Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Overview Comment:

Selling out of position as I have lost conviction for Sequoia to execute well over the short term and potentially longer, will be happy to jump back in if I see the core business continue to improve from the current downturn but I cant convince myself this is the case. Summary of my issues:

- I think these markets are somewhat subdue but more normalised than COVID times so to act like this is a one-off bad year I'm not sure that is correct.

- Management has continually moved the goalpost on longer term targets. How will they seriously hit $300m revenue in FY26 when they have divested Morrison's securities and had revenue go backwards this year? Now the goal is their own management determined numbers...

- Too much focus on EBITDA and no mention of actual results in presentations. Feels like management is not acknowledging the real result and real profitability.

- Couldn't meet guidance set 6 months ago that didn't look difficult at the time.

- Don't trust management to deploy capital well given recent acquisitions. Ie acquisitions that are too small to make an impact given the cash. If they think the company is so undervalued, why aren't they going hard on the share buy back???

General notes:

- Recent trading shows improved confidence in the equity market division.

- Mangement looking to make earning accretive acquisitions.

- "Shareholder returns through buybacks, dividends and capital returns will remain a key focus for our board"

Positives:

- 80% sale of Morrisons for $40.5m. With final payment made as of 31st August.

- Cash at bank on 31/8/23 of $40m.

- Licensee services revenue growth = 23%

- Direct investments revenue growth = 16%

Negatives:

- NPAT = -$2.6m

- FCF = Basically neutral at approximately $0 (+ or - a few hundred k). However, payables vs receivables decreased $8.7m, so the actual cashflow could be worse?

- Didn't meet the H2FY23 guidance of $6m EBITDA from 1HFY23 results.

- Results were down YoY due to " weaker equity market conditions and non-recurring expenses".

- Outlook is 15% return on management equity by division. So management get to decide if they meet their own expectations??

- Presentation never mentions actual NPAT. Mangement clearly hiding the real result. Every year has non-reoccurring items. Even on this basis comparing to the actual previous year figure this year was worse.

- While the licensees services business has grown in revenue significantly this isn't going through to the EBITDA line.

- Company is "seeking" to deliver 15% ROME. So this is just an aspiration and management haven't met their aspirations before.

- The goalposts have changed. Before it was a revenue target of $300m in 5 years now its ROME of 15%? Was actually $400m at one point.

- Why haven't they been going hard on the buy backs? Surely the board thinks the shares are undervalued at this price. What else are they going to do with $40m?

- Way too much focus on EBITDA. ITD matters and are genuine costs to shareholders. NPATA is a fair measure given the amortization of goodwill, which they use to report on but that seems to have disappeared. Gary Cole has previously mentioned being a Warren Buffett fan, surely, he has heard of "bullshit earnings" then?

Has the thesis been broken?

- Yes, lost my conviction in management and the growth of the business at least over the short term. To many flags. Would be happy to jump back in if results improve but I can't see it being the case. To many broken promises by management. Don't trust them that they can actually put $40m to good use. Will anyone want to deal with them after the Share Cafe issues? They haven't made a large acquisition in a long time, they have all been relatively small, if they are going to make many small acquisitions there is too many moving parts that can go wrong in my opinion.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Management has stated they expect FY24 revenue to exceed FY22.

- What is the quality of the acquisitions that management make.

- When will results improve?

- What are they going to do with the pile of cash?

- Keep watching the growth of licencing services business. This may be the thing you are missing by selling out.

Expectations:

- Sequoia has announced the following expectations yesterday:

- Revenues = $130m

- EBITDA = $5.5m

- "Normalised" EBITDA = $9.0m

- Cash operating profit of around $5m for FY.

- Management previously guided H2FY23 would be better then H2FY22, including H2FY23 EBITDA of $6+ m.

- Results will be announced on 29th August.

Questions to be answered:

- Any update on the sale of Morrisons securities.

- Are the acquisitions working? This business requires acquisitions to grow so is management getting the integration right?

- Had this on watch until the sell of Morrisons was announced which I saw as positive. Need to have another good look at the value and prospects after the results announcement.

- What is the plan for the cash after Morrison's divestment? Will Gary give some the cash back to shareholders? I expect them to keep quite a bit of it for acquisition but I don't want them to keep it all. Will the quality of the acquisitions be lowered due to the need to deploy capital? Any messaging on this front?

