weeks, as I've taken time away from the markets - save for 'adverse event monitoring' - and had my head down in a pile of summer reading.)

However, as January marks the winter conference season in the US, on this rainy Noosa afternoon, I caught up with the RMD and TLX presentations.

I thoroughly recommend anyone who is an $RMD holder or watcher to listen to Mick's presentation. I caught the recording shortly after it went out on my mobile app for Quartr.com (free). (Still can't access via the website, as I think you need a JP Morgan invitation. Even so, the presentation is available on the Resmed Investor relations site. Presentation )

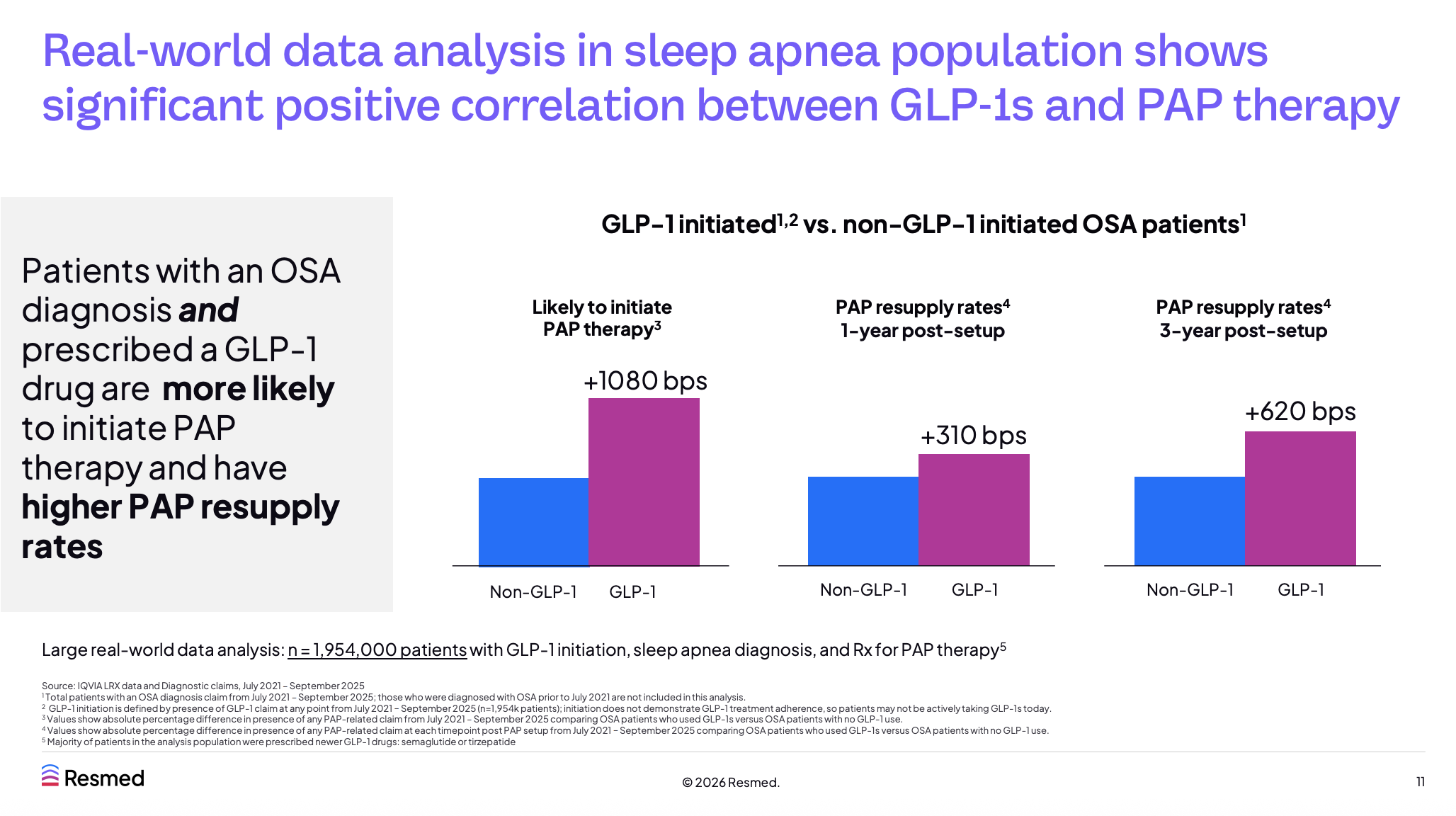

To the point of this post ... just take a look at this chart.

It is showing for the first time, the 3-year data for the differential in PAP resupply rates post set-up for patients with and without a GLP-1 script. RMD's thesis is that GLP-1 patients represent a more highly motivated cohort who use PAP therapy more and for longer is holding up. Importantly, the differential value of this cohort appears to be expanding, extending the initial picture first shown a couple of years ago.

