Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Boo, no SPP - tho this activity "may" explain the "seemingly inexplicable" 44% gain in SP in the past week

Weebit Nano Raises USD32.56 Million in Private Placement of Shares

Weebit Nano Ltd (ASX:WBT, Weebit Nano or Company) has successfully raised AUD50 million via a strongly supported share Placement (Placement) to existing and new institutional investors from Australia and abroad. Under the Placement, Weebit Nano is issuing approximately 16.7 million new fully paid ordinary shares at AUD3.00 per share (New Shares). Funds raised will be used to scale up commercialisation activities as part of new customer and partner engagements that are expected to materialise over the coming 12 months, to support working capital needs associated with further technology development, and to strengthen the Company’s balance sheet. Commenting on the successful Placement, Weebit Nano CEO Coby Hanoch said: “We are extremely pleased with the strong support we received from institutional investors. Whilst Weebit had an adequate cash balance, strategically, bringing forward the capital raise puts the Company in a much stronger position. With advanced discussions and negotiations progressing with multiple parties, and our goal to sign multiple foundry and customer agreements over the next 12 months, the strengthened balance sheet provides additional flexibility to pursue new business opportunities on a much stronger footing. “Whilst the Board and I would have liked to offer a Share Purchase Plan (SPP) for our retail investors, given the legal requirements of the SPP Offer Price needing to be lower than Weebit’s trading price in a specified period, and this Placement being done at a substantial premium to this, we have not been able to offer an SPP at the same price as the Placement on this occasion. “Weebit is uniquely positioned as the market’s only independent provider of qualified ReRAM. Our competitive advantages around customisation capability and the expertise of our team means we are extremely well placed in a large and growing market as the industry looks to replace embedded flash in next-generation devices

“We are continuing to see strong interest from foundries, IDMs, and product companies, and we remain confident in our ability to close a commercial deal this calendar year, as well as executing on our 2025 targets which include additional agreements with foundries and product companies.” AUD50 million Placement The completed AUD50 million Placement comprised an offer of 16.7 million new fully paid ordinary shares (New Shares) in Weebit Nano at AUD3.00 per New Share, a 6.5% premium to the 5-day VWAP of AUD2.82 per share. The Placement was strongly supported by institutional investors, both domestic and international, reflecting strong investor demand, and confidence in Weebit Nano’s ReRAM technology and its future growth prospects

Each New Share issued under the Offer will rank pari passu with existing shares on issue in the Company

Settlement of New Shares issued under the Placement is expected to occur on Thursday 21 November 2024, with allotment of the New Shares issued under the Placement scheduled for Friday 22 November 2024. The Placement will take place as a single tranche and fall within the Company's available Listing Rule 7.1 capacity. Unified Capital Partners Pty Ltd acted as Lead Manager, Bookrunner and Underwriter to the Placement (Lead Manager). The Placement will not be accompanied by a share purchase plan (SPP) because the requirements for SPP pricing to be less than the recent market price, cannot be met in this instance

DISC: Held in RL & SM

Key highlights • Demonstrated ReRAM at extended automotive conditions, including lifetime operation at 150 degrees Celsius and endurance of 100K cycles •

Tech transfer to DB HiTek progressing to schedule; engaging with DB HiTek customers •

First live demonstration of Weebit ReRAM on GlobalFoundries’ 22FDX® wafers at Embedded World conference •

Progressed negotiations and evaluations with leading foundries, integrated device manufacturers (IDMs) and product companies •

Appointed IP industry veteran Issachar Ohana as Chief Revenue Officer to drive ReRAM licensing sales.

