Concentrating on the two main sources, lithium brine deposits tend to have superior operating cost economics comparative to hard rock sources, for lithium carbon equivalent (LCE) production. While hard rock deposits have higher operating costs,

brine operations are highly capital intensive at the outset. Other negative factors for development of evaporation-type brine deposits are the long development times (due to design issues and permitting, as well as the long lead time for evaporation to occur) and often an extended period between initial investment and revenue generation.

Some of the disadvantages of brine when compared to hard rock extraction are partly mitigated by the development of direct lithium sorption (DLS) and some of the limitations of solar evaporation.

Vulcan’s Project is based on an established, commercially viable DLS technology which has been adapted to its URVBF brine

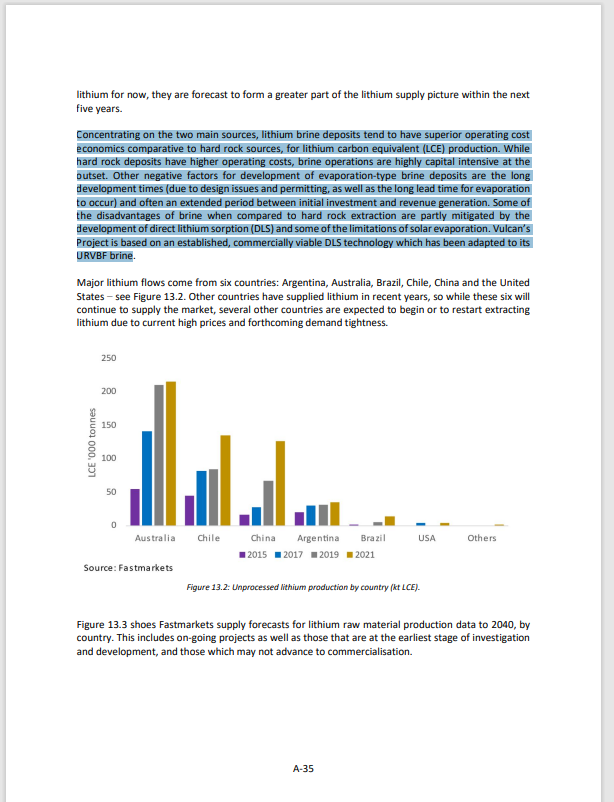

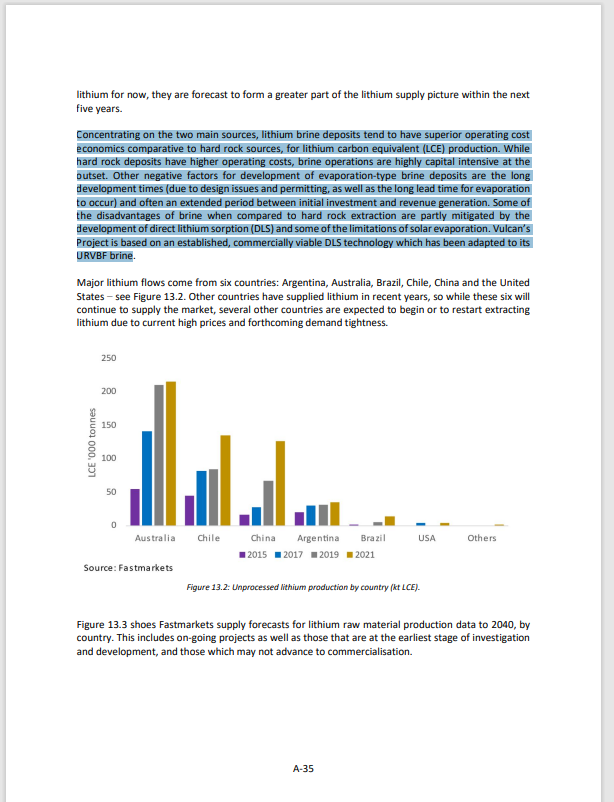

- Release Date: 05/05/23 09:27

- Summary: Prospectus for Regulated Market of FSE (Prime Standard)

- Price Sensitive: Yes

- Download Document 11.66MB

Cheap value, quality or crap?