Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

WHK CR @ $0.0115 with one free attaching WHKOA listed option for every 2 New Shares subscribed which is exercisable at $0.02 each expiring 24 April 2028. I feel this is the last chance to secure some contracts before they run out of funds.

A$2 MILLION PLACEMENT COMPLETED TO DRIVE GROWTH & ADVANCE AI/ML AUTOMATION

HIGHLIGHTS

Firm commitments to raise A$2 million via a share placement to sophisticated and professional investors.

Funds raised will advance automation of Cyber Resilience Moonshot regional cyber big data portfolio analytics across Sectors, Cities, States or Nations.

Won new Independent Cyber Governance Risk and Compliance (“GRC”) Program for U.S. Investment Firm across all subsidiaries.

The Company is currently in the process of reviewing opportunities to establish a small operational office in Perth, Australia, in support of AUKUS Defense Company Cyber Compliance.

Presentation gave some more detail on new product offerings with subscription pricing and current contracts. Need to see some of these bigger contracts completed to support the marketing and development of the subscription programs which could build a decent revenue.

WHK is a company I have held a small parcel in RL for a few years as a speculative interest in the cybersecurity thematic. Media of cyber incidents only seems to be increasing. My thesis was that compliance issues surrounding cybersecurity would become a major consideration for boards and the Whitehawk platform appeared to offer a solution. Also the founder had extensive US connections.

"WhiteHawk developed the first cloud, AI/ML based cyber risk monitoring, prioritization and mitigation online cybersecurity exchange, democratizing access for all companies and organizations to address their Digital Age Risks and those of their suppliers/vendors, continuously and cost-effectively. "

It has shown promise in tendering for US government contracts and has one large contract with a global social media company but has never quite reached an inflection point of uptake to become profitable. Many of the government contracts are drawn out tender processes and subject to lengthy delays.

Last 4C

Revenue for the Quarter was US$309.5K.

WhiteHawk continues to manage expenses below planned budget, expending US$256K on average per month in total operating expenses over the last quarter.

Group incurred net cash outflows from operations in the Quarter of US$414K. Only $599K in the bank.

A small Cap raise in April, the Company completed Placement Tranche 2 Placement raising an additional A$535,000 (equivalent to US$335,605) to support ongoing operations.

"The Company expects an increase in net operating cash flows in the coming quarter, driven by additional revenue from recently secured and renewed contracts."

Today an announcement of options being exercised at a 60+% premium to current SP. Only $17K value but interesting nevertheless. Lots of recent discussion on HC of potential rerate if one of the big contracts is announced but this has not been forthcoming.

WhiteHawk has been selected as the core cyber partner on the GSA SCRIPTS BPA (Supply Chain Illumination Program Tools & Services Blanket Purchase Agreement)—a government-wide contract vehicle that enables any U.S. federal agency to rapidly acquire advanced supply chain risk management (SCRM) tools and services.

Strategic Positioning & Competitive Edge WhiteHawk collaborated closely with small business US Government prime Knexus Research LLC, Babel Street, and Dun & Bradstreet over the past year to optimize and deliver a robust, AI-powered suite of supply chain illumination tools, including:

Global cyber and business risk datasets,

Real-time vendor risk assessments,

Continuous monitoring and analytics capabilities.

Bear Case

•Pay S3 Consortium to write articles promoting the company and have ads on marketindex.com.au

•Management is incentivised to increase share price

•Have relied on equity swaps with RiverFort Global Opportunities to raise cash resulting in some dilution to shareholders

•Spent 10% of revenue in 2020 & 20% in 2019 on marketing*

•Negative free cash flow of ~$1.1M FY 2020; however, trending positively since

•Gross margins of 49% aren’t particularly strong for a tech company

•Lack pricing power

•Is there a competitive advantage?

*No note is provided but some if not all of this would include payments to companies such as S3 Consortium (i.e. Next Tech Stock) for promotion.

“The minute I hear executives focused on stock price my ears always perk up. You can’t serve two masters. Are you focused on your business or are you focused on the price of the equity?”

