Bull Case - What to Like

Founder led with Fadi Geha acting in an executive director role while holding a modest 3.85% stake in the company.

Previous directors Tillett, Tye, Flukes and Ghosh hold 7.58%, 1.61%, 1.3% and 0.51% respectively with current NED Thornhill holding 1.32%.

Previous insider buying of shares and options on market and participation in capital raises.

Margins could improve as one-off hardware sales are overtaken by recurring subscription revenue.

Sales are predominantly composed of ARR.

Bear Case - What Not to Like

Gross margins of 53% for the year suggest Simble software technology offering is dependent on hardware sales; however, if these are one-off margins could improve as/if the company grows.

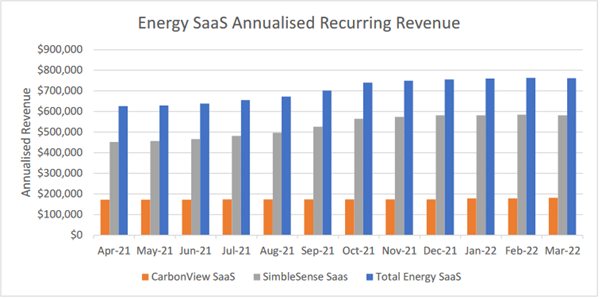

The notes to the financial statements are thin providing no insight into segment revenue or an explanation of how hardware vs software sales affect margins. Up until a year ago the company was showing the below graph in their quarterly reports. A lack of ARR growth in CarbonView and modest growth in SimbleSense is disappointing.

Lack of revenue growth.

Not enough cash to self-fund with another capital raise likely in the near future.

Weak Balance Sheet with negative net assets and equity of -$434,479.

Revenue is not geographically diverse (Australia and UK).

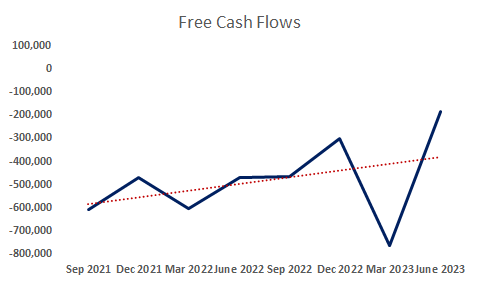

The June 2023 4C shows a significant decline in cash burn from operating activities, $182,000 for the most recent quarter versus $943,000 for the previous two. Should this fall in staff costs and admin and corporate costs persist Simble could be interesting; however, lumpy quarterly receipts from customers challenges this idea. See graph Free Cash Flows below.

What to Monitor

Simble’s ability to avoid another dilutive capital raise. With just under $1M in cash at the end of the current period they have 6.5 estimated quarters of funding available. This assumes their recent uptick in receipts from customers and decrease in expenses is a trend that continues and not a one-off, in which case it could be less.

Simble’s quarterly cash receipts from customers are quite lumpy (see graph Free Cash Flows above). Signs of scalability, that is consistent growth in operating cash flows that outpace expenses will be something to monitor across future 4Cs.

Simble Solutions lack of sales traction, weak balance sheet and probable future capital raises make the investment case unappealing despite being a founder led company with decent insider ownership and belief from management.