Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Per the Australian.

Shield Master Fund investors unknowingly played a key role in ensuring Sequoia Financial’s $40.5m sale of Morrison Securities succeeded after they were put into the stricken Shield fund by advisers linked to Sequoia through its subsidiary, InterPrac.

The Shield fund’s responsible entity handed $15m to Morrison buyer New Quantum as a loan in mid-2023, three months after New Quantum agreed to buy 80 per cent of the securities business.

This loan was crucial to keeping the Morrison deal alive, coming shortly before the August 31 deadline for the purchaser to make its final $15m payment to ASX-listed Sequoia.

..........

Sequoia’s links to advisers and funds

Many of Shield’s investors had their superannuation savings put into the fund by InterPrac-authorised representatives of advisers Venture Egg and Reilly Financial. Sequoia is InterPrac’s parent company and Sequoia’s CEO Garry Crole is also the managing director of InterPrac.

The Shield fund, structured as a managed investment scheme, only started taking investor money in early 2022 but by September 2023 it had $446m in super savings. By the time the corporate regulator halted investment into the fund in early 2024, 5800 investors had $480m of retirement savings tied up and impossible to access.

Shield collapsed last year and liquidators are currently working through how much money can be returned to investors who fear their wealth has been lost.

ASIC is investigating whether the fund and its directors misled investors and mismanaged funds.

ASIC is also investigating InterPrac and advice firms Venture Egg and Reilly Financial as part of its broader probe into Shield and another stricken fund, the First Guardian Master Fund.

InterPrac-licensed Venture Egg was run by Ferras Merhi, who is also under investigation by ASIC.

James Hird, Garry Crole and Merhi Ferras, centre.

Mr Merhi ran two advice shops, the aforementioned Venture Egg and Financial Services Group Australia (FSGA). FSGA is now in liquidation, and InterPrac cut ties with Venture Egg in May this year.

Between the two advice firms, Mr Merhi and his teams put more than 6000 of the 12000 affected investors into Shield and First Guardian, The Australian understands.

Both Shield and First Guardian were marketed as diversified portfolios that were delivering higher returns than those available in industry super funds.

Their rapid accumulation of client money was in large part due to lead generators that would cold call prospective investors and use aggressive tactics to link them up with advisers, sometimes in a three-way call.

An investigation by The Australian found that in some cases, Venture Egg financial advisers tipped clients into the Shield and First Guardian funds without their knowledge, listing one set of investments on statements of advice before switching investor money into others. Those other strategies were the two funds First Guardian and Shield, and a third fund, Euree Asset Management, run by former footballer James Hird.

As well as owning InterPrac, ASX-listed Sequoia has a 20 per cent stake in Euree, which counts InterPrac’s Mr Crole as a director and Mr Hird as its managing director. Euree has said it is a top performing fund and all redemption requests were being honoured. The Australian is not suggesting any wrongdoing by Euree.

Venture Egg’s Mr Merhi has previously outlined to The Australian how he operated a negative consent model, meaning if clients didn’t reply to investment change requests they were assumed to give consent.

“Basically, if you’ve emailed and you’ve given a significant amount of time for the client to respond, and then the client doesn’t respond, then consent by acquiescence,” Mr Merhi explained.

The Australian has spoken to a number of advisers who dispute the legitmacy of negative consent.

InterPrac previously told The Australian it ordered advisers to stop putting client superannuation money into Shield and First Guardian in mid-2023 “once unusual volumes were observed”.

But it did not inform ASIC at the time, it said, because “there was no evidence of any inappropriate management of the said funds”. It took the hold off First Guardian in September of that year meaning new capital could be accepted.

The Australian has seen evidence suggesting Venture Egg clients had savings moved into both funds during the lockout period, which came after Sequoia had agreed to sell Morrison to New Quantum, but before the transaction had completed. The Australian is not suggesting InterPrac or Sequoia knew the source of New Quantum’s funds at the time.

As a licensee, Interprac would have clipped the ticket on advice given to clients by Venture Egg and Reilly Financial advisers, typically between 5 and 10 per cent of the client fee.

A spokesman for Sequoia said the firm “takes its corporate responsibilities seriously and does not comment on speculation. The company believes that the questions infer factually incorrect and misleading claims”.

More issues at SEQ - FAAA questions missing million from Libertas - Professional Planner

$50M Market Cap, $16M Cash, $5M in investments.

$8.6M in operating profit - including equity accounted investments.

Ongoing gross Divi yield (excl. special) of about 16%.

So many warts but so cheap.

Get your deckchair & popcorn to watch the action over at SEQ.

A 249D action likely to get up, but not without an ugly stoush, with ASIC now involved.

Chair resigning to the back benches, then resigning totally. Key staff frog marched out of the office.This one has got it all.

A likeable, but highly promotional CEO (that's code for big promises & vision, though shallow to low execution) to get rolled by good old shareholder apathy. When you only need 50.1% of voters, a highly organized shareholder group can succeed. Goodness knows what they are going to do about filling the CEO role.

Got to be spooking all their licensees and advisers. Have been a holder in the past - happy to watch the firecrackers go off. SP likely to fall.

News of a loosening of laws relating to financial advice.

This will allow banks, and super funds to offer financial advice.

Garry Crole bought ~ $31k shares on-market.

Overview Comment:

Selling out of position as I have lost conviction for Sequoia to execute well over the short term and potentially longer, will be happy to jump back in if I see the core business continue to improve from the current downturn but I cant convince myself this is the case. Summary of my issues:

- I think these markets are somewhat subdue but more normalised than COVID times so to act like this is a one-off bad year I'm not sure that is correct.

- Management has continually moved the goalpost on longer term targets. How will they seriously hit $300m revenue in FY26 when they have divested Morrison's securities and had revenue go backwards this year? Now the goal is their own management determined numbers...

- Too much focus on EBITDA and no mention of actual results in presentations. Feels like management is not acknowledging the real result and real profitability.

- Couldn't meet guidance set 6 months ago that didn't look difficult at the time.

- Don't trust management to deploy capital well given recent acquisitions. Ie acquisitions that are too small to make an impact given the cash. If they think the company is so undervalued, why aren't they going hard on the share buy back???

General notes:

- Recent trading shows improved confidence in the equity market division.

- Mangement looking to make earning accretive acquisitions.

- "Shareholder returns through buybacks, dividends and capital returns will remain a key focus for our board"

Positives:

- 80% sale of Morrisons for $40.5m. With final payment made as of 31st August.

- Cash at bank on 31/8/23 of $40m.