Zach Abraham – Bulwark Capital Management

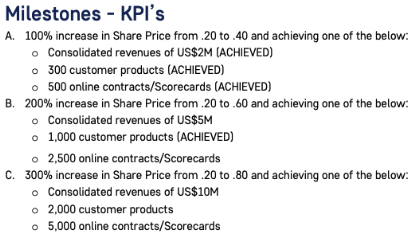

I looked at WHK in 2020 and nearly invested. Despite the share price appreciation and subsequent fall, I’m glad I didn’t. Management appear focused on the equity (share price) as opposed to the business. CEO Roberts is entitled to as many as ~48M shares upon reaching certain milestones. There are 230M SOI for context. These milestones focus on share price appreciation and are easily achievable. In addition shareholders’ money is being used (up to 10-20% of total revenue) to promote the company in order to increase her stock compensation. I’d much rather management be incentivised to increase shareholder returns than line their own pockets at my expense.

WHK has some appealing aspects to it, in particular very strong tailwinds in the cybersecurity sector, expenses under control and approaching positive free cash flow and is founder led with skin in the game. However, my lack of trust in management means the bear case wins over the bull.

Bull Case

•Founder led with Ms Roberts owning 9.81%

•Modestly paid management and board – CEO earns $161,000

•No recent capital raise(s)

•Strong revenue growth; however, this is off a low base

•Expenses are growing much slower than revenue

•Cash from operating activities has improved over last 3 4Cs - $0.8M, $0.34M, & $0.176M

•CEO has a strong track record & is well regarded in the industry

•Strong balance sheet

•Strong tailwinds for cybersecurity industry fuelled by CMMC* being rolled out through to 2026 in the US

*Disclosure: not held

HIGHLIGHTS

• Invoiced US$2.1M in 2020 more than doubling invoiced US$1M in 2019.

• Collected US$953K relating to sales receipt from customers.

• Invoicing for the 4th quarter 2020 is US$273K.

• US$181K in receivables will be collected in January 2021.

• Executing on Phase 2 of current contract with U.S. Department of Homeland Security (DHS) CISA QSMO Cybersecurity Marketplace, as sub-contractor to Guidehouse (formerly PWC Federal), for $1.5 to $1.8M USD Fiscal Year 2021, starting October 2021.

• Executing on first Prime U.S. Federal Government CIO Cyber Risk Radar contract for base year and 4 option years, not to exceed $1.18M USD per year.

• Executing on next phase of Cyber Risk Program $400K USD contract via a Global Consulting Firm in direct support of a Global Manufacturer, including: advanced risk validation by Red-Team, prioritization and mapping to Company risk priorities and how to best mitigate top risks in 2021 via innovative best practices and solution options.

• Executing on and will be responding to new Task Orders, expected in 2021 first quarter, on second and third U.S. Federal Government Department CIO Contracts.

• Signed partnership agreement with a Global Insurance Group, with intent to tailor WhiteHawk online platform as a service for business clients has been delayed to March 2021.

• Engagement continues on two Proofs of Value (POV), one in the U.S. Financial Sector and one with a U.S. Government Agency.

• Sontiq/WhiteHawk Small Business Suite offerings to two U.S. Financial Institutions with 5,000- 10,000 current clients, as an annual SaaS contract, are under review by each institution’s new client services and risk teams respectively.

• New near term partnered opportunities with General Dynamics Information Technology (GDIT) and Red River.

• Developed, vetted and executing on new 2021 Strategy, to include growing Sales Pipeline across U.S. Federal Government, Defense Industrial Base and Industry, with broadened Go to Market Strategies in the U.S. and now including the Australian market.

• Underwent the due diligence to become an ESG (Environment, Social, Governance) Registered company, a new standard in measuring the sustainability and ethical impact that a company makes.

• COVID-19 Impact Update: o No delays in product line development, execution and client delivery o Sales engagement and virtual demo’s underway continuously o Able to hire top talent to meet current contract requirements and work and collaborate virtually.

• Continue to experience contract scoping and completion delays of 60 to 90 days, with government and industry procurement teams. Welcoming the 2021 U.S. Administration’s renewed focus on Cyber Risk and Resilience and the US market heightened awareness following on the SolarWinds hack, affecting both US Federal Government and major corporates.

• WhiteHawk finishes the 4th quarter with a cash position of US$2.4M and no debt.

DISC: I have a small holding

App 4D - Half Year Report

Revenues up 106%

Loss down 23%

Loss $1.3M

https://asx.api.markitdigital.com/asx-research/1.0/file/2924-02273981-6A993418?access_token=83ff96335c2d45a094df02a206a39ff4

I do not hold WHK