Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

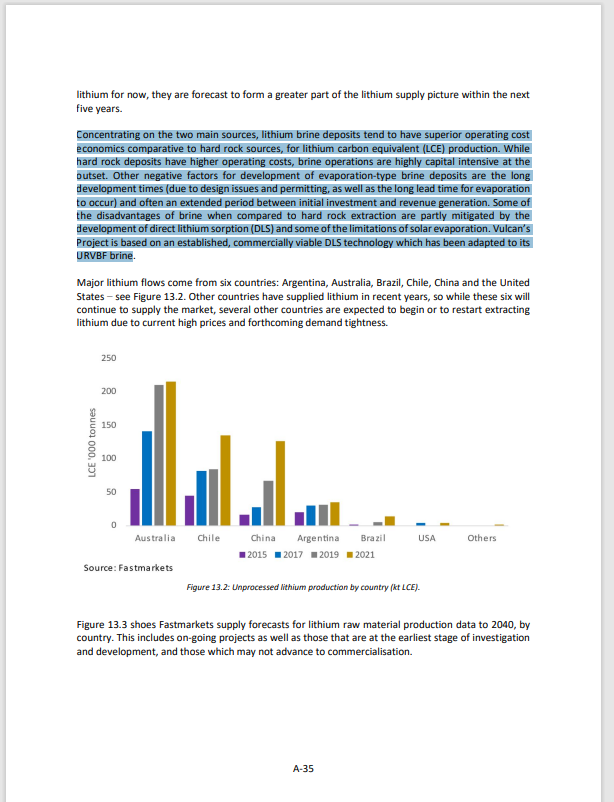

Concentrating on the two main sources, lithium brine deposits tend to have superior operating cost economics comparative to hard rock sources, for lithium carbon equivalent (LCE) production. While hard rock deposits have higher operating costs,

brine operations are highly capital intensive at the outset. Other negative factors for development of evaporation-type brine deposits are the long development times (due to design issues and permitting, as well as the long lead time for evaporation to occur) and often an extended period between initial investment and revenue generation.

Some of the disadvantages of brine when compared to hard rock extraction are partly mitigated by the development of direct lithium sorption (DLS) and some of the limitations of solar evaporation.

Vulcan’s Project is based on an established, commercially viable DLS technology which has been adapted to its URVBF brine

- Release Date: 05/05/23 09:27

- Summary: Prospectus for Regulated Market of FSE (Prime Standard)

- Price Sensitive: Yes

- Download Document 11.66MB

Cheap value, quality or crap?

- Stellantis will become the second largest shareholder in Vulcan, at 8% shareholding, following issue of the fully paid ordinary shares at the 30-day Volume Weighted Average Price (VWAP) of A$6.622 (€4.367) per share which represents ~11.450m shares1 .

- Vulcan and Stellantis have also extended their binding lithium hydroxide offtake agreement (see ASX release 29/11/2021) by five years, to 2035.

- Stellantis is one of the world’s leading automakers and mobility providers. It has a portfolio of 14 vehicle brands and two mobility companies. Stellantis was the market leader in the low emission vehicle category (LEV) for Passenger Cars and Light Commercial Vehicles in the main European countries region in Q1 20222 .

Down from $8 at the end of May to under $5 just recently (approx 30%).

Now up 30% in one day ... back to $6.50. What a ride!

This time for geothermal heat energy, 20yr agreement with German MVV Energie starting 2025.

31st Jan = Signed binding offtake agreement with LG Energy for their Lithium hydroxide.

"Vulcan's current plans for lithium production are now fully booked for the first five years of operation."

Wow, what a strong sales pipeline. Selling something they don't yet have, in contracts for 5yrs at a time, for a time period 3yrs into the future!

Vulcan pushes to keep lawsuit papers secret

From todays AFR - it's behind the paywall so...

Under-siege lithium hopeful Vulcan Energy Resources is pushing to maintain secrecy over documents it has filed in court as part of its lawsuit against research firm J Capital.

