Soco corporation, an IT consultancy firm specialising in enterprise cloud solutions. They listed in Dec 2022, so very fresh. They raised $5m at $0.20. No selldown from founders and major SH who currently own 79%. I put them on a watchlist as they looked interesting but the SP raced up to $0.35 on listing which was a bit steep for me. Since then they have come back down and have stabilised the around the 25-28c range. Today they released their 1H23 numbers and they were pretty good, as you would expect with a recent listing. But I think the lipstick is natural on this pig.

They have a nice story around people and culture and understanding the customer and designing the right solution for them. It looks like it is working as staff satisfaction scores are high (94%), retention was 98%. They do provide share options to staff which I think is a good way to incentivise an outcome. I get that competitive advantage vibe here from looking after your customer --similiar to an aussie broadband approach.

Retained customers contribute significantly to next years revenue. In FY22 70% of revenue came from 2021 clients and in 1H23 78 retained clients contributed 91% of revenue. They did add 18 new clients ($0.9m rev) and I would expect these will contribute to the 2nd half and 1H24. Good spread of client base- skew towards goverenment clients.

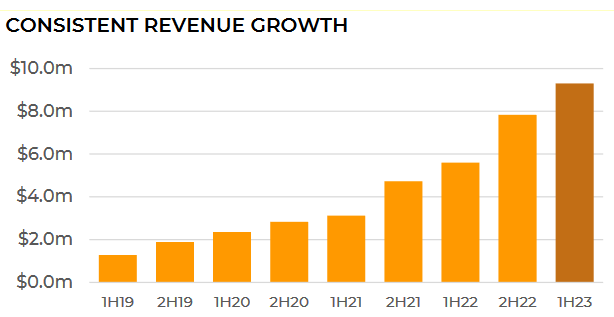

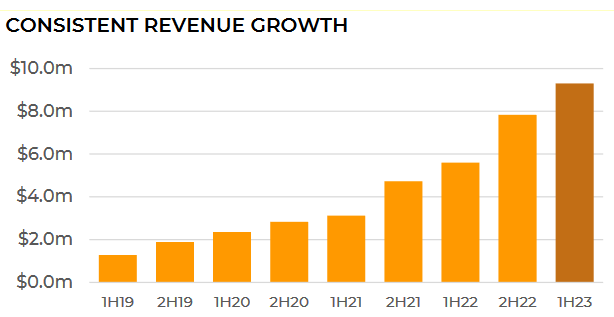

Revenue growth is good at $9.3M (up 60% on pcp). They have been profitable since founding (9 years). Their growth does seem to be consistent and they are maintaining guidance of $18.5m revenue ($3m EBIT and $3.3m EBIDTA) for the year, which they should hit comforatable as they look to have a slight skew to the 2nd half and they only need to match H1 to get there. Since 2019 revenue has consistently grown at that 40-60% range on the pcp. 2024 guidance will be key as I expect this growth rate to continue. NPAT of $255K for 1H after IPO costs. They have an operating EBIT margin of around 15-18%. It's not a SAAS company so it wont get the large multpliers but I think this could be a very stead and consistent grower that is founder led, has good corporate culture and is filling a niche.

Other things that jumped out

They make their financials very easy to read and understand.

Low working capital requirements

Customers pay quickly - average debtor days 36

Buisness historically focused on east coast and 66% revenue came from Federal government.

Expansion has started in west with a new office opened -- I expect this will increase WA and SA based customers.

Staff numbers increasing rapidly --> currently at 80 up from 51 in Jun 22. Driving growth

No debt and 4.8m cash

Aiming to payout 40-60% of NPAT in dividends (start end of FY23)

I am expecting around the $2m NPAT for the FY23, normalised for the IPO expenses ($900k)