In my mind, this should be marked as a price sensitive announcement in tomorrow's market open, and it will be interesting to see how the US market reacts overnight, as the presentation was made after the US market closed, and it is unclear to me whether the Australian market took much notice of it today.

Now that said, there was no change to long term guidance of high single digits revenue growth with operating levarge to drive teens EPS growth. So, arguably you could say this is all in the share price, albeit the market is at a 13% discount to consensus.

Beyond this, the overall presentation is well worth listening to. It is less about the detailed financial and operational performance, and more about strategy, markets, products, trends, competition and the opportunity ahead. Included there were some interesting insights shared from last week's CES conference, where $RMD is clearly investing in positioning itself for the trend with consumer tech / home tech. (Mick has been banging on about brand value and marketing ROI for about a year now.)

As I am still on "retreat" you'll have to excuse me not giving my usual summary. But as I was partly back in "work mode" to listen to the conferences, I thought I'd at least share the insight above.

Overall, its a pretty exicting presentation inncluding other good news on gross margin potential, and PAP therapy exclusion from competitive tendering requirements in US public health (which was still an open question at the last quartertly).

Mick was at his "Energiser Bunny" best!

I'll be back properly in a couple of week's time, in the run up to quarterlies and half year results.

Here's to a propserous 2026 for all.

Disc: Held

$RMD have announced their 1Q Results. Just on the call now,

Overall, volume growth was modest (and weak in software), however, a strong financial result was achieved due to an accelerating rate of improvement in %GM - up a very significant 290bps over PCP.

Here's a breakdown.

Headline Results

- Revenue: US $1.34 billion (+9% YoY; +8% constant currency)

- Gross Margin: 61.5% (up 290 bps YoY); non-GAAP 62.0% (up 280 bps)

- Operating Income: US $446 million (+15%); non-GAAP US $482 million (+19%)

- Net Income: US $349 million (+12%); non-GAAP US $375 million (+15%)

- Diluted EPS: US $2.37 (+12%); non-GAAP US $2.55 (+16%)

- Operating Cash Flow: US $457 million (> net income reflecting strong cash conversion)

Revenue Breakdown

- Devices: US $680 million (+9%, +7% cc)

- Masks & Other: US $489 million (+11%, +10% cc)

- Residential Care Software: US $166 million (+6%, +5% cc)

- Regional:

- U.S., Canada & LatAm +10% (ex-software)

- Europe, Asia & Other +6% cc (ex-software)

Growth was driven by sustained demand for sleep and respiratory-care devices, masks, and accessories across all regions.

Margins and Costs

- Gross margin improvement came from manufacturing/logistics efficiencies and component cost declines.

- SG&A expenses +7% cc (19.4% of revenue) mainly from the VirtuOx acquisition, higher employee costs, marketing, and tech investment.

- R&D spend +10% to US $87 million.

- Recorded US $16 million restructuring charge for workforce planning aligned to 2030 strategic priorities.

Cash Flow and Capital Management

- Operating cash flow: US $457 million

- Dividends paid: US $88 million

- Share repurchases: 523,000 shares for US $150 million

- Quarterly dividend declared: US $0.60 per share

Operational and Strategic Highlights

- Lancet Respiratory Medicine study: projects ~77 million U.S. adults with OSA by 2050 (≈ +35% vs 2020).

- Dual Red Dot Design Awards for AirTouch N30i (mask innovation).

- Launch of the Sleep Institute (global clinical insights initiative debuting at World Sleep Congress 2025).

- Board changes: Nicole Mowad-Nassar joined (Aug 2025); Rich Sulpizio to retire (Nov 2025).

Management Commentary

CEO Mick Farrell highlighted a “strong start to FY2026,” citing 9% revenue growth, 280 bps margin expansion, and 16% non-GAAP EPS growth as evidence of the company’s strategy to transform home healthcare through “hardware, software and solutions that people love.”

Mick cited that the weak Europe, Asia and Other growth was cycling a high PCP, and he expected growth to accelerate again in FY26.

My Overall Assessment

ResMed delivered double-digit bottom-line growth supported by broad-based demand and margin gains. Operating efficiency improvements and strong cash generation offset modest SG&A and R&D expansion.

For me the key number was the GAAP Operating Income Growth of +15% to PCP, achievable because %GM expansion balanced the relative weakness in volume growth.

Capital management was as guided, with the US$150m of share buybacks in the quarter signalled as being the expected rate for the remaining quarters of the year. Buybacks represented about one third of operating cashflow.

As ever, a lot of innovation was covered by Mick in the presentation, with the key development being the launch of the AirTouch F30i fabric-based, full-faced mark, which Mick indicated will be high-value, high-margin. Two variants are launched. This is a breathrough product as the team have spent some time in their fabric engineering unit in Singapore. Mick believes this product will help drive revenue growth. It will be offered alongside the exist silicone-based masks.