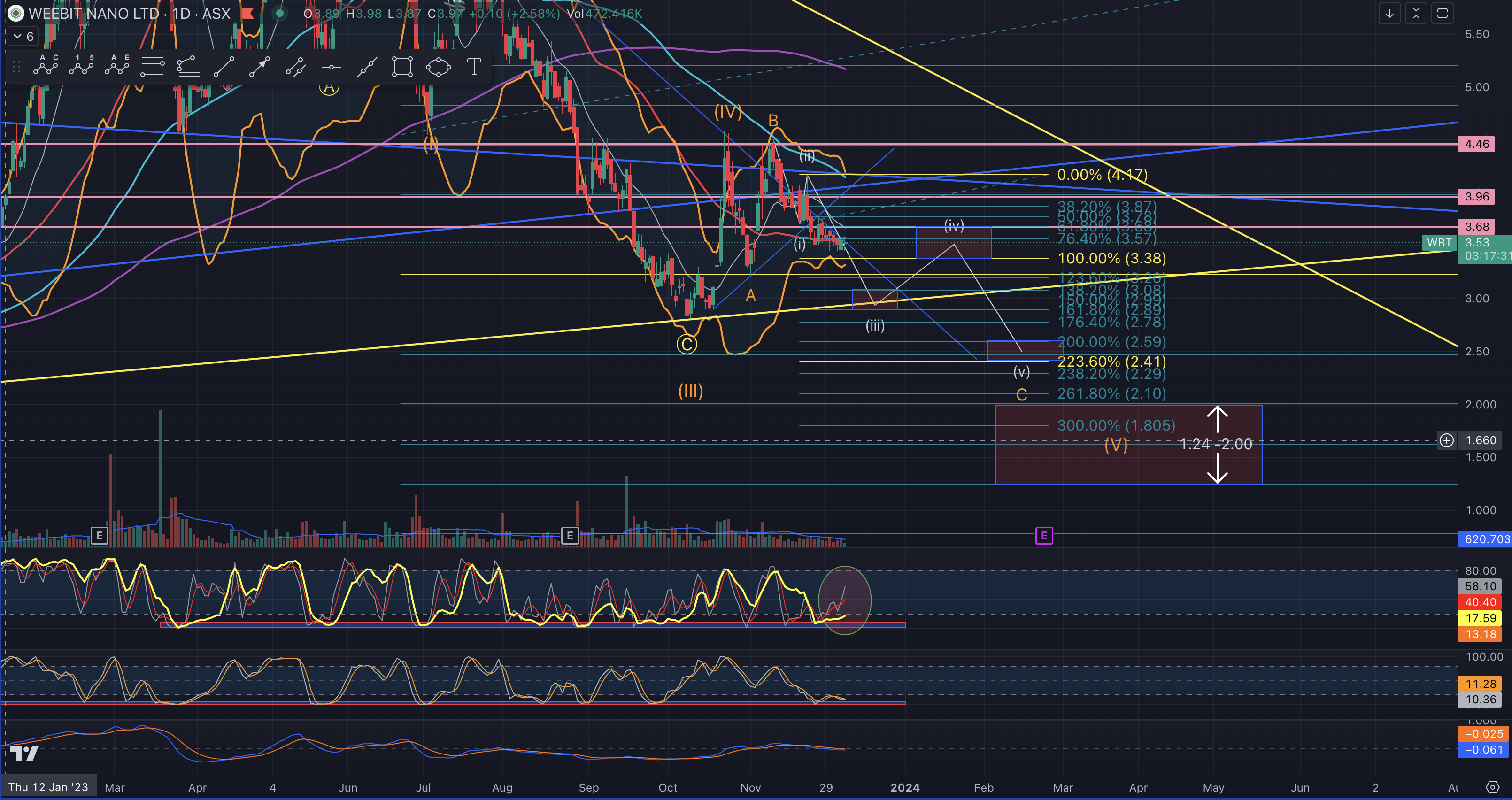

Well WBT made it to my target for wave(V) down and broke below its long term trend line. It was interesting also to note that wave(iv) didnt rise to the usual targets. That tells me WBT is in the dog house with the investors until something develops news wise to reboot investor intersest. Im sitting here also watching the recording of the lastest interview with CEO Coby from WBT here on Strawman and he is reinforcing the "it's takes time to come to market" tag line. I have felt this a number of times in my investing experience.

Take Arafure (ARU), recently climbed 78% in 1 day just because the AU gov said it would fund a good portion of their new mine development for Rare earths. Ok thats great but its very early days for that to actually commence, hence the substantial drop back down on the same day.

Question is, how long will it take for WBT to explode. No one knows that. Will it rise from where it is now? maybe, although I dont want to be part of any fluke rises and then get caught when it drop back below my purchase price. I like to wait for the first impulsive move up for wave 1 and then the pull back of wave 2. Once I see how these 2 waves play out then I will determine weather I will enter for the historically most powerful wave, wave 3. good luck all

Just a quick note on WBT. My technicals on the wbt charts is telling me there is more to drop. So im waiting for confirmation to the upside before I enter.

