Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

TPW has has been a great stock for me. Bought at $5.50 in SM and average $4.10 in real life, so it's my first multibagger. Now I want to let my winner run, but thought I'd play around with a few scenarios to see just how crazy this price is at the moment.

Caution, this IS my first rodeo, so they'll be plenty of holes which I'm happy for people to point out.

Okay, based on the May trading update, and referring back to a few previous updates, FY25 revenue should be around $610M. Revenue has been growing consistently at around 25% a year for the last few years. EBITDA margin is expected to be close to 3%, same as FY24. The H1FY25 investor presentation has a long term EBITDA margin goal of +15%. NPAT margin in H1FY25 was 2.9%.

So, starting figures for this valuation are FY25 revenue of $605M, margin of 2.5%. Low growth scenario adopt 20% earnings growth, 5% margin growth, mid 25% earnings 10% margin and high 30% earnings and 20% margin growth. Forecasting 5 years, discounting back at 10% and adopting a weighting of low 25%, mid 50% and high 25% then I need a P/E of 60 to get todays share price.

In this scenario, the mid range has the revenue at $1.8B with a 4.4% margin. This is probably still single digit market share.

Is 60 high for a disruptor like TPW? Do I take some profits at $26.20? Oh, the laps my thoughts are doing in my head!

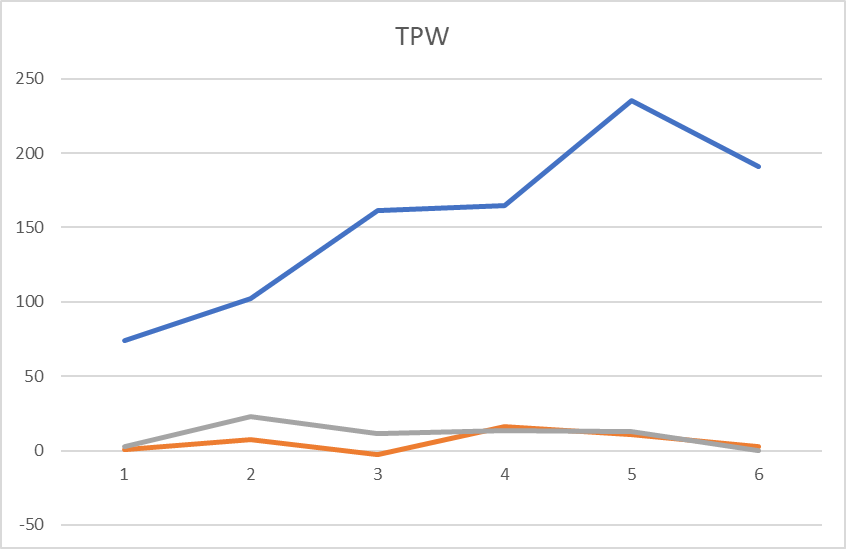

Below is my 6 monthly, Rev (LHS), PBT and CFO (RHS) chart. FH23 included. Actually this is not too bad, still profitable, sales trending higher. However, probably some post C19 uncertainty and showing no leverage in PBT/CFO. Probably one of (if not ) the best online retailer, imo. just not enough there given valuation. good write up below for details--Not held

Temple and Websters results were not flattering today and reflective of the advantage they experienced due to covid as well as the tightening environment we have all seen.

The results also highlight the seasonal nature in which they operate, furniture and homewares B2C and B2B as well as entry to home improvement.

In the conference call the leadership referenced the shift to value for consumers and away shift away from discretionary spending in the July to Dec half.

Revenue was 12% down for the December half to 207m from 235m.

NPAT fell from 7.2m LY to 3.87mill TY or 46% lower.

EPS also fell to 3.15c from 6c LY.

Customer count was also down for the half which the leadership explained that it was vital they have profitable customers not customers whom are incentivised to spend via more sales and marketing.

Positive to see the business pivot to control costs across their segments including marketing whose costs fell 23% or 7.6mill to 24.4mill for the half.

Inventory also fell to 25.7mill or 3% compared to last year.

Focus on maintaining EBITDA margins between 3-5% for the 2023 was a call out.

For a growth play TPW has seen its SP trimmed by 25% so far today.

At $3.70 market capitalisation is around $450mill or 1.2x sales but the earnings contraction see's the EPS for FY 2023 likely to come in at 6-7c, equating to PE of 52x.

That's no discount.

