Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

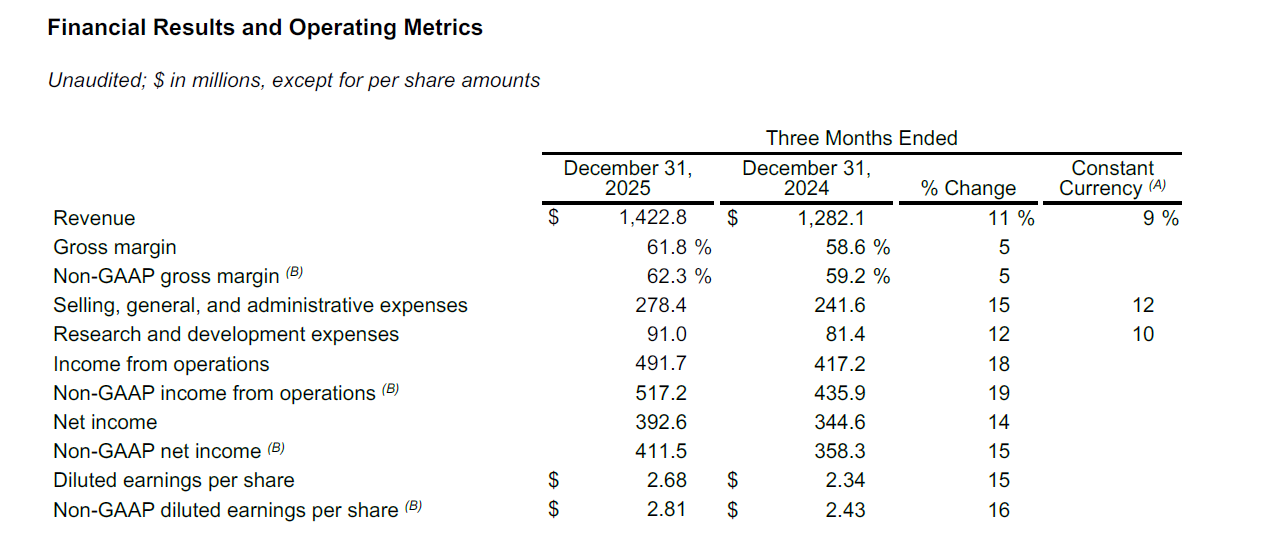

$RMD posted their 2Q FY26 results this morning. I'll share their headlines, and then summarise a few of my takeaways from the investor call just finished.

TLDR: a solid result with a few pluses and minuses. %GM continues to do heavy lifting. (+310bps PCP; +30bps QoQ) Overall GAAP diluted EPS broadly inline with consensus. NPATgrowth of +14% / +15% for diluted EPS due to $175m of buybacks in the Q.

All numbers are US$, except for my valuation.

Their Headlines

• Revenue increased by 11% to $1.4 billion; up 9% on a constant currency basis

• Gross margin up 320 bps to 61.8%; non-GAAP gross margin up 310 bps to 62.3%

• Income from operations increased 18%; non-GAAP income from operations up 19%

• Diluted earnings per share of $2.68; non-GAAP diluted earnings per share of $2.81

• Operating cash flow of $340 million

Observations from the Investor Call

1. Revenue (all % to PCP)

Devices growth in US +8% strong, weaker in RoW at =5% (CC) explained due to cycling a strong PCP (+9%) and lumpy effects (e.g. fleet management in Japan).

Mask +16% in US a strong result, with +8% cc RoW also weaker. Overall mask strength OF +14%(CC).

Masks starting to see benefit of new fabric masks, with reported positive user feedback.

2. Gross Margin

%GM of 61.6% up 310bps (PCP) and 30bps (QoQ).

Mick spoke of continuing focus on %GM expansion, with goal of sustainably driving this up, and with a set of identified improvements in hand.

90% of US customers now able to receive orders from US factories within 2 day.

3. Expenses

SG&A was a drag on result up +12% (CC) actually higher than revenue growth. Continuing marketing campaigns cited as one ongoing driver - as $RMD are active in experimenting with new ways to reach customers and promote awareness of sleep health. A $6m exceptional expense saw the conclusion of costs of restructuing.

These two items together pulled Operating Income growth down slightly to +17%.

4. Balance Sheet

Cash and cash equivalents up to $1.417bn from $1.383bn in prior quarter

Net cash is $753m, up from $715m in the previous quarter and significantly up from net debt of $151m in the PCP.

So despite $88m in dividends paid and $175 million share repurchases in the quarter, the balance sheet has strengthened significantly over the year, and incrementally over the quarter. Expected buyback of $600m in FY26.

Other Notes including from Q&A

3-yr result on increased resupply rate of +6% for patients with both a CPAP and GLP-1 script announced a few weeks ago at the JP Morgan Conference was reiterated. Mick believes the GLP-1 headwind is proving to be a tailwind.

He was asked whether int he dataset, this remained true for mild of moderate AHI scores, which can be significantly reduced by GLP1, and Mick said you still need CPAP for the symptom relief and improved sleep, and promised to publish "case studies" in future. But he did not commit to segmenting the real world evidence.

$RMD have FDA approval for their sleep concierge MyAir. This uses AI to give personalised recommendations to users on how to optimise the machine settings. Mick said the $RMD devices have settings that the large majority of users have not used for over decades. He believes personalised settings will improve patient experience and adherence, keeping more patients on devices for longer.

Mick discussed new publications showing benefits of CPAP therapy on brain health. For example, adherence to CPAP may reduce dementia risk by 30-40%, based on evidence of impact on reducing key Alzheimer biomarkers.

Mick said this is adding to the growing body of evidence that CPAP drives sleep health, cardiovascular health and brain health.

On tariffs, $RMD products have continued to retain exemptions from international tarrifs, and he repeated the news from JP Morgan Cont that $RMD products will be exempt from public health competitive tendering in the US.

No change on the messages regarding the return of Phillips. Mick quoted Philips management as saying that they still don't know when they can return to the US. And in the 100+ international markets where they have returned, Mick said $RMD has seen no change in its market share, and that Phillips is fighting to recover #4, #3 and #2 spots. Key message: we welcome competion but see the ecosystem of devices, masks and software are strong.

Mick believes consumer health will continue to drive patient funnel. Expects more wearables to add OSA detection FDA approval (adding to Apple and Samsung).

My Overall Assessment

A solid, relatively uneventful result.

Things to watch in future:

- SG&A growth - will it normalise?

- RoW devices and masks - does it tick back up?

- GLP-1: what granularity is disclosed for the mild/moderate cohort?

Valuation

Unchanged at A$42.00 (A$37.80 - 46.70) - next update in October.

I'm a "BUY" on RMD, but as I have a 10% RL position, I am my target weight so am not adding today, but will consider some minor additions on any SP weakness, e.g., below $36.

Happy New Year to all StrawPeople.

I am taking a short break this afternoon from my Extended Summer Retreat on the Sunshine Coast (hence my radio silence on this forum over recent weeks, as I've taken time away from the markets - save for 'adverse event monitoring' - and had my head down in a pile of summer reading.)

However, as January marks the winter conference season in the US, on this rainy Noosa afternoon, I caught up with the RMD and TLX presentations.

I thoroughly recommend anyone who is an $RMD holder or watcher to listen to Mick's presentation. I caught the recording shortly after it went out on my mobile app for Quartr.com (free). (Still can't access via the website, as I think you need a JP Morgan invitation. Even so, the presentation is available on the Resmed Investor relations site. Presentation )

To the point of this post ... just take a look at this chart.

It is showing for the first time, the 3-year data for the differential in PAP resupply rates post set-up for patients with and without a GLP-1 script. RMD's thesis is that GLP-1 patients represent a more highly motivated cohort who use PAP therapy more and for longer is holding up. Importantly, the differential value of this cohort appears to be expanding, extending the initial picture first shown a couple of years ago.

In my mind, this should be marked as a price sensitive announcement in tomorrow's market open, and it will be interesting to see how the US market reacts overnight, as the presentation was made after the US market closed, and it is unclear to me whether the Australian market took much notice of it today.

Now that said, there was no change to long term guidance of high single digits revenue growth with operating levarge to drive teens EPS growth. So, arguably you could say this is all in the share price, albeit the market is at a 13% discount to consensus.

Beyond this, the overall presentation is well worth listening to. It is less about the detailed financial and operational performance, and more about strategy, markets, products, trends, competition and the opportunity ahead. Included there were some interesting insights shared from last week's CES conference, where $RMD is clearly investing in positioning itself for the trend with consumer tech / home tech. (Mick has been banging on about brand value and marketing ROI for about a year now.)