- Licensee services revenue growth = 23%

- Direct investments revenue growth = 16%

Negatives:

- NPAT = -$2.6m

- FCF = Basically neutral at approximately $0 (+ or - a few hundred k). However, payables vs receivables decreased $8.7m, so the actual cashflow could be worse?

- Didn't meet the H2FY23 guidance of $6m EBITDA from 1HFY23 results.

- Results were down YoY due to " weaker equity market conditions and non-recurring expenses".

- Outlook is 15% return on management equity by division. So management get to decide if they meet their own expectations??

- Presentation never mentions actual NPAT. Mangement clearly hiding the real result. Every year has non-reoccurring items. Even on this basis comparing to the actual previous year figure this year was worse.

- While the licensees services business has grown in revenue significantly this isn't going through to the EBITDA line.

- Company is "seeking" to deliver 15% ROME. So this is just an aspiration and management haven't met their aspirations before.

- The goalposts have changed. Before it was a revenue target of $300m in 5 years now its ROME of 15%? Was actually $400m at one point.

- Why haven't they been going hard on the buy backs? Surely the board thinks the shares are undervalued at this price. What else are they going to do with $40m?

- Way too much focus on EBITDA. ITD matters and are genuine costs to shareholders. NPATA is a fair measure given the amortization of goodwill, which they use to report on but that seems to have disappeared. Gary Cole has previously mentioned being a Warren Buffett fan, surely, he has heard of "bullshit earnings" then?

Has the thesis been broken?

- Yes, lost my conviction in management and the growth of the business at least over the short term. To many flags. Would be happy to jump back in if results improve but I can't see it being the case. To many broken promises by management. Don't trust them that they can actually put $40m to good use. Will anyone want to deal with them after the Share Cafe issues? They haven't made a large acquisition in a long time, they have all been relatively small, if they are going to make many small acquisitions there is too many moving parts that can go wrong in my opinion.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Management has stated they expect FY24 revenue to exceed FY22.

- What is the quality of the acquisitions that management make.

- When will results improve?

- What are they going to do with the pile of cash?

- Keep watching the growth of licencing services business. This may be the thing you are missing by selling out.

I don't know that this creates opportunity. SEQ was a large holding of mine and I have done exceptionally well out of it yet I have to say I am totally disappointed in it as well. I like GC and in fact I would call him a friend - I am no longer sure he calls me one. I have mostly sold out a few lying around but not material at all. Our experience was great and yet bad. Each has to make their own decisions, but over the period of our investment we felt that GC was over optimistic and that each year the presentation looked different. In one aspect GC was right and we were wrong and that was Morrisons - we could not see how this fitted into a (well what is SEQ - A wealth management business, a financial planning business or a technology business or a legal compliance business) Certainly in our opinion it wasn't a financial reporting business and we hated FNN and then GC went and bought Share Cafe etc.

I suppose this became the overwhelming feeling we had - That GC would put anything into it as there was no real planned business model. I don't think we blamed him it seems to be a mantra of most financial planning and advisor businesses at this moment. After the Royal Commission and the exit of banks and the older planners retiring the industry doesn't seem to know how it will unfold. I really thought that GC had the vision. So at first it was advisor numbers. Then it was compliance companies , including a training company and a family office etc. Right now I have no idea what to measure.

The other noise we suffered was a substantial shareholder arriving on a cheap entry after Sargon imploded and then the slow bleed of that stock into the market.

The best and biggest thing to happen here was for someone to come and offer what in my opinion is a huge price for Morrisons and after asking around I get the understanding that it is as much the technology and systems that Morrisons have as the brokerage firm. GC sold 80% of this for double my entire valuation of it. It is at a low because Brokers are doing it a lot tougher at the moment. so valuations should be lower.

My view is that as I understood it we were supposed to get or buy more advisor firms to become 800 planners we did not do that. There was and still is a logical move for CAF, DVR and WTL to look at how they can merge or even CUP. My view is that there are too many CEO's and not enough shareholders driving this right now so no-one seems to see that size does count.

So you are now left with GC and co and a lot of money. Do they spend it wisely. Based upon past performance we decided not to take that risk. Without the Morrisons deal there would have been a lot of blood on the street...

Add to that that the Share Cafe deal has not worked as I see it

One of the most unusual statutory presentations of FY23 results by SEQ, and one which has being unappreciated by analysts.

For starters, the company elected to display the Morrison results on one line - basically as net profits from disposed of division’.

so when you read the actuals presented by Refinifiv and others, it totally distorts a number of key indicators - such as rev, EBITDA increases or decreases etc.

Yes, Garry Croll covered these in his presentations and videos, along with a string of adjustments to get ‘normalised’ results (which I hate, particularly since this now appears to be an annual inclusion).

The results were lousy - we were prepared for that - and the future looks much brighter - but go back one year and GC was similarly optimistic. I like GC, I do, but he is now on watch to ensure the FY24 actuals back up the vision.

I do like his quirky invention of ROME - Return on Managements Estimates (of the value of the sum of the parts). Currently he sees the sum of the parts adding up to $135m against a market cap of around $70m

i did stump up and buy more in RL because of the value of the grossed up special dividend and the cash warchest following Morrison completion and his mentioning strong performances in the final months of FY23 and continuing into July and August. Plus increasing your pool of financial advisors by 5% when the industry lost 35% says they must be regarded highly..

But, I will be watching their approach to deploying the cash.

Expectations:

- Sequoia has announced the following expectations yesterday:

- Revenues = $130m

- EBITDA = $5.5m

- "Normalised" EBITDA = $9.0m

- Cash operating profit of around $5m for FY.

- Management previously guided H2FY23 would be better then H2FY22, including H2FY23 EBITDA of $6+ m.

- Results will be announced on 29th August.

Questions to be answered:

- Any update on the sale of Morrisons securities.

- Are the acquisitions working? This business requires acquisitions to grow so is management getting the integration right?

- Had this on watch until the sell of Morrisons was announced which I saw as positive. Need to have another good look at the value and prospects after the results announcement.

- What is the plan for the cash after Morrison's divestment? Will Gary give some the cash back to shareholders? I expect them to keep quite a bit of it for acquisition but I don't want them to keep it all. Will the quality of the acquisitions be lowered due to the need to deploy capital? Any messaging on this front?

next instalment fee for the Morrisons business due tomorrow by NQ. $15m transfer where SEQ will transfer 50.1% of the shares in Morrisons across to NQ. The market on higher-than-normal volume is selling down. There have been suggestions along the way that NQ would not have available funds do this acquisition of Morrisons. Will be interesting to see how this goes.

