Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

I no longer hold Vmoto and I don’t follow it anymore. However, I just happened to notice an email from Equitise (Crowd Sourced Funding) who are raising funds for a potential competitor, Savic Motorcycles. I thought Strawfolk following Vmoto might be interested in what else is on the horizon.

Investment Highlights:

- Innovative In-House Developed Technology including the bike’s proprietary motor and inverter system and a sophisticated lithium-ion battery, which is incorporated into a modular powertrain unit. It also includes disruptive vehicle software, cloud architecture and IoT data processing system.

- Experienced & Passionate Teamconsisting of engineers, advisors and executives from Ford, Harley-Davidson, Triumph, Toyota and Bosch Rexroth.

- Early Traction has seen the team build a community of over 20,000 followers across its database and social channels, and has secured 250 pre-orders, the equivalent of $6m in revenue.

- Game-Changing Design has seen the team receive several awards in their short history, including Good Design’s automotive and transport award and the Victorian Premier’s Design Award.

within their latest report all looked rosy except - one important ‘quiet fact’ :- Q1 new orders are quite lot lower than same time last year.

Vmoto released a new presentation on 16 May. I don’t think there is anything within it that we don’t already know. However, it’s a nice we’ll-presented overview of the business. It covers how it’s been performing and it’s future direction.

I have a small holding IRL in VMoto and the business is going quite well. I don’t see Vmoto shooting the lights out but it looks like it might be a steady performer going forward. The share price has also been reasonably stable this year in a very volatile market. A few highlights copied below:

On the 13 May Director Shannon Coates bought 60,000 shares in Vmoto for an average price of $0.385 per share, total $23,000. https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02522114-6A1091908?access_token=83ff96335c2d45a094df02a206a39ff4

Disc: Held IRL

There will be some dilution to Vmoto shares following this ASX announcement today (04/04/22). However, this strategic partnership with the Castiglioni family who has over thirty years of history in the motorcycle industry, and having previously owned some of the most iconic and successful motorcycle brands and companies worldwide (such as the iconic and prestigious MV Augusta) looks to be a huge vote of confidence and a much needed shot in the arm for Vmoto.

Mr Giovanni Castiglioni also has options to take up a further 21 million shares over the next 3 years, the largest tranche being 8 million shares at 65c three years from now.

I think the news will be viewed very positively by the market,

Global electric vehicle company Vmoto Limited (ASX: VMT) (Vmoto, or the Company) is pleased to announce that it has entered into a strategic advisory and investment agreement with Giovanni Castiglioni (Castiglioni) along with a partnership and investment agreement with Graziano Milone (Milone), both well-known and experienced European entrepreneurs, investors and executives in the global motorcycle industry.

The Castiglioni family has over thirty years of history in the motorcycle industry, having previously owned some of the most iconic and successful motorcycle brands and companies worldwide such as the iconic and prestigious MV Augusta. The style and design of the most successful MV Agusta motorcycles were conceived during the Castiglioni family management. The strategic agreement with Castiglioni will consist of a direct investment in Vmoto as well as the appointment of an advisor to Vmoto's board of directors with the objective of developing new sales opportunities and marketing strategies, both in the European market and globally. Castiglioni will also share his vast experience in motorcycle designs and collaborate with Vmoto on the development of new motorcycle products for the Company.

At the same time, Vmoto has also appointed Mr. Graziano Milone, partner of Vmoto's joint venture in its Italian distribution company, Vmoto Soco Italy srl (VSI), as the Company's Chief Marketing Officer / President of Strategy and Business Development. Milone is an experienced entrepreneur with a proven history of success in numerous sectors, including the distribution of motorcycles. Milone has successfully developed and increased sales for a number of renowned international trading and manufacturing groups in Italy and Europe. The Company, through VSI, has entered into an investment agreement with Milone.

Along side the direct investment in Vmoto, Castiglioni will also make an investment in VSI. Following the Castiglioni investment into VSI, both Castiglioni and Milone will each own 25% of VSI (together 50%), while Vmoto will retain a 50% interest in VSI.

Photo: Mr Giovanni Castiglioni (left hand side) and Mr Graziano Milone (right hand side) signing the agreements to enter strategic partnership and investment with the Company.

