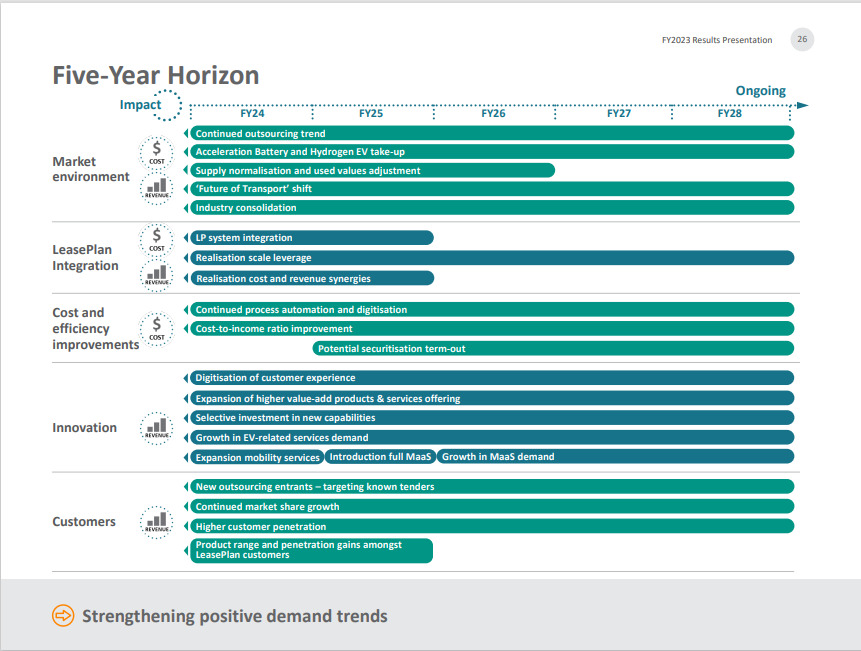

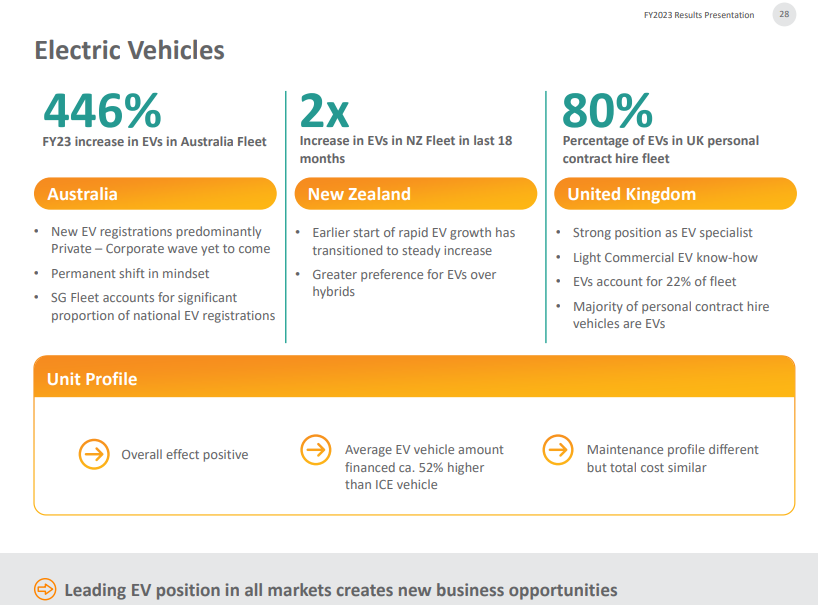

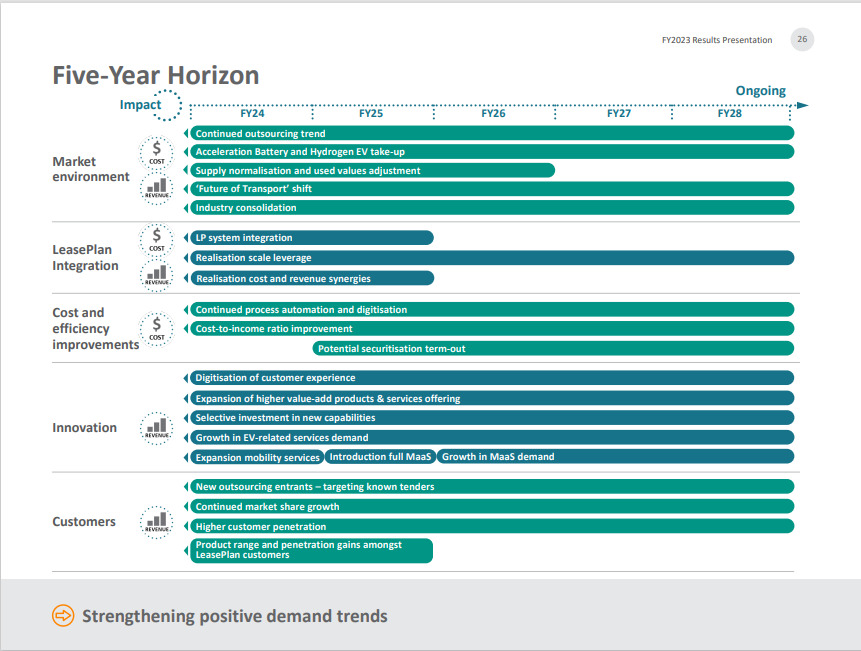

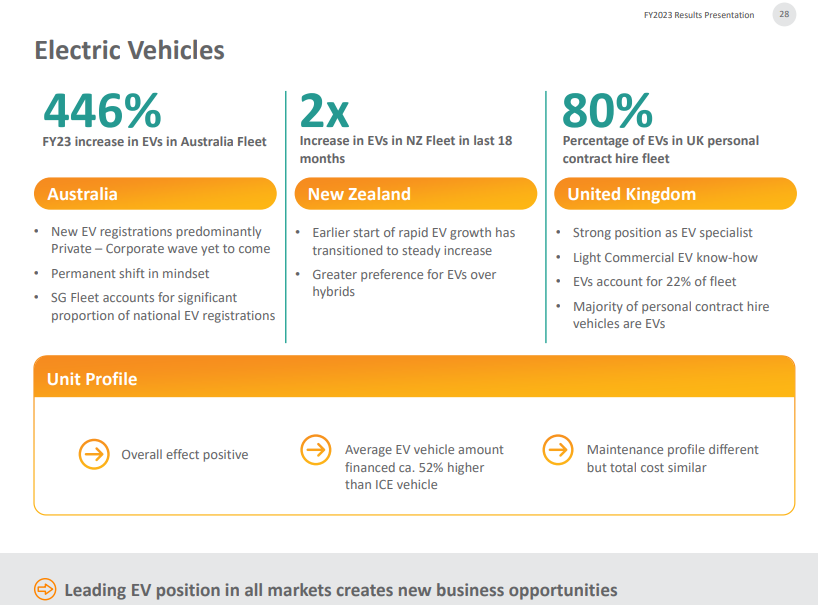

Rapid acceleration in demand for EVs

• Continued growth in quoting for ICE vehicles confirms EV is attracting new customer segment