1d chart

The last couple of days have been weak after hitting the bottom Yellow Trend line of the major consolidation triangle it has been working in. Also note the separation of the thin white line (current indicator) to the Yellow Line (long term indicator) on my Stochastic indicator. They should be following each other ish and when i see it look like it is in the green circle, then i expect the white to come back to the yellow again, therefore an drop is immanent. By how much? not sure there at the moment.

The last couple of days have been weak after hitting the bottom Yellow Trend line of the major consolidation triangle it has been working in. Also note the separation of the thin white line (current indicator) to the Yellow Line (long term indicator) on my Stochastic indicator. They should be following each other ish and when i see it look like it is in the green circle, then i expect the white to come back to the yellow again, therefore an drop is immanent. By how much? not sure there at the moment.

Remember, always wait for a decent move to the upside for confirmation. If you miss it, no problem, theres always more fish in the sea. Better than being stuck in a falling stock right.

@Strawman, thanks for arranging the meeting. Understanding the ReRam technology is not that difficult, with plenty of Research material available on the Net. Understanding how all of this will evolve is probably the most complex I have ever encountered in my time investing. So many industry stakeholders, motivated by innovation in pursuit of nett value to the chain, but requiring very large capital allocations along the way. The whole dynamic of early adopters versus laggards and at a point, gool old competition to the fore.

Due to time constraints, you did not get to raise the question on IP. From what I have read, this is hotly contested across the supply chain with everyone trying to stake a claim based on their aspect of change. Also, the power of patents in all of this and Royalty Payment conformance.

All considered, I plan to add at least 1000 shares to my holding each quarter, this on the basis that the time will come. Investment RISK surprisingly low in my opinion. Impossible to come up with a sensible valuation (good luck to anybody that tries) and suspect the Shorters continue to have time on their side.

Once again, thank you.

RobW

IP industry veteran Issachar Ohana to drive sales as company focuses on revenue generation

WBT prepping for growth Revenue - hope so..No real projections in this Presentation

Updated Charts and thoughts

So we made it to as low as 3.45 recently just below my wave 3 target of 3.51. As wave 3 went lower, this then pulls down wave 4's target shown by the box on this 1h chart. I also have a divergence showing up on my 1h RSI/Stoch indicator and it also hit resistance today, so I'm now looking for the next leg down to begin.

Im now looking @ 3.43 to 3.23 for my next target for the last wave 5 down. Trouble is, we have now formed an ABC pattern within wave 4, which could open the door to drop below my main Yellow Trend Line you can see on my charts. Ill revisit once the next leg down has finished.

Im watching this one ike a hawke as I believe it has loads of potential and there is a lot of hype over it, hece the volatility.

Updated Charts and thoughts

So we have now seen wbt move down (ish) to my wave 3 target (see the small orange numbers down in the larger C wave). It could still drop further below the yellow incline trend line down to 3.51 - 3.60 on this wave 3 down though I am then expecting a jump up to 3.96 - 4.10 for a wave 4 retrace before heading back down to my wave 5 target of 3.37. Wave 4 as a rule can be rather protracted also before starting for the last wave 5 down. As always this is all determined on a lack of positive news coming out for WBT. In saying that it has certainly gone higher than some of my targets as there is a lot of hype around WBT as can be seen when it does a move up, its usually does so with gusto.

This is how my chart looks now

Further update on WBT charts. While wbt has had some nice 20-30% gains of recent, they havent been highly probable and therefore I haven’t participated in them. I am still seeing negaitive trends with weebit. I now have revised my charts taking into account the most recent price actions and it still points me down. You can see my new target has risen to $3.40 - $3.50. This is especially because we now have a firm wave A and wave B in place. The next wave should be a wave C down (comprising 5 waves) to my target area. In the greater picture we are still in an extended wave IV retrace which is common of wave 4, while still looking for a wave V down to the 1.20 - 2.00 region. Of course this thesis can be broken with substantial good news (invalidating my thoughts).

Quick update. While we have just have had a nice 3 wave structure up recently (which I took no positions in as it was too uncertain for me) breaking out above my consolidation triangle, I believe we will see an imminent reversal down now to my target shown @ around 2.95 so long as it doesn’t break meaningfully above th 4.18 price (recent resistance with top of wave (ii) shown on my charts) . You never know the exact path $ takes but over all the patterns and and targets $ hits tells a lot.

The 3 wave stucture up will now result in 5 waves down to the green taget (approx) with much higher probability. When it gets there I may take a position depending on my indicator etc. Good luck everyone.