Bennett + Co principal Martin Bennett, who is representing Vulcan Energy, told the Federal Court on Tuesday that the national media should not be able to access the company’s court applications or statement of claim, which would detail the grounds on which the firm was suing J Capital.

Mr Bennett said Vulcan Energy believed ‘‘it and its shareholders have been the subject of a short-and-distort campaign, and the publicity of these matters is likely to add to the impact on the market of that campaign’’.

He said Vulcan chief executive Francis Wedin, chairman Gavin Rezos, chief operating officer Thorsten Weimann and co-founder Horst Kreuter had sued ‘‘for defamation and are concerned that the publicity of the matters contained in the statement of claim gives currency to the defamations’’ allegedly made by J Capital and its principal, Tim Murray.

‘‘Ordinarily, there would be methods that should be made for some confidentiality to be maintained, rather than give further currency to a defamation,’’ Mr Bennett said.

Justice Craig Colvin noted that members of the media had been trying to access the documents related to the lawsuit, which was filed in the Federal Court this month.

‘‘And you would press the position that there oughtn’t be access to those documents?’’ Justice Colvin asked, to which Mr Bennett responded: ‘‘Yes.’’

Lawyers representing Mr Murray and J Capital did not argue either way for public access to the documents.

The Federal Court has banned J Capital from sharing its critical report of ASX-listed Vulcan Energy, whose share price has increased by 6000 per cent since a backdoor listing in 2019.

Vulcan disputes the allegations made in a J Capital report, which claims the Perth-based company has used overly optimistic and conflicted inputs in a pre-feasibility study for its plans to mine geothermal brine in the Upper Rhine region of Germany for lithium.

Vulcan shares have fallen about 30 per cent since J Capital released a report late last month titled Vulcan – God of Empty Promises.

Bennett + Co has applied to the Federal Court in Western Australia under consumer protection laws that protect against misleading or deceptive conduct.

Yesterday, Justice Colvin extended orders that prevent J Capital from discussing or republishing anything to do with Vulcan’s rebuttal to the research firm’s original claims that were posted publicly to the ASX this month, or anything related to the Vulcan executives named in the court application.

However, Justice Colvin said he would shortly allow media to make written submissions arguing their case to access the court documents.

Justice Katrina Banks-Smith last week ordered that the court suppress transcripts of a hearing related to the case last Monday, and that no document lodged or filed in the case be made available to the public without leave of the court.

In his original report, released after market trading on November 26, Mr Murray questioned the claims that the lithium market darling could develop and harness geothermal power in the Rhine Valley to produce lithium hydroxide using unproven commercial lithium electrolysis processing technologies.

Vulcan rejects the J Capital report. ‘‘The report contains many claims that are wrong and misleading. Vulcan categorically rejects the claims contained in the report,’’ the company noted in its 11-page response.

Have no holding in Vulcan or any of their competitors but if there’s a short report on it I hope the price takes off and they get massively squeezed. Wouldn’t mind seeing a repeat of Wisetech at all.

Following on from my forum post titled "The Future Winners of The EV Supply Sector" I've attached my comparison table for some of the companies that are innovating in the space.

Hopefully can start a discussion on the sector and find the future winners!

Vulcan & Circulor to establish world-first full lithium traceability & CO2 measurement across supply chain

Highlights:

- Vulcan to use Circulor's full traceability and dynamic CO2 measurement solution for Zero Carbon Lithium™ across the European Lithium-ion battery and Electric Vehicle (EV) supply chain, in a world-first for the lithium sector.

- Circulor’s customers include major European automotive manufacturers such as Volvo Cars, Daimler, Polestar and Jaguar Land Rover, which indicates OEMs’ growing need to demonstrate responsible sourcing of raw materials like lithium and to track and manage the embedded CO2 emission in their upstream supply chain for EVs, as they strive towards their net zero targets.

- Circulor offers a software solution that enables customers to track raw materials through supply chains to demonstrate responsible sourcing and sustainability.

