20 February 2025

Half Year Results for FY2

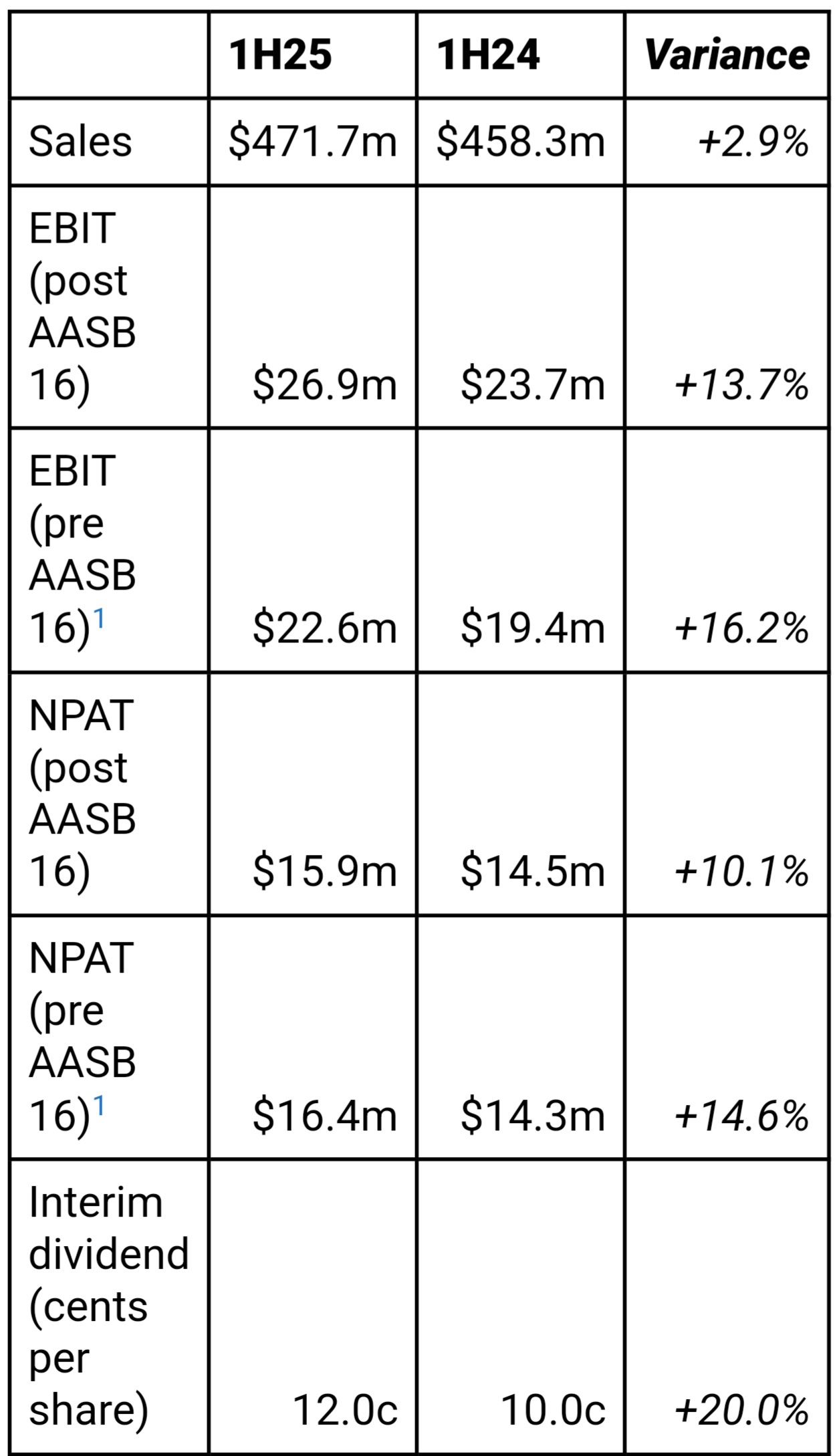

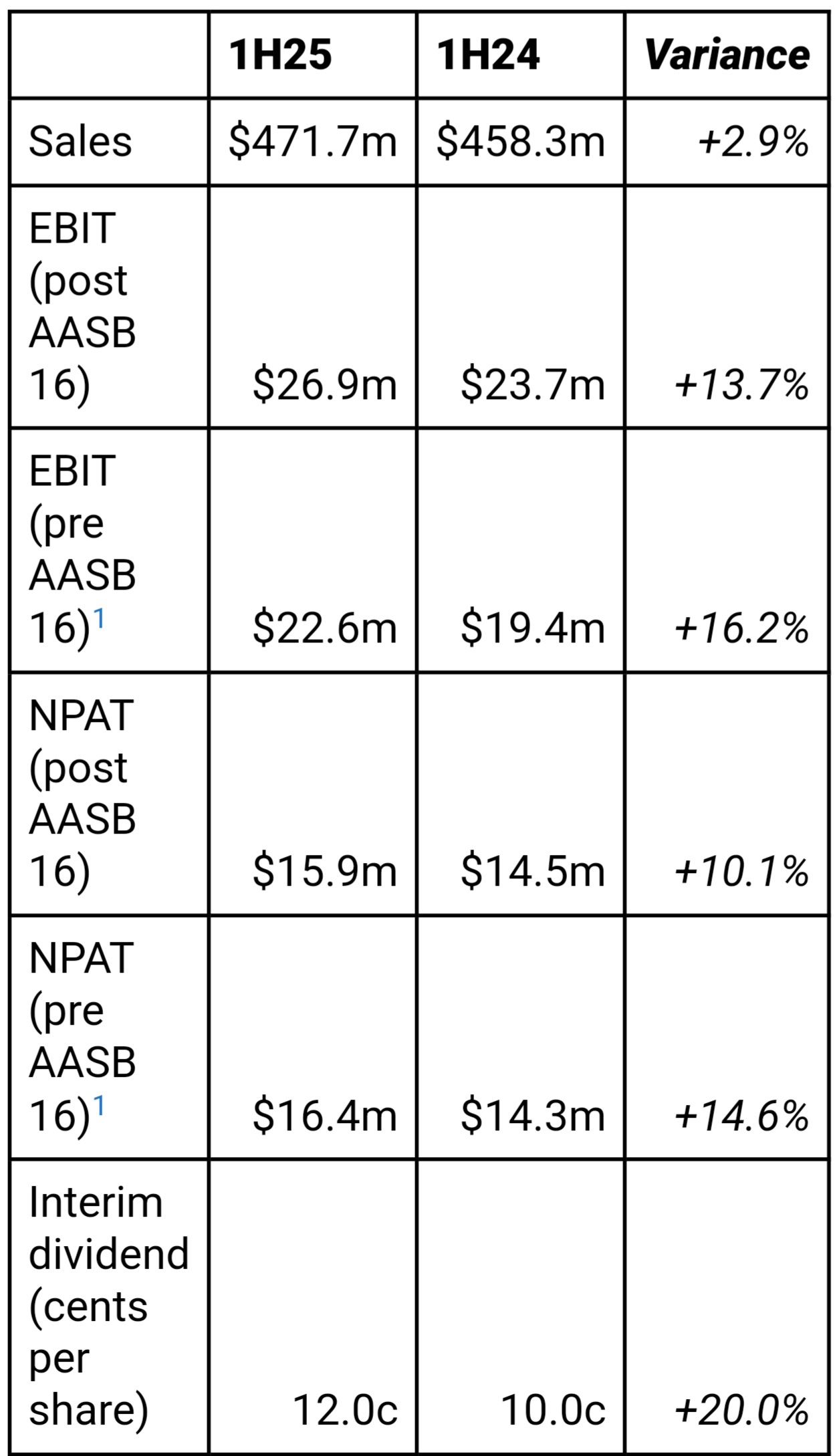

Results Summary

The Chair of The Reject Shop Limited (the Company or The Reject Shop), Steven Fisher, said:

“The Reject Shop reported a strong first half result and, pleasingly, the positive sales momentum has continued into the second half. I am delighted to see a growing number of Australians visiting The Reject Shop to discover our unique, exciting and ever-changing general merchandise and seasonal ranges while also saving money on branded everyday essential items.”

