Presentation to the Australian Rice Growers’ Conference - link

At around 435m market cap, this food business is not small and upside is limited versus a small cap. But for a business this size with so much scale this is still ignored by the market.

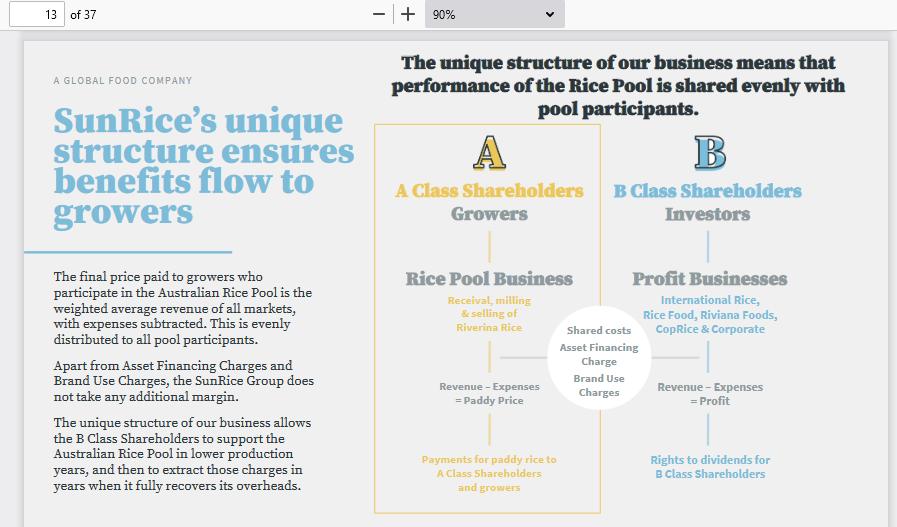

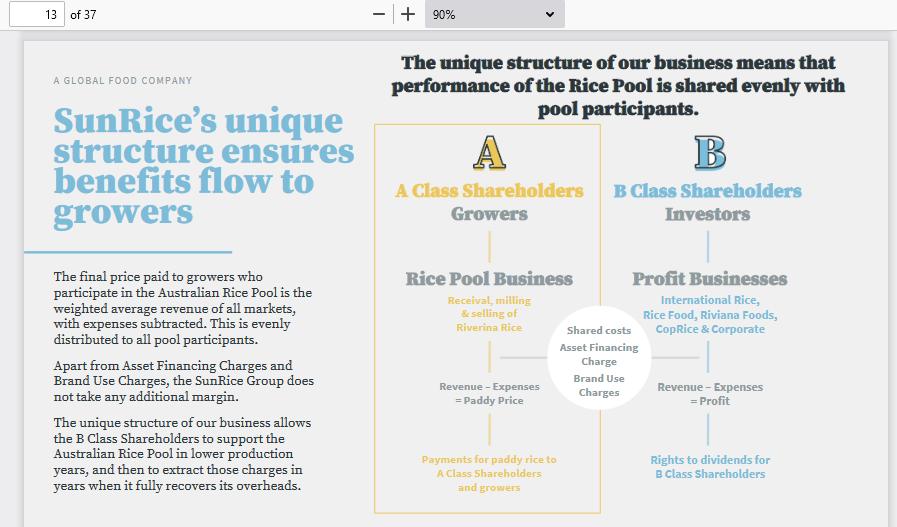

Share structure which was mentioned in the last straw. A major headwind for the share price as holdings of rice growers and maximum holding limits makes it hard for institutions/funds to build a large position. Investors would however benefit from the high dividend instead (now paid twice a year from once a year)

