Some notes to help me prime for Friday's meeting.

I'll be honest, my initial assumptions with Vmoto were that it was likely to be a capital heavy, low margin business operating in a highly competitive market. Much of that seems true, but there are some positives.

First some background:

Vmoto entered the ASX via a backdoor listing in 2006, and got into electric scooters via the acquisition of German based E-max in 2009. Between 2012 & 2014, it launched its own e-scooter brand in China.

Over that time it has raised close to $90m and has accumulated losses of over $53m. That being said, in recent times it appears to have turned a corner being consistently profitable and delivering positive operating cash flow since FY19. Moreover, sales have been growing at an impressive clip -- revenues are up 3x since FY18.

Vmoto's vehicles are designed in Europe with manufacturing done at its wholly owned plant in Nanjing, China. It has a warehousing and distribution facility in the Netherlands. It is represented by 53 distributors in 60 countries.

It operates under three brands:

- Vmoto -- aimed at the Asian value market

- E-Max -- a premium product aimed at B2B (dealers) western markets market

- Super Soco -- a third party B2C brand aimed at western markers, for which Vmoto holds exclusive sales and marketing rights outside of China.

The company also does Original Equipment manufacturing (OEM) for other producers.

The company believes it has a first mover advantage in the 2-wheel electric vehicle market -- a market that is growing rapidly and expected to grow at ~32% per year through to 2027.

There are strong regulatory tailwinds in places like Europe, with many countries having mandated EV targets, government subsidies and increased investment in charging stations. There is also increasing adoption of EV vehicles (side note: a friend of mine who is a mad bike enthusiast speaks very highly of electric bikes, which have very high torque and acceleration).

The company is targeting ride sharing and delivery companies. As of last quarter they had 15 delivery customers and 8 ride sharing customers.

The companies manufacturing plant has capacity to produce 10x current production volumes.

At present, it looks like ~85% of revenue are from China, with 6% from Europe, 5% from Singapore and 4% from Australia. However, i'm not sure this represents where actual bikes are sold -- for example, in the recent 3Q, less than 3% of units were sold in China. I'll need to ask Blair about this on Friday.

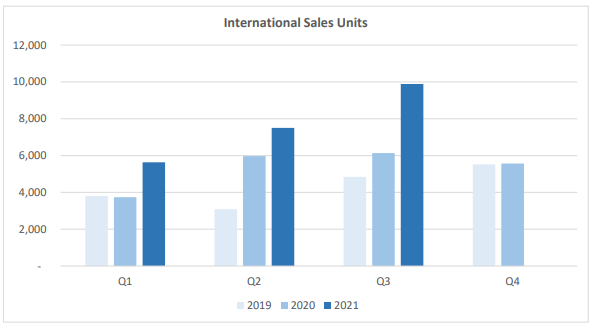

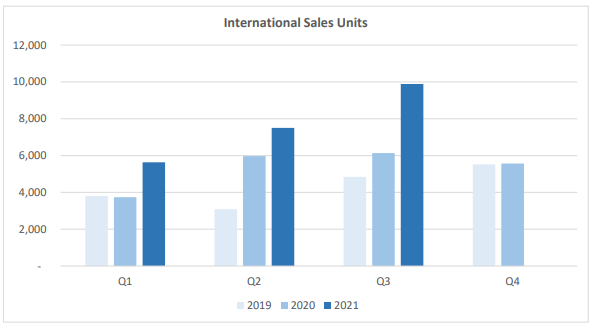

As of the most recent quarter, Vmoto reported a 40% lift in units sold. The last 3 years of quarterly unit sales are as follows:

After a raise in 2020, and thanks to positive cash flow, the company has a cash position of $17m with no debt.

On a trailing 12 month basis (H2 FY20 and H1 FY21 -- they report on a calendar year basis), revenues were $74.2m with net profit of $5.9m (a net margin of ~8%)

With a current market cap of $118m, that puts shares on a PE of 20. If they maintain sales momentum, and margins, that seems pretty reasonable.

Risks/questions

- Is there any risk with the Chinese manufacturing license? How easily could this be taken away and what would that mean?

- What are the expected costs of expanding into India and the US?

- What is the breakdown between B2B and B2C and what are the differences in margins? Which segments have the better growth prospects?

- What are the near to medium term capital investment requirements? Does the company have enough cash, debt facilities to meet these?

- Who carries the inventory risk -- dealerships or Vmoto?