Overall, a solid result, however, it will be interesting to see how volume growth trends through the quarters to follow.

Disc: Held (RL 9%)

$RMD released their 4Q earnings (and also FY) this morning. I listened to the call and Mick's energy had an even greater effect on waking me up this morning than my Breville Barista Pro - brewed coffee (sorry, I hold $BRG in RL, couldn't resist.)

I'll post here the summary from my BA and then at the end of the straw add a few comments, which I may sharpen up on when the transcript is released, as Mick gave some more helpful information in the Q&A.

TLDR: Another strong performance, both top line and bottom line, with gross margin expansion particularly strong, capping off a strong year.

Unclear where the SP will go today, as it has run hard into the results following the wider post-April recovery in equities. However, it's P/E in the GLP-1 era remains significantly discounted to the pre-GLP-1 era, so there is ample room from strong returns if they continue to execute, IMO.

SUMMARY (Focused on Q4 to PCP)

My Assessment

4thQ rounds out a strong year, the consistency of execution has been tremendous.

Markets outside the Americas helped drive a strong revenue finish, which has been good to see as they've lagged a little in some quarters.

The %GM is stunning, however, about 50% of this is due to favourable FX. Other drivers include 1) ongoing logistics improvement as the ratio of sea-to-air freight returns to pre-pandemic norms, and 2) continuing tailwinds from the shift in mix from AirSense 10 to AirSense 11. Remarkably, Mick (CEO) and Brett (CFO) both talked of the runway ahead for %GM improvement, with %GM being guided to 61% to 63% in FY26. (This should drive some valuation TP upgrades.)

Strategically robust to the tariffs wars, given significant expansions in onshore US manufacturing capacity.

Current risk: is the renogiation of reimbursement regimes in the US at the moment including Medicare / Medicaid, however, Mick expressed a lot of confidence about this, as he has been through this several times before.

Recent bolt-on acquisitions and marketing campaigns demonstrate that $RMD is being very front-footed in growing awareness, growing the home diagnosis capability (Mick spoke about the continuing backlog in sleep clinics). Clearly, $RMD are getting after a much bigger vision of evolving from a CPAP business, to a sleep health and breathing health company. Clearly a lot of ideas and innovations in the pipeline.

He spoke about experiments $RMD on marketing, to raise awareness (e.g. current Lions' Tour) and indicated very favourable ROI metrics on this. He is eyeing what he says are a billion undiagnosed OSA sufferers in their 140 global markets.

Cashflow was very strong with cash and equivalents up from $0.23bn to $1.21bn, over a year, despite growing dividends($0.31bn), share buybacks($0.3bn), a bolt on acquisition ($0.14bn) and repaying debt ($0.04bn) all annual figures.

No significant new developments on the GLP-1, although some data in the full SEC filing was referred to, but this isn't available yet. Mick said they were continuing to see that patients on combination therapy tend to replenish supplies at a significantly higher rate. One remark Mick made was that he considered it likely that GLP-1 will dominate the drug-space because of their wider therapeutic benefits. (I need to go back over the transcript to prooerly understand what we meant.

Foraward guidance on %GM, %SG&A and %R&D all indicate continued operating leverage and double digit earnings growth potential.

Overall, $RMD is executing well. It is probably at fair value, depending on your view on the extent to which GLP-1 crimps its long-term growth prospects.

I'm a happy HOLD at these levels, for now this my largest ASX RL position (took the opportunity to add during the Trump tariff market tantrums).

Disc: Held in RL (9%) and not on SM

$RMD announced their 3Q results this morning. I might come back and summarise the results later.

Overall volume growth was modest with reasonable earnings growth due to operating leverage. There was strong cash flow generation and $RMD will increase their share buyback program from about US$75 million per quarter to about US$100 million per quarter.

Importantly Mick Farrell sounds pretty confident that Resmed will be exempt the tariffs on their imported devices into the US coming from Australia and Singapore which produce most of the devices for that market. Resmed continue to expand both their R&D and manufacturing facilities in the US.

However, the main reason for this post is to call out a recent study published in the Lancet which builds on existing research as to the mortality benefits for patients on CPAP therapy. Included below is a summary prepared by my business analyst.

Pépin, Jean-Louis, et al. “Obstructive sleep apnoea and long-term cardiovascular mortality: the impact of continuous positive airway pressure therapy.” The Lancet Respiratory Medicine, 2024, 12(5), pp. 472-480.

“A study published in The Lancet Respiratory Medicine analyzed data from over 1.1 million patients with obstructive sleep apnea. This meta-analysis, which included 30 studies (10 randomized controlled trials and 20 real-world evidence studies), found that continuous positive airway pressure (CPAP) therapy significantly reduces all-cause mortality by 37% and cardiovascular mortality by 55%.”