Giovanni Castiglioni commented: “I have been working unofficially alongside the members of the Vmoto team for some time and I am pleased to formalize this relationship. I am excited about Vmoto's growth potential and confident that with the Company's unique and innovative products, established B2B and B2C markets, and the strong vision of Charles and his team, the Company is on the verge of becoming one of the most successful players in the electric urban mobility space. I want to thank Charles for the trust in me and Milone for his foresight and commitment to the strategic development of Vmoto both in Italy and globally. I am very proud and excited to support them in this fantastic endeavor".

Charles Chen, Managing Director of Vmoto, said: “I am thrilled to have someone as experienced and successful as Giovanni not only joining our share register, but also coming on board as the new team member as a global advisor who focuses on our sales strategies, global marketing and development. His experience and impressive track record in the global motorcycle industry gives me great confidence in his ability to support Vmoto in delivering unprecedented growth and success, enhancing the Company's already bright future. I am also thrilled to consolidate my friendship and collaboration with Graziano Milone who, in addition to playing a strategic and important role for Vmoto, has increased his stake in the Company as a demonstration of the trust he places in Vmoto".

Graziano Milone, CMO / President of Strategy and Business Development commented:" I am very happy that Giovanni joins our team and I am sure that his experience and contribution will be an integral part of Vmoto’s growth. His experience in style and image will be important for the development of Vmoto's future products. On this occasion, I thank Charles and his team for the trust he placed in me".

Vmoto recently announced a record preliminary financial result for financial year 2021, confirming its status as a leader in the manufacturing and distribution of zero-emission electric motorcycles/mopeds, both in the B2B and B2C markets. The Company achieved an unaudited net profit after tax of $8 million, strong operating cash flows, highly liquid working capital and a strong cash balance with no bank debt.

Vmoto's position as a leading electric motorcycle/moped company in Europe, combined with a well-established and competitive manufacturing base in Nanjing, has led to strong financial performance by the Group in recent years and has enabled the Company to take advantage of the incredible opportunity presented with the global electrification of the entire transport industry. The significant and fast growing market opportunity in front of the Company, has attracted Castiglioni to become an investor and shareholder in Vmoto.

The Company recently attended the latest international EICMA show, where it successfully launched the new Vmoto "Stash” project, a 7kw urban electric motorcycle. In addition, the Company has several new models in the pipeline, to be released in the coming 36 months, which will enable Vmoto to consolidate its position as one of the world’s most significant producers of premium electric two-wheel vehicles.

Investment Agreement

Castiglioni and Milone have agreed to subscribe for 1.2 million and 300,000 Vmoto Shares respectively, at an issue price of the lower of $0.36 per share; and the market price per share as at the Completion Date less 15%. They have also subscribed for 21 million and 2.1 million free attaching options respectively (on the material terms set out in Tables 1 and 2 below) which, if exercised, will inject a further $12.9 million in cash into the Company. The Shares and Options will be issued pursuant to the Company's 15% annual placement capacity.

Vmoto Soco Italy srl (VSI”)

Castiglioni, through his nominee, has also agreed to acquire a 25% interest in Vmoto’s Italian distribution company, VSI, from the existing 50% joint venture partner. Mr Milone, through his nominee, will retain a 25% interest in VSI and Vmoto will maintain its 50% interest in VSI.

VSI serves as an important international distribution arm for the Italian market and actively facilitates Vmoto's growth in pursuing business opportunities around the world.

In addition, Vmoto has agreed with each of Castiglioni and Milone, to a put and call option to acquire all of the shares held by Castiglioni's nominee and Milone's nominee in VSI, the share price of which is tied to an EBITDA multiplier based on the 2023 and 2024 performance of VSI. The put and call option periods commence on the date of approval of the financial statements of VSI for the 2024 financial year and lapse 6 months thereafter.

European Design and Products Development

It is important to underline that Vmoto has in addition to the strategic partnership with Castiglioni and the key global appointment of Milone, inaugurated the European design and product development center in Italy. The first products designed for new Vmoto premium series are the result of the collaboration with C-Creative, one of the leading design and engineering centers in the sector, led by the world famous designer, Mr. Adrian Morton and the key engineer, Mr. Paolo Bianchi. Together they have created some of the most iconic and successful motorcycles of the past 20 years.

Photo: First model of VMOTO new premium product series, VMOTO STASH

Table 1 – Option Terms issued to Mr Giovanni Castiglioni (or his nominee)

Table 2 – Option Terms issued to Mr Graziano Milone (or his nominee)

-ends-

Substack post from Adam Rosato:

https://chequematemedia.substack.com/p/vmoto-asxvmt-riding-the-ev-megatrend

If you are interested, you are going to have to follow the link. It is worth the read with well thought out arguments on the market opportunity, strengths and risks.