Disc - held IRL and SM

March 23

Conservative new valuation using sum of the parts after Morrison Securities divestment and accounting for a more negative outlook:

- Morrison securities = $50m

- Cash = $5m

- Rest of the business = 8 x cash operating profit of $5m (guess - roughly half of FY22) = $40m

- Total value = $95m

- Valuation per share = 72c

September 22

Using 12x the operating cash flow pre-tax but accounting for a 30% tax rate plus cash. Ie using a operating cash flow after tax of $10.3 mil:

- (12 x 10.3) + 14.9 = $138.5 mil

- Valuation per share = $1.02

12 times multiple used to account for the likely growth in earnings and balanced by the fact the market is unlikely to highly value this company.

interview with Gary about the Morrison deal. Key points were that it’s a win win for them regardless the outcome of the deal. They also hold 20% and Gary seems to think that the Morrison business with some proper funding can grow massively and they will be rewarded in the future if this occurs.

Also right at the end Gary (who I swear says way to much in interviews and gets stung when things don’t go to fruition) mentions they will be able to bypass the dividend strategy that was expected to grow to 70% over coming years and they will likely payout 100% if the deal goes through.

pretty impressive deal if they get paid.

disc held IRL and SM

Sequoia has announced the divestment of 80% of Morrison Securities. Sequoia will receive $40.5m in cash for the transaction and retain 20% of the business. The Morrison balance sheet will be debt free and have a net working capital of $10.5m at completion. Management believes that Sequoia balance sheet limited Morrison's expansion and the new ownership will allow the business to capitalise on opportunities. There had been several expressions of interest for Morrison Securities. The transaction will be completed in August 2023. If the deal fails to go through Sequoia will receive deposits made by the purchaser.

Overall, I think Sequoia has made a very good deal. Effectively the rest of the business had an EV of near zero based on the pre-halt price. Morrison and SSI represented only around half of EBITDA for FY22. I think the valuation of Morrison appears to be at least 10x EBITDA, it is hard to get exact profit/EBIT figures for just Morison Securities to be able to put multiples on the actual earnings. Sequoia maintaining a stake in case of any future growth is a good aspect of the deal as well. Market liked the announcement initially jumping from 50c to 62c after trading halt but slide back to 55c.

I have updated my valuation to 78c as a sum of the parts. See valuation straw.

Turned out the rumours were true. The company is divesting 80% of its Morrisons stake for $40m, and leaving $10.5m of working capital in the business. It looks like a good deal overall.

Morrison partial divestment. Assuming it all goes ahead.

I have adjusted revenue target, post Morrisons, for FY 2026 to $180M. They have ambitions above this number, but continually miss objectives. Sequoia Financial Group's vision is to be the premier non-aligned financial services licensee advice business in Australia. Sequoia consists of 4 divisions: Wealth Division, Equity Markets Division, Direct Investment Division, and Professional Services Division. Sequoia has had a chequered past, and experienced some growing pains in 2019, when their roll-up strategy unravelled, and their CEO departed. The present CEO has remained in place since that period, with the internal changes and cost cutting in FY2020 steadying the ship so to speak. Sequoia comprises somewhat of a roll-up business model, however, it is demonstrating some strong organic growth. Notably: 1) Morrison Securities (Equity Markets) has grown revenue 98% over the past 12 months - now being divested., 2) Licensee Services Division growing revenue at around 10% over the previous corresponding period. A slowdown, but exepcted in the current market. Sequoia have identified the following tailwinds for the business: a) Increased demand for independent financial advice. b) Banks exiting their vertically integrated businesses (selling off their adviser businesses). Long term objectives flagged: 1) Increase group revenue "towards" $300 M by end of FY 2026. 2) Increase licensees to 640 from current 355 by 2026. This is a downward revision from FY 2022. OK, in the SEQ's revenue growth rate has been 13% pa over the past 3 years. Management is aiming to grow revenue 38% per annum into FY 2025. I don't believe it is possible without wild, risky acquisitions. I think they can grow revenue at 10-20% pa, and there is evidence of organic growth in the businesses. Assuming they can achieve $180 M revenue, @ 4.0% NPAT margin, 10% pa growth in share count, I come up with an EPS of 7.1 cents per share. Given the quality of the business (roll up & key personnel risks), I have applied a discount rate of 16%, and a PER ratio of 15. DISC - I HOLD

Wealth management software business New Quantum is understood to have lobbed a bid for ASX-listed peer Sequoia Financial’s equities clearing business Morrison Securities.

Street Talk understands New Quantum – which burst into dealmaking spotlight last year with a bid for Openmarkets – is in talks to acquire the Sequoia unit which sells white-labelled clearing and stockbroking solutions to third-party institutional and adviser networks.

Sequoia requested a trading halt on Tuesday morning, saying it was in the final stages of negotiating a partial divestment of a subsidiary.

New Quantum’s interest comes after Morrison Securities’ revenues fell 7 per cent in the December half to $14 million amid a lull in trading volumes. It made $4.4 million gross profit.

Morrison pulled in 23 per cent of Sequoia’s $61 million group revenue for the half.

Updated: Mar 7, 2023 – 5.15pm. Data is 20 mins delayed.

It’s one of the business’s four units divisions: direct investment division, professional services, licensees services division and equity markets division. Sequoia had a $69.6 million market capitalisation.

Interestingly, New Quantum’s tilt at Openmarkets in 2022 was said to have failed amid concerns around the acquirer’s funding capability.

SEQ is in a trading halt pending an announcement of a partial divestiture.

The murmurs are it is Morrisons. We'll just have to wait and see.

SEQ came out with their 1HFY23 Investor presentation after market close.

The summary is weak top line growth, salved in part by improving margins. The "abnormal" items (flagged previously) however resulted in a weak NPAT result of only $600k for the half. The market, in its infinite wisdom, was already anticipating numbers like this with the shares hurtling towards their 52w lows.

Management is forecasting a much improved second half, so it comes down to how much trust the market places in that prognostication. Given the recent track record though, some jitters won't be surprising in the least.

Overall, this is a thesis-weakening result, though not a thesis-busting one.

Trading update released today was negative overall. Only positive was increase in the dividend. To me again this shows management thinks the business won't grow as much as they had hoped. These issues have mostly already been flagged in previous announcements.

Drop in EBITDA due to the following factors:

- Delay in claims cost repatriation of more than $2m due to professional indemnity insurers not yet recognising a claim.

- Increased adviser servicing costs.

- Integration within the direct investment divisions has been slower than expected.

- Specialist investments business has reduced EBITDA by 500k due to reduced marketing that was previously flagged.