As I am still on "retreat" you'll have to excuse me not giving my usual summary. But as I was partly back in "work mode" to listen to the conferences, I thought I'd at least share the insight above.

Overall, its a pretty exicting presentation inncluding other good news on gross margin potential, and PAP therapy exclusion from competitive tendering requirements in US public health (which was still an open question at the last quartertly).

Mick was at his "Energiser Bunny" best!

I'll be back properly in a couple of week's time, in the run up to quarterlies and half year results.

Here's to a propserous 2026 for all.

Disc: Held

Resmed Inc. Announces Results for the First Quarter of Fiscal Year 2026

• Revenue increased by 9% to $1.3 billion; up 8% on a constant currency basis

• Gross margin up 290 bps to 61.5%; non-GAAP gross margin up 280 bps to 62.0%

• Income from operations increased 15%; non-GAAP income from operations up 19%

• Diluted earnings per share of $2.37; non-GAAP diluted earnings per share of $2.55

• Operating cash flow of $457 million

A typically solid result. The price has been drifting gently downwards heading into it, and seems to have stabilised, though it is too early to judge conclusively.

If it wasn't my largest position, I would have likely already added to my position heading into the print.

October-2025

$42.00 ($37.80 - 46.70)

Note:

1. Although this looks like a minor downgrade to my last valuation, this does not reflect any fundamental change in my view, rather, this time I have full updated my models based on the full FY24 and FY25 results, with tweaks to some assumptions. (August update was a quick adjustment to old model to history match FY24 and FY25 results.)

2. Today's 1Q FY26 result not included in model, as modelling does not have quarterly resolultion. However, starting point for Net Margin dialled back from strong FY25 result, back to 26.5%.

Two methods followed. Above are outputs of a 10 year DCF and 6 scenarios.

Conclusion is that current SP of $39.60 represents fair value - HOLD.

ASSUMPTIONS

Revenue Growth: scenarios of 7.5%, 8.5% and 9.5% annually

Margin expansion: 2 cases i) 0.25% p.a, ii) 0.5% p.a. annually

Net annual change in working capital driven by increasing inventory, which is maintained at 17% of revenue throughout (upside potential offset by ignoring other increasing WC drivers.).

Shares on issue grow at 0.1% pa

Capex = D&A

WACC= 8.5%

AUD:USD = 0.65

Continuing Value Growth = 3.0%

RESULTS

Method 1 Results - DCF

Valuations $42.00 ($37.80 - $46.70)

Note: Annual EPS growth ranges from 8.5% to 11.4%

Method 2 Calculate EPS in 2030 discounted back at WACC. P/Es chosen are 24, 27 and 30. Results $40.40 ($33.70 - $47.90). Scenarios plotted below.

Comment on differences between Method 1 and Method 2

a) Longer time horizon of DCF method vs 2030 EPS method growth

b) Likely a higher P/E will be achieved than the lower bound value of 24, if $RMD sustains a c. 10% pa EPS growth outlook, which is implied by free cash flow growth over FY30-FY35 in DCF model.

------------------------------------------------------------------------------

August-2025

$43.80 ($40.00 - $47.80)

I've just realised my valuation on here is 2 years old. So this is a quick update of the current model, to reset to the2024 and 2025 actuals (which has a significantly strong FCF than my last model!) I will hopefully do a proper update when things are quieter. This is a placeholder for now.

I've dialled down the revenue growth scenarios to 7%/8.5%/10%, realising that value growth is driven as much by continuing operating leverage as by the top line.

Outputs - just based on the revenue scenarios - very rough and crude model, and round to nearest $0.10 in reported result.

Scenario 1: $40.02

Scenario 2: $43.74

Scenario 3: $47.80

Average Val: $43,84

---------------------------------------------------

August-2023

Initial post was on 100% equity basis.

Updated to include capital structure and other tweeks as follows:

D/E = 36%, Cost of debt = 6%, Cost of Equity = 10%, WACC = 9.0%

SOI increase at 0.4% p.a.

Also, revenue scenarios tweaked down to 11%, 12.5% and 14% growth p.a.

Updated Scenarios:

1: $31.34

2: $34.97

3: $38.99

Average Val. = $35.10

------------------------------------------------------

Updated DCF based on three scenarios:

ASSUMPTIONS

Explicit period of 2024-2033; FCF g-CV=5% (which may be conservative)

Revenue growth: three scenarios 11%, 12.5% and 14%

Capex at 4% x revenue

No explicit GM% assumption, but Net Margin trends from 21.50% to 23.75% driven initially by %GM returning to 57% over next two years, then continued operating leverage from SG&A.

Maintain R&D at 7%x Revenue, although may tighten in later year to preserve %NM margin assumption if SG&A leverage maxes out, which would be consistent with maturing business and g-CV of 5%.

Change in working capital driven by inventory returning to 17% x Revenue, (previously 14%).

No allowance for cash flow release as inventory normalises over next two years, although assumed leverage reduced from 1.0 x EBITDA to bring interest charge down in line with net margin assumption.

WACC=10%

AUD:USD = $0.75 (note currently = $0.657)

Results:

Scen 1: $30.86

Scen 2. $34.30

Scen. 3. $38.12

Average Valuation (equal weighted): $34.40

Significant differences to previous model: slightly less agressive on revenue scenarios. Assume flat GM%, leading to more gradual net margin improvements over time. Raiseed inventory % of sales increased working capital y-o-y.

$RMD have announced their 1Q Results. Just on the call now,

Overall, volume growth was modest (and weak in software), however, a strong financial result was achieved due to an accelerating rate of improvement in %GM - up a very significant 290bps over PCP.

Here's a breakdown.

Headline Results

- Revenue: US $1.34 billion (+9% YoY; +8% constant currency)

- Gross Margin: 61.5% (up 290 bps YoY); non-GAAP 62.0% (up 280 bps)

- Operating Income: US $446 million (+15%); non-GAAP US $482 million (+19%)

- Net Income: US $349 million (+12%); non-GAAP US $375 million (+15%)

- Diluted EPS: US $2.37 (+12%); non-GAAP US $2.55 (+16%)

- Operating Cash Flow: US $457 million (> net income reflecting strong cash conversion)

Revenue Breakdown

- Devices: US $680 million (+9%, +7% cc)

- Masks & Other: US $489 million (+11%, +10% cc)

- Residential Care Software: US $166 million (+6%, +5% cc)

- Regional:

- U.S., Canada & LatAm +10% (ex-software)

- Europe, Asia & Other +6% cc (ex-software)

Growth was driven by sustained demand for sleep and respiratory-care devices, masks, and accessories across all regions.

Margins and Costs

- Gross margin improvement came from manufacturing/logistics efficiencies and component cost declines.

- SG&A expenses +7% cc (19.4% of revenue) mainly from the VirtuOx acquisition, higher employee costs, marketing, and tech investment.

- R&D spend +10% to US $87 million.

- Recorded US $16 million restructuring charge for workforce planning aligned to 2030 strategic priorities.

Cash Flow and Capital Management

- Operating cash flow: US $457 million

- Dividends paid: US $88 million

- Share repurchases: 523,000 shares for US $150 million

- Quarterly dividend declared: US $0.60 per share

Operational and Strategic Highlights

- Lancet Respiratory Medicine study: projects ~77 million U.S. adults with OSA by 2050 (≈ +35% vs 2020).

- Dual Red Dot Design Awards for AirTouch N30i (mask innovation).

- Launch of the Sleep Institute (global clinical insights initiative debuting at World Sleep Congress 2025).

- Board changes: Nicole Mowad-Nassar joined (Aug 2025); Rich Sulpizio to retire (Nov 2025).

Management Commentary

CEO Mick Farrell highlighted a “strong start to FY2026,” citing 9% revenue growth, 280 bps margin expansion, and 16% non-GAAP EPS growth as evidence of the company’s strategy to transform home healthcare through “hardware, software and solutions that people love.”

Mick cited that the weak Europe, Asia and Other growth was cycling a high PCP, and he expected growth to accelerate again in FY26.

My Overall Assessment

ResMed delivered double-digit bottom-line growth supported by broad-based demand and margin gains. Operating efficiency improvements and strong cash generation offset modest SG&A and R&D expansion.

For me the key number was the GAAP Operating Income Growth of +15% to PCP, achievable because %GM expansion balanced the relative weakness in volume growth.

Capital management was as guided, with the US$150m of share buybacks in the quarter signalled as being the expected rate for the remaining quarters of the year. Buybacks represented about one third of operating cashflow.

As ever, a lot of innovation was covered by Mick in the presentation, with the key development being the launch of the AirTouch F30i fabric-based, full-faced mark, which Mick indicated will be high-value, high-margin. Two variants are launched. This is a breathrough product as the team have spent some time in their fabric engineering unit in Singapore. Mick believes this product will help drive revenue growth. It will be offered alongside the exist silicone-based masks.