Sequoia has announced the divestment of 80% of Morrison Securities. Sequoia will receive $40.5m in cash for the transaction and retain 20% of the business. The Morrison balance sheet will be debt free and have a net working capital of $10.5m at completion. Management believes that Sequoia balance sheet limited Morrison's expansion and the new ownership will allow the business to capitalise on opportunities. There had been several expressions of interest for Morrison Securities. The transaction will be completed in August 2023. If the deal fails to go through Sequoia will receive deposits made by the purchaser.

Overall, I think Sequoia has made a very good deal. Effectively the rest of the business had an EV of near zero based on the pre-halt price. Morrison and SSI represented only around half of EBITDA for FY22. I think the valuation of Morrison appears to be at least 10x EBITDA, it is hard to get exact profit/EBIT figures for just Morison Securities to be able to put multiples on the actual earnings. Sequoia maintaining a stake in case of any future growth is a good aspect of the deal as well. Market liked the announcement initially jumping from 50c to 62c after trading halt but slide back to 55c.

I have updated my valuation to 78c as a sum of the parts. See valuation straw.

Trading update released today was negative overall. Only positive was increase in the dividend. To me again this shows management thinks the business won't grow as much as they had hoped. These issues have mostly already been flagged in previous announcements.

Drop in EBITDA due to the following factors:

- Delay in claims cost repatriation of more than $2m due to professional indemnity insurers not yet recognising a claim.

- Increased adviser servicing costs.

- Integration within the direct investment divisions has been slower than expected.

- Specialist investments business has reduced EBITDA by 500k due to reduced marketing that was previously flagged.

Positives:

- Increase in number of advisors and looking to consolidate AFS licences from 4 to 3.

- Morrison securities performing in line with budget expectations.

- Dividend to increase. Though this shows the business isn't going to grow as management expected from a ROE as a shareholder it is the correct approach unless they can find high ROIC acquisitions.

- Dividend payout ratio to increase from 40% in FY23 to grow towards 70% by 2026. Management says this is due to the need for acquisitional growth flattening. This is a change from the previous approach by management. However, maybe a more realistic expectation of where the business will get to and a better allocation of investor capital for maximum return.

- H1FY23 outlook:

- Revenue looks like it will be significantly down from H1FY22. I didn't expect this. New structured products are a stated reason for the revenue drop, this was at Sequoia's election due to volatility of equity markets and interest rate uncertainty. This is affecting the "Equity Market" division.

- Abnormal item of remediation will affect the H1FY23 result.

- Company now has a $15m loan from ANZ, "on positive terms" which is available for acquisitions only. This is a positive outcome due to the low share price that would have made scrip highly dilutionary which the company is aware of. Management continuing to show they will allocate capital in a very focused and considered way.

- Morrison business continuing to increase market share in FY23.

- CEO states buyback has been slow on purpose to conserve cash for acquisition.

- CEO stated that SEQ is sometimes accused of doing too much. In his view this is wrong as the company's strategy is to provide as many services as possible to financial planners and accountants.

Overall, a negative outlook for the 1HFY23 results. Not so much expected so the company will have to be on watch as a result, do not buy more shares as a result.

General Notes

- Both positive and negative is the revised business plan. I have had a feeling that management was going to have to push through some risky acquisitions to get anywhere near the $400 mil revenue growth target. There has to be a point where there is nothing they can buy at value especially given the size of the industry they are in and the current undervaluation of the shares. Return of capital to shareholders through dividends/buy backs is a much better approach. Previously, management didn’t seem keen on increasing the dividend payout ratio when they could use the cash for acquisition. The new plan objectives by end FY26:

- Revenue = $300 mil. 20% CAGR from FY22.

- EBITDA = $30 mil. 25% CAGR from FY22

- Operating net cash flow pre-tax = $30 mil. 20% CAGR from FY22. (Same margin achieved in FY22)

- Dividend payout ratio increasing from 33% this FY to 70% in FY26.

- My free cash flow for the company = $10.57 mil

Positives

- Revenue up 26.5% to $147.3 mil. Very good result. The higher margin divisions had very strong revenue results, a positive sign for the future.

- EBITDA up 7.3% to $12.4 mil. Within guidance.

- Operating cash flow pre-tax up 36.2% to $14.7 mil.

- Cash balance $14.9 mil (excludes client money).

- Full year dividend per share – 1.4c. Up 40%. Given they haven’t been able to find acquisition

- Management hit guidance/results as expected. Still strong focus on cash earnings not accounting earnings.

- Will continue share buy backs.