Positives:

- Increase in number of advisors and looking to consolidate AFS licences from 4 to 3.

- Morrison securities performing in line with budget expectations.

- Dividend to increase. Though this shows the business isn't going to grow as management expected from a ROE as a shareholder it is the correct approach unless they can find high ROIC acquisitions.

Earnings downgrade - CAS10211831 3477-6340-2528 (markitdigital.com)

Some of the factors had already been flagged in recent months but still tough when they're trying to build market confidence.

A raise to the upcoming dividend is the sole consolation at the moment reflecting Mangement's confidence in the future.

- Dividend payout ratio to increase from 40% in FY23 to grow towards 70% by 2026. Management says this is due to the need for acquisitional growth flattening. This is a change from the previous approach by management. However, maybe a more realistic expectation of where the business will get to and a better allocation of investor capital for maximum return.

- H1FY23 outlook:

- Revenue looks like it will be significantly down from H1FY22. I didn't expect this. New structured products are a stated reason for the revenue drop, this was at Sequoia's election due to volatility of equity markets and interest rate uncertainty. This is affecting the "Equity Market" division.

- Abnormal item of remediation will affect the H1FY23 result.

- Company now has a $15m loan from ANZ, "on positive terms" which is available for acquisitions only. This is a positive outcome due to the low share price that would have made scrip highly dilutionary which the company is aware of. Management continuing to show they will allocate capital in a very focused and considered way.

- Morrison business continuing to increase market share in FY23.

- CEO states buyback has been slow on purpose to conserve cash for acquisition.

- CEO stated that SEQ is sometimes accused of doing too much. In his view this is wrong as the company's strategy is to provide as many services as possible to financial planners and accountants.

Overall, a negative outlook for the 1HFY23 results. Not so much expected so the company will have to be on watch as a result, do not buy more shares as a result.

Interesting takeaways:

Key view still see themselves as undervalued, 59% owned by insiders so difficult for any outsider to takeover.

Open to selling part of the business to realise sum of the parts valuation - subject to price.

Didn't answer my question on the buyback on why it isn't more aggressive though.

Interesting re ASX dropping blockchain replacement to CHESS.

Morrisons (SEQ) I believe invested to prepare so hopefully can get a rebate as indicated below:

Per AFR

ASX is considering providing rebates to customers who have invested in building the replacement CHESS project.

ASX managing director Helen Lofthouse again apologised for the disruption, saying that the company is cognisant of the work customers have done on the project.

“One of the approaches you’ve seen us use when there are issues for our customers is we absolutely have gone through rebate processes from time to time to address customer issues.

“That’s certainly an approach that we’ve used in the past in this kind of situation.”

Looks like Acorn Capital is building up their position and probably who is driving the recent uptick in traded volume.

Not sure which vehicle but their listed LIC has an interesting mix of stocks, I dont know too much about them. Look to have okay performance longer term but not outstanding. Latest fund updates don't have anything on SEQ so maybe next quarter.

This has to be the most frustrating buyback, they start buying back at $0.57 but the share price falls a further 10% and they stop buying back shares despite using less than 7% of the facility. Do they see value in their own shares or not?

We may have seen the worst of the industry exits with growth last week for the first time in a while:

Key Adviser Movements This Week:

- Net Change of advisers +9

- 35 Licensee Owners had net gains for 44 advisers

- 31 Licensee Owners had net losses for (-38) advisers

- 2 new licensees commenced and (-2) ceased

- 11 Provisional Advisers (PA) commenced and none ceased.

Pleasingly SEQ also saw growth -

"A good number of licensee owners (35) did manage net growth this week. Sequoia via Interprac gained the most at 5 with six appointment and one loss. Two of the advisers came from Nextplan and two from a now closed licensee. Castleguard via its licensee Lifespan was up net 3, which included picking up two advisers from AMP.

Three licensee owners were up plus 2, these being Fortnum which included one PA, Findex and a new licensee with advisers moving away from Crown Wealth. A long tail of 30 licensee owners up net 1 including Chris Brycki of Stockspot fame, and Shartru gaining an adviser from FYG Planners."

Reporting on the struggles of the financial advice industry - The profit struggles of financial advice licensees laid bare - Financial Newswire. I know for a fact that many publicly listed companies are trading at lower than private market multiples making the typical rollup strategy untenable.

General Notes

- Both positive and negative is the revised business plan. I have had a feeling that management was going to have to push through some risky acquisitions to get anywhere near the $400 mil revenue growth target. There has to be a point where there is nothing they can buy at value especially given the size of the industry they are in and the current undervaluation of the shares. Return of capital to shareholders through dividends/buy backs is a much better approach. Previously, management didn’t seem keen on increasing the dividend payout ratio when they could use the cash for acquisition. The new plan objectives by end FY26:

- Revenue = $300 mil. 20% CAGR from FY22.

- EBITDA = $30 mil. 25% CAGR from FY22

- Operating net cash flow pre-tax = $30 mil. 20% CAGR from FY22. (Same margin achieved in FY22)

- Dividend payout ratio increasing from 33% this FY to 70% in FY26.

- My free cash flow for the company = $10.57 mil

Positives

- Revenue up 26.5% to $147.3 mil. Very good result. The higher margin divisions had very strong revenue results, a positive sign for the future.

- EBITDA up 7.3% to $12.4 mil. Within guidance.

- Operating cash flow pre-tax up 36.2% to $14.7 mil.

- Cash balance $14.9 mil (excludes client money).

- Full year dividend per share – 1.4c. Up 40%. Given they haven’t been able to find acquisition

- Management hit guidance/results as expected. Still strong focus on cash earnings not accounting earnings.

- Will continue share buy backs.

Negatives

- The sudden change in strategy to not acquire to grow. However, as stated I believe this target to be more reasonable and requires less risk.

- Accounting returns only up slightly compared to cash and revenue increases. I don't think the market sees through to the underlying cash earnings as well as it does to accounting earnings so a negative in terms of the value of the company being recognised in the short term.

Has the thesis been broken?

- No, while the management plan was downgraded. Those were nice to have targets in my mind. Thesis is based on company being able to maintain it's current results with some growth.

Valuation

- Using 12x the operating cash flow pre-tax but accounting for a 30% tax rate plus cash. Ie using a operating cash flow after tax of $10.3 mil:

- (12 x 10.3) + 14.9 = $138.5 mil

- Valuation per share = $1.02

- 12 times multiple used to account for the likely growth in earnings and balanced by the fact the market is unlikely to highly value this company.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Continued revenue and cash flow growth.

- Over the longer term management needs to execute on their stated strategy.

