Not a huge fan of online retailing but this one appears to be pulling ahead of the peers. Consistently profitable, hitting an ebitda margin of 2-4%, now targeting 3-5% for fy23. i was on the call for FY22. the company appears to have more control over the P&L than others. they also came out with LT target of 15% ebitda margins and $2b rev. previously i saw a study by NYU Stern that measured online retial having a NPAT margin of 5%, the above implies about double that. one interesting comment by management was that bulky goods are hard to get right and it was no surprise that the margins the physical store retailers achieved were high (NCK?). Have entered teh home improvement market and the B2B market. At a $630m market cap, even at current revenues would be 30x with a 5% margin. Worth wathcing. plenty of runway here.

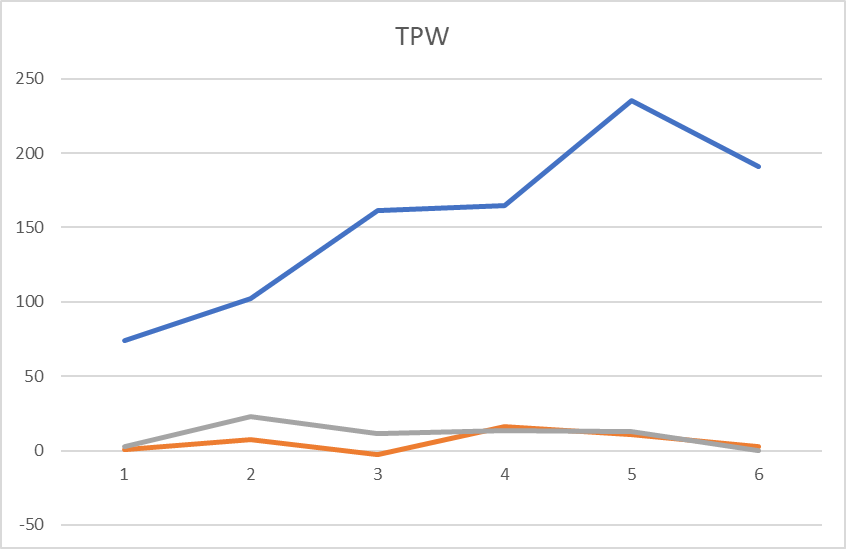

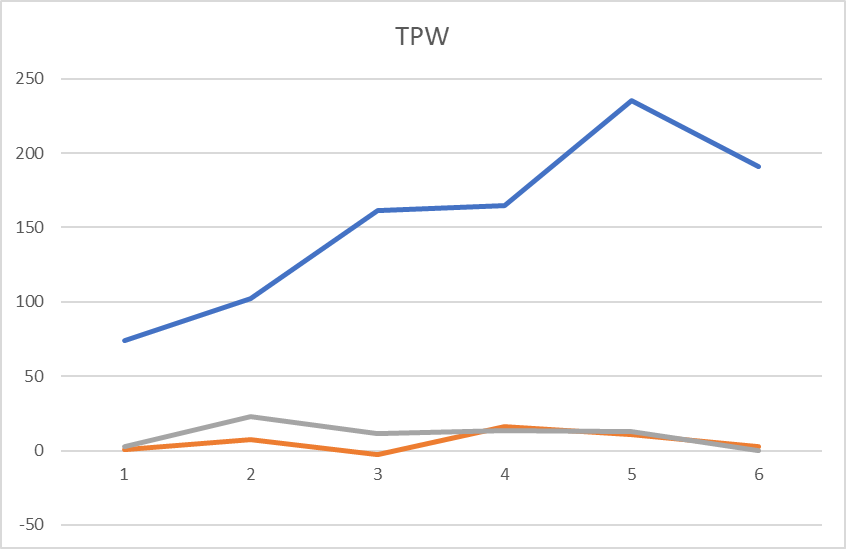

below are teh last 6 half years rev, PBT, and Cfo. controlling the outcome. has been a volatile tiem through C19 but now we start to see the true run rate! its ok. disc not held