Can see some downside SP movement as a consequence but with no debt and 102m of cash will be riding the period out and look ahead to more prosperous times beyond 2023.

TPW Half-Yearly-Report-and-Accounts.pdf

Disc Held in RL outside my top ten position

Customer Feedback

As a customer, I am over TPW, in the past 18months I have ordered 4 items, 3 of them did not match the photo or the colours in the product description.

- Product image bright jade green, turned up dark bottle green

- Light fitting, had no photo of ceiling rose, description said black, turned up silver

- Light fitting, image in browns, description says multi coloured, box turns up with colour grey printed on it and yep, the product does not match the image.

In the past, to return the items I had to push for a refund including the postage, despite the product not matching the website description/image. I was told repeatedly, it’s not their fault as the computer screens will have a colour variance. (Yep, totally get that, my partner is a photographer, and my computer screen is calibrated.) I also checked the images across various devices, it’s not a 20-30% colour variation which would be acceptable. It’s an easy way to deflect the return back onto the customer, for those who don’t push back.

To receive a refund for change of mind you need to pay an extra surcharge, otherwise it is a store credit. Return postage is to be paid both ways which is fair enough for a change of mind, but the cost adds up and makes this option prohibitive for large items. My recent light fitting was $30 postage one way, so the return is $63 ($3 return surcharge) on a $200 light.

By the way, if you return the items you are unable to review the product, which by default means you only see positive reviews.

On a positive note, my sister recently received a couch from TPW, she was happy with it, but it was a cheap couch for the kids’ room, so it fitted her expectations.

Branding and Marketing

I think there is a disconnect with the TPW brand and the operating model. Customers assume the product is coming from Temple and Webster, but the dropshipping model means they are promoting product from a vast number of suppliers. The quality of the images/product supplied therefore varies and I believe limits their control. In the customers mind the products are from TPW. It’s not like Amazon where we know the product quality can be variable and is from many suppliers, therefore we don’t blame Amazon when the product does not live up to expectations. In TPW case, we blame TPW.

In the beginning, their ranging and product quality from was good, as they have grown this has diminished in my opinion.

I also had a look at the Build by Temple and Webster, I struggled to see the differentiation between the 2 brands, the website is a direct copy rebranded and the product/price I looked at was the same.

As a side note, the Brosa showroom option is an elegant solution to big furniture online purchases, you make a special trip to check it out, and then buy online. Of course, this is only feasible with a tighter product range and would not work with the TPW ranging, too large and disconnected. I did note however, BTI recently wrote down its Brosa investment, so perhaps all is not well in online furniture land.

So today my fun will be getting TPW to agree, again, that their product description does not match what I received and getting a refund processed…… This is the last time I will purchase from TPW.

Not a huge fan of online retailing but this one appears to be pulling ahead of the peers. Consistently profitable, hitting an ebitda margin of 2-4%, now targeting 3-5% for fy23. i was on the call for FY22. the company appears to have more control over the P&L than others. they also came out with LT target of 15% ebitda margins and $2b rev. previously i saw a study by NYU Stern that measured online retial having a NPAT margin of 5%, the above implies about double that. one interesting comment by management was that bulky goods are hard to get right and it was no surprise that the margins the physical store retailers achieved were high (NCK?). Have entered teh home improvement market and the B2B market. At a $630m market cap, even at current revenues would be 30x with a 5% margin. Worth wathcing. plenty of runway here.

below are teh last 6 half years rev, PBT, and Cfo. controlling the outcome. has been a volatile tiem through C19 but now we start to see the true run rate! its ok. disc not held

A solid update by TPW today reconfirming guidance and launching a new online business that will cater to the home improvement sector currently valued at ~$16B. I have taken a new position after selling out a few month back.

Like the business and imo it's current trading price is very, very attractive.

Trading update The second half of FY22 continues to trade well and in line with management’s expectations with YoY revenue growth of 23% for the period 1st January to the 30th of April vs. the same period in 2021, and up 116% vs 2020.

The full year FY22 EBITDA margin range of 2-4% is reaffirmed and is expected to be ~3% (excluding The Build investment).

As previously stated, our diversified supply chain, including both private label and drop ship, continues to hold up well and underpin growth, and we are in a strong stock position for Q4FY22.

We continue to invest into areas that are building key strategic moats around the business (data, personalisation, AR/AI, logistics) and we will continue to use our strong balance sheet position to further grow organic opportunities, such as our private label offering, whilst leaving room for opportunistic inorganic activity.