SEQ announced FY22 results today

mixed bag really and I think the market certainly was unsure at first as I was.

Highlights included

- Total revenue beat expectations at 147.3m 26.6% increase

- EBITDA of 12.4M (7.3% increase) within guidance but lower end.

- NPAT of $5.7m 3% increase YoY

- increased dividend payout total year payout of 1.4c

- EPS 4.23c

As I suggested above when I first saw the result I was really disappointed, as was the market. Sure SEQ beat revenue but I thought given historic information that EBIDTA would have been the top end of guidance or even beat it. Some large investments within the company were made to upgrade technology and service uplift.

The other notable inclusion that really surprised me was the longer term revenue target for FY26 which was reduced from 400m to 300m. At first it was a concern however quite quickly I took this more of a realistic and achievable task that would reduce risk. To make the 400m SEQ would most likely have to make some really risky acquisitions and it was always a bit of a worry for me. I feel now the 300m will reduce that risk and still maintains a good growth trajectory. Gary (CEO who is a large part of my thesis) suggested that given the current share price he does not believe it is a good idea to acquire other businesses on higher multiples that would include Shares and therefore has reduced his longer term outlook as some acquisitions that may have been in eye are now not worth the expense. I am content with this outcome

projections include

- 20%CAGR in revenue to FY26

- 25% CAGR in EBITDA to FY26

- 20% CAGR in operating net cash flow pre-tax

- increasing the dividend payout ratio to 10% each year to 70% in FY26.

Overall we saw growth in all 4 segments. I am not going to go over each segment but the investor webiner went through the longer term growth outlook and expectations moving forward and I am very comfortable to continue to hold. Key focus is on improving margins of the licence service division and equity market division to 10+%. Gary is. conservative and bascially suggested he would hope to see % margins in these sectors much higher in future.

I think a lot of the acqusitions moving forward will be within the professional service division and direct investment division where margins are 26.4% and 37.8% albeit on lower total revenue. So certainly some work can be done here to expand. Professional Service division grew 55.8% to $11m from FY21 and are hoping for margins closer to 30%.Direct Investment division the expectation is thatrevenue will move to $15mil ($2.6FY22) by FY2026 with gross margins currently at 37.8%, so this is quite attractive growth.

I like listening to Gary speak, he is always comparing the business to "the tortoise not the hare" suggesting we are going to grow at a slow but good rate and get it right. He is very conservative and has mentioned that advisory is his absolute passion and what he was put on the earth to do. The passion is evident. He owns a good number of shares and is aligned to shareholders.

Lastly the Share Buy-back was put on hold because results were out so no buy-backs have been occuring now for some weeks. Gary did say he plans on commencing this straight away and given he sees the share price as cheap, I suspect that some buying will be back on the cards. This will at least hold the SP where we are at a minimum so I am content to continue to hold.

DISC- hekd IRL and SM

This is not a company that I thought I'd like. It's given us every reason not to. Poxy prior results, low (often no) margins, bitsy, complicated financial statements and with 30 businesses under the hood there's a lot to get your head around. But actually this is an interesting turnaround story that still has a long way to play out and is only partially reflected in the improved share price. If this business does only half of what management are targeting it will be a multibagger.

The catalyst for the turn around in this company I attribute to the appointment of a new CEO three years ago and has been reflected in improved financials for the past two years.

Without going into the details of what all 30 businesses under the Sequoia banner do essentially the business is focused on providing offerings to the financial services industry (Financial Planners/Analysts etc.). It is split into four divisions – Wealth, Professional Services, Equity Markets and Direct Investment. It's worth calling out one of the businesses separately which is Morrison Securities under the Equity Markets division. I’ll come back this.

What I like:

- Financial trajectory. Of course this is only good for as long as it lasts put all metrics appear to be heading in the right direction. Revenue was up 38% in FY21 vs pcp and 51% in FY22 HY vs pcp. Margins are growing and the business is consistently profitable.

- The CEO. In company presentations the CEO is very clear about what the company is (and isn’t) and targets that they should be measured against. He likes to quote Warren Buffett, for which he gets an immediate tick. He owns approximately 10% of the business and was buying recently at the current share price. Here is a link to a Sharecafe presentation he did (from 19 minutes) - Note the way he speaks to the disclaimer slide. Overall he gives the impression that he is working in the interest of shareholders.

- Morrison Securities. This is an ASX Clearing House similar to Open Markets or Finclear. The CEO states it’s of a similar size to Open Markets, more profitable and growing as fast. Last year Open Markets did a pre-IPO roadshow and was proposing to list at an implied value of $160.8 million. The market cap of the entire of Sequoia is approximately $79 million, which suggests that the market values the whole as a lot less than the sum of its parts.

- Cash. At the half year they disclosed cash approaching $36m, half of this is client funds (not a bad model in a rising interest rate environment) and they are also mandated to keep a buffer for the Morrisons business. However this still leaves a warchest to go out and acquire more businesses.

Not so much:

- The CEO. If he leaves chances are so will I.

- Margins. A 10% margin is OK but doesn't leave a lot of margin for error if things go balls up.

- Acquisitions. Great when they work not so much when they don't.

- Predictability. At the AGM in mid November they forecast half year revenue to be $63m. Six weeks later they actually delivered $79 million. I like management who under promise and over deliver but that's a big variance. So much so it's either borderline incompetent or a very difficult business to forecast, maybe in either direction. Something to watch out for in the future.

What it boils down to:

Let's say they missed their FY25 target of $400m and instead deliver $300m. Let's say they achieve their EBITDA margin target of 10% because of scale benefits and because they actually did better than that in the second half of FY21. Let’s say that EBITDA is a proxy for free cash flow. What would you pay for a business that is growing quickly and delivering $30m free cash flow. I would say as an absolute minimum you'd pay 12 times. Ignoring dilution (let’s say its minimal) that implies a market cap of $360 million and a share price approaching $3. I’d take that.

Great write ups by @Dominator @LifeCapital and @Rapstar on the companies page.

[Held]

Today's market update, reaffirming Sequoia's FY22 guidance confirms to me my thesis is on track. The positives/negatives I take out of this announcement and recent acquisitions announced are:

- Management continues to think as capital allocators and strongly in shareholder interests. They are aware of the current low valuation of the company and using this undervaluation to buy-back shares. Management will not continue to issue shares for acquisitions at current prices. It was disappointing they did this for the recent acquisition.