On 31 January Vmoto provided an update on its activities for the quarter ended 31 December 2021 (4Q21). Vmoto said it delivered strong operational and commercial performance, driven by increasing demand for the Company's products, particularly its B2B products.

Highlights

• 7,410 units in total sold in 4Q21, in line with the Company's expectations, bringing total unit sales for FY21 to 31,275 units, up 33% on FY20 and up 57% on FY19

• Record international unit sales for FY21 of 29,945 units, up 40% on FY20 and up 74% on FY19

• Strong positive operational cash flows for 4Q21

• Strong net cash position of A$18.6 million, with no bank debt as at 31 December 2021

• Firm international orders of 12,488 units as at 31 December 2021, providing a very solid runway for FY22 sales

• New international distributors appointed, and ongoing discussions and samples shared with a number of potential new B2C and B2B customers

• Vmoto expanded its partnership with Helbiz (NASDAQ: HLBZ), an intra-urban transportation company headquartered in New York, USA, and will supply 2,000 additional electric mopeds to Helbiz for deployment in the Italian market

• Vmoto launched new VMOTO premium brand and products and exhibited its new and existing range of products at 2021 EICMA, a world class international motorcycle exhibition

4Q21 Sales Performance

During 4Q21, Vmoto sold a total of 7,410 units, with more than 93% of units being sold into international markets, while just under 7% of units were sold into the Chinese market. Total international units sold in 4Q21 of 6,917 units was up 23% on 4Q20 and up 6% on 4Q19, demonstrating continued strong momentum in the business.

Sales figures from 4Q21 are in line with the Company’s expectations and reflect general seasonal fluctuations, including the National Day holiday in China in October 2021.

Record international sales units were delivered for FY21 with 29,945 units sold into international markets (excluding China), up 40% on FY20 and up 74% on FY19.

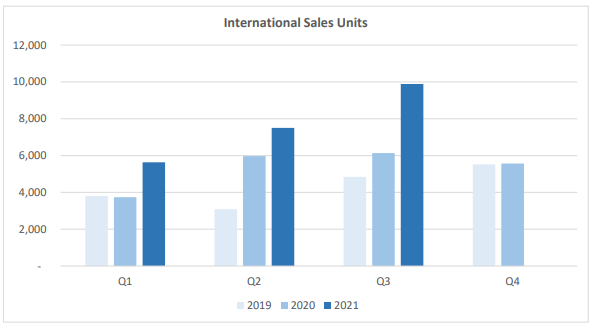

The chart below illustrates the Company’s historic international unit sales, by quarter, for the previous three financial years:

My Take

Three weeks ago Noddy shared the profit guidance announcement: “Vmoto expects to achieve net profit after tax (NPAT) of between $7.5 million and $7.8 million for FY21 (the final results being subject to completion and independent audit)”

There was no confirmation in the 4Q update which I thought was a bit strange.

Sales versus Orders

Total Sales were 7410 units for the quarter, down on 2Q and 3Q spoiling what appeared to be an increasing quarterly trend. However, keeping an eye on the order book, this was to be expected.

Orders over the last 3 quarters were trending down which had me concerned. It would appear that international orders for Vmoto can be quite lumpy!

The good news is that firm International Orders at end of 4Q were for 12488 units. Looking at the Sales versus Orders graph I prepared below, the 4Q order book appears to be an all time record for Vmoto beating 4Q20 by 13.5%.

Looking at the table below it seems that sales lag orders by 1 to 2 quarters. Sales for 4Q21 (7410) is somewhere between the orders for 2Q21 (9639) and 3Q21 (6067), which is what you might expect.

Projecting forward with the order book at 12488 units, we could reasonably expect sales for 1Q22 to be upwards of 10,000 units and possibly one of Vmoto’s best sales quarters.

Going Forward

Given there is a strong order book going into FY22 and the EV tailwinds, I feel reasonably confident that sales will continue to increase strongly going forward. I like the look of the new SuperSocco range which is expected to attract a premium market in US, Europe and Australia.

The legal dispute with their Chinese partner hasn’t been resolved yet which clouds things a little for now.

