Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Bull Case - What to Like

Founder led with Fadi Geha acting in an executive director role while holding a modest 3.85% stake in the company.

Previous directors Tillett, Tye, Flukes and Ghosh hold 7.58%, 1.61%, 1.3% and 0.51% respectively with current NED Thornhill holding 1.32%.

Previous insider buying of shares and options on market and participation in capital raises.

Margins could improve as one-off hardware sales are overtaken by recurring subscription revenue.

Sales are predominantly composed of ARR.

Bear Case - What Not to Like

Gross margins of 53% for the year suggest Simble software technology offering is dependent on hardware sales; however, if these are one-off margins could improve as/if the company grows.

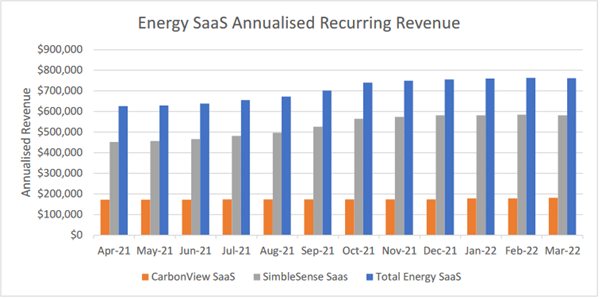

The notes to the financial statements are thin providing no insight into segment revenue or an explanation of how hardware vs software sales affect margins. Up until a year ago the company was showing the below graph in their quarterly reports. A lack of ARR growth in CarbonView and modest growth in SimbleSense is disappointing.

Lack of revenue growth.

Not enough cash to self-fund with another capital raise likely in the near future.

Weak Balance Sheet with negative net assets and equity of -$434,479.

Revenue is not geographically diverse (Australia and UK).

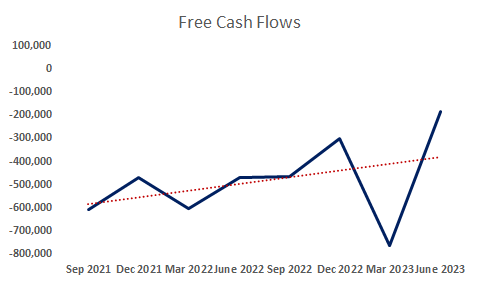

The June 2023 4C shows a significant decline in cash burn from operating activities, $182,000 for the most recent quarter versus $943,000 for the previous two. Should this fall in staff costs and admin and corporate costs persist Simble could be interesting; however, lumpy quarterly receipts from customers challenges this idea. See graph Free Cash Flows below.

What to Monitor

Simble’s ability to avoid another dilutive capital raise. With just under $1M in cash at the end of the current period they have 6.5 estimated quarters of funding available. This assumes their recent uptick in receipts from customers and decrease in expenses is a trend that continues and not a one-off, in which case it could be less.

Simble’s quarterly cash receipts from customers are quite lumpy (see graph Free Cash Flows above). Signs of scalability, that is consistent growth in operating cash flows that outpace expenses will be something to monitor across future 4Cs.

Simble Solutions lack of sales traction, weak balance sheet and probable future capital raises make the investment case unappealing despite being a founder led company with decent insider ownership and belief from management.

Simble came onto my radar a couple years ago because of insider buying but I never got around to exploring it further. Despite previous insider buying the share price has steadily declined since.

Simble Solutions technology enables customers to monitor, control, and reduce energy usage and carbon emissions helping them achieve their ESG targets. The company has two core solutions – SimbleSense an energy and IOT monitoring and reporting platform and CarbonView a carbon and sustainability measurement and reporting system.

SimbleSense is an integrated hardware and software solution providing businesses with the ability to manage energy consumption. It is offered direct to industrial customers and through channel partners who resell Simble’s platform to their end customers. These channel partners sell SimbleSense platform under their own brand to end customers with pricing per meter or device per annum. SimbleSense reports real time energy usage enabling actionable insights to support businesses in reducing consumption costs.

CarbonView is a carbon and sustainability platform for businesses supporting the management and reporting of carbon emissions. It enables carbon footprint measurement, reporting and minimisation and is sold to large corporates and government bodies. Large customers require their suppliers to use CarbonView to report their carbon footprint. A supplier portal version is available for these customers, paid for by the large customer. Simble claims this allows them to focus on a smaller number of large customers while still gaining access to many smaller suppliers; however, this advantage has yet to materialise in the financial statements.

Australia and UK are the core markets for Simble’s offerings.

Government implementation of various carbon emission policies could provide tailwinds for the company. For example, 11,900 businesses now have to report under UK Streamlined Energy and Carbon Reporting vs 4,000 three years ago while in Australia 400 large carbon emitting companies now have to report under government mandates. Simble Solutions believe they will benefit from these tailwinds.

Simble has over 600 direct and indirect customers throughout Australia and the UK. Despite this impressive number, revenue was still only $1.5M for the year suggesting the cost for Simble’s offering might be tiny. The company announced a contract with United Solar Group whereby United committed to a rollout to 500 residential homes (of their 12,000+ customer base) resulting in minimum revenues of $260,000 over the 3 years. $260,000/3 years = $86,667/500 = $173.33 per customer per annum. Should United sign up all 12,000 of their customers, Simble would see $2.1M in yearly revenue from the deal; unlikely for a number of reasons. I’m doubtful how much money a residential consumer would save using SimbleSense compared to the $173.33 yearly subscription; however, it’s possible one-off hardware or installation costs are included in this price. However, should that be true, the recurring revenue would be even lower for Simble. It seems as if CarbonView would be an offering with better unit economics for the company.

Simble only has 2 Glassdoor reviews with an overall rating of 4.3/5, giving little insight into company culture.

[Edited to update disclaimer --- managed to sell the last of my shares!]

Just a quick update based on their recent 4C. Link

- 11% increase in receipts to $463,000. (An increase of $45,000).

- Product costs increased 116% to $197,000. (An increase of $106,000).

- Other operating costs decreased about 6%. (A decrease of $49,000).

Totals:

- Income $463,000

- Expenses $934,000

- Cash outflow of $469,000

- Cash on hand $847,000

- Available loan $200,000

- So 2 and a bit quarters of available funding.

A cap raise is surely on the way. It's hard to see that this company will get to profitability before the availability of capital dries up.

(Disc: I hold some free options IRL which were given out when I was a holder of the shares IRL.)