“Management’s focus during FY25 has been to improve gross profit margin, deliver comparable store sales growth and continue opening new stores. These strong results demonstrate that we are currently on track to deliver all three of these objectives this financial year while also maintaining a strong balance sheet, with approximately $75 million in cash and no drawn debt at the end of December 2024.”

“I am also pleased to announce that the Board has determined to pay a fully franked interim dividend of 12.0 cents per share to shareholders.”

Sales

Sales for the half were $471.7 million, up 2.9% on the prior corresponding period (pcp).

Comparable store sales for the half were up 1.5% on the pcp (1Q: +0.3%; 2Q: +2.5%). The improved second quarter performance was driven by a well-executed Christmas trading period, which saw strong sales growth and gross profit margin improvement compared to the pcp, particularly in Christmas categories.

Sales growth during the half was driven by basket growth as well as further customer transaction growth. Most pleasingly, sales growth was driven by both general merchandise and consumables products. Growing general merchandise sales has been a key focus of our strategy and this result demonstrates that the new and improved merchandise offering is resonating well with customers.

Profit (Pre AASB 16)

Gross profit (pre AASB 16) was $196.3 million, which was up 6.1% on the pcp. Gross profit margin was 41.6%, which was up approximately 125 basis points on the pcp.

Management has continued to focus on improving gross profit margin, and, pleasingly, during the half this was achieved without a material improvement in the product sales mix. Over time, the Company is targeting to favourably shift the product sales mix as the general merchandise and seasonal offerings continue to improve and gain traction with customers. For context, higher margin general merchandise (including seasonal) is expected to represent approximately 50% of sales in FY25 compared to approximately 60% in FY19.

Consistent with many Australian retailers, the Company is facing a number of inflationary cost pressures, which were well managed during the half. The pre AASB 16 cost of doing business was 35.5% of sales (compared to 34.8% in the pcp), which was in-line with management’s expectations. Store expenses were 30.6% of sales (compared to 30.3% in the pcp), while administrative expenses were 4.8% of sales (compared to 4.5% in the pcp). Within store expenses, store labour increased to 14.4% of sales (compared to 14.0% in the pcp), while store occupancy costs were again in-line with the pcp at 12.3% of sales.

Store expenses also include the operating costs associated with opening and closing stores 2. These costs totalled approximately $0.8 million in 1H25 (compared to $1.0 million in the pcp).

Depreciation (pre AASB 16) of $6.5 million was $0.4 million higher than the pcp.

EBIT (pre AASB 16) was $22.6 million, which was up 16.2% on the pcp.

Property update

The Company continues to expand its store network having opened nine new stores during the half (mostly during the second quarter).

Management is pleased with the performance of its new store openings and continues to look for new locations where it can conveniently serve more Australians. The Company expects to open a further seven new stores during the second half. Beyond FY25, there is currently a pipeline of approximately 15 new stores.

The Company closed one store during the first half, closed one store during January 2025 and expects to close a further three stores during the second half. Each of these store closures are candidates for potential relocation, with two of these stores confirmed to reopen this calendar year.

At the end of the half, The Reject Shop’s national store network included 393 stores, up from 383 at the end of December 2023. This compares to 354 stores at the end of FY20, after which the Company began more meaningfully expanding its store network.

Balance sheet remains strong

The Company’s balance sheet remains strong with a net cash position at 29 December 2024 of $74.9 million. This compares to a net cash position of $49.9 million at the end of June 2024 and $80.7 million at the end of December 2023. Since the end of December 2023, approximately $7.7 million in cash was returned to shareholders via ordinary dividends and an on-market share buy-back.

As at the balance date, and consistent with the position at the end of June 2024, the Company did not have any drawn debt.

Inventory closed at $143.1 million, which was down from $146.4 million at the end of June 2024.

Dividend

In August 2023, the Company reinstated its previous dividend policy to maintain a minimum dividend payout ratio of 60% of net profit after tax, subject to the underlying profitability and financial requirements of the Company which will be assessed periodically. The Company retains flexibility in deciding how much of the annual dividend is declared as an interim or a final dividend.

The Board has determined to pay a fully franked interim dividend on ordinary shares of 12.0 cents per share (compared to 10.0 cents per share in the pcp). The interim dividend is payable to shareholders registered at 5.00pm on Thursday, 17 April 2025 and is due to be paid to shareholders on Thursday, 1 May 2025.

