This has been (another) disappointing investment for me. So far at least.

I have taken a few days, digesting the FY25 result and reviewing the investment thesis. Putting it in writing is useful, basically because it forces me to do it properly.

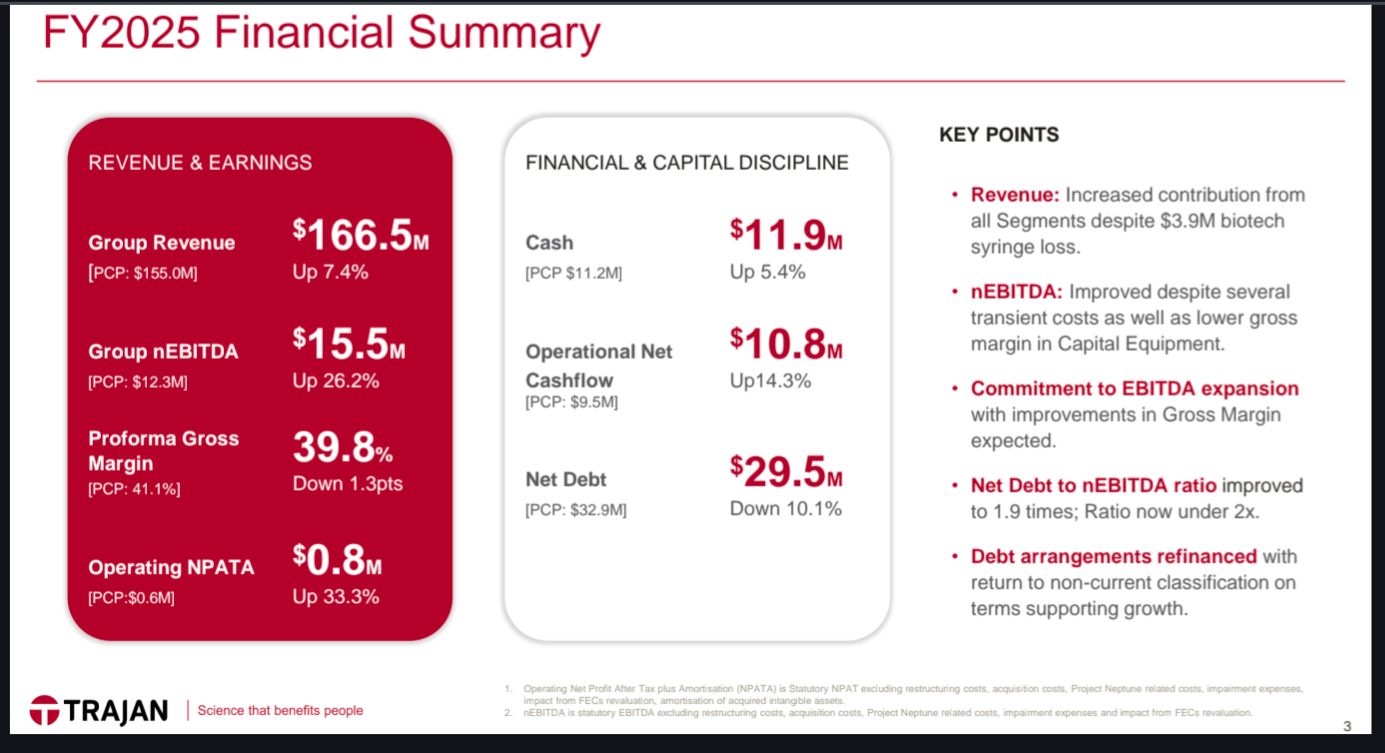

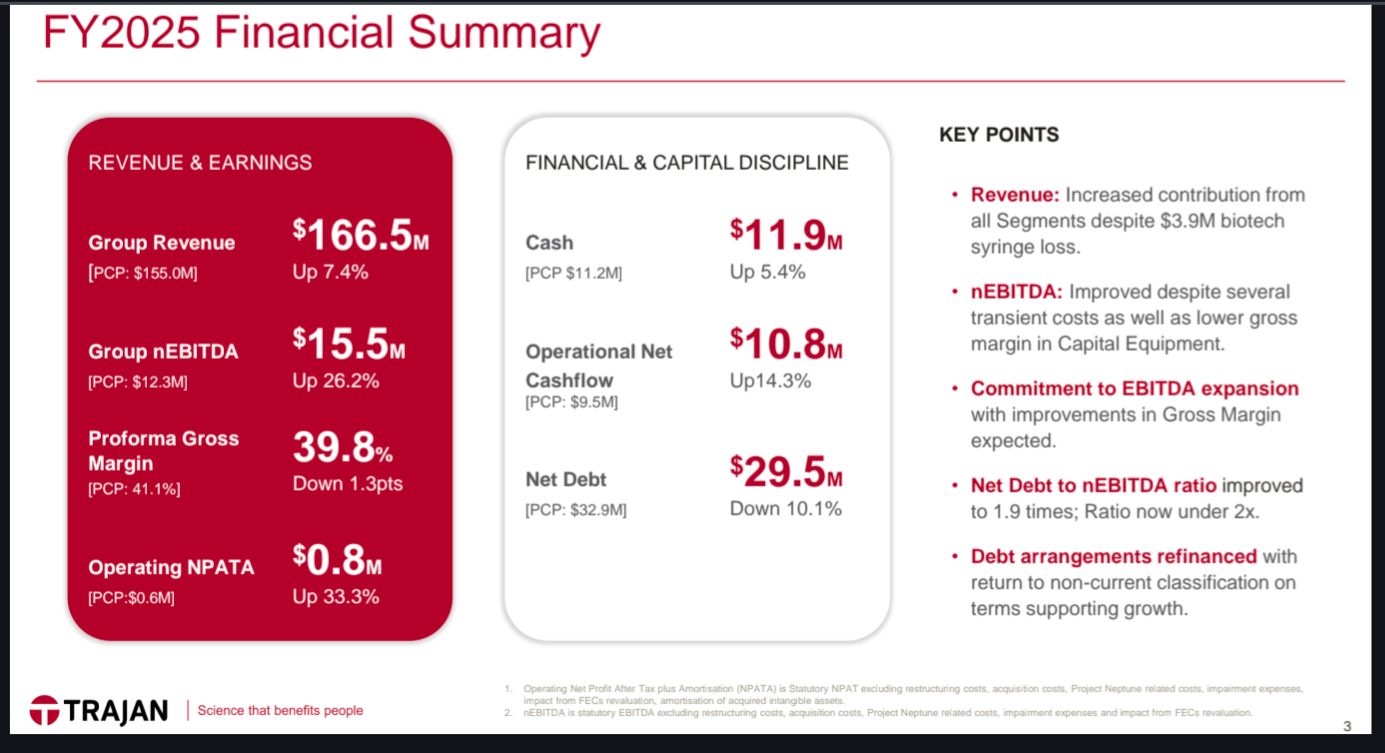

On the surface, the result looks pretty good. Decent increases in revenue and EBITDA. However, they were cycling the FY24 year, which was a terrible result, hit by destocking behaviour. For those who follow Audinate, TRJ experienced a very similar phenomenon, where customers stocked up on consumables following pandemic-related supply issues. This then unwound in FY24. Basically customers ran down their stockpiles back to normal levels and didn't buy anything. Revenue actually dropped from FY23 to FY24.

TRJ Revenue

FY23 $162.2M

FY24 $155.0M

FY25 $166.5M

Viewed across the 3 years, revenue growth is obviously nothing special. Prior years are not comparable due to acquisitions, unfortunately, so we can't get a more long-term picture. Presumably FY23 was slightly inflated by "stocking up", whereas FY24 was artificially low due to destocking. So the 7.4% revenue growth this FY almost certainly overstates the real underlying growth. And is therefore a bit disappointing.

Now on to profitability. Again the published numbers look superficially good. nEBITDA up 26% to $15.5 million. But again, they are cycling a poor result from last year. They missed their initial guidance ($17-19M), as guided in the market update a few weeks ago. The given reasons were: FX revaluation, delays, and tariff announcements requiring "repositioning" of supply chains. As I understand it, manufacturing at the US facility was increased, to avoid tariffs. It is reasonable that doing this would come at a cost, and that it is outside the company's control. However the overall lack of profitability is still a concern.