Further to @raymon68 comments about possible short positions with JP morgans recent buy in, I thought I would share my techinical analysis with you all

first start on the daily chart

This is the approx path (the white zigzag line down) I believe the price of WBT will take without any further substantially positive news being released over the next 2 ish months. Of coarse nothing is perfect so it may vary in time and or price points reached, however it should provide a good guide. I do a lot of chart analysis and this is based on Fibonacci levels that historically provide levels where the population and therefore automatic trading software and high frequency software looks at (obviously because software is written by humans).

You can see WBT is stuck around the 3.58 or 50 sma at the moment although the circled Stochastic indicator below the charts is showing weakness and the RSI/Stoch indicator below that is pointing back down again. Below those 2 indicators is the momentum indicator which is just going sideways also. So im definitely seeing a drop down to the main Yellow trend line below for the (iii) wave down. You can then follow the waves (iv) & (v) in white down from there. To confirm my bearish opinion we now look at the 9day chart below

You can see on the Stochastic Indicator, I have circled it also as it is pointing down too. I do believe the price will see the purple 200sma at a price of $2, however it may even see as low as 1.25 - 1.65.

My opinion of course is if no meaningful positive news surfaces over the next 2-3 month. You can see the same has happened for Brain Chip (BRN).

So on that note I thought it was interesting that @raymon68 mentioned JP setting up for a possible short position which would obviously align with my opinion. Could you elaborate why you thought this Raymon68 as I dont understand how you came to that opinion. Im thinking it might be because of taking a large position with Options (short) and need to put those options up to be shortable. Am I on the right track?

Form 603 for JP Morgan - are these dudes setting up for shorting WBT?

delivered by David (Dadi) Perlmutter

welcoming well-known Australian entrepreneur and marketing executive Naomi Simson to the Board in August 2023.

Return (inc div) 1yr: 8.36% 3yr: 17.24% pa 5yr: 36.34% pa

AGM Thursday 23rd. Melbourne.

A global top-10 foundry HQ in South Korea

❖ One of world’s top-tier foundries for analog & power ICs

❖ Annual revenue of US$1.3 billion

No Profit Yet.. To will see if Optimism translates to cash.

Market Cap $744M

Return (inc div) 1yr: 14.78% 3yr: 20.69% pa 5yr: 40.60% pa

Positive news????? .......... Hopefully.

Taken from @WBT's announcement today

Coby Hanoch, CEO of Weebit Nano, said: “Revenue generation is a pivotal moment in Weebit Nano’s

commercialisation journey with our unique ReRAM well positioned to replace existing flash technology due to its

superior performance capabilities1. This milestone highlights our significant technical achievements over the past

year, including full qualification at both industrial and automotive temperatures for the embedded market,

where memory is embedded into a ‘system-on-chip’ (SoC). The embedded emerging non-volatile memory (NVM)

market is expected to reach $2.7 billion by 2028, with ReRAM expected to account for more than a third of that

Intelligent Investor / The Eureka Report has just published (the transcription of) an interview by Alan Kohler of Coby Hanoch, the CEO of Weebit Nano

https://www.intelligentinvestor.com.au/investment-news/weebit-nano-a-new-type-of-memory/153061

Table of contents:

The non-volatile memory market

Unsure if it's paywalled or not (probably is)?

DISC: Held in RL & SM

Weebit CEO Coby Hanoch said: “Despite an extremely challenging situation in Israel at present, Weebit’s team and operations in the country continue to deliver against its plans. Unfortunately, this is not the first time we have faced a situation like this, and we have well-thought-out contingency plans in place to minimise disruptions to our operations

Based in Israel and France

AGM November 2023:

Cost effective NVM.

Price up to $3.40 9.3%

An announcement just out from WBT - there were hints of this in your conversation with Coby during your recent @Strawman meeting with him. Given the bump in SP yesterday perhaps the market knew before this public announcement

Weebit Nano licenses ReRAM to DB HiTek, a global top-10 foundry

DB HiTek to manufacture Weebit’s embedded technology in customers’ analog and power designs

Weebit Nano Limited (ASX:WBT, Weebit or Company), a leading developer of advanced memory technologies for the global semiconductor industry, and DB HiTek, one of the world’s largest foundries, have signed a commercial agreement whereby DB HiTek has licensed Weebit ReRAM for its customers to integrate as embedded non-volatile memory (NVM) in their systems on chips (SoCs)