Overall, a solid result, however, it will be interesting to see how volume growth trends through the quarters to follow.

Disc: Held (RL 9%)

Sharing some thoughts out loud from the worrier in my head. Might be my mood today.

What happened at Philips in recent years—with so much value lost following a major product recall—got me thinking about the possibility of something similar happening at ResMed.

Looking back through ResMed’s history, there have been a few recalls of varying scale (as with Cochlear too), with the last large-scale device recall dating back to 2007. On top of that, there are plenty of negative customer reviews online that don’t quite align with the company’s polished brand image.

While those reviews should be taken with a grain of salt, together with the recall history they suggest a business that may be a little more fragile than I first considered. I’m still a holder, as ResMed continues to appear best-in-class despite these risks—but it’s worth keeping in mind when weighing up the overall risk profile. What happened to Philips could happen to ResMed too, though I see it as simply part of the territory when investing in medical device companies

On a side note, I had a similar thought about Nick Scali. Their customer reviews don’t seem to match the company’s polished public image. In fact, some of the worst retail reviews I’ve ever seen came from them—particularly during the COVID lockdowns, but also beyond that. The poor feedback was partly hidden by combining reviews from their furniture repair arm which was received fantastically, with those of the retail business. At one point there was even an “I Hate Nick Scali” Facebook group with around a thousand members who felt scammed. Yet despite all that, profits kept growing showing sometimes product quality may not matter as much as we think.

Did not think i’d ever get a ResMed promotion through my amex card.

Wondering if anyone else has heard about the positive trial results from a new competitor: US-based biotech company Apnimed which announced successful Phase 3 results for its oral drug AD109. It targets obstructive sleep apnea (OSA) pharmacologically, potentially providing a simpler alternative to ResMed’s CPAP devices.

AD109: A Breakthrough Oral Treatment for Obstructive Sleep Apnea

AD109 is a first-in-class oral medication showing exceptional promise for treating obstructive sleep apnea (OSA), with consistent Phase 3 trial results demonstrating significant efficacy across diverse patient populations.

Clinical Trial Results and Effectiveness

Phase 3 Trial Outcomes:

- SynAIRgy trial: 55.6% reduction in AHI (Apnea-Hypopnea Index) from baseline at 26 weeks compared to placebo (p=0.001)

- LunAIRo trial: 46.8% reduction in AHI from baseline at 26 weeks vs. 6.8% with placebo (p<0.001)

- Both trials enrolled over 600 participants each, representing mild, moderate, and severe OSA across all weight classes

Key Efficacy Measures:

- Complete disease control: 22-23% of patients achieved AHI <5 events/hour

- ≥50% AHI reduction: Achieved by approximately 51% of participants

- Disease severity improvement: 45-51% of participants moved to a lower OSA severity category

- Oxygenation improvements: Significant reductions in hypoxic burden and oxygen desaturation index

Mechanism of Action

AD109 combines two active ingredients that work synergistically to address the root cause of OSA:

Aroxybutynin (2.5mg): A novel antimuscarinic agent that blocks certain receptors in the upper airway muscles

Atomoxetine (75mg): A selective norepinephrine reuptake inhibitor that increases norepinephrine levels in the brainstem

Combined Effect: The drug targets the hypoglossal motor nucleus to increase signals to upper airway muscles during sleep, preventing airway collapse without requiring external devices like CPAP machines. This approach increases genioglossus muscle responsiveness by approximately threefold compared to placebo.

Safety Profile

AD109 has demonstrated a favourable safety profile across multiple clinical trials: https://pmc.ncbi.nlm.nih.gov/articles/PMC10765395/

Common Side Effects (mild to moderate):

- Dry mouth

- Insomnia

- Urinary hesitancy

- Mild increases in heart rate (8-9 beats/minute)

Safety Highlights:

- No serious adverse events related to AD109 reported in Phase 3 trials

- Well-tolerated across diverse patient populations

- Side effects consistent with known profiles of individual drug components

- No clinically relevant changes in blood pressure, prostate function, or cognitive measures

Market Impact and Timeline

Regulatory Timeline: Apnimed plans to submit a New Drug Application (NDA) to the FDA by early 2026, with AD109 having received Fast Track Designation in 2022

Market Significance: If approved, AD109 would be the first oral pharmacotherapy for the estimated 80+ million Americans with OSA, potentially addressing the large population of patients who cannot tolerate or refuse CPAP therapy.

The consistent results across two large Phase 3 trials, combined with the novel mechanism targeting the neuromuscular root cause of OSA, position AD109 as a potentially transformative treatment option that could reshape the sleep apnea treatment landscape.

AD109 vs CPAP Comparison

AD109 Performance:

- AHI reduction: 46.8-55.6% reduction from baseline

- Complete disease control: 22-23% of patients achieve AHI <5 events/hour

- ≥50% AHI reduction: Achieved by ~51% of participants

CPAP Superiority:

- Greater efficacy: CPAP demonstrates 73-86% AHI reduction vs AD109's 46-56%

- More complete control: CPAP achieves AHI <5 in most compliant patients vs 22-23% with AD109

- Consistent performance: CPAP effectiveness is not dependent on drug metabolism or individual response variability

Clinical Significance

CPAP Advantages:

- Immediate and reversible effect - works every night it's used

- Near-complete elimination of events during proper use

- Proven long-term cardiovascular and health benefits

- Adjustable pressure settings for individual optimization

AD109 Considerations:

- Offers convenience as an oral medication without equipment

- May benefit patients who cannot tolerate CPAP therapy

- Represents meaningful improvement for mild-moderate OSA where CPAP compliance is poor

- Still leaves majority of patients with residual sleep apnea (AHI >5)

A good recent article about GLP-1’s working alongside CPAP therapies rather than replacing them altogether. Supports Resmed’s continued strong performance after the big dip when GLP-1 mania was in full effect.

Relevant sections from the article:

One thing I can't quite understand is why RMD bother paying such a small dividend. It's so trivial relative to the share price and surely it would cost a fair bit to administer.

Given they pay out less than 1%pa and in 4 tranches, wouldn't it be more efficient to do it once or twice a year? Or not at all?

Would it be to get it into some ETF's or managed funds which require dividends?

Just seems a waste of time from my perspective.

$RMD released their 4Q earnings (and also FY) this morning. I listened to the call and Mick's energy had an even greater effect on waking me up this morning than my Breville Barista Pro - brewed coffee (sorry, I hold $BRG in RL, couldn't resist.)

I'll post here the summary from my BA and then at the end of the straw add a few comments, which I may sharpen up on when the transcript is released, as Mick gave some more helpful information in the Q&A.

TLDR: Another strong performance, both top line and bottom line, with gross margin expansion particularly strong, capping off a strong year.

Unclear where the SP will go today, as it has run hard into the results following the wider post-April recovery in equities. However, it's P/E in the GLP-1 era remains significantly discounted to the pre-GLP-1 era, so there is ample room from strong returns if they continue to execute, IMO.

SUMMARY (Focused on Q4 to PCP)

My Assessment

4thQ rounds out a strong year, the consistency of execution has been tremendous.

Markets outside the Americas helped drive a strong revenue finish, which has been good to see as they've lagged a little in some quarters.

The %GM is stunning, however, about 50% of this is due to favourable FX. Other drivers include 1) ongoing logistics improvement as the ratio of sea-to-air freight returns to pre-pandemic norms, and 2) continuing tailwinds from the shift in mix from AirSense 10 to AirSense 11. Remarkably, Mick (CEO) and Brett (CFO) both talked of the runway ahead for %GM improvement, with %GM being guided to 61% to 63% in FY26. (This should drive some valuation TP upgrades.)

Strategically robust to the tariffs wars, given significant expansions in onshore US manufacturing capacity.

Current risk: is the renogiation of reimbursement regimes in the US at the moment including Medicare / Medicaid, however, Mick expressed a lot of confidence about this, as he has been through this several times before.

Recent bolt-on acquisitions and marketing campaigns demonstrate that $RMD is being very front-footed in growing awareness, growing the home diagnosis capability (Mick spoke about the continuing backlog in sleep clinics). Clearly, $RMD are getting after a much bigger vision of evolving from a CPAP business, to a sleep health and breathing health company. Clearly a lot of ideas and innovations in the pipeline.

He spoke about experiments $RMD on marketing, to raise awareness (e.g. current Lions' Tour) and indicated very favourable ROI metrics on this. He is eyeing what he says are a billion undiagnosed OSA sufferers in their 140 global markets.

Cashflow was very strong with cash and equivalents up from $0.23bn to $1.21bn, over a year, despite growing dividends($0.31bn), share buybacks($0.3bn), a bolt on acquisition ($0.14bn) and repaying debt ($0.04bn) all annual figures.