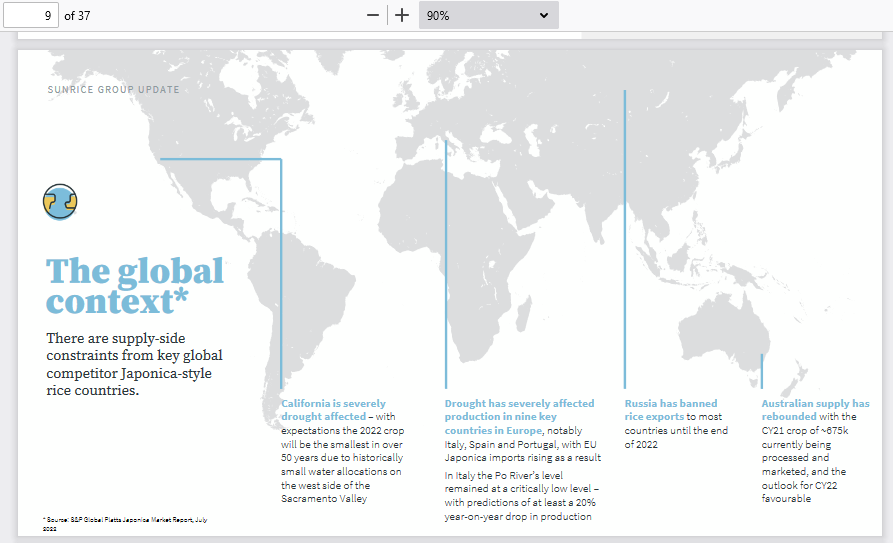

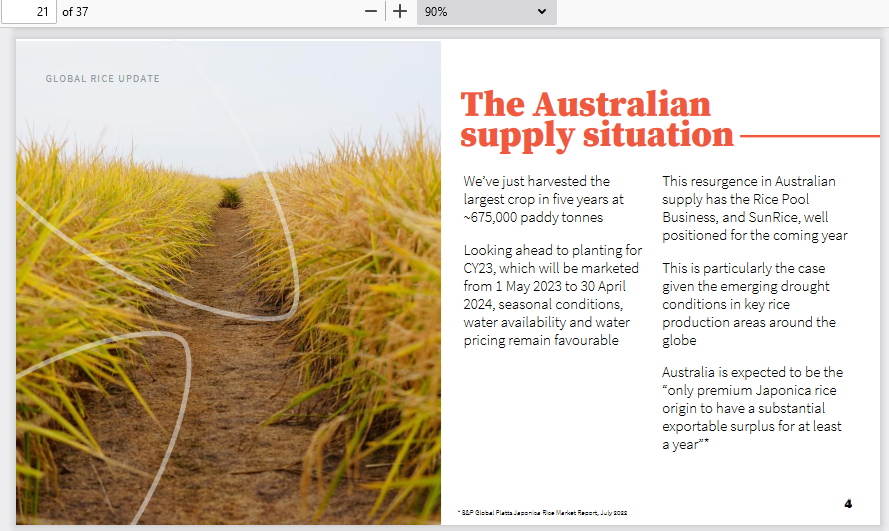

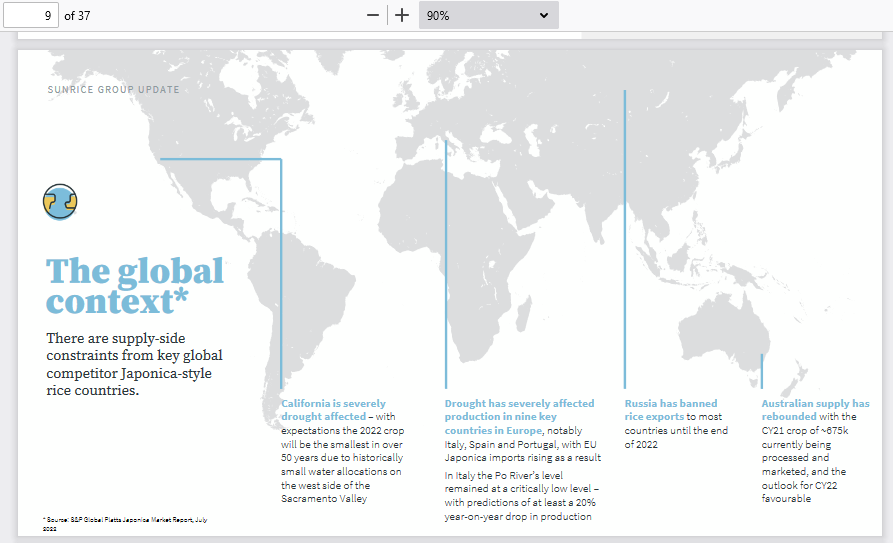

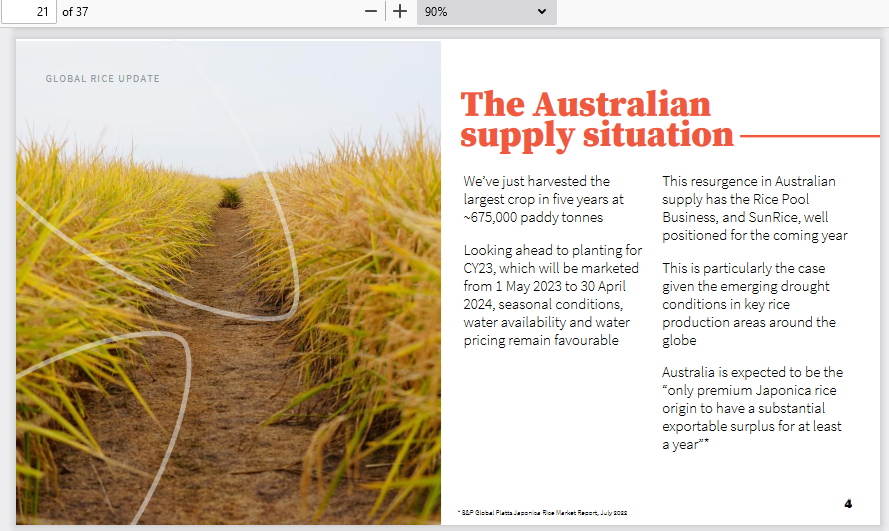