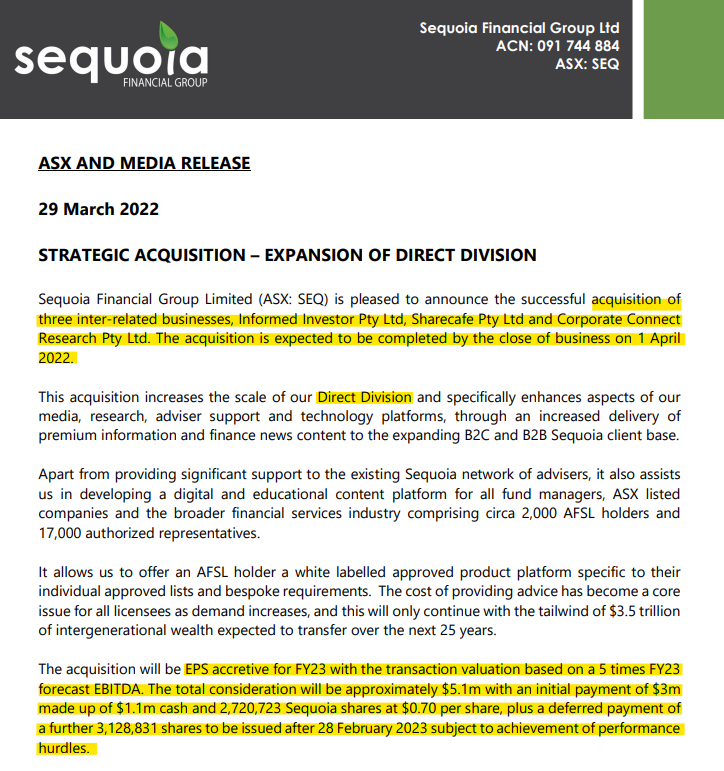

- Recent acquisition of Informed Investor, Sharecafe and Corporate Connect Research gave me a better sense of what SEQ is trying to do within the "Direct" division, initially I didn't really value his division due to the small role it plays comparatively. These acquisitions really boosted the direct division's purpose and value to shareholders in my view.

- Revenue as a minimum will be up 12% YoY. Guided range of 12-26% improvement on FY21. The company is growing as expected.

- EBITDA of $12-13.5m (with top end of this figure expected) and operating cash flow before tax of around 10c per share. This matches my predictions in my original thesis.

- The company continues to print cash and the market is only valuing the cash flows of SEQ at an EV / (FY22 cash flow) of between 5-6 times according to management figure released. I still consider SEQ ridiculously cheap at these levels (16-20% earnings yield on EV/cash flow). Investors are getting the potential growth in the company as a free option at this price and management are showing they are executing as planned.

I currently have a full position in SEQ in my RL portfolio and will likely over the next few months to be looking to move to an oversized position.

I think this acquisition (March 29) by SEQ is strategically very smart. Effectively, it buys a large base of individual investors via Share Café and it will marry them with its full suite of products and advisor network. The ‘lifetime value’ of these customers can be massive with so many products/services to cross sell.

Plus, I like the thought of working all sides of the investment ‘carcass’. That is, providing advice to investors whilst moving them into the SEQ ‘revenue chain’ at a low cost of acquisition, services to advisors, and marketing and awareness strategies to listed entities. Preservation of independence will be crucial though, as we all know the worth of the research reports produced by the ‘guns for hire’ analysts.

The informed investor acquisition, in particular, will really assist with the advisor network as the product looks relatively sticky.

Overall, I am impressed by Garry Croll the MD, he goes quietly about his business whilst executing a very smart strategy, he is transparent and cogent in what he says, and he is working his cash surpluses brilliantly.

This deal has been struck at 5X FY23 EBITDA – okay - and I believe with just a 10% organic growth over likely FY22 results, plus this acquisition will see FY23 EPS at around 6c to 7c and growing. His combo of shares and cash is okay by me because it ensures the vendors are roped in for at least two years to bed down the acquisitions. Plus, they are impressive people to have onboard.

Sequoia has been in a trading halt for the last couple of days pending an acquisition announcement. This morning they announced they were acquiring three business, including Sharecafe, which I'm sure some of us have used as an ideas generator/validator. These businesses will fall under Sequoia's Direct division. The release gives a decent explanation of each business and interestingly it spends some time talking to the credentials of the key personnel who are staying on with Sequoia, including Tim McGowan who will now head up the Direct division.

The price seems reasonable without being outstanding. It is largely script based though and is perhaps a little disappointing as the CEO made a point of saying right up until recently they weren't interested in diluting shareholders in acquisitions at the current share price. The share price hasn't really moved on the news and I would say that's a lot more reflective of what we're seeing more broadly in the market - compared to last year - where it now recognises both the opportunity and the risk that comes with acquisitions.

Overall I think it's a nice little announcement in line with their overall strategy for both organic and acquisitive growth, that gets them that little bit closer to their FY25 $400m revenue target.

[Held]

Overall Comment:

Very good result for Sequoia. Above management guidance/expectations. Appear to be executing on the growth strategy. SEQ is a high conviction holding that I believe is undervalued by the market. Investors are getting a well-run business with a free option on planned growth at current prices.

General Notes

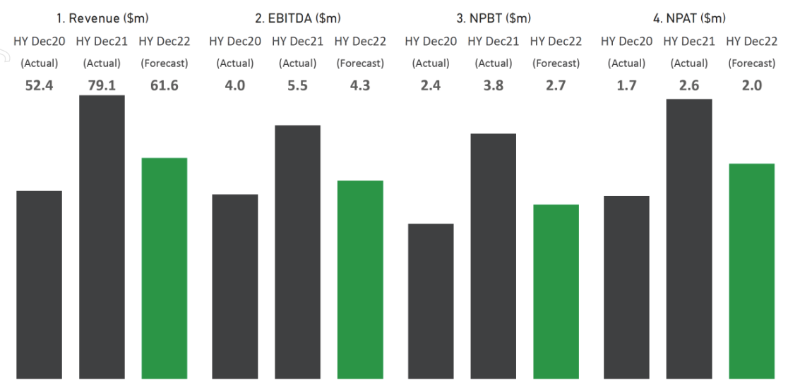

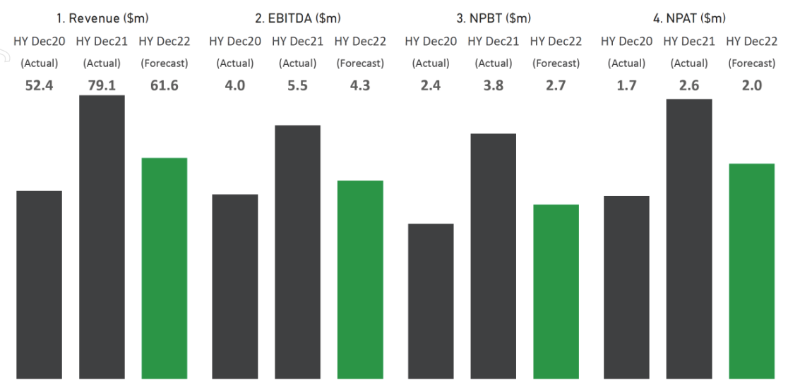

- Key financials for 1HFY22:

- Revenue = $79m, up 50.9% from $52.4m.