Valuation

I’m happy to retain my current valuation of 63c for now, however I won’t be buying further shares above 42c until I see the order book continue to grow next quarter and the legal dispute with their Chinese partner resolved.

Disc: Held IRL and SM

FY21 Profit Guidance

Global electric vehicle company, Vmoto Limited (ASX: VMT) (the Company or Vmoto) is pleased to advise that the Company has continued to ramp up its international growth strategy and expects to achieve net profit after tax (NPAT) of between $7.5 million and $7.8 million for FY21 (the final results being subject to completion and independent audit), which is a signifcant increase on FY20 NPAT of $3.7 million and will be the largest net profit ever achieved in Vmoto’s history.

During FY21, Vmoto achieved a number of key operational and commercial milestones, which included:

- Record expected NPAT for year ended 31 December 2021, the highest since Vmoto's establishment

- In excess of 30,000 units sold in FY21, a significant increase on the 23,547 units sold in FY20

- Positive operational cash flows for FY21

- Strong cash position with no bank debt as at 31 December 2021

- Additional international B2C distributors secured, bringing the total to 58 across 62 countries

- Strong growth across B2B operations, leveraging the increased popularity of last mile delivery and ride-sharing services

- Launch of the new Vmoto premium brand and associated products

***

It's a strong result which the market has responded to appreciatively. It's about in-line with where I had them, but although I have a valuation of closer to 60 cents I haven't pulled the trigger here as my concern is it's forward order book. Rick has a nice graph of how this has been trending and I'd want to see that turning around before I thought more seriously about investing. Still, it's a excellent result for a company of this size in this industry.

[Not held]

Late yesterday afternoon Vmoto released an ‘immaterial’ ASX announcement which almost slipped under my radar. Vmoto said the announcement was in response to speculation about the Vmoto Soco joint venture agreement in China.

Under the agreement Vmoto retains exclusive sales and marketing rights for “E-Max” and “Super Soco” products globally, excluding China, while Soco Shanghai retains exclusive sales and marketing rights for “Super Soco” products and is granted exclusive sales and marketing rights for "E-Max" products for the China market.

In the announcement Vmoto said it ‘has been forced to take certain legal actions in China to protect its rights and to ensure Soco Shanghai meets its obligations, under the Agreement.’

My guess is it will remain ‘immaterial’ if Vmoto’s understanding of the agreement is valid and Soco Shanghai sticks to their end of the bargain!

Some notes to help me prime for Friday's meeting.

I'll be honest, my initial assumptions with Vmoto were that it was likely to be a capital heavy, low margin business operating in a highly competitive market. Much of that seems true, but there are some positives.

First some background:

Vmoto entered the ASX via a backdoor listing in 2006, and got into electric scooters via the acquisition of German based E-max in 2009. Between 2012 & 2014, it launched its own e-scooter brand in China.

Over that time it has raised close to $90m and has accumulated losses of over $53m. That being said, in recent times it appears to have turned a corner being consistently profitable and delivering positive operating cash flow since FY19. Moreover, sales have been growing at an impressive clip -- revenues are up 3x since FY18.

Vmoto's vehicles are designed in Europe with manufacturing done at its wholly owned plant in Nanjing, China. It has a warehousing and distribution facility in the Netherlands. It is represented by 53 distributors in 60 countries.

It operates under three brands:

- Vmoto -- aimed at the Asian value market

- E-Max -- a premium product aimed at B2B (dealers) western markets market

- Super Soco -- a third party B2C brand aimed at western markers, for which Vmoto holds exclusive sales and marketing rights outside of China.

The company also does Original Equipment manufacturing (OEM) for other producers.

The company believes it has a first mover advantage in the 2-wheel electric vehicle market -- a market that is growing rapidly and expected to grow at ~32% per year through to 2027.

There are strong regulatory tailwinds in places like Europe, with many countries having mandated EV targets, government subsidies and increased investment in charging stations. There is also increasing adoption of EV vehicles (side note: a friend of mine who is a mad bike enthusiast speaks very highly of electric bikes, which have very high torque and acceleration).

The company is targeting ride sharing and delivery companies. As of last quarter they had 15 delivery customers and 8 ride sharing customers.

The companies manufacturing plant has capacity to produce 10x current production volumes.

At present, it looks like ~85% of revenue are from China, with 6% from Europe, 5% from Singapore and 4% from Australia. However, i'm not sure this represents where actual bikes are sold -- for example, in the recent 3Q, less than 3% of units were sold in China. I'll need to ask Blair about this on Friday.