Negatives

- The sudden change in strategy to not acquire to grow. However, as stated I believe this target to be more reasonable and requires less risk.

- Accounting returns only up slightly compared to cash and revenue increases. I don't think the market sees through to the underlying cash earnings as well as it does to accounting earnings so a negative in terms of the value of the company being recognised in the short term.

Has the thesis been broken?

- No, while the management plan was downgraded. Those were nice to have targets in my mind. Thesis is based on company being able to maintain it's current results with some growth.

Valuation

- Using 12x the operating cash flow pre-tax but accounting for a 30% tax rate plus cash. Ie using a operating cash flow after tax of $10.3 mil:

- (12 x 10.3) + 14.9 = $138.5 mil

- Valuation per share = $1.02

- 12 times multiple used to account for the likely growth in earnings and balanced by the fact the market is unlikely to highly value this company.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Continued revenue and cash flow growth.

- Over the longer term management needs to execute on their stated strategy.

Today's market update, reaffirming Sequoia's FY22 guidance confirms to me my thesis is on track. The positives/negatives I take out of this announcement and recent acquisitions announced are:

- Management continues to think as capital allocators and strongly in shareholder interests. They are aware of the current low valuation of the company and using this undervaluation to buy-back shares. Management will not continue to issue shares for acquisitions at current prices. It was disappointing they did this for the recent acquisition.

- Recent acquisition of Informed Investor, Sharecafe and Corporate Connect Research gave me a better sense of what SEQ is trying to do within the "Direct" division, initially I didn't really value his division due to the small role it plays comparatively. These acquisitions really boosted the direct division's purpose and value to shareholders in my view.

- Revenue as a minimum will be up 12% YoY. Guided range of 12-26% improvement on FY21. The company is growing as expected.

- EBITDA of $12-13.5m (with top end of this figure expected) and operating cash flow before tax of around 10c per share. This matches my predictions in my original thesis.

- The company continues to print cash and the market is only valuing the cash flows of SEQ at an EV / (FY22 cash flow) of between 5-6 times according to management figure released. I still consider SEQ ridiculously cheap at these levels (16-20% earnings yield on EV/cash flow). Investors are getting the potential growth in the company as a free option at this price and management are showing they are executing as planned.

I currently have a full position in SEQ in my RL portfolio and will likely over the next few months to be looking to move to an oversized position.

Overall Comment:

Very good result for Sequoia. Above management guidance/expectations. Appear to be executing on the growth strategy. SEQ is a high conviction holding that I believe is undervalued by the market. Investors are getting a well-run business with a free option on planned growth at current prices.

General Notes

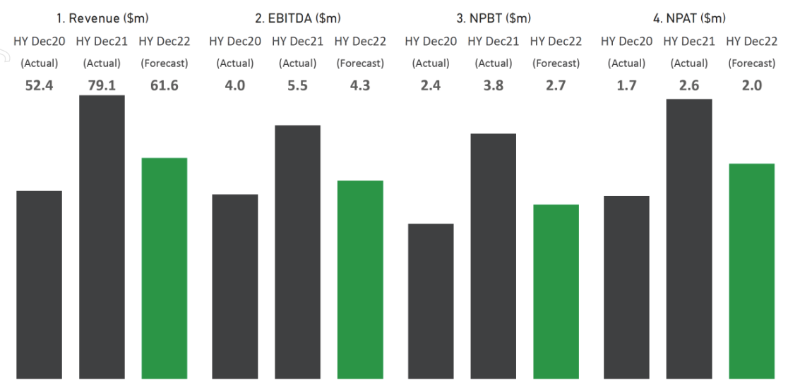

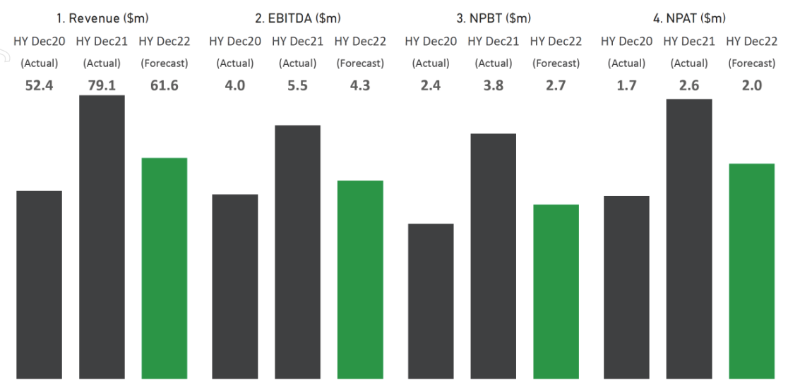

- Key financials for 1HFY22:

- Revenue = $79m, up 50.9% from $52.4m.