- "Operating profit" = $5.5m

- Operating net cash flow (pre-tax) = $5.9m

- NPAT = $2.6m, up 57.4%.

- 0.5c dividend fully franked

- NTA = 10.5c per share

- Net assets = $43.4m

- "FCF" = $3.6m (my calculation)

- Cash at bank = $17.3 m (excludes client cash)

- EPS = 1.9c

- EBITDA margin was down to 7%, however, due to seasonality this is expected to return to the budgeted 8% in 2H.

- On 10/1/22, SEQ purchased Topdocs Legal to enhance the existing document businesses for $330k.

Positives

- Revenue up significantly higher than the management plan of only 15%.

- Morrison securities average monthly number of contract notes up 59% and funds on CHESS up to $4.1bn from $2.8bn. Market volatility is good for Morrison securities through increased trading, given the current environment I expect the great results to continue.

- Equity markets group increased revenue 88% from $21.7m to $40.8m.

- Head office costs flat.

Negatives

- EBITDA of Wealth group was down on 1HFY21.

Has the thesis been broken?

- No, better than expected result. Company is executing well and performing above expectations. As per buying plan, take up a full position.

- Still a new holding but I do have high conviction. After yearly result look into moving to an overweight position.

Valuation

- No change to current valuation. Still undervalued by the market.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Company goal to provide their services to 1000 advisors and 3000 accountants by 2025. Group revenue of $400m by 2025.

- Guidance - EBITDA of 10c per share. Ensure EBITDA margin returns to 8%.

- What is management going to buy with the cash at bank that it is building?

- Consider making SEQ an overweight position after next reporting period?

Overview:

Sequoia Financial Group provides products and services for ASFL holders, accountants and financial advisors. The company is split into four divisions:

- Wealth - Wealth advisor business, providing licensee services to financial advisors.

- Professional Services - Provides back office/admin type services for accountants and financial planners. For example, access to legal documents or SMSF administration on their behalf.

- Equity Markets - ASX clearing for 55 ASFLs. Morrisons is the main business in this segment. Trades for higher values with average orders of around $100k. Ie not for day traders/Selfwealth type clients but professionals and high net worth individuals. Competitors are Openmarkets and Finclear.

- Direct - News type business, seminars and newsletters.

CEO is an ex-financial advisor. Very passionate about non-conflicted advice. Sequoia does not sell any financial products (such as funds) to clients they only provide services to the financial advice industry. SEQ has been growing rapidly in recent years with CEO’s plan to continue this growth through organic means and acquisitions of businesses at 4-7x PE using the cashflows of the business. The four different segments of the business create the ability to cross sell all the different products that SEQ produces.

The value proposition of SEQ is that they are the "picks and shovels" for financial services industry. They provide products that enable financial planners and accountants to be able to provide advice services at a cheaper price or saves them time.

Main Thesis:

- CEO that thinks as a capital allocator, has experience in the field and has high insider ownership of the company. Therefore, strongly aligned with shareholders. The CEO talks about being the tortoise not the hare, compounding returns over time. Management is looking to take the operating cashflows of the business to buy cheap businesses that are earnings accretive to further increase the growth of the business.

- Growth in revenues and profitability appears consistent and likely to continue moving forward.

- The company's share price has good upward momentum (and unchanged during current market ups and downs).

- The diversity of revenue sources and high friction costs of moving to competitors

- Company appears undervalued at current earnings. If SEQ is able to achieve or even make it halfway to the compound growth goals management have set out, there is a high upside potential. The growth doesn't appear to be priced in.

- Sum of all parts of the company, appear undervalued. Morrisons, for example, has competitors that are less profitable but valued higher than what SEQ share price implies.

- Advisors are leaving the big banks and conflicted firms. Independent financial advice after the Royal Commission is the way forward for the industry. SEQ is perfectly positioned for this pivot.

- A company that can be held for a long time as management has a clear path to create long term compounding returns.

General Notes:

- There is normally seasonality to the earnings of the company. There is a tendency that bills are paid near the end of the financial year.

- Management’s goal is to increase revenue to $400 million by the end of FY2024.

- Key goals of board and management:

- While they are in the advice industry, profitability doesn't appear to be clearly linked to funds under management as they are the licensor for advisors. FUM could affect Morrisons business.

- Company reports "Operating Profits"/EBITDA. This is a reasonable figure to see the underlying profitability of the company year to year.

- Wealth division doesn't lock financial planners in with high upfront or exit fees. CEO states they don't want planners that don't want to be with them.

- CEO keen to take questions and hear from shareholders during AGM presentation.

- 15% growth expectation of management doesn't include acquisitions.

- FY22 will be the first year of the family office business, a new segment for the business.

Positives:

- CEO talks about Warren Buffett, obviously a big fan and looks to allocate capital in the same way.

- Strongly cash flow positive. This cash flows facilitates the purchases of business at low PEs (4-7x) which will compound growth into the future.

- Consistent revenue growth over the last 5 years from $23 mil in FY16 to $116 mil in FY21.

- A good likelihood of their being a shortage of advisors in the future due to current change in the industry.

- Advisors that are licenced through SEQ are not conflicted trying to sell products from SEQ.

- Strong ability to cross sell the different products across the different units of the business. For example, the advisors licenced under the wealth division can be sold the services offered by the professional services division.

- Consistent share price momentum since May 20. Steady bottom left to top right movement. The share register is very tight with only 600-700 shareholders.

- CEO owns approximately 9% of the shares of the company. Is very aligned with shareholders and has experience in running businesses (he sold his previous financial advice business).

- CEO has made recent on-market purchases.

- Company appears to have hit a point of operating leverage with increasing revenues resulting in larger increases in profitability.

- Net cash position. However, can't use all cash and cash equivalents to calculate enterprise value as a large portion of the funds are client’s funds not for company use. Additionally, company must have $7.5 mil available, a requirement for the Morrisons business.

- Company report states non-cash return on equity for all divisions was above objective of 15% in FY21.

- Stock on HIN (Equities division) in FY21 went from $1.5 billion to $4 billion.