No wonder there is a significant backlog at sleep clinics, which is holding back revenue growth. Hopefully the new $RMD FDA approved home testing device will help. (Might give that a go myself when I can get one!)

Happy to be back at my full allocation after a brief GLP-1 wobble a year ago!

Disc: Held in RL and SM

$RMD have announced their second quarter results, which I'll very briefly comment on. The big news, is their assessment from a trial they are running which indicates that GLP-1's are likely both to increase CPAP adoption and adherence. It will be interesting to see how the market - and the various analysts and commentators - react to this news. If true, it turns the negative thesis on its head.

Their Highlights

• Revenue increased by 12% to $1.2 billion; up 11% on a constant currency basis

• Gross margin contracted 50 bps to 55.6%; non-GAAP gross margin grew 10 bps to 56.9%

• Income from operations decreased 2%; non-GAAP operating profit up 20%

• Operating cash flow of $272.8 million

• Diluted earnings per share of $1.42; non-GAAP diluted earnings per share of $1.88

My Assessment

Strong revenue growth with devices (+11%) leading masks (+9%,...weaker than expected by the market), with the SaaS business growing at 24%.

On supply, AirSense-10 now fully available to all customers. AirSense-11 continuing to be approved in new markets, with Japan the most recent market to be approved. Still 100 markets to be approved.

On return of Phillips, Mike Farrell was bullish about the return of competition - noting that the market is competitive and that Phillips will have to fight their way back from the bottom against the 4th, 3rd, 2nd and best players. Their return for deviced in the US is still pending.

%GM contracted on the PCP comparison, but improved over the prior quarter, with the CFO projecting continued improvement in %GM through the rest of the year (absent any shipping impacts of the current Red Sea problems). %GM was slightly impacted by the mask with magnets safety notice/recall issue - a one-off which has been full dealt with in the Q.

Positively SG&A only increased by 5% (4% on CC), meaning that the these fell as a % of revenue to 19.1% from 20.5%.

The GAAP result at the NPAT level was weak, due mainly a major restructuring that has been implemented in the Quarter. This was a material item, with a $64m restructuring charge hitting the P&L. Hence the restructure announced a few months ago has resulted in a significant streamlining of the business. I'm not a fan of one-off restructuring charges, so we'll have to see over the coming quarters if the changes result in a sustainable leaner organisation. The was the major component driving a declind in NPAT over the PCP.

On a non-GAAP basis, $277m NPAT compares with $244m in the pcp, an increase of 13%.

Cash generation was strong, with operating cash flow of $273m and PPE, Intangible and Acquisition Investing Csh flows of around $32m. In the Q, $RMD bought back around $50m of shares, which they continue to plan to do each quarter going forward.

Overall, a strong result with waters muddied through restructuring charges.

GLP-1 UPDATE

The big news is the reported progress results from $RMD "real world" study of 529,000 patients on CPAP taking GLP-1s. I include the two slides below. Mike touted these results as essentially turning the "GLP-1 will kill CPAP" thesis on its head. Bascially, he said the real world evidence is that it will drive CPAP update and adherence! I'll let the slides talk for themselves, and no doubt there will be significant commentary and reaction to this over the coming days.

Finally, Mike discussed in some detail how innovation in health wearables (Apple, Google, Samsung) is also like to provide a tailwind of increased awareness of sleep health.

OK, that's all from me. Off to teach class.

Good results. Thesis solidly intact.

Disc. Held in RL and SM

GS have published a major research note on $RMD and $FPH (available on CommSec) looking at the impact of various pharmaceutical products on the market.

I've had a quick scan, and it needs a proper read when I'm fresh, but it is a pretty deep dive. They have a well resourced global healtcare research desk!

Interestingly, they've adjusted the 12m TP for $RMD from $38.40 to $33.00, noting their DCF valuation is at $35.50,... which incidentally is about where I stand.

For $FPH the reduction is smaller to $24.00 from $25.00 because of this company's 70% focus on the hospital segement, which is less susceptible to pharmacetical treatments.

Both rated as BUY, with $FPH remaining on the GS "conviction list".

Disc: I hold both $RMD and $FPH in RL

Why I Believe the Market Got It Wrong About $RMD

$RMD has followed NYSE down another 5% on the open, which indicates there has been a pause for thought over the weekend (given that NYSE plummeted 18.5%).

I have picked up a parcel at $29.00, and stand poised for another, should we see the price drop to $28.50. Usually, I've learned not to catch a falling knife, but I'll make an exception for $RMD and in this note I set out why.

I have updated my valuations over the weekend, and nudged my expected value down from $37.00 to $35.10 - in truth, I could believe anything from $34 - $40, and Friday's result didn't really change that.

Some of what I cover in this straw has been discussed by other Straw People and me over the weekend. However, in this straw I go into a little more depth.