As of the most recent quarter, Vmoto reported a 40% lift in units sold. The last 3 years of quarterly unit sales are as follows:

After a raise in 2020, and thanks to positive cash flow, the company has a cash position of $17m with no debt.

On a trailing 12 month basis (H2 FY20 and H1 FY21 -- they report on a calendar year basis), revenues were $74.2m with net profit of $5.9m (a net margin of ~8%)

With a current market cap of $118m, that puts shares on a PE of 20. If they maintain sales momentum, and margins, that seems pretty reasonable.

Risks/questions

- Is there any risk with the Chinese manufacturing license? How easily could this be taken away and what would that mean?

- What are the expected costs of expanding into India and the US?

- What is the breakdown between B2B and B2C and what are the differences in margins? Which segments have the better growth prospects?

- What are the near to medium term capital investment requirements? Does the company have enough cash, debt facilities to meet these?

- Who carries the inventory risk -- dealerships or Vmoto?

Vmoto is one of my top 10 stocks by portfolio weight IRL. The Q321 market update released on 2 November highlighted some outstanding sales results:

• 10,142 units in total sold in 3Q21, up 40% on 3Q20 and up 52% on 3Q19

• International sales of 9,889 units for 3Q21, up 61% on 3Q20 and up 104% on 3Q19

• Positive operational cash flows for 3Q21

• Strong cash position of A$17.4 million, with no bank debt as at 30 September 2021

• Firm international orders of 6,067 units at 30 September 2021, providing a solid runway for FY21sales

• New international distributors appointed, and ongoing discussions and samples shared with a significant number of potential new B2C and B2B customers in new markets

• Vmoto exhibited its brands and products at a number of the world class electric motorcycle racing events, FIM ENEL MotoE World Cup (“MotoE”) across Europe during 3Q21

The 5th dot point (international orders) may be something to watch going forward. Since Q420, when the orders peaked, there has been a trend downwards in orders. Hopefully this is just a COVID related blip!

I’ve plotted the Sales (blue) and Orders (orange) from quarterly updates since Q319 on the graph below. As you can see there seems to be about 2 - 3 quarters lag time between when orders are received and the realisation of sales. I think Vmoto is in for a pleasing FY21 result, however I will be watching the trend in orders and sales more closely in future quarterly updates.

31-Aug-2021: Euroz Hartleys coverage of Vmoto Results (see attached file) - Buy/$0.74 PT

Analyst: Harry Stevenson

Half Year Results, Key Points:

VMT has released it’s half year accounts showing continued strong growth ahead of our forecasts.

- Revenue of $39.3m (EHL $34.9m) generated on total unit sales of the 13,723 (~$2.86k per unit vs EHL $2.5k).

- Revenue up 50% YOY (1H’20 $26.2m)

- EBITDA of $5.4m up 100% (up $2.7m in PY).

- NPAT of $4.0m (EHL $3.1m) up 119% on 1H’20.

- Vmoto Soco Manufacturing; the groups JV with Super Soco Intelligent Technology generated profit for the period of $1.2m – VMT’s 50% share $.61m

- Cashflow from operating activities of $1.7m with a cash position of $16.7m as at 30 June up from $15m as at 31 December.

- NTA of $39m

- On annualised half year results VMT trades circa ~11x P/E; with second half likely stronger again.

Investment Thesis

VMT has delivered a strong 1H’21 result ahead of our forecasts. Margins across the board were stronger than anticipated with increasing returns to scale. VMT management have highlighted that they remain confident that they will be able to deliver strong sales and revenue growth for the remainder of FY’21. We maintain our Buy Recommendation and $0.74/sh Price Target.

Vmoto Ltd (VMT)

- Share Price: $0.33 (31-Aug-2021)

- Price Target: $0.74

- Valuation: $0.74

- Shares on issue: 278.3 m(dil)

- Market Capitalisation: $91.8m

- Enterprise Value: $75.6m

- Debt: $0.45m

- Cash: $16.7m

Disclosure: I do not hold Vmoto shares.

What does Vmoto do?

Vmoto designs, manufactures and markets electric two-wheel vehicles including electric mopeds and motorcycles. The company offers its products primarily under the Vmoto, Super Soco, and E-Max brand names. Vmoto Limited was incorporated in 2001 and is based in West Perth, Australia. Vmoto has a market cap of $107 million.