No significant new developments on the GLP-1, although some data in the full SEC filing was referred to, but this isn't available yet. Mick said they were continuing to see that patients on combination therapy tend to replenish supplies at a significantly higher rate. One remark Mick made was that he considered it likely that GLP-1 will dominate the drug-space because of their wider therapeutic benefits. (I need to go back over the transcript to prooerly understand what we meant.

Foraward guidance on %GM, %SG&A and %R&D all indicate continued operating leverage and double digit earnings growth potential.

Overall, $RMD is executing well. It is probably at fair value, depending on your view on the extent to which GLP-1 crimps its long-term growth prospects.

I'm a happy HOLD at these levels, for now this my largest ASX RL position (took the opportunity to add during the Trump tariff market tantrums).

Disc: Held in RL (9%) and not on SM

i spend a lot of my time on international stocks now, and look at these MF shortcuts as an easy way to assess sentiment on a stock.

the following on RMD was interesting in that clearly there are lingering concerns in the US, to put it mildly.

Although the Oz version of MF has probably lost its talent, the US guys are ok, in the usual "growthy" damn the torpedoes MF style lol

https://www.youtube.com/watch?v=9QW7TnaMk18

This announcement today seems to be the cause of the share price drop. Keen for anyone with medical expertise to weigh in...

A drug like this has always been my number one risk. If it passes the next phase 3 that is due in a few months, and the cost and efficacy is as good or better than CPAP, this could be really bad news...

$RMD announced their 3Q results this morning. I might come back and summarise the results later.

Overall volume growth was modest with reasonable earnings growth due to operating leverage. There was strong cash flow generation and $RMD will increase their share buyback program from about US$75 million per quarter to about US$100 million per quarter.

Importantly Mick Farrell sounds pretty confident that Resmed will be exempt the tariffs on their imported devices into the US coming from Australia and Singapore which produce most of the devices for that market. Resmed continue to expand both their R&D and manufacturing facilities in the US.

However, the main reason for this post is to call out a recent study published in the Lancet which builds on existing research as to the mortality benefits for patients on CPAP therapy. Included below is a summary prepared by my business analyst.

Pépin, Jean-Louis, et al. “Obstructive sleep apnoea and long-term cardiovascular mortality: the impact of continuous positive airway pressure therapy.” The Lancet Respiratory Medicine, 2024, 12(5), pp. 472-480.

“A study published in The Lancet Respiratory Medicine analyzed data from over 1.1 million patients with obstructive sleep apnea. This meta-analysis, which included 30 studies (10 randomized controlled trials and 20 real-world evidence studies), found that continuous positive airway pressure (CPAP) therapy significantly reduces all-cause mortality by 37% and cardiovascular mortality by 55%.”

No wonder there is a significant backlog at sleep clinics, which is holding back revenue growth. Hopefully the new $RMD FDA approved home testing device will help. (Might give that a go myself when I can get one!)

Happy to be back at my full allocation after a brief GLP-1 wobble a year ago!

Disc: Held in RL and SM

It hasn't been a great few weeks since the latest quarterly came out (despite the numbers looking good as discussed earlier on Strawman).

The shares are currently testing the 200D MA from above, which is an important level to preserve the broader bullish trend. So far, it is looking good with the shares up off that level on a deeply red day for the indexes.

Tail winds for RMD?

RMD CEO Mick Farrell says he's sees "....Potentially some tail winds in tariffs." Click here to see video he talks tariffs at approximately 10min mark, but the whole video is worth checking out for RMD investors.

Meanwhile.....

The New Zealand-based, ASX-listed Fisher & Paykel Healthcare is straight out of the blocks this morning announcing it will be hurt by the new regime of US tariffs.

In a statement to the ASX this morning, the company said while it didn't expect any impact in the 2025 financial year, 2026 was a different matter.

Fisher & Paykel Healthcare currently manufactures around 45% of its volume in Mexico and 55% in New Zealand.

Late on Friday (Saturday morning AEDT), US President Donald Trump announced he would be hitting Mexico with a 25% tariff, along with a 25% tariff on Canada and 10% on China on Tuesday,

"For the 2026 financial year, the company's cost would likely increase to the introduction of the new tariffs, acknowledging that the economic environment, global response to US tariffs and foreign currency movements may be fluid over this period," Fischer & Paykel's statement said.

It said it would update the market on the impact on its gross margins when it releases full year results in May.

Another source of potential gains - https://www.afr.com/companies/healthcare-and-fitness/sleep-device-giant-resmed-says-trump-tariffs-will-boost-profits-20250131-p5l8k7

It's been a while between drinks, but here we are at a new 52w high today.

Can it break decisively out of this sub-$40 range this time? Hopefully the price action is portending good things to come from earnings.

FWIW Updated research reports on ResMed out from many brokers/investment banks today - here's a short summary snippet across the range (Citi and BoFA also released updates but I don't have the details)

CLSA: Outperform 12m PT$41.50

Strong 1Q25 underpins positive sentiment through FY25: O-PF retained; Devices healthy, likely RoW share gains, GM up slightly QoQ, in-line with Cons; FY25CL outlook: robust earnings + strong balance sheet, but GLP1 caution; Valuation: PE Rel highlights RMD valuation upside, even accounting for risks; Price target rises 4% to A$41.50

UBS: Neutral 12m PT US$225

Small sales beat, in line gross margin and delivery on operational costs make up 6% core EPS beat

ResMed has delivered across the P&L with beats to consensus expectations everywhere except gross margin which was in line. We think, if there is an area investors might be less sure of it will be whether 11% consensus expectations for top line growth for FY25 can be delivered given 2H growth is likely to be a bit slower than 1H growth

RBC: Sector Perform PT US$225

RMD delivered a strong 1Q25 result with a 3% revenue beat, gross margins broadly in line with expectations (but a 400bps improvement YoY and a 10bps improvement QoQ), non-GAAP income from operations exceeding consensus by 5% and non-GAAP net income beating consensus by 6%. Segment revenues exceeded consensus across all categories, with the exception of Americas masks which came in line with consensus. We expect the market will view this as a strong result

Macquarie: Outperform 12m PT $37.70

1Q25 a beat; Revenue ahead of expectations, driven by RoW; Gross margin; SG&A/R&D; Buy-back program; New products

Wolfe Research: Underperform PT US$190

Bulls win the round – good upside quarter, increase estimates and target. Our Underperform call oriented around a 1-2 year view on risk/reward to the multiple – still see it similarly, albeit on a slightly higher EPS base now

JP Morgan: Overweight PT $37

Double digit growth across all segments; Gross and operating margins to improve through the year; GM, opex and tax guidance unchanged, interest cost lowered, buyback lifted; Mega trends still to provide support; Gaining or holding share across markets; SaaS business growth across the verticals; Buyback spend lifted, M&A “tuck-ins” of up to $0.5b; Working capital lifted due to higher inventories, operating cashflow still strong

BoFA:

1Q25 result: Disproving the bears

Citi:

Strong Q1 on better Devices revenue and tax rate

DISC: Held in RL & SM

Very happy with todays quarterly results from Resmed. Very good growth in devices, consumables, market share and cost improvements too. Revenue up 11%, gross margins up 4%, EPS up 42%, albeit they were comping a flatish quarter last year.

What was also really good to hear was how CEO Mick Farrell talked about the business and the future. Great commentary around helping patients, improving lives, embracing rather than talking down competition, capital allocation thinking, acknowledging the great work of the team etc. These are excellent qualities for a leader to have and there is not a lot of hubris coming through despite their dominant market position.

There was also really positive data about how GLP 1 drugs are proving to be a tailwind rather a headwind as first feared. And also some good signs for what's happening with sleep apnea and wearables that are creating demand.

If you own RMD or have it on your watchlist, this call is well worth a listen and results also here - https://event.choruscall.com/mediaframe/webcast.html?webcastid=AyogqgdH

https://investor.resmed.com/news-events/press-releases/detail/390/resmed-inc-announces-results-for-the-first-quarter-of-fiscal-year-2025

ResMed is the third most shorted healthcare stock in the S&P500, with nearly 6% of the float short, behind Moderna and DaVita.

If the company continues to deliver and hit even something in the ballpark of its its longer-term aspirations, there's plenty of upside as more shorts will be forced to cover their positions, even after the great run we have had since the lows of last year.

Small hit on Resmed yesterday following a fairly significant downgrade by Wolfe Research, asserting that the risk of market disruption by Eli Lily's obesity treatment and GLP-1 agonist Tirzapetide warrants a reduction in growth forecasts to mid-single digits, anda target PE of about 20. The trigger for this is an assumption / thesis that Eli Lily will be awarded approval to market their drug to treat sleep apnoea (OSA), that the TAA will fall and RMD will see product growth slow to mid-single digits, from high-single/low double digit growth.