Headquartered in South Korea, DB HiTek is a global top-10 foundry with annual revenue of more than $2 billion

Under the agreement, Weebit ReRAM will be available in DB HiTek’s 130nm Bipolar-CMOS-DMOS (BCD) process – ideal for many analog, mixed-signal, and power designs in consumer, industrial, and other IoT devices. For these applications, Weebit ReRAM provides a low-power, low-voltage, cost-effective NVM that is easy to integrate and has proven excellent retention at high temperatures. As a back-end-of-line (BEOL) technology which does not require process tuning, ReRAM offers significant advantages over flash for BCD processes. Weebit ReRAM also provides higher density and endurance than conventional Multi-Time Programmable (MTP) technologies

The agreement includes technology transfer, qualification, and licensing. In addition to its 130nm BCD process, DB HiTek has the option to use Weebit ReRAM technology for other process nodes

Coby Hanoch, CEO of Weebit Nano, said: “DB HiTek is one of the world’s top-tier foundries for analog and power integrated circuits. As one of the world’s largest contract chip manufacturers, DB HiTek’s extensive customer base can gain significant advantage from using Weebit ReRAM in their new product designs, including improvements to retention, endurance, and power consumption. Our collaboration with DB HiTek is commencing immediately, beginning with the transfer of our technology to the company’s production fab. We are seeing increasingly strong market demand for Weebit ReRAM and expect to sign further commercial agreements, including many of the top- tier foundries and integrated device manufacturers as well as fabless design companies, in the coming months”

Ki-Seog Cho, CEO, DB HiTek, said: “Weebit ReRAM will provide customers using our 130nm BCD process with a very low-power, high-density and cost-effective NVM. Given Weebit’s high-quality technology and unique combination of design and process engineering, we believe the technology transfer and qualification processes will proceed quickly. Looking ahead, we’re delighted to see Weebit’s strong commitment to continued roadmap innovation”

Under the technology transfer and qualification agreement, Weebit and DB HiTek will immediately cooperate in transferring Weebit’s embedded ReRAM technology to a DB HiTek production fab and then continue to qualify the technology towards volume production

The technology licensing agreement grants DB HiTek a non-exclusive license to manufacture Weebit ReRAM as embedded NVM in designs from customers globally. DB HiTek will add Weebit’s memory module to its BCD 130nm Process Design Kit (PDK). DB HiTek customers can use the standard modules in the PDK or have modules customised for their needs. Weebit will receive manufacturing license fees, project use fees and royalties based on production volumes, with these license fees and royalties determined by Weebit when delivering the relevant modules to customers and may differ for each module

The economic materiality of this agreement is not known at this time due to the contingent nature of the license fees and royalties, as they depend on the number of customers who sign up to use Weebit’s technology and on the number of chips those customers produce using Weebit’s technology. However, Weebit views this commercial agreement as strategically important given DB HiTek is a global top-10 foundry, and further validates Weebit’s cutting-edge technology

DISC: Small position Held in RL & SM

Short interest has increased to over 6%. Short sellers may be coming after them after it was added to the ASX 200 index?

It's a 603 big Buddy.

Fully Paid ordinary shares: 9,712,338 5.18%

Fully Paid ordinary shares Notice of initial substantial holder 9,712,338 *Note these securities are comprised of 1,563,864 shares in which First Sentier Investors Holdings Pty Limited and its subsidiaries have voting power and 8,148,474 securities in which First Sentier Investors Holdings Pty Limited's ultimate parent, Mitsubishi UFJ Financial Group, Inc. on and from 24 August 2023, has informed it that it has voting power prior to the date of this notice. Holder of relevant interest Class and number of securities Fully Paid ordinary shares.

Who is Sentier?

Adviser Asset & Investment Management - First Sentier Investors

4 growth stocks to watch in a tough year for growth (firstsentierinvestors.com.au)

2022 ideas: WTC, PME, MP1, AUB

Mid Cap Team:

It seems that this company has developed this cutting edge technology, which may???? become an industry standard.

It is a shame that I don't have the same confidence in the way it is managed!!!!

Funny????? things again occuring with the share price!!!!

An opportunity to top up?????? .......... or just get out?????

confirmation: Weebit Resistive Random-Access Memory (ReRAM) IP has been fully qualified for industrial temperatures employing SkyWater’s 130nm CMOS (S130) process, including third party processing

The sudden pullback (16+%) in the SP yesterday makes me worry that there might be a leaky ship, with some information pending, despite no ASX announcement.

