Started to take stock of Block today following last week’s release of its 2QFY2025 results. Have held since converting from APT shares in Jan 2022 but it has been a coffee can holding and have spent no time on monitoring progress. The APT conversion was almost the super-peak of XYZ, have been underwater since the conversion, and on hindsight, was not a good entry point at all, but the current trajectory looks very promising indeed.

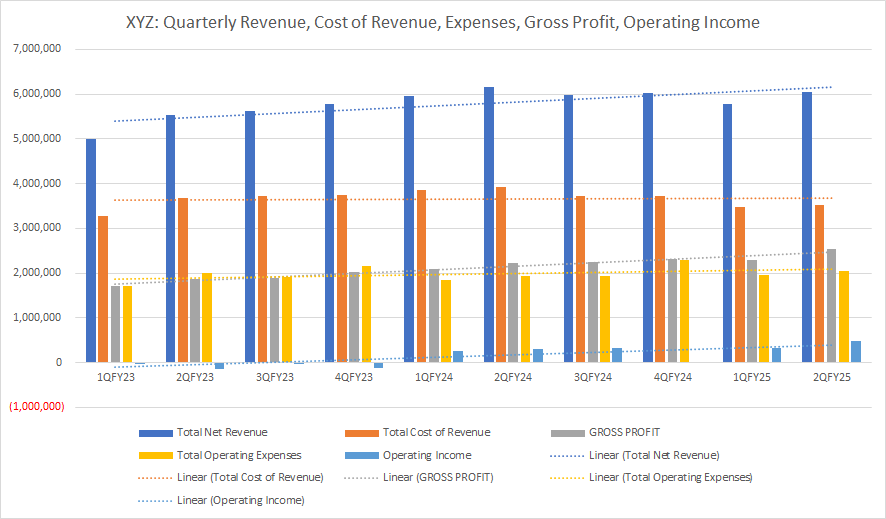

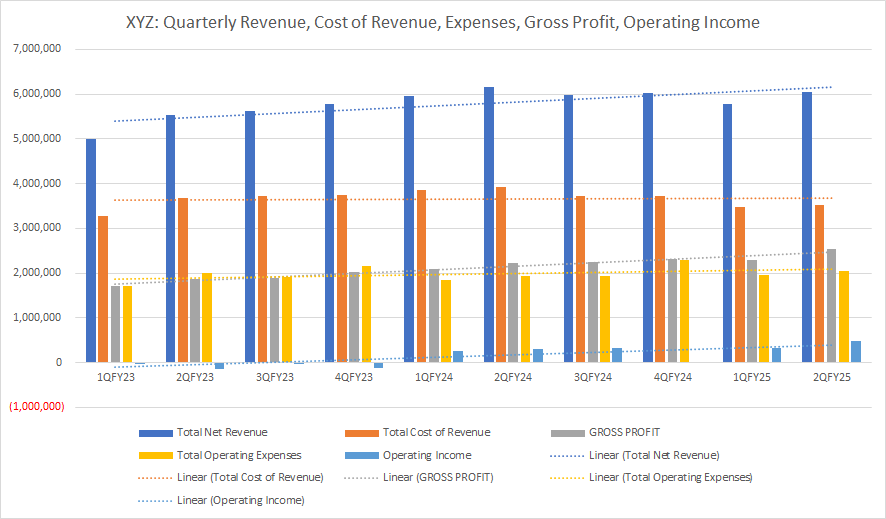

The following 4 quarterly charts from FY2023 tell the high-level story at a glance. Will need to have a good read of the 10-Q report to get into a bit of the weeds, but these basic charts gave a good feeling of where things are heading.

The initial overwhelming feeling is that it feels like operating leverage is kicking in nicely.