This is total bunk, and I will take advantage of pullbacks to buy more stock.

Firstly, the TAA for obesity and OSA is massive, and much larger than current market penetration by resmed and Phillips. So there is plenty of growth potential still on the table.

Secondly, it is not my view that tirzapetide will significantly reduce the TAM. This agent has really good evidence for inducing and maintaining pretty good weight loss, but we aren't talking about a magic wand of skinniness. From memory, Tirzapetide users on max doses achieve and sustain nearly 15-20kg weight loss while taking the drugs. Thats pretty good and absolutely worthwhile. And while that may treat/reverse OSA in some overweight patients, for the many obese patients who are (much) more than 20kg overweight, the drug will improve their weight profile and may improve but not eliminate their OSA. In fact, engaging with weight management may improve their interest in other procedures down the track. That is, new and better weight loss drugs may actually increase the TAM, with better health literacy and understanding of the issue.

If Eli Lily obtain OSA as an indication for tirzapetide, it will only be of use in patients who have OSA and either diabetes or obesity, and its approved for those already. It wont help already-slim patients who have OSA, and can already treat obese patients with OSA; therefore, obtaining a marketing indication for OSA is irrelevant to resmed's TAM.

Finally, my thesis remains consistent with Resmed management. The TAM for OSA is large, obesity and OSA is a generational problem in developed nations and will be for 20-30 years. Anti-obesity drugs may reduce obesity levels, but anti-obesity surgery (gastric sleeve, bypass etc) is even more effective than drugs, and yet the obesity problem continues to grow. Wolfe Research's claims of market disruption are overblown and wont meaningfully reduce the TAM for OSA treatment/ equipment.

Accordingly, I maintain a mid-30s PE ratio for resmed.

EDIT: Immediately after posting I noticed @mushroompanda's straw haha. Fantastic line of thought mate.

Here's a snippet from an Equity Mates newsletter received in my inbox this morning (for context, this is in relation to Apple's new products that were announced yesterday):

"Outside the AI announcements, Apple’s product updates showcased some pretty cool features. Two of our favourites: Apple Watches will soon feature a sleep apnea detector (surely that’s good for ResMed?) and Apple’s AirPods 2 will be able to double as hearing aids (maybe not so good for Cochlear?)"

How interesting, I never thought a story about Apple could flow on to consider how this may affect ResMed sales..

Disc: Not held

BOOM

Perhaps both. Today, Wednesday 4th September 2024, the ASX got smashed and every sector was in the red, following falls in the US on their Tuesday (Monday was a public holiday over there for Labor Day).

But not ResMed, or FPH either; both made new 12-month highs today:

Tables sourced from: https://marcustoday.com.au/

Below, not many on the left side (12 month highs) but they ran out of room for the 12 month lows (on the right):

After Industrials, Healthcare was the second least worst sector today, and we have those two CPAP providers heading up the new 12-month high share price list. As well as IXI - the iShares Global Consumer Staples ETF that tracks the performance of the S&P Global 1200 Consumer Staples (Sector) Capped Index, so the sort of thing that people turn to when the world goes pear-shaped - even in a zombie apocalypse, they'll still be selling tins of baked beans I suppose.

Health care and consumer staples are generally considered "defensive" sectors" - so "risk off" sectors, when people just aren't feeling the optimism around the near-term potential of share-markets.

Only thing is - when you look at the charts of ResMed and Fisher & Paykel Healthcare, they do NOT look like defensive stocks, they looks very much like growth stocks - their one year charts are all bottom left to top right.

One year ago, I was arguing that while Ozempic and the like did NOT present a major threat to the future viability and growth of ResMed, I wouldn't invest in them because I felt that people would always be searching for better options for their OSA treatment, due to the invasive nature of CPAP and the drawbacks of being connected to a machine via a tube while you sleep. In short, I felt that CPAP as an industry was ripe for disruption by any tech that was easier to use.

So I thought that future competition from something other than CPAP - for OSA specifically - was the thing that concerned me, so I was never going to be a RMD or FPH investor.

Well, here we are, less than a year later and I'm using a Phillips DreamStation CPAP machine connected to a ResMed mask every night after being diagnosed with severe OSA (just shy of 60 episodes per hour, so around 1 per minute on average) and it's fair to say, tending towards the possibility of having a little rethink about my earlier assumptions and opinions...

A brief note out from UBS

3yr SURMOUNT-1 data does not change what we know about GLP-1s and OSA

ResMed shares were down in US trading yesterday, along with other perceived GLP-1 loser stocks (TNDM, PODD, DXCM, INSP) after the release of three year data from Lilly's SURMOUNT-1 trial showing 94% reduction in progression to diabetes among adults with pre-diabetes and obesity / overweight. This is not a new study - the original (72 week) results (for weight loss) were published in the NEJM in 2022 - this is later reporting of a secondary end point. This is also not an OSA study (not even as a secondary end point) but adds to the growing pile of evidence for positive outcomes via management of the metabolic axis using modern GLP-1s. In this case we think weakness in ResMed shares is probably unjustified given that although there is a link between sleep quality and insulin resistance, the link between excess weight and OSA is stronger and is what will dominate the influence of GLP-1s on ResMed's business. In other words, the stock should not be penalised twice. Similarly, SURMOUNT-1's 94% greater than the 73% in Novo's SELECT trial, but it is already known that tirzepatide leads to greater weight loss than semaglutide so this difference should not be surprising

Where do we stand on ResMed shares?

We have recently started to lean slightly more positive on ResMed shares, although remain Neutral rated, as there is some evidence for the "funnel filling" thesis (i.e. that GLP-1s could be good for the stock in the medium term as more patients come in to care, even if we are convinced they are bad in the long run). We continue to prefer CSL (Buy, PT USD340) and TLX (Buy, PT AUD29) for their fairly unencumbered exposures to growing end-markets, pricing power and ability to leverage the economics of their base businesses far into the future. We are more nervous about situations with lower pricing power or structural challenges around profitability largely - services and providers

DISC: Held in RL & SM

stick that in your pipe and smoke it ozempic !!!!

For investors

+1 858-836-5000

For media

‘+1 619-510-1281 [email protected]

ResMed Inc. Announces Results for the Fourth Quarter of Fiscal Year 2024

– Year-over-year revenue grows 9%, operating profit up 38%, non-GAAP operating profit up 30%

– Operating cash flow of $440 million

– Quarterly dividend increases 10% to $0.53 per share

– Company to host an Investor Day on September 30, 2024

Note: A webcast of ResMed’s conference call will be available at 4:30 p.m. ET today at http://investor.resmed.com

SAN DIEGO, August 1, 2024 – ResMed Inc. (NYSE: RMD, ASX: RMD) today announced results for its quarter

ended June 30, 2024.

Fourth Quarter 2024 Highlights

All comparisons are to the prior year period

• Revenue increased by 9% to $1.2 billion; up 10% on a constant currency basis

• Gross margin improved 350 bps to 58.5%; non-GAAP gross margin improved 330 bps to 59.1%

• Income from operations increased 38%; non-GAAP income from operations up 30%

• Operating cash flow of $440 million and debt repayments of $300 million

• Diluted earnings per share of $1.98; non-GAAP diluted earnings per share of $2.08

Full Year 2024 Highlights

All comparisons are to the prior year period

• Revenue increased by 11% to $4.7 billion; up 11% on a constant currency basis

• Gross margin improved 90 bps to 56.7%; non-GAAP gross margin improved 120 bps to 57.7%

• Income from operations increased 17%; non-GAAP income from operations up 21%

• Operating cash flow of $1.4 billion and debt repayments of $0.8 billion

• Diluted earnings per share of $6.92; non-GAAP diluted earnings per share of $7.72

“Our fourth quarter and full-year fiscal year 2024 results demonstrate strong performance across all sectors of our business,” said Mick Farrell, Chairman & CEO of ResMed. “Ongoing patient and customer demand for our best-in-class products and software solutions is incredibly strong, driving solid growth across our devices, masks, and software businesses. The global ResMed team’s focus on operating excellence, ongoing cost discipline, and profitable growth acceleration resulted in gross margin expansion, strong operating leverage, and double-digit growth in bottom-line profitability.

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024 Page 2 of 10

“Nearly 2.5 billion suffer from major sleep health and breathing disorders. As the market leader in these significantly underpenetrated markets, we’re well-positioned as the clear leader to drive increased market penetration, demand generation, and accelerate growth for our businesses. We’re laser-focused on increasing awareness with the fast-growth population of sleep-health-interested consumers, creating virtual pathways that expand access to therapies, while offering a broad portfolio of medical device products, software solutions, and beyond, as we deliver value for all ResMed stakeholders.”