Already aware of the supply crisis around the world ex-Australia

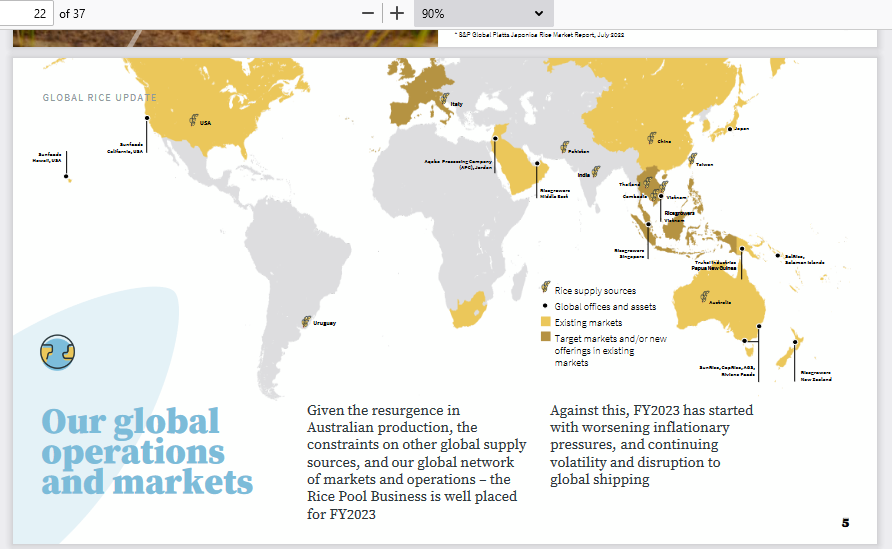

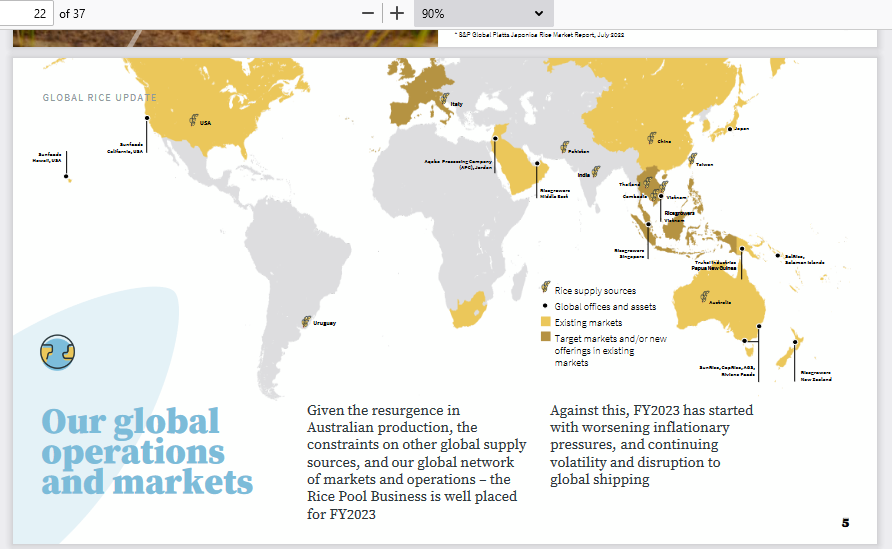

Ricegrowers global supply/demand network - economies of scale???

