Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I have been keeping an eye on SOCO corporation to decide if the problems they have had in the 1st half of 24 are temporary or a sign of a harder environment for the business going forward. SOC are a relatively recent listing (Jan 23) so the risk of being floated at the highpoint of their growth cycle can't be discounted entirely. The CEO has also announced his resignation in Feb, with executive director and founder Sebastian Rizzo moving to the interim CEO. There is high insider ownership and none of the previously escrowed shares have been sold, so on balance i don't consider the CEO departing a major red flag. Especially considering he bought $10K worth of shares on market in Dec 23. He has been the CEO at 3 companies previously and his tenure has generally run for around 1.5-2.5 yrs at each based on his Linkedin profile. It sounds like he was brought in primarily to get the IPO away.

The first half of 24 was disappointing and was marked by project delays and missed contracts, which had a corresponding flow on's to the business economics. Over the last 5 years they had been steadily increasing revenue, half on half and year on year and subsequently had been increasing headcount to meet this growth. Headcount is up from 38 to over 100 now. The problem came over the last 6 months where project delays meant the increased headcount has just eaten away their margin. The underutilised staff expense led to a swing in EBITDA from $1.5m in H1 2023 to $0.1m H1 2024 and a NPAT of ($0.8M) vs $0.25m pcp.

Management have guided to an improved 2nd half and have said the delayed projects have now commenced. So to me the key question is whether the delays are actually behind them and whether the increased headcount will be put to use.

A couple of reasons to suggest projects delays are temporary and things are moving in the right direction

- Management have guided that "Team utilisation is forecast to return to traditional levels by the fourth quarter positioning the company for a return to profitable growth in FY25."

- I read in the DMX capital Feb report about the "considerable scandal amongst the “Big4” consultancies in Canberra, with Canberra cutting back on its spending as a result." A plausible reason for the project delays.

- I was looking at ReadyTech this morning and saw this in their outlook "Revenue growth in the low double digits, reflecting a shift in timing of a number of high conviction enterprise deals into FY25." suggesting that project delays are an industry effect not a company effect.

- High insider ownership with management steadily buying on market, not large quantities but consistent 10-20K buys.

- Have a history of keeping clients once they are won and in H1 24 "80 retained clients delivered 87% of revenue" which is consistent with prior year rates.

There is still plenty of uncertainty and execution risk around SOC but at $0.12, the upside return is fairly compelling for me giving that they have a history of revenue and profit growth, have $2.7m cash available and $3m of undrawn debt. So no solvency risk in the near term. The selling pressure from the poor H1 results also looks to be exhausted.

The commentary around their recent acquisition and its integration is also positive. The flipside is that they will likely need to pay an additional $1.6m (in each of 2024 and 2025) if Asxym meet the performance earn outs which looks likely.

SOCO gave a 1H24 market update this morning that was disappointing, if not unexpected. They had flagged a slowdown in project initiation at the AGM and in todays update said that these conditions have continued into the 2nd quarter.

It looks like the slippage is from delays in the initiation of client projects that are largely now back on track with a number of new projects scheduled to start in Q3, along with the projects that were delayed from the 1H. Its not clear what caused the delays and were they primarily on the client end or the SOCO end, it is unlikely to be a staffing issue as they have expanded headcount in FY23 up from 55 to 78. So I am taking at face value that the delays are largely timing related rather than underlying problem related.

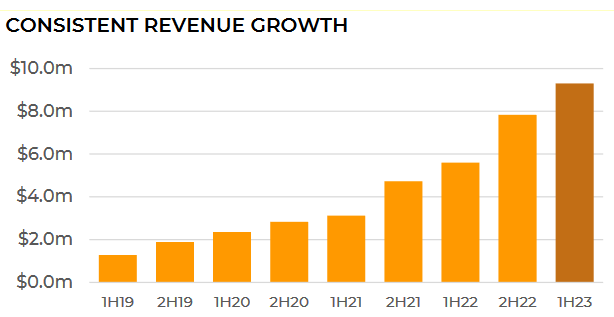

So the hit is relatively large to the 1H 24 numbers with revenue from ongoing SOCO operations guided at $7.9m -- equivalent to what they earned in 2H 22. They have consistently said that there is a revenue skew towards the 2nd half and this can be seen in the graph below of their revenue history. They also guided for EBITDA of $0.2m, with a $0.6m hit from acquisition costs from the recently completed AxSym deal. The extra headcount on reduced revenue is probably having an impact here as well. The good news from the update is that the AxSym is fitting in well and will make up some of the shortfall in revenue contributing somewhere between $1.6-1.8m revenue for the 2 months of ownership in 1H24. So all up revenue should be ahead of 1H23 but EBITDA will be significantly reduced ($0.2 vs $1.4m in 1H23). They will have $2m cash at year end and access to a $3m debt facility so their capital position is fine for now. If it is just a timing issue then the 20% pullback on todays update is very much an overeaction, and it is only 11 trades for 191k shares.