- This system implementation enables reputational protection, proof of compliance with regulations and dynamic carbon tracking.

- Circulor’s CO2 solution provides a dynamic month-to-month visibility of CO2 intensity across the supply chain and its participants.

- Battery raw materials transparency, traceability and sustainability weredirectly targeted in the latest European Commission Battery Regulation proposed in December 2020.

- Vulcan will be implementing Ciculor’s solution to its future lithium supply contracts with European OEMs to help them meet their sustainability objectives for material traceability and CO2 transparency.

- Circulor’s solution will first be used during Vulcan’s project development including at a pilot and demonstration plant level, when the first samples are dispatched to customers.

- Circulor and Vulcan will work together to prepare Vulcan and its supply chain for full traceability of Vulcan’s Zero Carbon Lithium™ product at the production start in 2024.

DISC: Small holding

Highlights:

~ Vulcan will be collaborating with DuPont Water Solutions, a leader in water filtration and purification, to test and scale up Direct Lithium Extraction (DLE) solutions for Vulcan’s world-first Zero Carbon Lithium® extraction process.

~ DuPont will leverage its portfolio of proprietary Direct Lithium Extraction (DLE) products to assist Vulcan with input and test-work during Vulcan’s Zero Carbon Lithium® project Definitive Feasibility Study (DFS). As part of the project, DuPont will be developing and testing an integrated Direct Lithium Extraction Process for Vulcan’s brine. DuPont’s multi-technology portfolio of lithium selective sorbent, nanofiltration, reverse osmosis, ion exchange resins, ultrafiltration, and close circuit reverse osmosis will be leveraged for the study.

~Agreement is in line with Vulcan’s strategy to test and pursue commercially mature DLE products from major suppliers for its project to minimize technical risks and accelerate development of the project.

~Unlike current extraction processes, the Zero Carbon Lithium® project will demonstrate the world’s first completely carbon neutral lithium extraction process with virtually zero environmental disruption.

~DuPont Water Solutions (DWS) is a leader in sustainable water purification and separation technologies, including ultrafiltration, reverse osmosis (RO) membranes and ion exchange resins.

DISC: I hold

Acquisition of a world leading German-based geothermal consultancy team

Highlights:

~ Binding agreement signed to acquire 100% of geothermal subsurface consultancy company GeoThermal Engineering GmbH (GeoT).

~ GeoT has a highly credentialed, world-leading scientific team with over a century of combined expertise in sub-surface development of geothermal projects, from exploration to production drilling.

~ Acquisition is part of Vulcan’s plans to accelerate its Zero Carbon Lithium® project in Germany, by rapidly growing its development team.

~ GeoT (https://www.geo-t.de/en/) is based in the Upper Rhine Valley, Germany, and is owned by Vulcan Executive Director Dr. Horst Kreuter.

Positive Pre-Feasibility Study 15/1/21

Shares looking to rise 34+% at open

https://vul.live.irmau.com/site/PDF/232dbb56-08a7-4f19-aac4-70fd4d11ec97/PFSPresentation

$4.8M Institutional and ESG Investor Equity Placement

Firm commitments received for a $4.8 million equity placement (before costs) to institutional and sophisticated investors ("Placement").

Placement significantly oversubscribed involved insititutional investors in Australia and Europe and was strongly supported by investors from the Enviornmental, Social, Governance ("ESG") sector.

Funds raised to acclerate Vulcan's Pre-Feasibility Study ("PFS") and pilot plant development at its globally unique Zero Carbon Lithium Project in Germany.

https://asx.api.markitdigital.com/asx-research/1.0/file/2924-02247461-6A983588?access_token=83ff96335c2d45a094df02a206a39ff4

Disclosure: I no longer hold.

Investor Webinar/Presentation

https://asx.api.markitdigital.com/asx-research/1.0/file/2924-02244880-6A982666?access_token=83ff96335c2d45a094df02a206a39ff4

VSA Capital Podcast Episode 36, Dr Francis Wedin, MD of Vulcan Energy and former director of Exore.