- "Operating profit" = $5.5m

- Operating net cash flow (pre-tax) = $5.9m

- NPAT = $2.6m, up 57.4%.

- 0.5c dividend fully franked

- NTA = 10.5c per share

- Net assets = $43.4m

- "FCF" = $3.6m (my calculation)

- Cash at bank = $17.3 m (excludes client cash)

- EPS = 1.9c

- EBITDA margin was down to 7%, however, due to seasonality this is expected to return to the budgeted 8% in 2H.

- On 10/1/22, SEQ purchased Topdocs Legal to enhance the existing document businesses for $330k.

Positives

- Revenue up significantly higher than the management plan of only 15%.

- Morrison securities average monthly number of contract notes up 59% and funds on CHESS up to $4.1bn from $2.8bn. Market volatility is good for Morrison securities through increased trading, given the current environment I expect the great results to continue.

- Equity markets group increased revenue 88% from $21.7m to $40.8m.

- Head office costs flat.

Negatives

- EBITDA of Wealth group was down on 1HFY21.

Has the thesis been broken?

- No, better than expected result. Company is executing well and performing above expectations. As per buying plan, take up a full position.

- Still a new holding but I do have high conviction. After yearly result look into moving to an overweight position.

Valuation

- No change to current valuation. Still undervalued by the market.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Company goal to provide their services to 1000 advisors and 3000 accountants by 2025. Group revenue of $400m by 2025.

- Guidance - EBITDA of 10c per share. Ensure EBITDA margin returns to 8%.

- What is management going to buy with the cash at bank that it is building?

- Consider making SEQ an overweight position after next reporting period?

Overview:

Sequoia Financial Group provides products and services for ASFL holders, accountants and financial advisors. The company is split into four divisions:

- Wealth - Wealth advisor business, providing licensee services to financial advisors.

- Professional Services - Provides back office/admin type services for accountants and financial planners. For example, access to legal documents or SMSF administration on their behalf.

- Equity Markets - ASX clearing for 55 ASFLs. Morrisons is the main business in this segment. Trades for higher values with average orders of around $100k. Ie not for day traders/Selfwealth type clients but professionals and high net worth individuals. Competitors are Openmarkets and Finclear.

- Direct - News type business, seminars and newsletters.

CEO is an ex-financial advisor. Very passionate about non-conflicted advice. Sequoia does not sell any financial products (such as funds) to clients they only provide services to the financial advice industry. SEQ has been growing rapidly in recent years with CEO’s plan to continue this growth through organic means and acquisitions of businesses at 4-7x PE using the cashflows of the business. The four different segments of the business create the ability to cross sell all the different products that SEQ produces.

The value proposition of SEQ is that they are the "picks and shovels" for financial services industry. They provide products that enable financial planners and accountants to be able to provide advice services at a cheaper price or saves them time.

Main Thesis:

- CEO that thinks as a capital allocator, has experience in the field and has high insider ownership of the company. Therefore, strongly aligned with shareholders. The CEO talks about being the tortoise not the hare, compounding returns over time. Management is looking to take the operating cashflows of the business to buy cheap businesses that are earnings accretive to further increase the growth of the business.

- Growth in revenues and profitability appears consistent and likely to continue moving forward.

- The company's share price has good upward momentum (and unchanged during current market ups and downs).

- The diversity of revenue sources and high friction costs of moving to competitors

- Company appears undervalued at current earnings. If SEQ is able to achieve or even make it halfway to the compound growth goals management have set out, there is a high upside potential. The growth doesn't appear to be priced in.

- Sum of all parts of the company, appear undervalued. Morrisons, for example, has competitors that are less profitable but valued higher than what SEQ share price implies.

- Advisors are leaving the big banks and conflicted firms. Independent financial advice after the Royal Commission is the way forward for the industry. SEQ is perfectly positioned for this pivot.

- A company that can be held for a long time as management has a clear path to create long term compounding returns.

General Notes:

- There is normally seasonality to the earnings of the company. There is a tendency that bills are paid near the end of the financial year.

- Management’s goal is to increase revenue to $400 million by the end of FY2024.