I like (I thought) what the company is doing and want to believe that everything is "Ridgy Didge", but this is the second time (the first being just before the Capital Raise) over a couple of months something like this has happened.

Should I be concerned???? Is there something in the pipeline that a few know about?

Just wondering if I am alone here, or if the expert Brain's Trust out there, believe that it just part of a "normal" fluctuation???

TIA

Director: S.Atiq Raza, Acquired: 84,360 Ordinary Shares. Disposed: 90,000 Unlisted Options

Weebit Nano Limited is a leading developer of advanced semiconductor memory technology. The company’s ground-breaking Resistive RAM (ReRAM) addresses the growing need for significantly higher performance and lower power memory solutions in a range of new electronic products such as Internet of Things (IoT) devices, smartphones, robotics, autonomous vehicles, 5G communications and artificial intelligence

Got the cash ..Get the clients

I will take the contrasting view. A few weeks ago I wrote on here that management should raise some cash while the opportunity presented itself, albeit higher levels would have been even nicer! This sucks short term, it always does, but my view is good management teams raise cash when the share price gets out of control. Look at what it's done to 3DP -- they are running on an oily rag despite commanding a ridiculous valuation at one point. They never raised cash when they absolutely should have. We shouldn't for a second think that Weebit should realistically be priced at 6.00-7.00 in this current market -- essentially a market cap of 1b for a company that (currently) doesn't make a cent of revenue. Don't get me wrong, I sit firmly in the bull camp here, this is a company that could realistically be earning billions in revenue one day. But that day is many years away and to get there they will need cold hard cash. Raising capital at 5.00 per share significantly reduces dilution (vs 2.00 a share). Yes, the share price games this week have been disappointing, but I am also careful to blame management / the company in this scenario, particularly with no evidence at hand. There are lots of people that are exposed/aware of a capital raising like this, and a good portion of those are external to Weebit. I think it pays to be cautious about a leaky ship, but I don't want to be too emotional about this in the scheme of things. Onwards and upwards.

I have to completely agree with @BullsWool.

Yesterday's sudden & dramatic sell-off, smells heavily, dare I say of "Insider Trading ". If not, then certainly not a good look, despite their response to the ASX query!!!!!

Sure the price had ramped up over the past few weeks, and probably not sustainable ....... BUT ...... the sudden pullback?????????

I must admit to a level of disappointment that some in the market were clearly aware of the upcoming capital raise and the discount to previous market price. This is the second time they have had issues in the last 6 months and sends a bit of a worrying signal.

The mother of all Trading Halts!!! Anyone find out what's going on???????

Announcements coming thick and fast today, here's one more.

Coby Hanoch said, Weebit Nano 's progress in the first half of the financial year means we are well-placed to productise our embedded ReRAM technology and secure first revenues in 2023.

As announced on 10 November 2021, Weebit Nano Ltd (WBT or Company) is inviting eligible shareholders to participate in a non-renounceable pro-rata entitlement offer (Entitlement Offer) of new fully paid ordinary shares in WBT (New Shares) at an issue price of A$2.84 per share to raise approximately A$9 million.

Under the Entitlement Offer, the Company will offer New Shares to eligible shareholders on the basis of 1 New Share for every 41 shares held at 7.00pm (AEST) on 15 November 2021 (Record Date).

Shareholders who are eligible to participate in the Entitlement Offer may also apply for New Shares in excess of their entitlement under the Entitlement Offer which may be satisfied out of any shortfall from the Entitlement Offer.

The Entitlement Offer is expected to close at 5.00pm (AEDT) on Monday, 29 November 2021

This follows the successful share placement announced on 10 November 2021 where the Company raised approximately $25.2 million from 4 Israel-based institutional investment and pension funds and directors and received binding commitments from certain Directors for approximately a further $300,000 (Placement) (the Placement and Entitlement Offer are together the Offer).

The cornerstone investor for the Placement was Meitav Dash. Managing over US$65 billion in assets, Meitav Dash is a major institutional investment and pension fund in Israel, operating for over 40 years with approximately 1,000 employees

Weebit Nano Ltd (WBT – Weebit) is a developer of next-generation semiconductor memory technology. Founded in Israel in 2015, the company develops Resistive Random-Access Memory (ReRAM) technologies which is a specialised form of non-volatile memory (NVM) for the semiconductor industry.