Solid Result for T&W for the half

Numbers are strong with revenue growth of 46% for the half and current trading up over 20% to date.

Rock solid balance sheet with no debt and 105.5mill in cash

Good control of expenses seeing ebitda margins 5.1% versus guidance of 2-4%

Like the move into other categories of Trade and Home improvement in terms of growing the revenue line.

Currently both categories are 7% and 4% of revenue but growing at 46% and 95% respectively.

The home improvement is particularly interesting with the development of furniture package options for builders. Feels like a niche play and one that could see some nice margins flow.

AI looks like a real strength of the business and is reflective of the moves in the different categories.

Overall the active customers are over 900k and revenue per customer increased for the half.

T&W through the drop shipping (74% of revenue ) method don't appear to have been significantly exposed / impacted significantly to the logistics challenges in terms of timing's and cost increases.

Credit to the business model and quality of the management especially comparative to the likes of Kogan.

This has been and will continue to be a long term hold fro me in real life .

Topped up at sub $8 recently .

Keen on further insights .....

Absolutely agree with @Kaboom re: Augmented reality being a game changer in retail.

Does anyone know of any augmented reality businesses?

I have been looking (sort of), and mostly come across the virtual reality type companies moving around in the gaming space. But are there any in the business space?

Key H1 FY21 Highlights *(2)

• H1 revenue of $161.6m up 118% year on year

• EBITDA of $14.8m, versus $2.3m in prior corresponding period (up 556%)

• Cash flow positive half with ending cash balance of $85.7m (including proceeds of a $40m placement)

• Active customers up 102% to 687k

• Trade and Commercial division grew 89% year on year

*(2) All numbers contained in this announcement are pre-auditor review

DISC~ I hold in Strawman

https://asx.api.markitdigital.com/asx-research/1.0/file/2924-02259079-2A1238772?access_token=83ff96335c2d45a094df02a206a39ff4

30-July-2020: In this LivewireMarkets Buy-Hold-Sell segment, Vishal Teckchandani discusses CCX (City Chic Collective), TPW (Temple & Webster) and UWL (Uniti Group, formerly Uniti Wireless Group) with Tobias Yao from Wilsons (Wilson Asset Management Group) and Arden Jennings from Ausbill.

Tobias and Arden both rate CCX, TPW and UWL as BUYS, and Arden said that both UWL and CCX were high conviction positions for Ausbill, with CCX in both their Ausbil Small Cap Fund and their Ausbill Microcap Fund. However, both WAM Funds (Wilsons) and Ausbill clearly hold all 3 companies in their respective funds.

Tobias also likes IFM (Infomedia) and Arden likes LIC (Lifestyle Communities).

Warning: Vishal's puns could elicit the odd groan...

June 29th, 2020: WAM Funds' Tobias Yao: "The fundie looking for the next Afterpay"

Tobias Yao in the Australian Financial Review

WAM Funds Portfolio Manager Tobias Yao shared his personal investing journey in the Australian Financial Review’s ‘Monday Fundie’ column. Tobias discussed his love of disruptive technologies and business models, the thrill of finding emergent industries and why WAM Funds like online retailer Temple & Webster Group (ASX: TPW).

---

As an aside, I also note that TPW is a company favoured by Claude Walker, who quit his job at The Motley Fool (Claude ran their "Hidden Gems" subscription service) 2 years ago, and is now writing for "A Rich Life". Claude has been bullish on Temple & Webster on Ausbiz' "The Call" in recent weeks (during that episode he mentions TPW while discussing HVN), but I believe he sold out too early and now regrets that decision.

It's a lesson I've also had to learn the hard way - it's not so much to let your winner run, although that's part of it. It's more that when you think something is overpriced, it doesn't mean it won't go even higher, so rather than sell out entirely, just start trimming your position. In other words, if it goes up 50%, sell one third, to take you back to your original weighting, and then rinse and repeat. For example.

However, everybody has to find what works for them personally. I personally like to trim my winners gradually rather than sell out entirely, until the investment thesis is busted, in which case I'll be out PDQ. I've also learned not to muck around when a company is no longer what you thought it was when you invested in it.

I don't personally hold TPW. I find it hard to buy companies that have gone vertical - like they have recently. However, I agree with Tobias and Claude that TPW has the type of retail business model that is going to continue to work very well in our brave new world, and I'd certainly be looking at them if they had a decent pull-back.