How did the market respond to $RMD results?

$RMD reported their 4Q results after NYSE closed and prior to ASX opening on Friday 3rd.

Shares are dual-listed on the NYSE, which every 1 US Common Stock trading as 10 CDIs on the ASX.

ASX 3rd August: $RMD opened at $30.10, down 11% from their Thursday ASX close of $33.85, closing the day at $30.70, down 9.31%. Volumes were high, with 14M shares traded, up on the more typical 1M. The 14M CDIs, traded are equivalent to 1.4M US Common Stock.

NYSE 3rd August: In New York, with more time to sharpen their pencils, the sell-off continued. 5.8m stock trading through the day – again around ten times typical daily volumes. New York closed at $179.25, down 18.5% (ouch!!)

The New York price, at an FX of 0.657 is equivalent to a Monday opening price of $27.28.

So all things being equal, $RMD should open around $27.28. (It didn't, it opened at $28.87, a cumulative fall since the 2nd August of 15%)

(To compare the prices on NYSE and ASX, you need to calculate: P(ASX) = P(NYSE) /10 / USD:AUD). Apologies if that is obvious to everyone, but I thought it might be helpful to explain.

Why did the market respond in this way?

In short, the result was a 5% eps miss. Market consensus was for eps of $1.69 per share, and the result came in at $1.60 per share.

While revenues grew strongly, (up 23% for the Q and 18% for the Y), analysts focused on the reduction in %GM which contracted 210 bps to 55.0% for the Q to pcp, and by 80bps to 55.8% for the Y to pcp. (Some - a small part - of this was FX)

How have valuations and targets been updated?

Using the data on marketscreener.com, and based on 6 of 12 brokers submitting target prices, after 6 have down graded the predictions on price targets have moved as follows (min, mean, max)

Pre-results: US$ ($221.00, $259.79, $290.00) estimated A$ ($33.63, $39.54, $44.14)

Post-results: US$ ($207.00, $248.63, $284.00) estimated A$ ($31.51, $37.84, $43.22)

So, the average decline is only 4.3%. However, only 50% of the dataset has updated, and usually when there are both upwards and downwards revisions, further updates follow during the next few days and even weeks. Part of the reason for this, is that the CEO and CFO will usually do a roadshow with major shareholders and institutions, and some will hold off updating their research until these conversations have taken place. In the forthcoming roadshow, the discussions will – I imagine – dig into some of the statements made on the call on the outlook for margins. In particular, remarks by Mick Farrell that high cost inventory is yet to work through fully. They’ll also dig into the impact of product mix on gross margin. Devices are lowest margin, with masks, consumables (filters, hoses etc.) on a significantly higher margin, and SaaS obviously much higher, but a small component.

The only detailed note I have is that of Goldman Sachs (Chris Cooper), an $RMD bull, who downgraded their 12m PT by 3% from A$39.60 to A$38.40, offering a detailed analysis in support.

So basically, the soft result has taken the analysts more or less back to where they were in July 2022, when everyone started getting bullish about $RMD again.

The figure below shows the consensus evolution from marketscreener.com.

Source: www.marketscreener.com

Why do I believe the market in NY and - as a consequence - the ASX on open has over-reacted?

We covered a lot of this in the usual excellent SM discussion over the week-end, so here I will summarise supported by a few data-driven charts, but I will add my own commentary resulting from the deep dive conducted during the weekend. (Yes, it was rainy in Brisbane!)

First of all, the overall result was very strong. Figure 1 illustrates.

Figure 1: Sales, Operating Profit and Net Income

Source: Company Accounts

I have plotted the revenue growth trend from 2018-2022, which shows clearly that $RMD drove sales hard in FY23. Let’s remember what happened and understand what has been going on. Understanding this is important to believing that gross margins will be restored again over time.

First, in June 2021, Phillips had their product recall, which immediately resulted in 5 million devices being removed from the market. They’ve been absent from much of the market ever since.

But this recall happened just as the supply chain constraints and, in particular, the chip constraints were starting to bite. While everyone drew down inventory to supply the shortfall, no-one could supply at the rate required. ($FPH have separately reported the challenges they face.)

The types of chips in short supply in these devices are the same technology that are used across a range of industries, like the auto industry, white goods, televisions, audio equipment etc. Not the bleeding edge high-performing chips you find in gaming PCs and laptops. It is these “lower tech” chips that really hit the crunch. As a result, manufacturers, like RMD, re-engineered their existing devices. Air Sense 10 was reconfigured to download data to an SD card, which required fewer electronics than the direct to cloud models.

These efforts allowed RMD to continue to supply the market, but they were unable to fully meet the opportunity presented by the withdrawal of Phillips. Of course, what also “helped” was that the closure of sleep clinics during COVID-19, did constrain the flow of new diagnoses. But of course, these have now opened up again.