- Key goals of board and management:

- While they are in the advice industry, profitability doesn't appear to be clearly linked to funds under management as they are the licensor for advisors. FUM could affect Morrisons business.

- Company reports "Operating Profits"/EBITDA. This is a reasonable figure to see the underlying profitability of the company year to year.

- Wealth division doesn't lock financial planners in with high upfront or exit fees. CEO states they don't want planners that don't want to be with them.

- CEO keen to take questions and hear from shareholders during AGM presentation.

- 15% growth expectation of management doesn't include acquisitions.

- FY22 will be the first year of the family office business, a new segment for the business.

Positives:

- CEO talks about Warren Buffett, obviously a big fan and looks to allocate capital in the same way.

- Strongly cash flow positive. This cash flows facilitates the purchases of business at low PEs (4-7x) which will compound growth into the future.

- Consistent revenue growth over the last 5 years from $23 mil in FY16 to $116 mil in FY21.

- A good likelihood of their being a shortage of advisors in the future due to current change in the industry.

- Advisors that are licenced through SEQ are not conflicted trying to sell products from SEQ.

- Strong ability to cross sell the different products across the different units of the business. For example, the advisors licenced under the wealth division can be sold the services offered by the professional services division.

- Consistent share price momentum since May 20. Steady bottom left to top right movement. The share register is very tight with only 600-700 shareholders.

- CEO owns approximately 9% of the shares of the company. Is very aligned with shareholders and has experience in running businesses (he sold his previous financial advice business).

- CEO has made recent on-market purchases.

- Company appears to have hit a point of operating leverage with increasing revenues resulting in larger increases in profitability.

- Net cash position. However, can't use all cash and cash equivalents to calculate enterprise value as a large portion of the funds are client’s funds not for company use. Additionally, company must have $7.5 mil available, a requirement for the Morrisons business.

- Company report states non-cash return on equity for all divisions was above objective of 15% in FY21.

- Stock on HIN (Equities division) in FY21 went from $1.5 billion to $4 billion.

- While revenues and profitability increased strongly over the past year head office costs are flat.

Negatives/Risks:

- Key man risk with CEO. Seems to be the driving force. However, high ownership lowers this risk.

- As the company continues to buy businesses it becomes too bloated with all these consolidated small companies. What may have worked as a small company might not work well in a large group. Need to monitor how integration works.

- Low liquidity. Average around $15K a day and a low number of transactions. Shareholders around 600-700.

- Financial planner numbers under the Sequoia licence don't increase. There is currently an exodus in the industry of planners (generally conflicted planners).

- This is a low gross margin business. Though improving with increasing revenues.

Valuation Metrics:

For valuation see valuation straw.

- Can’t use basic cash figure for EV calculations. Need to take out client cash that can’t be used by the business.

- Operating EBITDA is very similar to operating cash flow.

- Info for ratios using FY21 figures:

- Share price = 68c

- Market cap = $89.89 mil

- Cash = $13.3 mil (not counting client cash)

- EV = 89.89-13.3 = 76.59

- "Operating profit" / EBITDA = $11.5 mil

- NPAT = $5.55 M

- EBIT = $8.1 M

- Operating Cash flow = $15.5 M

- Equity = $41.1 M

- Ratios:

- PE = 89.89/5.55 = 16.2

- EV/E = 76.59/5.55 = 13.8

- EV/EBIT = 76.59/8.1 = 9.5

- EV/FCF = 76.59/15.5 = 4.9

- EV/EBITDA = 76.59/11.5 = 6.66

- ROE = 5.55/41.1 = 13.5%

- ROE (non-cash company measure) = 5.55/27.8 = 19.96%

- NTA per share = 10.4c

- P/B = 89.89/41.1 = 2.2

How I expect this will play out:

- SEQ will keep growing at a minimum of 15% with greater growth to come from acquisitions or outperformance of expectations.

- With the stable growth trajectory and great capital allocation focus of the CEO, I will be looking at SEQ as a long-term holding stock due to the potential for compounding returns.

- How profits will increase in the future:

- Acquisitions that are made using the cash flows off the business.

- More financial planners use Sequoia as licensees.

- Greater trading volumes for Morrisons.

- General move by consumers towards non-conflicted advice.

- Increase the number of docs they create through their professional services division.

When to get out:

- Management heavily reduces the revenue/profit expectations.

- Revenue or profit growth stops.

- CEO selling sizeable portion of shares.

- High valuation ($2+) = trim.

Post a valuation or endorse another member's valuation.