Financial Results and Operating Metrics

Unaudited; $ in millions, except for per share amounts

June 30, 2024

Three Months Ended

June 30,

2023 % Change

Constant Currency (A)

10 %

1 4

Constant Currency (A)

11 %

5 8

Revenue $ 1,122.1 Gross margin 55.0 Non-GAAP gross margin (B) 55.8 Selling, general, and administrative expenses 240.7 Research and development expenses 78.1 Income from operations 275.3 Non-GAAP income from operations (B) 400.5 307.0 Net income 229.7 Non-GAAP net income (B) 235.5 Diluted earnings per share $ 1.56 Non-GAAP diluted earnings per share (B) $ 1.60

9 % 6 % 6 1 3 38 30 27 30 27 30

%

June 30, 2024

Revenue

Gross margin

Non-GAAP gross margin (B)

Selling, general, and administrative expenses 917.1 Research and development expenses

Income from operations

Non-GAAP income from operations (B) 1,478.4 Net income

Non-GAAP net income (B)

Diluted earnings per share

Non-GAAP diluted earnings per share (B)

$

$ $

June 30, 2023

4,223.0 55.8 56.5 874.0 287.6 1,131.9 1,224.4 897.6 949.8 6.09 6.44

% Change 11

2 2 5 7

17

21

14

20

14

20

%

$ 1,223.2 58.5 %

59.1 % 242.2

80.9 381.2

292.2

306.3 $ 1.98 $ 2.08

Twelve Months Ended

$ 4,685.3 56.7 %

57.7 %

(A) In order to provide a framework for assessing how our underlying businesses performed, excluding the effect of foreign currency fluctuations, we provide certain financial information on a “constant currency” basis, which is in addition to the actual financial information presented. In order to calculate our constant currency information, we translate the current period financial information using the foreign currency exchange rates that were in effect during the previous comparable period. However, constant currency measures should not be considered in isolation or as an alternative to U.S. dollar measures that reflect current period exchange rates, or to other financial measures calculated and presented in accordance with U.S. GAAP.

(B) See the reconciliation of non-GAAP financial measures in the table at the end of the press release.

307.5 1,319.9

% %

1,021.0

1,139.3 $ 6.92 $ 7.72

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024 Page 3 of 10 Discussion of Fourth Quarter Results

All comparisons are to the prior year period unless otherwise noted

• Revenue grew by 10 percent on a constant currency basis, driven by increased demand for our sleep devices and masks portfolio, as well as strong growth across our Software as a Service business.

◦ Revenue in the U.S., Canada, and Latin America, excluding Software as a Service, grew by 10 percent.

◦ Revenue in Europe, Asia, and other markets, excluding Software as a Service, grew by 8 percent on a constant currency basis.

◦ Software as a Service revenue increased by 10 percent, reflecting continued organic growth in our SaaS portfolio.

• Gross margin increased by 350 basis points mainly due to reduced freight and manufacturing cost improvements, an increase in average selling prices as well as favorable product mix. Non-GAAP gross margin increased by 330 basis points due to the same factors.

• Selling, general, and administrative expenses increased by 1 percent on a constant currency basis. SG&A expenses improved to 19.8 percent of revenue in the quarter, compared with 21.5 percent in the same period of the prior year. The modest increase in SG&A expenses reflects cost management initiatives implemented during the December quarter.

• Income from operations increased by 38 percent, and non-GAAP income from operations increased by 30 percent.

• Net income for the quarter was $292 million and diluted earnings per share was $1.98. Non-GAAP net income increased by 30 percent to $306 million, and non-GAAP diluted earnings per share increased by 30

percent to $2.08, predominantly attributable to strong sales and gross margin improvement as well as

modest growth in operating expenses.

• Operating cash flow for the quarter was $440 million, compared to net income in the current quarter of $292

million and non-GAAP net income of $306 million.

• During the quarter, we paid $71 million in dividends and repurchased 232,000 shares for consideration of

$50 million as part of our ongoing capital management.

Other Business and Operational Highlights

• Supported the presentation of 39 clinical research abstracts at the annual American Thoracic Society (26 abstracts) and SLEEP (13 abstracts) conferences, demonstrating the breadth and depth of ResMed’s leadership in generating and analyzing real-world evidence in support of better clinical and patient outcomes. Research focused on a variety of topics including the increasing prevalence of Obstructive Sleep Apnea (OSA), the economic benefits of treating OSA, and the relationship between OSA and depression in women.

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024

Page 4 of 10

Dividend program

The ResMed board of directors today declared a quarterly cash dividend of

per share. The dividend will

have a record date of August 15, 2024, payable on September 19, 2024. The dividend will be paid in U.S.

currency to holders of ResMed’s common stock trading on the New York Stock Exchange. Holders of CHESS

Depositary Interests (“CDIs”) trading on the Australian Securities Exchange will receive an equivalent amount in

Australian currency, based on the exchange rate on the record date, and reflecting the 10:1 ratio between CDIs

and NYSE shares. The ex-dividend date will be August 14, 2024, for common stockholders and for CDI holders.

ResMed has received a waiver from the ASX’s settlement operating rules, which will allow ResMed to defer

processing conversions between its common stock and CDI registers from August 14, 2024, through August 15,

, inclusive.

2024

fter the live webcast. In addition, a telephone replay of the conference call will be available approximately three hours after the webcast by dialing +1 877-660-6853 (U.S.) or +1 201-612-7415 (outside U.S.) and entering the passcode 13747201. The telephone replay will be available

until August 15, 2024.

$0.53

Webcast details

ResMed will discuss its

quarter fiscal year

results on its webcast at 1:30 p.m. U.S. Pacific Time

today. The live webcast of the call can be accessed on ResMed’s Investor Relations website at

investor.resmed.com. Please go to this section of the website and click on the icon for the “

Earnings

Webcast” to register and listen to the live webcast. A replay of the earnings webcast will be accessible on the

website and available approximately two hours a

fourth 2024

Q4 2024

About ResMed

At ResMed (NYSE: RMD, ASX: RMD) we pioneer innovative solutions that treat and keep people out of the

hospital, empowering them to live healthier, higher-quality lives. Our digital health technologies and cloud-

connected medical devices transform care for people with sleep apnea, COPD, and other chronic diseases. Our

comprehensive out-of-hospital software platforms support the professionals and caregivers who help people

stay healthy in the home or care setting of their choice. By enabling better care, we improve quality of life,

reduce the impact of chronic disease, and lower costs for consumers and healthcare systems in more than 140

countries. To learn more, visit ResMed.com and follow @ResMed.

Safe harbor statement

Statements contained in this release that are not historical facts are “forward-looking” statements as

contemplated by the Private Securities Litigation Reform Act of 1995. These forward-looking statements –

including statements regarding ResMed’s projections of future revenue or earnings, expenses, new product

development, new product launches, new markets for its products, the integration of acquisitions, our supply

chain, domestic and international regulatory developments, litigation, tax outlook, and the expected impact of

macroeconomic conditions of our business – are subject to risks and uncertainties, which could cause actual

results to materially differ from those projected or implied in the forward-looking statements. Additional risks and

uncertainties are discussed in ResMed’s periodic reports on file with the U.S. Securities & Exchange

Commission. ResMed does not undertake to update its forward-looking statements.

– More –

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024

Page 5 of 10

RESMED INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited; $ in thousands, except for per share amounts)

Three Months Ended

Twelve Months Ended

Net revenue Cost of sales

$

$ $

$ $

$

$ $

$ $ $

June 30, 2024

1,223,195

7,987

—

— 507,668 715,527

242,187 80,861 11,262

—

— 334,310 381,217

(5,920)

868 (15,473)

— (2,960) (23,485)

357,732 65,495 292,237

1.99 1.98 2.08

146,915 147,533

$

$ $

$ $

$

$ $

$ $ $

June 30, 2023

1,122,057

8,395

—

— 504,671 617,386

240,687 78,144 12,319

9,177

1,792 342,119 275,267

(14,943)

(2,228)

(1,583) 20,227 61 1,534 276,801 47,137 229,664

1.56 1.56 1.60

147,015 147,554

$

$ $

$ $

$

$ $

$ $ $

June 30, 2024

4,685,297

1,982,769 32,963

6,351

7,911 2,029,994 2,655,303

917,136 307,525 46,521 64,228 — 1,335,410 1,319,893

(45,708)

(1,848) (4,045)

— (3,494) (55,095)

1,264,798 243,847 1,020,951

6.94 6.92 7.72

147,021 147,550

$

$ $

$ $

$

$ $

$ $ $

June 30, 2023

4,222,993

1,836,935 30,396

—

— 1,867,331 2,355,662

874,003 287,642 42,020 9,177 10,949 1,223,791 1,131,871

(47,379)

(7,265) 9,922 20,227

(5,712) (30,207)

1,101,664 204,108 897,556

6.12 6.09 6.44

146,765 147,455

Amortization of acquired intangibles (1) Masks with magnets field safety notification

expenses (1)

Astral field safety notification expenses (1) Total cost of sales

Gross profit

499,681

496,276

Selling, general, and administrative Research and development Amortization of acquired intangibles (1) Restructuring expenses (1)

Acquisition related expenses (1) Total operating expenses Income from operations

Other income (expenses), net: Interest expense, net

Gain (loss) attributable to equity method investments

Gain on equity investments (1) Gain on insurance recoveries (1) Other, net

Total other income (expenses), net Income before income taxes Income taxes

Net income

Basic earnings per share

Diluted earnings per share

Non-GAAP diluted earnings per share (1)

Basic shares outstanding Diluted shares outstanding

(1) See the reconciliation of non-GAAP financial measures in the table at the end of the press release.