Roll forward to FY23, and with supply chains repaired and Phillips still out of the market, sleep clinics open again, $RMD was able to achieve bumper sales. We won't see another +18% sales ... not ever!

In Figure 1, you can see that sales were approximately $400m above where they would have been on the 5-year trend.

But that incremental $400m is largely CPAP machines, and these devices have lower margins than the masks, hoses, and accessories.

Despite the degradation in % gross margin, overall operating profit has stayed largely on its 5-year trend. The CAGR in EBIT from 2018 to 2022 was 15.6%, and FY22 to FY23 was up 22.4%. Not too shabby, and not a result justifying a 15% SP fall..

Let’s now look at margin evolution in Figure 2.

Figure 2: Margin Evolution 2018 to 2023

First of all, what the market is so concerned about, %GM (the top blue line). If we look at pre-COVID being FY18 - FY20 (only 3 months COVID impacted and pre-Phillips), GM averaged 58.4% - which I will take as the baseline, as it has historically moved around a bit driven by product mix and FX.

Certainly, the trend from 58.4% to the 55.0% in Q4 FY23 is a worrying trend,… if it continues. And Mile Farrell was clear that it won’t. However, perhaps the market doesn’t believe him. At Q3 Results call he said:

“I see gross margin expansion in double-digit basis points ahead for the coming quarters and throughout the fiscal year and the calendar year. I'm bullish on gross margin expansion because I see geography mix and product mix headwinds subsiding. I'm bullish on gross margin as I see ventilator growth opportunities start to come back, and I see mask growth and replenishment growth, new patient growth start to come on masks. And I'm bullish on gross margin as we go forward because I see inventory costs starting to -- we're going to start to cut into that and bring them down versus the run-up we had with our competitor being out of market.”

Ninety days comes around quickly, but we didn’t see any of this in the results. In fact, %GM continued to slide from 55.3% to 55.0%. However, Mick restated his conviction that %GM would improve in the Q$ results call – while not actually confronting the fact he’d got it wrong (even though he was pushed by one analyst in the Q&A).

But I believe that – now they have the supply - $RMD has been going all out for share. Making hay while the Phillips-Sun shine. The gross profit and strong operating cashflow shows that was a rational thing to do, even though it means there %GM will be under the microscope in Q1 FY24.

Before leaving the margin picture, it is worth highlighting the strong picture shown by net margin. Over the last 5 years, $RMD appears to be gradually ratcheting up its overall economies of scale, going from a mid-teens net margin to a low-20% net margin.

You can also see the grey line, FCF % margin. This has been volatile due to movements in inventory and lumpiness in tax payments. More on inventory next.

For the final chart, we can consider some of the key revenue ratios shown in Figure 3.

Figure 3: $RMD Revenue Ratios (2018-2023)

Source: Company Accounts

We’ve already discussed the problem-child of %GM. Looking forward, I expect this to gradually start trending back up. Although it might not recover the halcyon days of 59.0%, it is reasonable to expect it to trend back to 57% over the next 1-to-2 years. This is because the turmoil and expediting arrangements required for the last few years, will be able to be optimised. Once AirSense-11 production fully ramps up, these manufacturing and supply arrangements will also move onto more of a steady state. Finally, inventory levels will move to more of a steady-state model. There will also be benefits on chips, as a cooling global economy and reinvestment in supply could even lead to over-supply.

True, Phillips will return, and this may increase competitive pressure on margins. But, as Mick points out, there are already several other competitors in the market ($FPH being one!). And Phillips will be starting again from at least a number 4 position in many markets.

The orange SG&A line shows how increasing economies of scale have allowed overheads to scale slower than revenue growth. Of course, FY21 and FY22 were helped by significant reductions in travel, and Mick explained that FY23’s slight uptick was due to both staffing costs and travel. Guidance for FY24 of 20-22% for SG&A allows some further headroom.

R&D has consistently been held at 6-7%, and Mick has guided for FY24 to be 7-8%. Ongoing investment in R&D is a good thing, as $RMD need to continue to reinvest to maintain its industry leadership, particularly as it strives to add further value by exploiting the huge dataset captured from customers.

I finish with Figure 3 by pointing to inventory (black line). You can see that inventory has reached 23.6% of elevated sales – a dramatic increase from historical norms of 13-15%.

Over time, $RMD should be able to manage levels back to historical norms. That said, across the board companies are reviewing their supply chain strategies, and it is to be expected that one of the lessons from the pandemic is that firms will place a greater emphasis on supply chain resilience over efficiency. So perhaps for $RMD, we will see inventory settle somewhat higher than has historically been the case.

[I admit here to being a bit of a supply chain geek, and in my spare time I teach operations and supply chain management to MBAs. I am thinking about using companies like $RMD as future teaching case studies, I already use $BRG.]