Vmoto owns a 30,000 sqm state of the art manufacturing facility in Nanjing, China; capable of up to 10x current production. It also owns a European subsidiary and warehouse in the Netherlands to support the strategic focus of accelerating sales into the European market.

Global coverage includes Europe, Asia Pacific, North America, South America, Australia, New Zealand and South Africa. European sales are most advanced with international units representimg 91% of CY2020 units sold.

Vmoto has a global B2C distribution network of 46 international distributors and 1,200 dealers in over 50 countries, with dealers' networks increasing.

Vmoto’s E-Max range of electric mopeds has secured a reputation in the international market as one of the best performing electric two-wheel delivery vehicles available.

There is also Increasing popularity of food delivery, third party delivery services and ride-sharing due to advances in app technology and mobile networks.

Electric performance

Vmoto is performing strongly both on and off the track!

In its latest ASX announcement (15 June) Vmoto said they had signed a sponsorship and marketing agreement to supply scooters and exhibit its brands at the world class electric motorcycle racing event, FIM ENEL MotoE World Cup (“MotoE”) during the 2021-2023 season.

Vmoto said the European electric scooter and motoryclce market is of strategic importance to Vmoto and is estimated to grow to US$758.5 million by 2025 equating to the second-largest market after Asia Pacific.

Off the track Vmoto is also performing extremely well! Revenue has grown over 840% over 3 years to $61 million (2017 - 2020). Over the same period Vmoto has gone from a loss of $6.3 million to a profit of $2.34 million.

Down the track revenues are forecast to more than double to $132 million (Dec 2023) and profits to grow over 250% to $9.7 million, ie. a 30% annual earnings growth over 3 years (Simply Wall Street data, 1 analyst S & P Global, see graph below).

Market Update (3 May 2021)

In the Market Update Vmoto announced:

- 5,869 units in total sold in 1Q21, up 42% on 1Q20 and up 54% on 1Q19.

- Positive operational cash flows for 1Q21

- Strong cash position of A$15.8 million, with no bank debt as at 31 March 2021

- Firm international orders of 10,702 units as at 31 March 2021, including the significant B2B order from Greenmo Group, with 3,864 units remaining to be delivered in 2Q21, providing a solid runway for FY2021 sales

- New international distributors appointed, and ongoing discussions and samples shared with a significant number of potential new customers in new market

- GO Sharing successfully raised EUR50 million (approximately A$77.8 million) with ambitions to further expand its ride-sharing operations into new markets

- Vmoto expanded its B2C product offering with the launch of three new B2C electric two-wheel vehicle models, the new TS, the new TC and CUmini model, unveiled at the 2021 Vmoto Soco

Valuation

Assuming Value = E/S x PE

= $9.7 million* (Forecast 2023 E) / 279 million (shares outstanding) x 25^ = $0.97

^I have used a PE of 25. I think this is reasonable given earnings are forecast to grow at 30% per year over the next 3 years.

*Simply Wall Street data

Now, discount at 10% per year over 3 years

= $0.97 x 0.7 = $0.68

The Simply Wall Street DCF value is $0.63.

Assuming the lower value estimate of $0.63 per share, VMT is undervalued by 63% (closed @ $0.385 on 7 July 2021).

Vmoto's future strategy

Vmoto continues to execute on its strategy of selling high performance and value electric two-wheel vehicles into international markets and continues to build both its B2B and B2C distribution network worldwide.

As the COVID-19 situation continues to evolve around the world, especially in India, the Board and Management remain in continuous discussion and preparedness, should the implementation of a revised strategy be required. However, having ended the 2020 financial year in a strong operational and financial position following numerous commercial achievements, the Company is confident in the strength of its global growth strategy and therefore, expects similar levels of growth to be delivered for the 2021 financial year.

Vmoto continues to focus on expanding its product range to extend its reach and appeal to a broader spectrum of the market for electric vehicle users, following the successful launch of 3 new B2C models in February 2021 and a new B2B electric delivery two-wheel vehicle in April 2021.

Additionally, Vmoto is evaluating and developing a new electric delivery three-wheel vehicle in consultation with its existing and new B2B customers, and is in discussions with a top European industrial design company with the objective of developing new electric two-wheel vehicle models to further enhancing the Company’s product range.

The global focus on mitigating the impacts of climate change and the transition towards electric vehicles provides Vmoto with a strong platform from which to accelerate its growth. As a result, the Company has broadened its commercialisation strategy and is confident it will be able to continue delivering strong sales and revenue growth in the coming year and beyond.