Investment thesis – Weebit is a leading disrupter in next-generation semiconductor memory solutions, with the company’s recent commercial deal validating its ReRAM technology. Other things I like:

- Industry tailwinds – applications such as IOT devices, smartphones, autonomous vehicles, artificial intelligence etc have ever-increasing storage requirements. Flash memory, the incumbent, cannot continue to scale due to cost, scalability and complexity limitations which make it more difficult to embed within next-generation chips. The next generation of memory technologies should address limitations in present storage, delivering data where it’s needed for real-time processing. Cost and power consumption are both important factors here.

- So, why ReRAM? What makes Weebit’s memory technology innovative?

- It is highly scalable and offers multiple commercial and technical challenges over alternative technologies.

- It can be quickly and easily integrated with existing standard manufacturing flows and processes – consequently is it much cheaper when compared to alternative NVM technologies.

- It is also proven to be significantly faster and more reliable and energy-efficient than existing Flash memory solutions.

- Recent commercialisation validates technology: Weebit recently announced its first commercial deal with SkyWater technology (NASDAQ: SKYT; US$1.3 billion MC). This provides commercial validation of Weebit’s ReRAM technology and commences the growth trajectory for the company’s technology onto customer chips. Volume production is anticipated by the end of CY2022. Weebit will receive licence fees and royalties as part of the deal. I anticipate (and hope) this recent deal will be the first of many.

- Competent and skilled management team with a great track record. In particular the company’s Chairman, David Perlmutter, is the ex-Chief Product Officer of Intel Corp. The chairman is crucial for the company’s success – with his experience and connections in the industry likely to provide the company with additional competitive advantages on top of its innovative ReRAM technology.

- Cash holdings at 21million, with no debt. Well placed to continue its growth trajectory into FY22.

Commercialisation strategy

Weebit’s technology can be used in both embedded memory and discrete (stand-alone) memory chips. The company is focusing on embedded memory in the short term – providing semiconductor companies like SkyWater with innovate solutions by embedding Weebit IP onto their chips.

Long term, Weebit’s goal is to expand beyond embedded applications into the much bigger market for discrete devices. Current discrete NVM encompasses NOR flash (which is broadly used for on-device code storage in consumer, automotive and industrial applications) and NAND flash (widely used for device and cloud storage).

Conclusion

In my opinion, Weebit has become less speculative with the recent commercialisation of its ReRAM technology. In the disruptive technology space, the first agreement is the most difficult (and important). I think this agreement makes the risk/reward element much more attractive. Consequently, I am more comfortable with it having a larger weighting in my portfolio – I am backing in a well-regarded management team and their ability to (continue to) achieve significant milestones through additional/future commercial deals. That said, there are still many risks that I need to be aware of going forward:

Risks/to monitor

- My thesis is based on Weebit being a market-leading disrupter in memory technology. It needs to lead the way with respect to cost, performance, scalability, and reliability. Another company producing superior technology – and then commercialising – will result in my thesis being busted and I will sell immediately.

- The company’s recent annual report indicates it was in discussion with multiple companies re: commercialisation of its ReRAM technology. SkyWater represents the first – hopefully of many. Ideally, the company will slowly start to announce additional partnerships over the next 12-24 months. This will continue to see its technology validated.

- Monitor the commercialisation of Weebit technology within SkyWater, which should provide the company with competitive advantages. It is important that this transition is a smooth one – success here will almost certainly result in other customers seeking out Weebit’s technology.

- In addition, how much will Weebit stand to make from its partnership with SkyWater? This will provide an indication of what we can expect from additional agreements etc. There aren’t a lot of details re: this yet.

- Losses in the year (11m) were more than double FY20 losses (4m). This is OK, particularly noting the progress the company made, but it’s not sustainable long term. Share dilution is particularly concerning, increasing twofold in FY21. With the recent partnership announcement and hopefully several more to follow in the coming months, FY22 should hopefully result in reduced levels of dilution and loss.

DISC: I am slowly starting to accumulate IRL and on Strawman – noting that my first entry point was $2.80. I think WBT represents great value between $2-$3.50 and I will continue to accumulate slowly at these levels. I am investing with a long-term horizon in mind here, provided the company continues to perform well. Well done to long term holders much before my time that have enjoyed phenomenal returns in the last few years.