Looking Forward

$RMD continues to innovate. Mick spoke about him personally trialling the next generation of mask, due out later in FY24.

A key asset will be the huge dataset from customers that it continues to build. This will give it unparalleled insights not only into improving and innovating its own products and services, but also in identifying new therapies and positioning itself (e.g., via acquisitions) to offer these in the long term. Because of this, I have no hesitation in seeing $RMD continuing to grow revenue at 10%-14% p.a., for the foreseeable future. After all it has done a CAGR over the last 4 years of 11.2%, and last year revenue growth was 18%. I am also therefore happy to assume continuing value free cash flow growth of 5% p.a. beyond the 10-year horizon.

But before I get too excited based on a largely backward-looking analysis, what are the major risks?

1. New Therapies: As discussed elsewhere on SM, several new therapies are emerging to tackle weight loss. Obesity - particularly in developed countries - is one of the big drivers of sleep apnoea. This is something to keep an eye on over time. But I am convinced that this is a longer-term, generational consideration, and not an issue impacting my investing time horizon of 5-10 years. The rationale is as follows:

- Sleep apnoea is under-diagnosed and under-treated; the global market is vast. Although $RMD currently treats 160m patients globally, its near-term target is to reach 250m and it estimates the potential total market at around 1bn.

- $RMD devices have application beyond sleep apnoea, including COPD (also underdiagnosed, and growing strongly) and some cardiac conditions. There are even instances when it can be helpful in asthma. There is growing clinical evidence of the effectiveness and economic benefits of CPAP, APAP, and related therapies. The cloud monitoring adds to the toolkit that incrementally allows patients to be trreated in the home.

- $RMD has the market leading position, helped by the withdrawal of Phillips for what will be 2 to 3 years by the time Phillips returns later this year. Both $RMD and competitors have filled the gap in the market place, and while the return of Phillips will increase competition, it will not be a game-changer, as the market is already competitive. One investment bank has estimated that $RMD has driven its markets share from 47% in 2019 to over 60%.

- Drugs are emerging and growing in use; however, they are expensive. The lifetime cost of the current GLP-1 treatments is c. $480,000, which $RMD estimates to be 35x the cost of the CPAP. Adherence to drug treatments is low at the 1-year mark, compared with >80% cited for CPAP, and the new drug treatments - though reasonably well-tolerated – have a wide range of side effects from lower risk higher prevalence to some rare/severe conditions. CPAC’s primary issue is some discomfort and facial marks from the masks.

2. Product Recall: Of course, Phillips has shown what a devasting impact a product recall can have. And, hopefully, $RMD have learned lessons and will be unrelenting in their pursuit of quality. While no-one can ever rule out such a shock befalling the company, I prefer to accept this risk through constraining my position size to 6.0% rather than in a valuation scenario, where I cannot assign a reasonable probability.

My Key Takeaway

There is nothing in $RMD’s performance that causes me to doubt the basis of my updated $35 valuation. And when considering various scenarios around that value, a SP below $30 offers a very highly skewed risk-reward profile to the upside.

If there is one surprise, it is that Mick was premature in predicting the GM% improvement. That is uncharacteristic of him. But as their supply chain pressures eased, perhaps the pent-up demand, the gross profit and market share opportunity was just too tempting. In any event, SP has paid a heavy -15% price for that error. And I contend the correction is a gross over-reaction.

Quality companies regularly present pullbacks. Those are the days I buy them. Today is one of those days. I've taken a small bite at $29.00, and have another order in at $28.00, if Mr/(s) Market will oblige me (which I doubt (s)/he will).

Disc: Held in RL (I don't hold companies that have proven to be long-term wealth winners on SM)

$RMD reported 3Q results on Friday. As I'd spent the second half of last week focused on my small cap results, I had to catch up on the recording of the earnings call over the weekend.

Results were pretty much in-line with market consensus: rrevenues were slightly ahead and EPS slightly behind due to lower % GM and higher expenses.

However, it was a fascinating result as the disussion contained a bit of everything impacting the PCP comparisons: tail-end of pandemic, recovery of supply chains, return of demand due to post-pandemic opening up, and the prolonged absence of a major competitor from the market (Phillips recall and aftermath).

Their Highlights

All comparisons are to the prior year period

• Revenue increased by 29% to $1,116.9 million; up 31% on a constant currency basis

• Gross margin contracted 150 bps to 55.3%; non-GAAP gross margin contracted 200 bps to 56.1%

• Income from operations increased 28%; non-GAAP operating profit up 27%

• Operating cash flow of $282.6 million

• Diluted earnings per share of $1.58; non-GAAP diluted earnings per share of $1.68

My Observations

The standout result was in devices, which comprise 55% of revenue. Sales rose by 43% in constant currency, and this was the engine that drove outstanding revenue growth. This had been well-signalled to the market and benefited from two major tailwinds.