Disc: Added to RL portfolio

03-Mar-2021: Euroz Hartleys: Vmoto (VMT (Buy): Strong Full Year Results

Analyst: Harry Stevenson - Industrials Analyst, +61 8 9488 1429

Recommendation: Buy, Price Target: $0.78/sh (up from $0.72/sh)

Strong Full Year Results

Investment case

VMT has released unaudited preliminary final results for the full year ended 31 December 2020. Results for the year were strong across the board with the company exceeding our previous forecasts (adjusted for impact of share based payments approved late in the year). With the award of the of VMT’s largest B2B order from strategic partner Greenmo Group in early FY’21 we look for a step change in unit sales through FY’21 with the company set to benefit from easing of lockdowns across Europe and continued transition to E-vehicles. The company launched a range of three new vehicles in late February which we expect will be well received given the welcome bump to performance. We have pushed through some adjustments to our full year FY’21 forecasts to reflect FY’20 results and as a result price target rises to $0.78/sh.

Key points

- Total revenue of $61m (vs Euroz $61.3m) up 34% YoY.

- Revenue per unit of $2,591 vs $2,287 in prior year; however this is muddied by inclusion of parts sales. We model FY’21 on a conservative $2,500 per unit.

- GP margins were stronger than anticipated at 23.5% (EHSL 21%); up from 21.1% in prior year.

- Growth in GP margins appears to be a reflection of the operating leverages within the new jointly owned manufacturing company “Vmoto Soco”. While we suspect Vmoto can do a little better we model FY’21 on 23% GP margins.

- EBITDA $5.8m up 101% YoY, adjusted for the impact of the share based payments $6.9m up 319% YoY.

- Strong operating cash flows of $4m; up 139% on PY.

- NPAT of $3.7m up 102% on PY.

- Total sales of 23,547 up 18% YOY, however down on EHSL forecasts of 24,528; given the lower than anticipated Q4 sales results.

- With the receipt of $13m B2B order received from Greenmo Group for 5,904 and record Q1 orderbook position VMT is on track to deliver 10,000 units in Q1’21; 45% of FY’20 total sales.

- Balance sheet position leaves VMT capitalised for future growth with $15m in cash and no debt.

- We have updated our forecasts to reflect FY’20 results as a result price target increases to $0.78/sh.

Vmoto Ltd, Year End: 31 December

- Share Price: 0.47 A$/sh (0.445 on 1-Apr-2021)

- Price Target: 0.78 A$/sh

- Valuation (DCF): 0.78 A$/sh

- WACC: 9.2%

- Terminal Growth: 2.5%

- Shares on issue: 276 m

- Market Capitalisation: 130.8 A$m

- Enterprise Value: 116.3 A$m

- Net Cash Cash (December): 14.5 A$m

Click on the link at the top for the full report, or open the attached file below.

Highlights

• 6,028 units in total sold in 4Q20 in line with the Company's expectations, bringing total unit sales for FY2020 in international and China markets to 23,547 units, up 18% on FY2019 and up 117% on FY2018

• Record international unit sales for FY2020 of 21,416 units, up 24% on FY2019 and up 112% on FY2018

• Continued positive operational cash flows for 4Q20

• Strong net cash position of A$15 million, with no bank debt as at 31 December 2020

• Firm international orders of 6,798 units held as at 31 December 2020, not including the additional significant B2B order from Greenmo Group of 5,904 units secured January 2020

• Currently more than 11,000 firm international orders held, providing runway for strong year of sales for FY2021

• Significant interest from business customers including food delivery, parcel delivery and ridesharing companies for Vmoto’s B2B products and in advanced discussions to secure orders from a number of B2B customers

• New international distributors appointed, and ongoing discussions and samples shared with a significant number of potential new customers in new markets

• Commenced marketing and promotion of the online World Premiere event organised by Vmoto whereby we will launch 3 new electric two-wheel vehicle models in 1Q21

sorry attacment was too big, please follow link

http://www.vmoto.com/assets/uploads/20210114/2021011414441259372.pdf

Vmoto-secures-A$13-million-B2B-order

Vmoto has secured a significant (repeat order) for 5904 units from their strategic B2B Greenmo Group ~ approx A$13M

Units expected to be delivered 1Q21 and to be used for Greenmo Group's European expansion