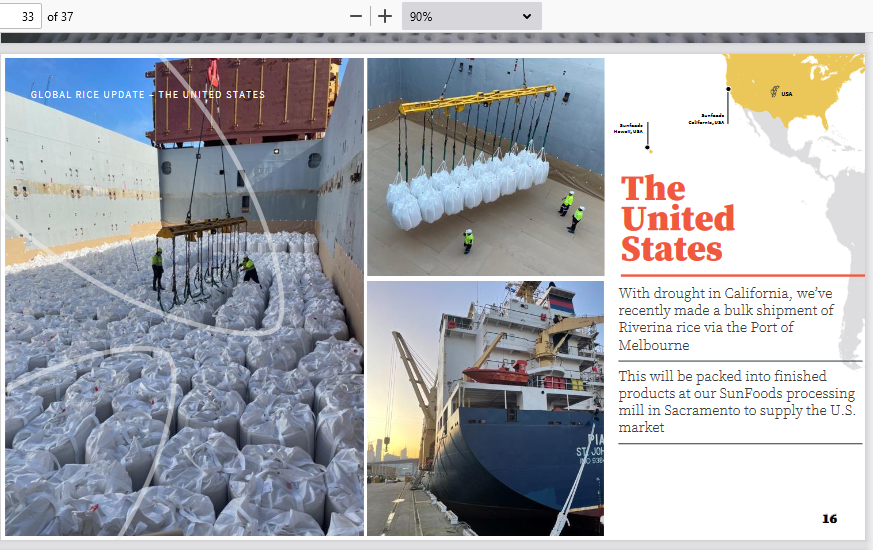

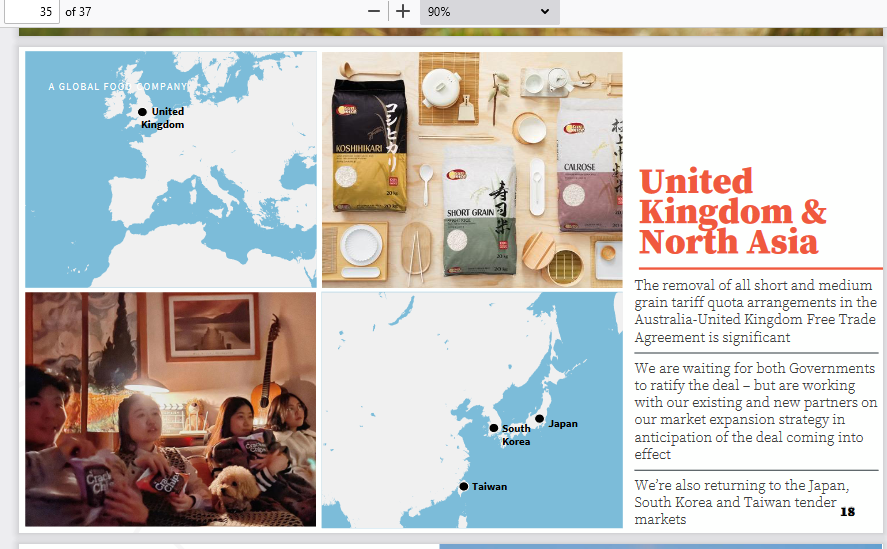

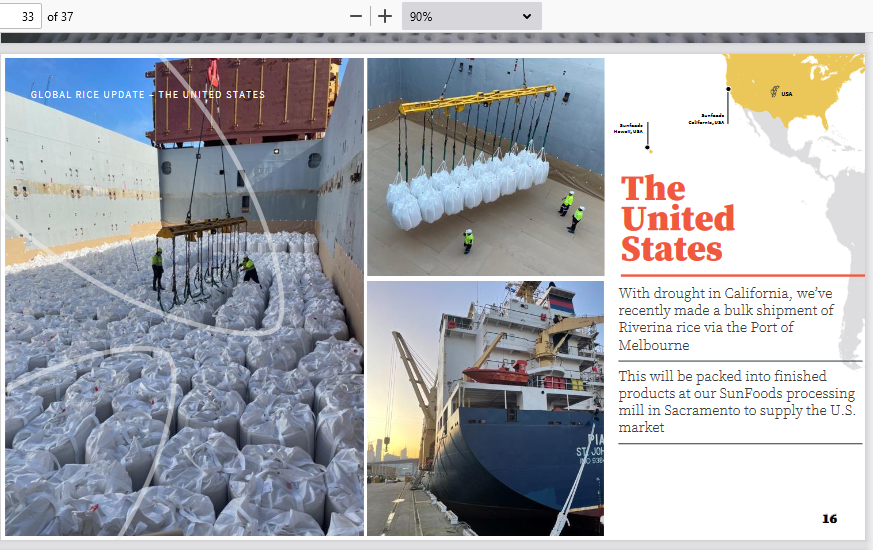

Supplying to the heavily drought-affected United States

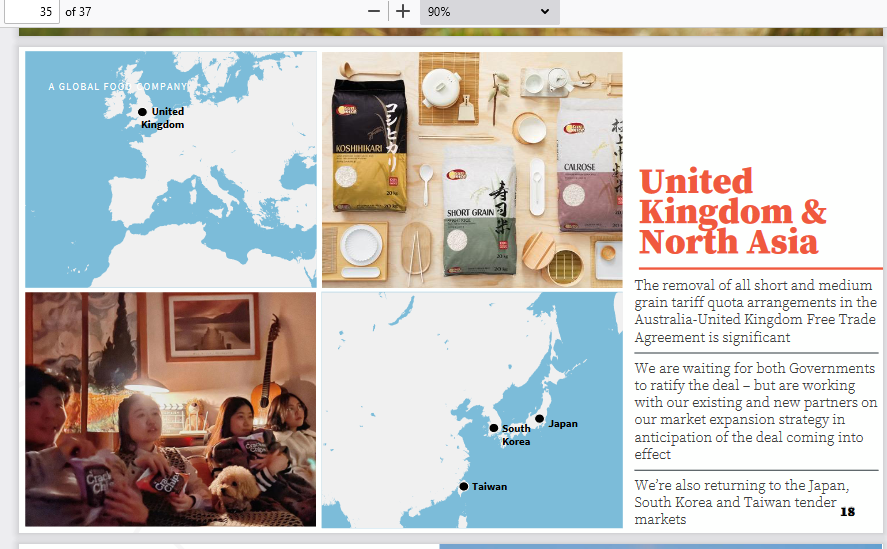

Potential new markets - UK post brexit.

Supply is no issue for now. With China restricting exports of Japonica rice to the world, could ricegrowers capitalise on this lucrative export market?

Brand awareness with Poh:

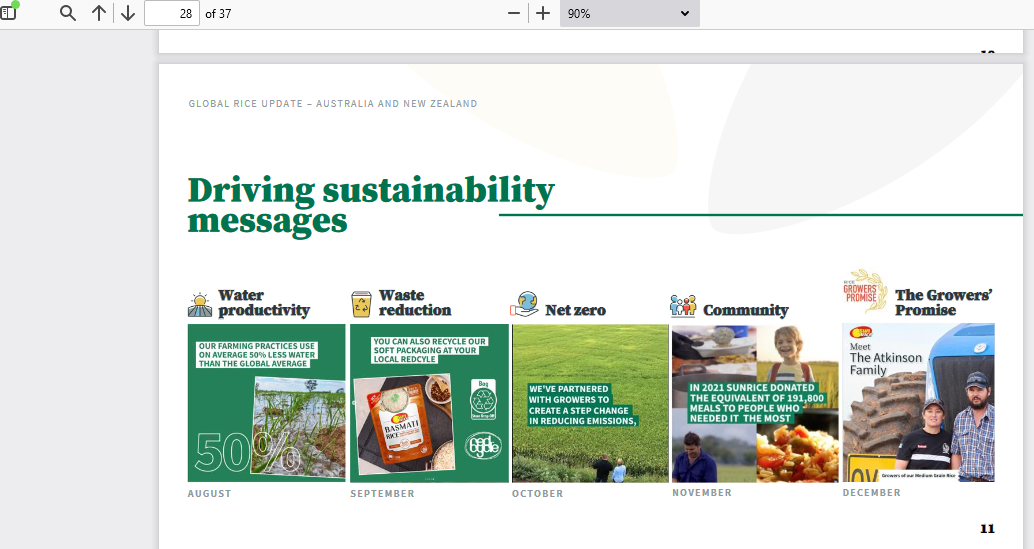

Issues: Water and sustainability

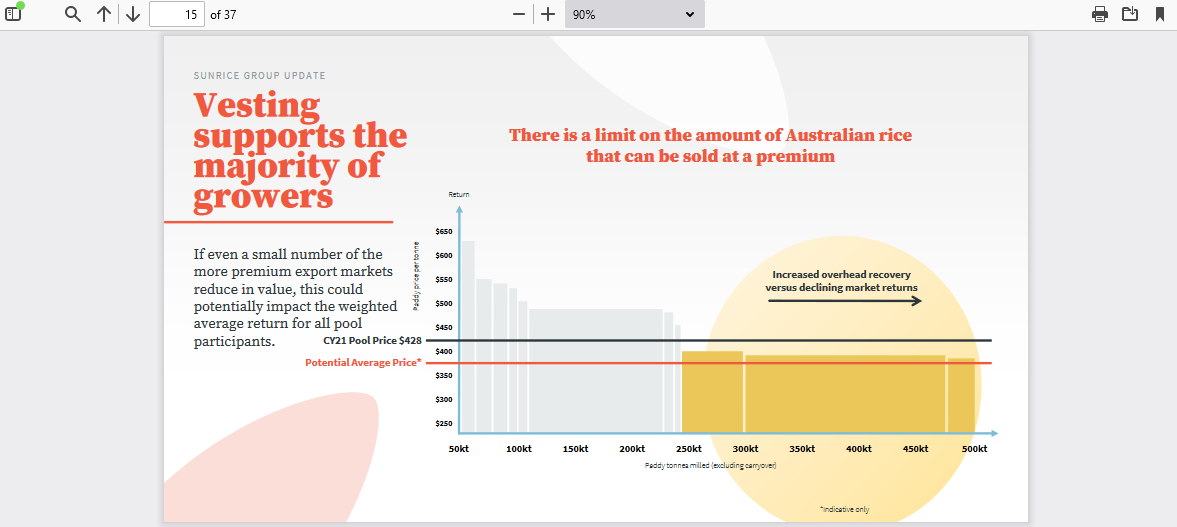

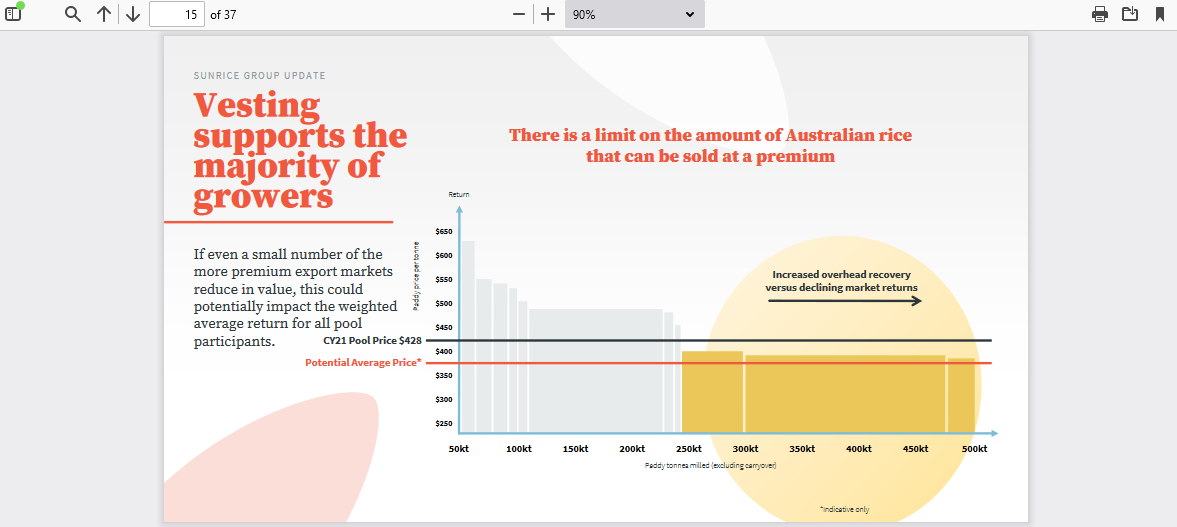

Issues: Still a price-taker but with drought happening in other markets at a time when rice consumption continues to grow maybe an inflection point will be reached soon...

Finally there is the question of what happens when the above average east coast rainfall disappears and we are in drought? The 50% reduction in water usage might not mean a thing unless there is a secure supply of water even during drought times.

[Held]