First – supply chain. Over the last two years, $RMD has been impacted significantly by supply chain, especially chip, constraints. This had significantly impacted the global roll-out of their new connected AirSense 11 cloud-connected product, which allows customer data to be uploaded to the cloud, shared with healthcare professionals and analysed to provided patient guidance. Previous generation AirSense 10 had been re-engineered to get around constraints. However, the big issue was that just as new customers started returning to GP’s and sleep clinics, supply across the world became constrained. Markets move into management by allocation from available suuply, and waiting times for new devices blew out to many months.

Second, in mid-2021, Phillips a major competitor had a product recall and has essentially been absent from the market while it remediated faulty products with existing customers and redesigned the product, having to go through regulatory approvals all over again. This has given $RMD (and $FPH) reduced competition in the market and exacerbated the supply shortage.

On the call, $RMD indicated that in the USA, AirSense 10 can now fully meet demand in the USA and is now “off allocation” and will get to a normal position in other markets over the next two quarters. Air Sense 11 is lagging, and will continue to see improved availability over the next several quarters. This latter product is still going through regulatory approvals in several markets.

The results call goes into these issues in some detail and provides a great case study into just how long it is taking supply chains to heal, following the disruptions induced by the pandemic and its aftermath (as well as other things going on in the chip industry).

What I found remarkable, is that when you stand back and look at the performance of $RMD over the last 5 years, you see just how well the company has been managed - pandemic, what pandemic! Sales have grown steadily at a CAGR of 12% and Earnings at a CAGR of 23%. (Figure 1 – note: I have used FY23 consensus forecast.)

Figure 1

The Future

Through the remainder of CY23, $RMD will continue to benefit from continuing improvements in supply as more and more of its global markets come into balance, as AirSense 11 is approved and launched, and as Phillips begins to re-establish supply.

CEO Mick Farrell spoke on the call about the overall market opportunity. He noted that $RMD had made a contribution to improving the lives of 156 million people in the last 12 months and remains on track to achieve its goal of 250 million by the end of FY25.

However, $RMD’s eyes remain focused on the global opportunity of 1 billion people suffering with obstructive sleep apnoea that needs to be treated worldwide, to which if you add in COPD asthma and insomnia, you’re talking 2.5 billion people in the total addressable market. Now of course, many (most?) of these people will unfortautely not have access to the healthcare or financial resources needed for $RMD’s products and services. But nonetheless, $RMD remains very bullish about the runway ahead of them.

During Q&A analysts asked Mick about threats from new therapies(e.g. drugs), and I was encouraged by the response and would encourage holders of $RMD and $FPH to listen to the recording of the investor teleconference.

With connected devices, SaaS products and the MEDIFOX DAN acquisition, $RMD are investing heavily in R&D to make maximum use of the data their devices are generating. They already have data for 14.5 billion nights of sleep data, to which they are applying AI and ML technology to be able to provide tailored clinical advice to customers and healthcare professionals, which will potentially drive improved efficacy and efficiency outcomes in the treatment of conditions.

Valuation

Overall, broker valuations edged up following the results, with 3 of the 11 covering analysts nudging up their valuations by about 1% on average.

Market consensus on valuation stands as $36.12 (min. $32.04; max $39.17; n=11; source Marketscreener.com) indicating a modest upside to Friday’s close of $33.71.

I don’t yet have my own model for $RMD, however, I think these estimates span a reasonable range of views as to the extent to which $RMD (and $FPH) have been able to gain a sustainable market lead over Phillips versus the expected increasing competitive intensity that will return over the coming years as Phillips get back into its stride and tries to make up lost ground (Phillips CFO on the record that they will not discount heavily to recover share).

$RMD is on a forward p/e of 40, which is reasonable in its sector given its growth and earnings stability. Referring to Figure 2 below, if you ignore the step up in P/E during late 2021/early 2022, when earnings were hit by the full impact of supply chain constraints, $RMD tends to sit at an average P/E of around 45, so it is not expensive on a historical basis - although the current discount can easily be understood in the current higher interest rate environment, and may actually be high on a recent historical basis.

Figure 2: P/E over last 5 Years

Overall Takeaways

This was a strong result. Due to excellent investor communications, the market understands that the eye-watering quarterly result will not be repeated. However, with the pandemic behind us and supply chains well on their way to full repair, $RMD is well and truly back to business as usual.

I expect to see sustained low teens revenue growth with 15%+ earnings growth over the near to medium term.

As a holder of both $FPH and $RMD, given that the former’s SP has run very hard over the last 6 months, I am considering a re-weighting of my RL portfolio from $FPH to $RMD, maintaining the combination at 6% of my total portfolio. It is great to have two ASX-listed companies as well-managed, global market leaders in hospital and home care segements, respectively.

Disc: Held IRL (2.5%). Not held in SM.

Post a valuation or endorse another member's valuation.