"VUL - best peforming lithium stock in the world"

https://soundcloud.com/user-596578261/vsa-capital-podcast-episode-36-dr-francis-wedin-md-of-vulcan-energy-former-director-of-exore

Enables fast-track potential growth of Vulcan’s 13.95MtLCE Resource Estimate and upside to Positive Scoping Study in PFS

Managing Director, Dr. Francis Wedin commented:

"Thanks to the hard work of our in-country team, this purchase option agreementsecuresaccess to acriticalpackage of data,which has the potential to fast-track the development of severalareas within the Vulcan ZeroCarbon Lithium™Project. Seismic data is an important tool for the development of geothermal brines, to sensibly manage and reduce the geological risk associated with production drilling targeting high-flow rate zones, which will form the basis of our combined renewable energy and lithium hydroxide project. Typically, there is significanttime and financial cost associated with acquiring this data in the field, but with this package, we will have effectively short-cut this process and substantially reduced the cost. These areas were not part of Vulcan’s resource estimate or Scoping Study1, so represent potential upside in our Pre-Feasibility Study for this year.”

Key Takeways:

With this acquisition Vulcan canfast-track:

-over a year of exploration time.

-approximately70% of the survey cost.

https://www.asx.com.au/asxpdf/20200504/pdf/44hjn35rjq8wg1.pdf

And a seperate announcement:

Listing Rule 5.3.4 AdditionalDisclosure

Summary: VUL appear to be using their money more efficiently then projected.

https://www.asx.com.au/asxpdf/20200504/pdf/44hjm6k25711fl.pdf

Ranya Alkadamani hired as non executive director.

https://v-er.com/appointment-of-non-executive-director/

Chairman, Gavin Rezos commented:

“We are very pleased to welcome Ranya to the VulcanZero Carbon Lithium™team. Ranya is highly regarded in the ethical and sustainable investment sector and her extensive experience as a communications strategist, working across media markets and for high profile people on matters of international importance will greatly assist Vulcanin our missionto produce and supply the electric vehicle (EV) battery market in Europe with the world’s first Zero Carbon Lithium™, and thus lower the carbon footprint of EV production.

Thesis:

•Management (Francis 21%, Horst 1%, Gavin 7.5%) has a high ownership in the company with lots of recent insider trading.

•Passionate management - Francis has stated he’s enjoying waking up everyday to pursue his passion and his dream.

•Honest and talented management – they’re hiring the right people and need to keep doing so – 2 Phds (Dr Francis Wedin and Dr Kreuter) and are honest with their admission of possible risks and future dilution/cap raising requirements

•Management compensation: unknown

•Dual revenue generation: sell zero carbon lithium hydroxide and sell geothermal energy back to grid – dual revenue de-risks overall operation

•Serves customers across economy, markets, and geography (throughout Europe)

•Stable environment – largest lithium resource in Europe and one of largest in world and is large enough to be Europe’s primary source of battery quality lithium hydroxide. Demand for product with big push towards EV (electric vehicles) in Europe.

•Possess moat/first mover – world’s first and only zero carbon lithium process, located in centre of fastest growing market removing dependence on China for raw materials. Only other known geothermal field with similar lithium grades and flow rate is in California.

•Can fast track production d/t existing infrastructure and agreement with geothermal operator.

•Possible pricing power - lithium hydroxide produced free of CO2 emissions in a core industrial region of Europe will benefit from a relevant premium on the reference price calculated for Asia. European battery industry will have strong incentives to use the raw material mined by Vulcan Energy Resources.

•Profitable business model – lower opex compared to traditional brine extraction – can extract in hours instead of months, not weather dependent, consistent product, no water stress (environmentally friendly)

•Vulcan’s negligible distance to market is a cost advantage as well as a carbon advantage.

