Bear Case

•Pay S3 Consortium to write articles promoting the company and have ads on marketindex.com.au

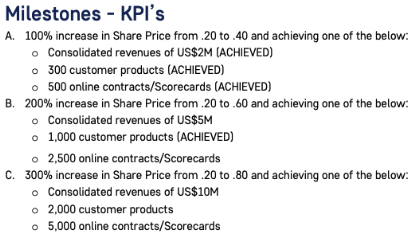

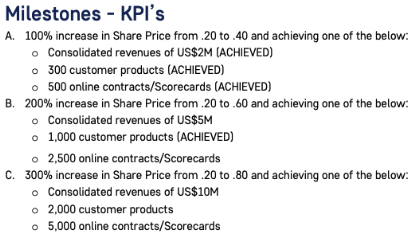

•Management is incentivised to increase share price

•Have relied on equity swaps with RiverFort Global Opportunities to raise cash resulting in some dilution to shareholders

•Spent 10% of revenue in 2020 & 20% in 2019 on marketing*

•Negative free cash flow of ~$1.1M FY 2020; however, trending positively since

•Gross margins of 49% aren’t particularly strong for a tech company

•Lack pricing power

•Is there a competitive advantage?

*No note is provided but some if not all of this would include payments to companies such as S3 Consortium (i.e. Next Tech Stock) for promotion.

“The minute I hear executives focused on stock price my ears always perk up. You can’t serve two masters. Are you focused on your business or are you focused on the price of the equity?”

Zach Abraham – Bulwark Capital Management

I looked at WHK in 2020 and nearly invested. Despite the share price appreciation and subsequent fall, I’m glad I didn’t. Management appear focused on the equity (share price) as opposed to the business. CEO Roberts is entitled to as many as ~48M shares upon reaching certain milestones. There are 230M SOI for context. These milestones focus on share price appreciation and are easily achievable. In addition shareholders’ money is being used (up to 10-20% of total revenue) to promote the company in order to increase her stock compensation. I’d much rather management be incentivised to increase shareholder returns than line their own pockets at my expense.

WHK has some appealing aspects to it, in particular very strong tailwinds in the cybersecurity sector, expenses under control and approaching positive free cash flow and is founder led with skin in the game. However, my lack of trust in management means the bear case wins over the bull.