- Revenue - growing nicely

- Cost of Revenue - flattish

- Gross Profit - growing nicely as revenue grows against flat cost of revenue

- Operating Expenses - also flattish

- Operating Income - growing

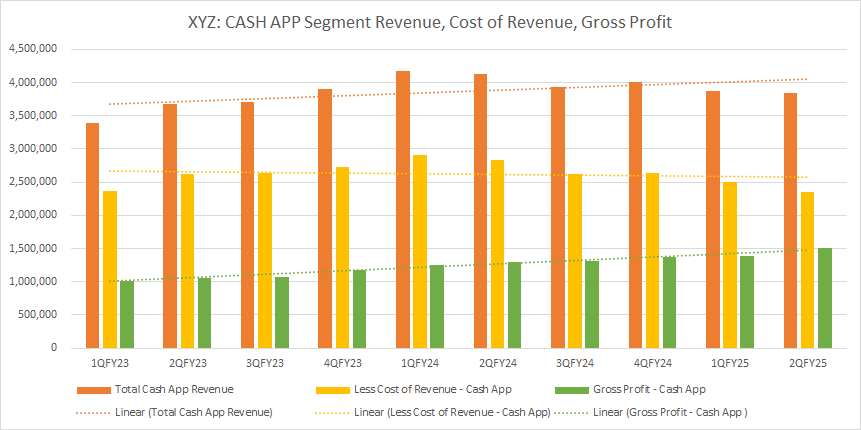

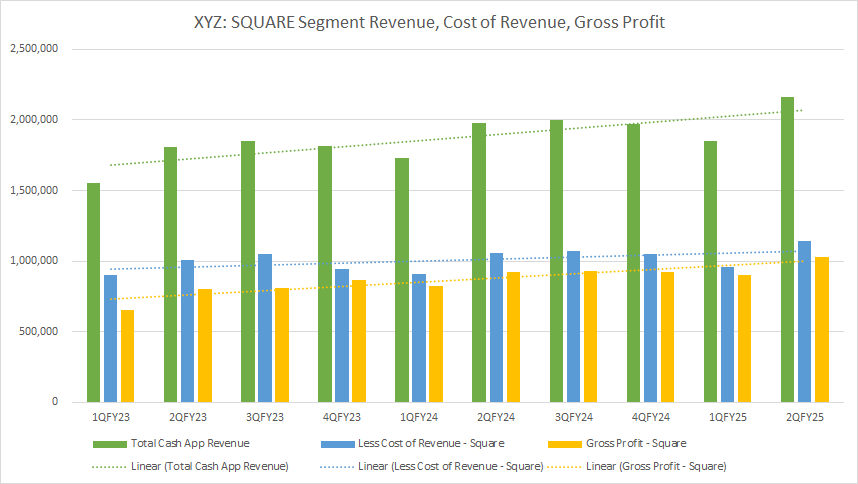

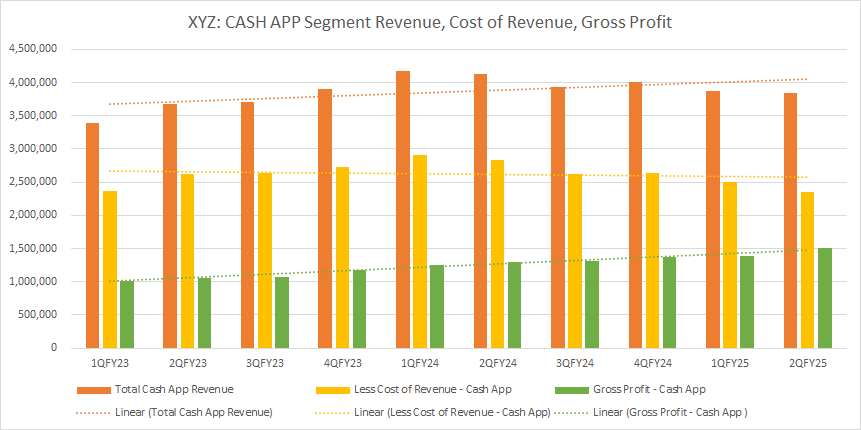

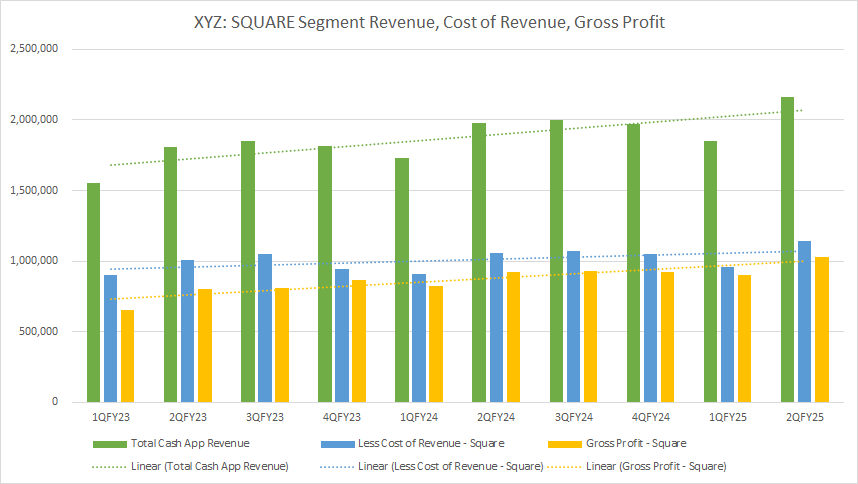

Same clear trajectory in the 2 XYZ Segments, Cash App and Square:

- Revenue - growing

- Cost of Revenue - declining for Cash App, marginally rising for Square

- Gross Profit - rising for both segments

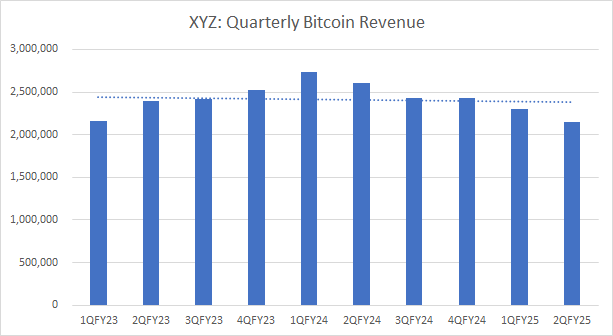

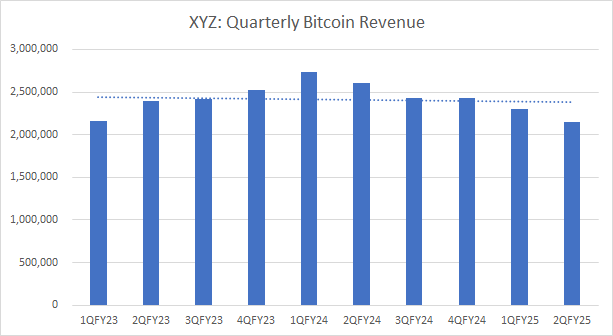

This may well be my proxy to gaining exposure to BTC .... revenue trend is flat to down-ish

Discl: Held IRL