Additional positive factors are that two directors have bought $10k each on market in November at prices between 24-26c. The AxSym purchase was part cash ($4.3m) and part shares ($3.2m)- issued at 29.8c. Given the shareprice is now 18c I think this is looking pretty interesting if your happy to look through the 1h24 numbers.

Notes from quick read through of annual report.

- Growth in revenue of 47% ($13400->$19700)

- Gross margin increase 58% ($7800 ->$12300)

- Company wants to be measured on Operating EBIT (up 33%)

- NPBIT (IPO costs deducted for better comparison) not keeping pace @ 22% ($2433->2972)

- Employee benefit expense up 54% ($8809->13573) –WA expansion, +/- wage inflation?

- Healthy balance sheet after IPO ($6488 Cash vs $2800 total liabilities) even though a decent chunk funneled towards dividends (presumably to reward original owners, currently not at a sustainable level going forward - franking @25%)

- Low churn and strong organic growth from existing client base. Also adding more government clients (QLD+ fed)

+ Profitable, growing organically, expanding physical footprint from QLD into WA

- Keep eye on cost control and revenue -> bottom line, future dividends & dilution (lower than prospectus but could change). Glassdoor reviews ok but not exceptional although they bill themselves under “Great place to work” banner.

Need to see at least two more reports of improving metrics as listed company before delving deeper and consider buy

A recent addition in RL and an outstanding buy order on SM this recently listed IT firm only came to my attention by way of a post bt @Slideup

SOCO Corporation Ltd (ASX:SOC) Preliminary Unaudited FY23 Results UNAUDITED FY23 HIGHLIGHTS:

Unaudited FY23 revenue of $19.8M, up 47.5% on the prior corresponding period (pcp) and $1.3M ahead of prospectus forecast

Unaudited statutory FY23 Operating EBIT1 of $3.4M up 34.2% on the pcp • Unaudited pro forma FY23 EBIT (including public company costs) of $2.7M, lower than prospectus pro forma forecast of $3.0M

Unaudited statutory FY23 NPAT of $1.5M is 3.4% ahead of prospectus forecast of $1.4M

Strong cash conversion of 108% (before IPO cash expenses)

Cash on hand of $6.4M, 13.2% higher than prospectus forecast

Expanding client base with 4 new state government clients, and 3 new federal government organisations added

Exceptional “Great Place to Work” score of 97% achieved in June 2023, an improvement of 300 basis points over June 2022 • Sales pipeline remains strong, now with an expanded offering that includes security and AI

Sharecount: 126.265m

Expecting NPAT of 2m or close

Expecting EPS of 1.5c

PE of 20 -- this is not a SAAS company but given it is founder led, has always maintained profitability, has no debt and has good corporate culture then I think 20 is reasonable.

Gives a today price of $0.31

Soco corporation, an IT consultancy firm specialising in enterprise cloud solutions. They listed in Dec 2022, so very fresh. They raised $5m at $0.20. No selldown from founders and major SH who currently own 79%. I put them on a watchlist as they looked interesting but the SP raced up to $0.35 on listing which was a bit steep for me. Since then they have come back down and have stabilised the around the 25-28c range. Today they released their 1H23 numbers and they were pretty good, as you would expect with a recent listing. But I think the lipstick is natural on this pig.

They have a nice story around people and culture and understanding the customer and designing the right solution for them. It looks like it is working as staff satisfaction scores are high (94%), retention was 98%. They do provide share options to staff which I think is a good way to incentivise an outcome. I get that competitive advantage vibe here from looking after your customer --similiar to an aussie broadband approach.

Retained customers contribute significantly to next years revenue. In FY22 70% of revenue came from 2021 clients and in 1H23 78 retained clients contributed 91% of revenue. They did add 18 new clients ($0.9m rev) and I would expect these will contribute to the 2nd half and 1H24. Good spread of client base- skew towards goverenment clients.

Revenue growth is good at $9.3M (up 60% on pcp). They have been profitable since founding (9 years). Their growth does seem to be consistent and they are maintaining guidance of $18.5m revenue ($3m EBIT and $3.3m EBIDTA) for the year, which they should hit comforatable as they look to have a slight skew to the 2nd half and they only need to match H1 to get there. Since 2019 revenue has consistently grown at that 40-60% range on the pcp. 2024 guidance will be key as I expect this growth rate to continue. NPAT of $255K for 1H after IPO costs. They have an operating EBIT margin of around 15-18%. It's not a SAAS company so it wont get the large multpliers but I think this could be a very stead and consistent grower that is founder led, has good corporate culture and is filling a niche.

Other things that jumped out

They make their financials very easy to read and understand.

Low working capital requirements

Customers pay quickly - average debtor days 36

Buisness historically focused on east coast and 66% revenue came from Federal government.

Expansion has started in west with a new office opened -- I expect this will increase WA and SA based customers.

Staff numbers increasing rapidly --> currently at 80 up from 51 in Jun 22. Driving growth

No debt and 4.8m cash

Aiming to payout 40-60% of NPAT in dividends (start end of FY23)

I am expecting around the $2m NPAT for the FY23, normalised for the IPO expenses ($900k)