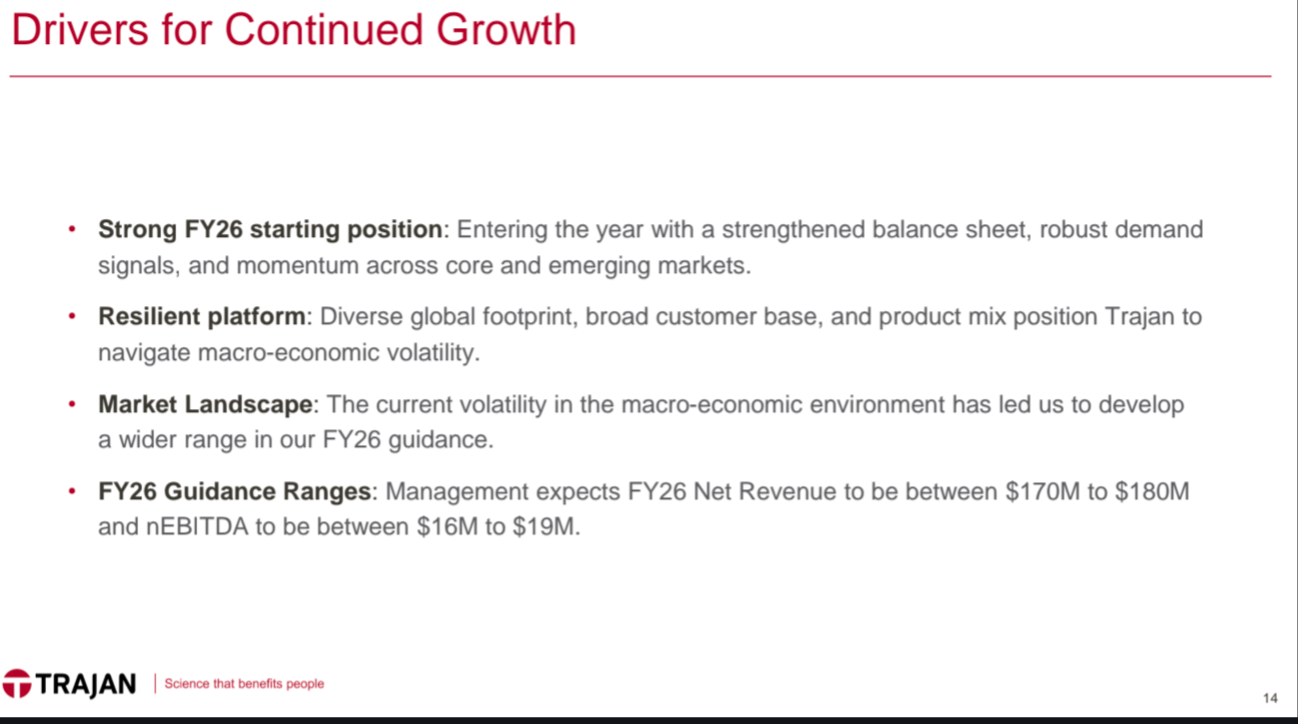

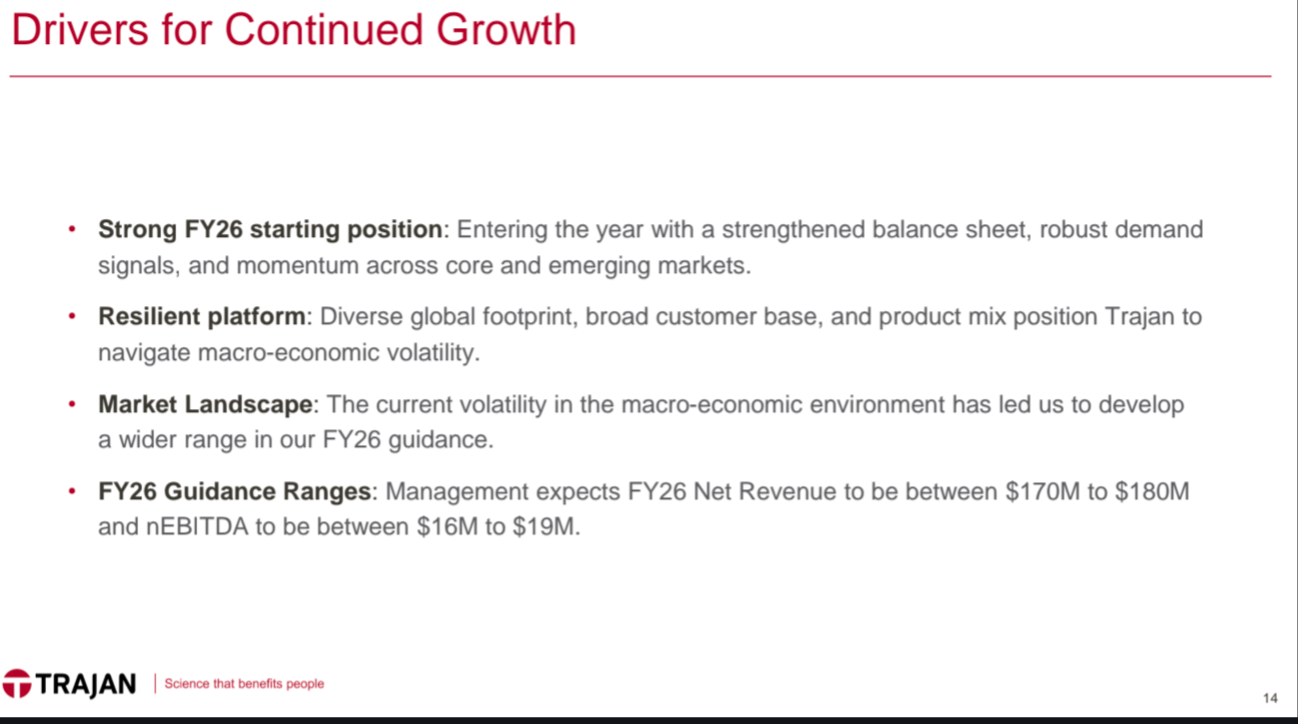

Guidance is interesting:

The overall tone is quite positive. But the guidance for nEBITDA in particular is not inspiring. Perhaps they are being conservative, due the the "macroeconomic environment". But if they are to start advancing towards their stated target of gross margins of 50%, EBITDA would have to improve much more. For comparison, Thermo Fisher Scientific (a much larger international company in the same industry) has EBITDA margins of 20-25%.

Investment Case

I invested in this company because I believed that it was undervalued, mainly due to a spate of acquisitions. It seemed to have been hyped on IPO and made a lot of acquisitions in a very short space of time. Profitability had suffered, the share price had tanked (from an IPO price of $1.70 in 2021, and an all-time high of over $4 in early 2022). The price was cheap relative to revenue. Any kind of improvement in profitability, coupled with long-term revenue growth of 5-7%, would increase the share price. Initiatives to boost profitability, including shifting some manufacturing to Malaysia, were underway and seemed likely to produce benefits.

So is that investment case still intact? Sort of. As is often the case, it hasn't happened as quickly as I would have liked. Profitability needs to improve. Some positive signs are there. But management need to "walk the walk".

The share price is still cheap on a revenue multiple basis (price/sales 0.84, EV/revenue 1.1). By comparison, Thermo Fisher trades on an EV/revenue or 4.8. Although statutory profits don't show it, TRJ is genuinely profitable, with free cash flow $9.3 million (and a market cap of only $138M)

I am prepared to hold for another 6-12 months. Still believe that the upside is greater than the downside. If they can grow revenue at 5% per year, and get their gross margin even halfway from the current 40% to the target of 50%, the share price will be much higher. The downside, given how cheap the price is, seems limited. TRJ makes essential products and has sticky customers. Debt is manageable, cap raises are very unlikely to be necessary.

It's not going to shoot the lights out. But it is pretty low risk, with some significant upside IMO. Some parallels with AHL, for those following that one.