Trading update

Sales during the first seven weeks of the second half were up 3.6% on the pcp (January +2.5%; February month-to-date3 +6.1%) and comparable store sales were up 1.4% on the pcp (January: +0.4%; February month-to-date3: +3.8%).

In the first seven weeks of the second half, general merchandise sales continued to grow compared to the pcp and gross profit margin has continued to improve on the pcp.

The Company’s first half performance should not be used as an indicator for the second half of the financial year as the Company typically generates a higher proportion of sales in the first half.

Comments from the Chief Executive Officer

The Chief Executive Officer, Clinton Cahn, said: “Our stated priorities for FY25 are to continue to improve gross profit margin while also growing sales through the ongoing improvement of the merchandise offering and expanding our national store network. I am pleased to announce today that, during the first half, the Company generated record first half sales, general merchandise sales returned to growth, gross profit margin (pre AASB 16) improved by approximately 125 basis points, nine new stores were opened and we reported the highest net profit after tax (pre AASB 16) result since the first half of FY18.”

“All of this would not have been possible without the hard work and dedication of each and every one of our committed team members across our stores, distribution centres and store support centre. I would like to thank all of our team members for their contribution and efforts during the half.”

“We are acutely aware that The Reject Shop plays a critical role in supporting Australians who are currently faced with significant cost of living pressures. We do this by helping our customers save money on branded everyday essential items such as cleaning products, toiletries, personal hygiene products, kids lunchbox snacks and pet products. In addition, our team continues to work hard to offer our customers exciting and new general merchandise and seasonal ranges at incredible value. We are focused on offering products that bring joy to our customers during challenging economic times while also making it more affordable for Australians to celebrate seasonal events with their friends and families.”

“The Reject Shop is Australia’s largest discount variety retailer and has a track record of helping customers save money for over 40 years. I would like to invite all Australians, including our shareholders and customers, to shop at any one of our 390+ stores across Australia, experience our exciting product offering and save money on each and every visit.”

This document has been authorised for release to the market by the Board.

Sales for the half were $471.7 million, up 2.9% on the prior corresponding period (pcp).

Comparable store sales for the half were up 1.5% on the pcp (1Q: +0.3%; 2Q: +2.5%). The improved second quarter performance was driven by a well-executed Christmas trading period, which saw strong sales growth and gross profit margin improvement compared to the pcp, particularly in Christmas categories.

Sales growth during the half was driven by basket growth as well as further customer transaction growth. Most pleasingly, sales growth was driven by both general merchandise and consumables products. Growing general merchandise sales has been a key focus of our strategy and this result demonstrates that the new and improved merchandise offering is resonating well with customers.

Profit (Pre AASB 16)

Gross profit (pre AASB 16) was $196.3 million, which was up 6.1% on the pcp. Gross profit margin was 41.6%, which was up approximately 125 basis points on the pcp.

1 Pre AASB 16 results have not been reviewed by the Company’s auditors. 1H25 Pre AASB 16 occupancy costs in EBIT and NPAT have been estimated using cash occupancy costs and include amortised incentive payments received from landlords. Refer to the Appendix of the 1H25 Results Presentation for a reconciliation of Post AASB 16 and Pre AASB 16 results.

Management has continued to focus on improving gross profit margin, and, pleasingly, during the half this was achieved without a material improvement in the product sales mix. Over time, the Company is targeting to favourably shift the product sales mix as the general merchandise and seasonal offerings continue to improve and gain traction with customers. For context, higher margin general merchandise (including seasonal) is expected to represent approximately 50% of sales in FY25 compared to approximately 60% in FY19.

Consistent with many Australian retailers, the Company is facing a number of inflationary cost pressures, which were well managed during the half. The pre AASB 16 cost of doing business was 35.5% of sales (compared to 34.8% in the pcp), which was in-line with management’s expectations. Store expenses were 30.6% of sales (compared to 30.3% in the pcp), while administrative expenses were 4.8% of sales (compared to 4.5% in the pcp). Within store expenses, store labour increased to 14.4% of sales (compared to 14.0% in the pcp), while store occupancy costs were again in-line with the pcp at 12.3% of sales.