- While revenues and profitability increased strongly over the past year head office costs are flat.

Negatives/Risks:

- Key man risk with CEO. Seems to be the driving force. However, high ownership lowers this risk.

- As the company continues to buy businesses it becomes too bloated with all these consolidated small companies. What may have worked as a small company might not work well in a large group. Need to monitor how integration works.

- Low liquidity. Average around $15K a day and a low number of transactions. Shareholders around 600-700.

- Financial planner numbers under the Sequoia licence don't increase. There is currently an exodus in the industry of planners (generally conflicted planners).

- This is a low gross margin business. Though improving with increasing revenues.

Valuation Metrics:

For valuation see valuation straw.

- Can’t use basic cash figure for EV calculations. Need to take out client cash that can’t be used by the business.

- Operating EBITDA is very similar to operating cash flow.

- Info for ratios using FY21 figures:

- Share price = 68c

- Market cap = $89.89 mil

- Cash = $13.3 mil (not counting client cash)

- EV = 89.89-13.3 = 76.59

- "Operating profit" / EBITDA = $11.5 mil

- NPAT = $5.55 M

- EBIT = $8.1 M

- Operating Cash flow = $15.5 M

- Equity = $41.1 M

- Ratios:

- PE = 89.89/5.55 = 16.2

- EV/E = 76.59/5.55 = 13.8

- EV/EBIT = 76.59/8.1 = 9.5

- EV/FCF = 76.59/15.5 = 4.9

- EV/EBITDA = 76.59/11.5 = 6.66

- ROE = 5.55/41.1 = 13.5%

- ROE (non-cash company measure) = 5.55/27.8 = 19.96%

- NTA per share = 10.4c

- P/B = 89.89/41.1 = 2.2

How I expect this will play out:

- SEQ will keep growing at a minimum of 15% with greater growth to come from acquisitions or outperformance of expectations.

- With the stable growth trajectory and great capital allocation focus of the CEO, I will be looking at SEQ as a long-term holding stock due to the potential for compounding returns.

- How profits will increase in the future:

- Acquisitions that are made using the cash flows off the business.

- More financial planners use Sequoia as licensees.

- Greater trading volumes for Morrisons.

- General move by consumers towards non-conflicted advice.

- Increase the number of docs they create through their professional services division.

When to get out:

- Management heavily reduces the revenue/profit expectations.

- Revenue or profit growth stops.

- CEO selling sizeable portion of shares.

- High valuation ($2+) = trim.

The CEO re-iterated the medium term goal of achieving $400 M revenue by FY 2025.

This is significant growth, and even if they significantly miss this goal, say achieving just $260 M by FY2025, Sequoia will be a significantly larger business than today.

DISC - I HOLD

Management have provided guidance for the HY to Dec 21:

1) Revenue up 20% to $63 M for HY 2022.

2) NPAT of $2.1 m, up 23.5% for HY 2022.

Overall guidance given for FY2022 is for EBITDA growth of more than 15%.

Trading on a forward PER of 13, assuming NPAT growth holds over FY2022.

DISC - I HOLD

@Rapstar

In reply to your #2022 Growth Outlook for SEQ

I just got off the webiner. I am feeling more confident as time passes with this growth story.

CEO was very bullish on the growth outlook basically stating that 15% organic revenue growth was an absolute minimum. I suspect over the year we will get some good trading updates. He also alluded to the fact that this does not count acquisitions. As you mentioned any business acquireed would be at 3.4x EBIT multiple and that any acquisition would exceed 15%EPS, with the goal of pay back period of 1.2 yrs. Any acqusition should add 500K to 1mil EBITDA. Would use back up cash therefore not increasing share count. Appears that acquisitions have been identified and discussions are taking place so we should see some announcements in coming months.

Key growth segment:

1. Sequoia Direct. Revenue is currently 2 mil and they are aiming for 10mil in 2 years. CEO mentioned the platform and its infrastructure is very god and they aim to market this now. They built this during the last year and it was impacted by COVID.

2. Professional Services:

- Target to increase SMSF adminsitered by 50% by June 2022.

- Panthercorp acquisition now fully integrated

- acqusitions in general insurance market place to occur (we have seen this with Steadfast with positive growth)

3. Equity Markets:The morrisons business which had significant growth appears extremely strong and maintains good retention. This is not like the SWF platforms which is more day trading rather this is advice and long term financial planning. Appears they are getting good numbers through the doors in the "boomer" category as they look for advice leading in to retirement. Simply they are winning business and not losing clients.

4. Wealth MGMT:

- further upside expected with the closure of many banks and insurer owned advice expected in the next 2-3 years. Aiming for 8% overall market.

- Mentioned July has been great/strong.

- Operating environemnt should continue to grow as advisor number frecast drop to 13000 down from 30000 in 2018. This is significant and SEQ is benefiting from this. SEQ is trying to increase advisors to 1000+ by 2025.

Lastly I was pleased to hear that top 100 share holders have not sold and continue to hold even through the last year where SP has risen somewhat sharply.

DISC: held

Tranche 3 of performance rights have the following performance hurdle:

Tranche 3 will vest if the Company’s 90 Day VWAP up to and including 30 June 2021 is at least $0.55.

Will be interesting to see if this performance hurdle drives a good news cycle form management over the next month or so, as they are well short of the hurdle ATM.

Management Medium Term targets from their September Presentation. They have lowered the 2024 goal from 1200 to 1000 advisers recently, but are ahead 2021 target.

If this is what success looks like, then SEQ could easily have a market capitalisation over $400 M in 3-4 years. I would be happy if they get to $250 M by 2024.

SEQUOIA FINANCIAL GROUP ANNOUNCES 1H21 RESULT

1H21 Highlights

- Consolidated Revenue rose by 28% to $52.4m

- Revenue growth in the core business units of Wealth and Equity markets was more than 40% with softer performances in our Professional Services and Direct Investment business units growth rates

- Operating Profit (EBITDA) rose by 176% to $4m • NPAT increased to $1.7M (up 548% from 1H20)

- Operating Cash Flow (excluding client funds) improved 142% to $3.4m

- Number of advisers operating under a Sequoia owned AFSL grew by 33% to 405

- Morrison Securities monthly contract note turnover increased by 300%

- Morrison funds on chess sponsored holdings increased from below $0.4 billion to $2.9 billion in the last 12 months

- Morrison revenue doubled to $11.1m

- InterPrac Financial Planning saw a revenue increase of 39% to $20.6m

- Sequoia Wealth Management saw revenue increase of 231% to $4.1m

- Cash at Bank (excluding client funds) remained steady at $13m