•Regulatory tailwinds - 42 stakeholders from EV battery supply chain (BMW, Daimler, Renault, Volkswagen, Umicore) joined the Responsible Minerals Initiative and the World Economic Forum’s Global Battery Alliance to demonstrate their commitment to creation of a sustainable Battery Value Chain by 2030. As well as EU’s push to limit carbon emissions – other lithium mining produce 13-15x CO2/LiOH H20 (hard rock) and 5x CO2/LiOH H2O (traditional lithium brine); Vulcan – negative carbon impact.

•Unknown/misunderstood – results from scoping study likely to gain investor interest this year, specifically the magnitude -approx. 13.9 million t LCE in JORC-compliant terms (inferred mineral resource, not mineral reserve) – many websites still incorrectly list it as a copper and zinc exploration company.

•Potential for high future ROE/ROIC - Following the ramp-up phase (2022 to 2023), which will be characterised by high capex, the investment will have paid for itself within a four-year period.

•Speculating – possible future government subsidies being zero carbon footprint technology

•Strong balance sheet with no current debt and a healthy current ratio.

•However; capital raising required for stage 1 - $55M (cash on hand currently = $3M); stage 2 - $425M for Oretenau region.

•Potential is massively undervalued - according to Alster DCF valuation = Enterprise value of $769M USD ($1.3B AUD) as of March 2020; assuming dilution valued at $2.45/share.

•Long-term hold - not forecast to be profitable for 2-3 years.

Risks:

•Incorrectly siting production wells and not achieving desired flow rate

•Consistency of lithium grade and potential dilution where re-injection fluids come into contact with production brine

•Possibly falling prices d/t increased market supply

“Given the strong pedigree of Vulcan’s geothermal team expertise in Germany, as well as the quality of Vulcan’s lithium experts and external geological engineering consultants, the Company is confident it can satisfactorily address the potential risks. Analyst consensus points to a lithium hydroxide supply deficit by the mid-2020s, and Vulcan’s diversified revenue stream with geothermal energy and low OPEX provides further protection against a lower price environment.”

Why I would sell:

Not hiring well - talented management essential

Management isn’t aligned with shareholders (unlikely considering how passionate Francis is as well as management ownership b/w 10-35% - not too high or low)

Pilot Plant/PFS fails

Permitting, demo plant, DFS fails

Permitting, financing construction fails

Staged commercial operation fails

Strong competitor enters EU market with similar zero carbon lithium product, similar or better operating costs and is capable of overtaking Vulcan

Lithium hydroxide demand disappears and/or price tanks (predicted undersupply in mid 2020's would have opposite effect)

Disclaimer: I own a small position in this company.

Algester Research on Vulcan Energy Resources Ltd

https://www.nextsmallcap.com/vulcan-our-first-ten-bagger-say-german-research-house/

"After the ramp-up phase from 2022 to 2023, which will be characterised by high capex, the investment will then pay for itself within a four-year period.

By discounting its modelled cash flow projection, Alster calculated an enterprise value for Vulcan at US$769 million — corresponding to around €700 million or A$1.3 billion.

Assuming dilution from raising additional equity as required, Alster determined a per share valuation of €1.45, or A$2.45 and provided and initial “buy” investment recommendation."

A Guardian article summarising how Vulture Energy Resources is revolutionising current lithium production processes.

https://www.theguardian.com/vulcan-energy-resources/2020/mar/16/why-zero-emission-lithium-batteries-are-essential-to-the-future-of-electric-cars

"Getting an electric car from raw material to a customer’s garage produces high carbon emissions: about 150% of the fossil-fuelled equivalent. A substantial proportion of these emissions comes from the manufacture of the lithium (and nickel, manganese and cobalt-oxide) battery that gets the motor running."

"“We aim to produce a net zero-carbon lithium hydroxide product - the type used in batteries.”"

"The European lithium-ion battery market is projected to grow at a compound annual growth rate of 15.9% during 2018-24. A better environmental choice also represents sound economic investment, and car manufacturers are already on board. Volkswagen, for example, says it’s committed to the sustainable extraction of raw materials."

Disclaimer: I do not own shares in VUL.