– More –

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024

Page 6 of 10

RESMED INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited; $ in thousands)

Assets

Current assets:

Cash and cash equivalents

Accounts receivable, net

Inventories

Prepayments and other current assets

Total current assets Non-current assets:

Property, plant, and equipment, net

Operating lease right-of-use assets

Goodwill and other intangibles, net

Deferred income taxes and other non-current assets

Total non-current assets

Total assets

Liabilities and Stockholders’ Equity Current liabilities:

Accounts payable

Accrued expenses

Operating lease liabilities, current Deferred revenue

Income taxes payable

Short-term debt

Total current liabilities Non-current liabilities:

Deferred revenue

Deferred income taxes

Operating lease liabilities, non-current Other long-term liabilities

Long-term debt

Long-term income taxes payable

Total non-current liabilities Total liabilities Stockholders’ equity

Common stock

Additional paid-in capital

Retained earnings

Treasury stock

Accumulated other comprehensive income

Total stockholders’ equity

Total liabilities and stockholders’ equity

$

$ $

$ $

$

$ $

$ $

$

$ $

June 30, 2024

238,361 837,275 822,250 459,833

2,357,719

548,025

151,121 3,327,959 487,570 4,514,675 6,872,394

237,728 377,678 25,278 152,554 107,517 9,900 910,655

137,343 79,339 141,444 42,257 697,313 — 1,097,696 2,008,351

588 1,896,604 4,991,647

(1,773,267) (251,529)

4,864,043 6,872,394

$

$ $

$ $

$

$ $

$ $

$

$ $

June 30, 2023

227,891 704,909 998,012 437,018

2,367,830

537,856

127,955 3,322,640 395,427 4,383,878 6,751,708

150,756 365,660 21,919 138,072 72,224 9,902 758,533

119,186 90,650 116,853 68,166 1,431,234 37,183 1,863,272 2,621,805

588 1,772,083 4,253,016

(1,623,256) (272,528)

4,129,903 6,751,708

– More –

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024

Page 7 of 10

RESMED INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited; $ in thousands)

Cash flows from operating activities:

Net income

Adjustment to reconcile net income to cash provided by operating activities:

Depreciation and amortization

Amortization of right-of-use assets

Stock-based compensation costs

(Gain) loss attributable to equity method investments, net of dividends received

(Gain) loss on equity investments Non-cash restructuring expenses

Gain on insurance recoveries

Changes in operating assets and liabilities: Accounts receivable, net

Inventories, net

Prepaid expenses, net deferred income taxes and other current assets

Accounts payable, accrued expenses, income taxes payable and other

Net cash provided by operating activities

Cash flows from investing activities:

Purchases of property, plant, and equipment Patent registration and acquisition costs Business acquisitions, net of cash acquired Purchases of investments

Proceeds from exits of investments

(Payments) / proceeds on maturity of foreign currency contracts

Net cash used in investing activities

Cash flows from financing activities:

Proceeds from issuance of common stock, net Purchases of treasury stock

Taxes paid related to net share settlement of equity awards

Payments of business combination contingent consideration

Proceeds from borrowings, net of borrowing costs Repayment of borrowings

Dividends paid

Net cash (used in) / provided by financing activities Effect of exchange rate changes on cash

Net increase / (decrease) in cash and cash equivalents

Cash and cash equivalents at beginning of period

Cash and cash equivalents at end of period

Three Months Ended

Twelve Months Ended

$

June 30, 2024

292,237

43,677 11,077 21,392

(868) 15,473 — —

(57,523) 8,910

(16,237)

121,975 440,113

(24,881) (1,442) (19,697) (3,073)

750

1,833 (46,510)

27,696 (50,004)

(421)

—

— (300,000) (70,553) (393,282)

130

451 237,910 238,361

$

June 30, 2023

229,664

46,760 8,440 19,927

5,102 1,584 9,177

(20,227)

(18,059) 6,257

(51,518)

330 237,437

(34,449) (4,285) (1,524) (2,500)

—

(3,765) (46,523)

23,493 —

(334)

(2,045) —

(145,000) (64,705) (188,591) (2,326)

(3) 227,894 227,891

$

June 30, 2024

1,020,951

176,870 39,339 80,184

1,848

4,045 33,239 —

(134,278) 172,203

(115,213)

122,072 1,401,260

(99,460)

(15,396) (133,464) (12,765)

1,000

(9,699) (269,784)

53,094 (150,011)

(8,757)

(1,293) 105,000

(835,000)

(282,320) (1,119,287) (1,719)

10,470 227,891 238,361

$

June 30, 2023

897,556

165,156 32,406 71,142

10,138 (9,922)

9,177 (20,227)

(106,511) (248,833)

(138,125)

31,342 693,299

(119,672) (14,328) (1,012,749) (32,229)

3,937

15,196 (1,159,845)

49,142 —

(30,631)

(2,361) 1,070,000

(405,000) (258,276) 422,874

(2,147)

(45,819) 273,710 227,891

$

$

$

$

$

$

$

$

$ $

$

$ $

$

$ $

$

$ $

$

– More –

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024

Page 8 of 10

Reconciliation of Non-GAAP Financial Measures

(Unaudited; $ in thousands, except for per share amounts)

RESMED INC. AND SUBSIDIARIES

The measures “non-GAAP gross profit” and “non-GAAP gross margin” exclude amortization expense from

acquired intangibles and restructuring expense related to cost of sales and are reconciled below:

Three Months Ended

Twelve Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Revenue

GAAP cost of sales

$ 1,223,195

$ 507,668 (7,987)

—

— $ 499,681

$ 715,527 58.5 %

$ 723,514 59.1 %

$ $

$ $ $

1,122,057

504,671 (8,395)

$ 4,685,297

$ 2,029,994 (32,963)

(6,351)

(7,911) $ 1,982,769

$ 2,655,303 56.7 %

$ 2,702,528 57.7 %

$ 4,222,993

$ 1,867,331 (30,396)

—

— $ 1,836,935

$ 2,355,662 55.8 %

$ 2,386,058 56.5 %

Less: Amortization of acquired intangibles (A) Less: Masks with magnets field safety notification

expenses (A)

Less: Astral field safety notification expenses (A) Non-GAAP cost of sales

496,276

617,386 55.0 625,781 55.8

— —

GAAP gross profit GAAP gross margin Non-GAAP gross profit Non-GAAP gross margin

% %

The measure “non-GAAP income from operations” is

GAAP income from operations

Amortization of acquired intangibles—cost of sales (A)

Amortization of acquired intangibles—operating expenses (A)

Restructuring (A)

Masks with magnets field safety notification expenses (A) Astral field safety notification expenses (A) Acquisition-related expenses (A)

Non-GAAP income from operations

–

reconciled with GAAP income from operations below:

Three Months Ended

Twelve Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

$ 381,217 7,987

11,262 — — — — $ 400,466

More –

$ 275,267 8,395

12,319 9,177 — — 1,792 $ 306,950

$ 1,319,893 32,963

46,521 64,228 6,351 7,911 483 $ 1,478,350

$ 1,131,871 30,396

42,020 9,177 — — 10,949 $ 1,224,413

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024

Page 9 of 10

Reconciliation of Non-GAAP Financial Measures

(Unaudited; $ in thousands, except for per share amounts)

GAAP net income

Amortization of acquired intangibles—cost of sales (A)

Amortization of acquired intangibles—operating expenses (A)

Restructuring expenses (A)

Masks with magnets field safety notification expenses (A) Astral field safety notification expenses (A) Acquisition-related expenses (A)

Gain on insurance recoveries (A)

Income tax effect on non-GAAP adjustments (A) Non-GAAP net income (A)

GAAP diluted shares outstanding

GAAP diluted earnings per share Non-GAAP diluted earnings per share (A)

Three Months Ended

Twelve Months Ended

RESMED INC. AND SUBSIDIARIES

The measures “non-GAAP net income” and “non-GAAP diluted earnings per share” are reconciled with GAAP

net income and GAAP diluted earnings per share in the table below:

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

$

$

$ $

292,237 $ 229,664 $ 1,020,951 7,987 8,395 32,963 11,262 12,319 46,521

— 9,177 64,228 — —

— —

— 1,792 483

306,341 $ 235,489 $ 1,139,294

$

$

$ $

897,556 30,396 42,020

9,177

10,949

949,757

147,455 6.09 6.44

6,351 7,911

— —

— (5,145)

(20,227) (5,631)

— (40,114)

(20,227) (20,114)

(A) ResMed adjusts for the impact of the amortization of acquired intangibles, restructuring expenses, field safety notification expenses, acquisition-related expenses, gain on insurance recoveries, and associated tax effects from their evaluation of ongoing operations, and believes that investors benefit from adjusting these items to facilitate a more meaningful evaluation of current operating performance.