• SG Fleet novated employer and driver profile supports EV take-up

• Demand to persist beyond current incentives and across multiple lifecycles

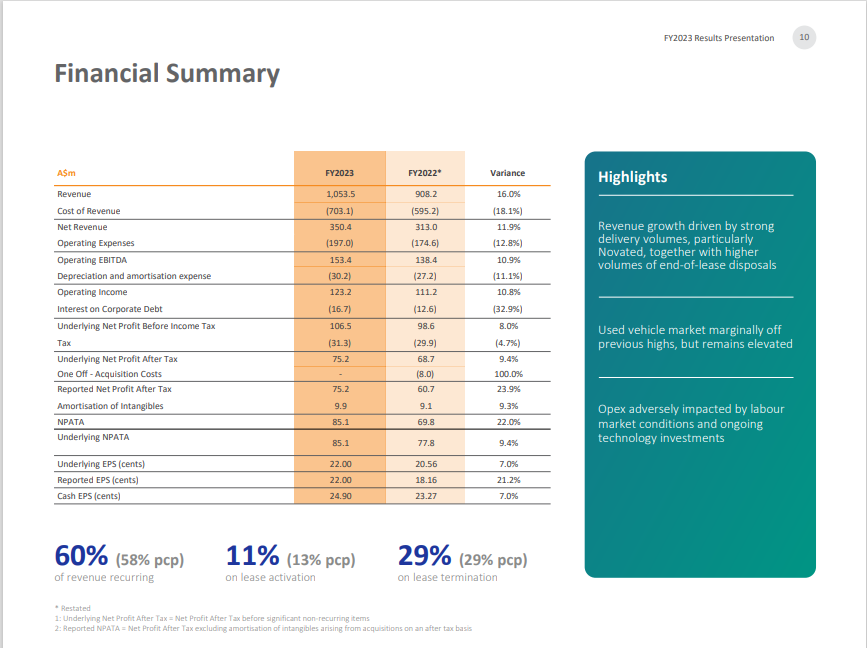

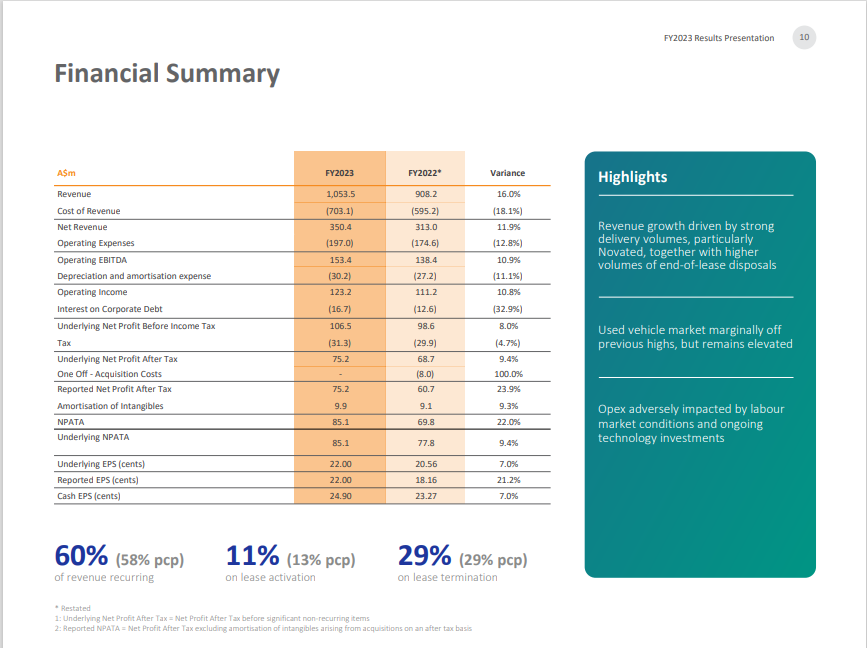

Revenue growth driven by strong delivery volumes, particularly Novated, together with higher volumes of end-of-lease disposals.

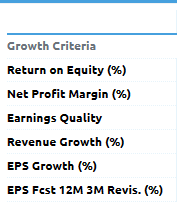

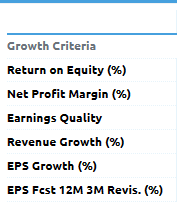

SGF Return (inc div) 1yr: 14.40% 3yr: 23.83% pa 5yr: -0.13% pa

SGF Profitable? Yes

But the Loans Alah Debt Equity is high.

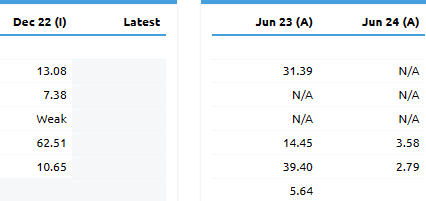

Now Check the others:

MMS

SIQ

Compare Net Profit Margin Dec 2022 below:

SGF: 7.38%

MMS: 13.82% note Debt / Equity is in better position

SIQ: 26.19%