Store expenses also include the operating costs associated with opening and closing stores 2. These costs totalled approximately $0.8 million in 1H25 (compared to $1.0 million in the pcp).

Depreciation (pre AASB 16) of $6.5 million was $0.4 million higher than the pcp.

EBIT (pre AASB 16) was $22.6 million, which was up 16.2% on the pcp.

Property update

The Company continues to expand its store network having opened nine new stores during the half (mostly during the second quarter).

Management is pleased with the performance of its new store openings and continues to look for new locations where it can conveniently serve more Australians. The Company expects to open a further seven new stores during the second half. Beyond FY25, there is currently a pipeline of approximately 15 new stores.

The Company closed one store during the first half, closed one store during January 2025 and expects to close a further three stores during the second half. Each of these store closures are candidates for potential relocation, with two of these stores confirmed to reopen this calendar year.

At the end of the half, The Reject Shop’s national store network included 393 stores, up from 383 at the end of December 2023. This compares to 354 stores at the end of FY20, after which the Company began more meaningfully expanding its store network.

Balance sheet remains strong

The Company’s balance sheet remains strong with a net cash position at 29 December 2024 of $74.9 million. This compares to a net cash position of $49.9 million at the end of June 2024 and $80.7 million at the end of December 2023. Since the end of December 2023, approximately $7.7 million in cash was returned to shareholders via ordinary dividends and an on-market share buy-back.

As at the balance date, and consistent with the position at the end of June 2024, the Company did not have any drawn debt.

Inventory closed at $143.1 million, which was down from $146.4 million at the end of June 2024.

Dividend

In August 2023, the Company reinstated its previous dividend policy to maintain a minimum dividend payout ratio of 60% of net profit after tax, subject to the underlying profitability and financial requirements of the Company which will be assessed periodically. The Company retains flexibility in deciding how much of the annual dividend is declared as an interim or a final dividend.

The Board has determined to pay a fully franked interim dividend on ordinary shares of 12.0 cents per share (compared to 10.0 cents per share in the pcp). The interim dividend is payable to shareholders registered at 5.00pm on Thursday, 17 April 2025 and is due to be paid to shareholders on Thursday, 1 May 2025.

2 Store closure costs include the non-cash write-off of assets associated with closures.

Trading update

Sales during the first seven weeks of the second half were up 3.6% on the pcp (January +2.5%; February month-to-date3 +6.1%) and comparable store sales were up 1.4% on the pcp (January: +0.4%; February month-to-date3: +3.8%).

In the first seven weeks of the second half, general merchandise sales continued to grow compared to the pcp and gross profit margin has continued to improve on the pcp.

The Company’s first half performance should not be used as an indicator for the second half of the financial year as the Company typically generates a higher proportion of sales in the first half.

Comments from the Chief Executive Officer

The Chief Executive Officer, Clinton Cahn, said: “Our stated priorities for FY25 are to continue to improve gross profit margin while also growing sales through the ongoing improvement of the merchandise offering and expanding our national store network. I am pleased to announce today that, during the first half, the Company generated record first half sales, general merchandise sales returned to growth, gross profit margin (pre AASB 16) improved by approximately 125 basis points, nine new stores were opened and we reported the highest net profit after tax (pre AASB 16) result since the first half of FY18.”

“All of this would not have been possible without the hard work and dedication of each and every one of our committed team members across our stores, distribution centres and store support centre. I would like to thank all of our team members for their contribution and efforts during the half.”

“We are acutely aware that The Reject Shop plays a critical role in supporting Australians who are currently faced with significant cost of living pressures. We do this by helping our customers save money on branded everyday essential items such as cleaning products, toiletries, personal hygiene products, kids lunchbox snacks and pet products. In addition, our team continues to work hard to offer our customers exciting and new general merchandise and seasonal ranges at incredible value. We are focused on offering products that bring joy to our customers during challenging economic times while also making it more affordable for Australians to celebrate seasonal events with their friends and families.”

“The Reject Shop is Australia’s largest discount variety retailer and has a track record of helping customers save money for over 40 years. I would like to invite all Australians, including our shareholders and customers, to shop at any one of our 390+ stores across Australia, experience our exciting product offering and save money on each and every visit.”