ResMed believes that non-GAAP diluted earnings per share is an additional measure of performance that investors can use to compare operating results between reporting periods. ResMed uses non-GAAP information internally in planning, forecasting, and evaluating the results of operations in the current period and in comparing it to past periods. ResMed believes this information provides investors better insight when evaluating ResMed’s performance from core operations and provides consistent financial reporting. The use of non-GAAP measures is intended to supplement, and not to replace, the presentation of net income and other GAAP measures. Like all non-GAAP measures, non-GAAP earnings are subject to inherent limitations because they do not include all the expenses that must be included under GAAP.

– More –

147,533 147,554 1.98 $ 1.56 $ 2.08 $ 1.60 $

147,550 6.92 7.72

RMD Fourth Quarter 2024 Earnings Press Release – August 1, 2024

Page 10 of 10

Revenue by Product and Region

(Unaudited; $ in millions, except for per share amounts)

U.S., Canada, and Latin America

Three Months Ended

RESMED INC. AND SUBSIDIARIES

June 30,

2024 (A)

June 30, 2023

$ 387.2 273.7

$ 660.9

$ 215.2 107.4

$ 322.6

$ 602.4 381.0

$ 983.5

138.6

$ 1,122.1

(A)

% Change

Constant Currency (B)

8% 9

8

6 % 15

9

10 10

Constant Currency (B)

Devices $ 406.2 Masks and other 321.2 Total U.S., Canada and Latin America $ 727.4

Combined Europe, Asia, and other markets

Devices $ 228.8 Masks and other 115.0 Total Combined Europe, Asia and other markets $ 343.9

Global revenue

Total Devices $ 635.1 Total Masks and other 436.2 Total Sleep and Respiratory Care $ 1,071.3

Software as a Service 151.9 Total $ 1,223.2

June 30,

2024 (A)

U.S., Canada, and Latin America

Devices $ 1,522.8 Masks and other 1,199.8 Total U.S., Canada and Latin America $ 2,722.6

Combined Europe, Asia, and other markets

Devices $ 921.3 Masks and other 457.4 Total Combined Europe, Asia and other markets $ 1,378.6

Global revenue

Total Devices $ 2,444.0 Total Masks and other 1,657.2 Total Sleep and Respiratory Care $ 4,101.2

Software as a Service 584.1

5% 17

10

6% 7

7

5 14 9

10 9

%

Twelve Months Ended

June 30,

2023 (A)

$ 1,444.4 1,039.0

$ 2,483.4

$ 826.3 415.3

$ 1,241.6

$ 2,270.7 1,454.3

$ 3,725.0

498.0

$ 4,223.0

% Change

5 15 10

11 10 11

8 14 10

17 11

%

%

%

10 % 8

10

7 % 13

10

17 11

Total

(A) Totals and subtotals may not add due to rounding.

$ 4,685.3

(B) In order to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign currency fluctuations, we provide certain financial information on a “constant currency basis,” which is in addition to the actual financial information presented. In order to calculate our constant currency information, we translate the current period financial information using the foreign currency exchange rates that were in effect during the previous comparable period. However, constant currency measures should not be considered in isolation or as an alternative to U.S. dollar measures that reflect current period exchange rates, or to other financial measures calculated and presented in accordance with U.S. GAAP.

– End –

Interesting addition to all the chatter on weight loss drugs. Will be fun to see if this alters pundits views on the relative merits of weight loss drugs.

Like all preliminary data, may well not survive further substantial analysis but it was a large cohort. At the risk of stating the obvious of you look hard enough for side effects, the law of large numbers states that you will encounter an increase in adverse event in one domain that is higher than expected. But people are usually unwilling to increase their risk of going blind

Drugs like Ozempic, Wegovy linked to eye condition causing vision loss

https://jamanetwork.com/journals/jamaophthalmology/article-abstract/2820255

This was a good discussion re RMD, on the Stocktake podcast

Nothing ground breaking. Really covering the same ground as we have all been covering.

But a good conversation, none the less

As @Arizona said, the Resmed price fall was the market reaction to the release of the Phase 3 endpoint results for Eli Lilly’s drug Tirzepatide. As is detailed in the abstract linked below the results showed significant effectiveness in reducing AHI (apnea-hypopnea index) which Resmed’s CPAP product addresses.

Bad news no doubt… or maybe – As was the reaction to Ozempic, the initial first order thinking was CPAP would no longer be needed and Resmed’s market would evaporate as the new drug “solved” the problem. But the high cost of Ozempic and the increased awareness of the problem of sleep aponia lead to increased interest in CPAP and a positive correlation when Ozempic customers also used CPAP, which Resmed announced data supporting last results announcement.

Now we have Tirepatide, as per the links below, it is also expensive, US$13k, especially compared to A$2k a CPAP machine costs as @Bear77 has informed us.

So, I think we are a long way from a terminal issue for Resmed. That said – I wouldn’t consider Resmed a bottom draw stock either. In the medium term the expansion of the market is likely to offset any impact drug treatments may have as alternatives. But in the long run, the price of the treatments will drop (as they come off patent and scale) and probably improve to a point the cost benefit equation is in their favor. In fact, if you live in China, it’s pretty close already!

Phase 3 results abstract:

· The New England Journal of Medicine (21/6/24): Tirzepatide for the Treatment of Obstructive Sleep Apnea and Obesity | New England Journal of Medicine (nejm.org)

Annual cost of Tirzepatide of US$13,410 ($2,247 per 1% reduction in A1c and $237 per 1 kg weight lost more cost effective than Semaglutide)

· National Library of Medicine (29/3/23): Short-term cost-effectiveness analysis of tirzepatide for the treatment of type 2 diabetes in the United States - PMC (nih.gov)

Tirepatide annual cost in China of around US$2,000:

· National Library of Medicine (13/5/24): Cost-utility analysis and drug pricing for tirzepatide for type 2 diabetes in the Chinese market compared with semaglutide - PubMed (nih.gov)

Disc: I own in RL

I found this a really useful article. They use RMD as the example but lessons applicable to any company

Best

C

How to identify a company's capital allocation strategy

ResMed is used as an example of how to spot a company’s capital allocation strategy in its financial statements.

Joseph Taylor

Capital allocation is the act of deciding what to do with cash generated from operations or raised from equity or debt markets. It is often referred to as a CEO’s most important job, and they generally have five main options.

The five main avenues for capital

Pay dividends

Dividends are perhaps the purest form of capital return. The company decides a percentage of profits to pay out and each shareholder gets a cash payment for each share they own. The shareholder can then decide to spend, save or reinvest the funds they receive.

Buy back shares

By buying back shares the company increases the percentage ownership of the remaining shareholders. Just like any share purchase, price matters. If shares are repurchased at a price above their intrinsic value, it is likely the money could have achieved a better return elsewhere.

Pay down debt

Paying off debt is also a return of capital – only this time to bondholders rather than shareholders. This can also be a good thing for shareholders as lowering debt can reduce the financial risk of a company. It should also reduce future interest and debt payments, meaning more cash can be allocated elsewhere.

Invest in organic growth

Profits can be reinvested in the hope of sowing even more profits in the future. Investments in organic growth might include buying more property and equipment, increasing research and development spending, hiring more staff or moving into new territories or product lines.

Buy other companies

Instead of reinvesting internally, management might choose to acquire another company. Creating shareholder value through acquisitions is famously hard – but it is possible. Berkshire Hathaway (NYS:BRK.A), Constellation Software and Danaher (NYS:DHR) have excelled while channeling a lot of capital towards acquisitions. But the fact they are so famous might tell you something.