Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Crypto Round Up reports:

Top stories in the Crypto Roundup today:

- Square Adds Bitcoin Payments for U.S. Small Businesses

- North Dakota to Launch Dollar-Backed Stablecoin With Fiserv in 2026

- Solana’s Jupiter to Launch JupUSD Stablecoin Backed by Ethena’s USDtb

Square Adds Bitcoin Payments for U.S. Small Businesses With No Fees for First Year

Square, the payments platform owned by Block (SQ), is launching tools that let small U.S. businesses accept bitcoin, convert sales into crypto, and manage everything from the same dashboard they use for day-to-day operations.

The new feature set, called Square Bitcoin, includes a built-in wallet and the option to automatically convert up to half of daily card sales into BTC. Bitcoin payments go live on Nov. 10 with no processing fees for the first year.

Square says sellers using early versions of the tools have already converted 142 bitcoin.

Bulls see compounding at scale.

Bears see an expensive growth mix with execution risk.

Q4 guide says offense. 3Q margin says caution.

08/21/2025

at 'X'.com 1.3K tuned in

>> Conversation notes no audio !! click at 3:18 minutes >> at 30:00 minutes discuss BTC -'No gate keeper'

I noted 'cash out' is XYZs focus..... OBJ started with Block now at cash out.

Block - Conversation with IR and Owen Jennings

https://x.com/blockir/status/1958279740822896980?s=46

Block did a X spaces for small retail shareholders. Goes for about half an hour. Well worth a listen

08/21/2025

·

Started to take stock of Block today following last week’s release of its 2QFY2025 results. Have held since converting from APT shares in Jan 2022 but it has been a coffee can holding and have spent no time on monitoring progress. The APT conversion was almost the super-peak of XYZ, have been underwater since the conversion, and on hindsight, was not a good entry point at all, but the current trajectory looks very promising indeed.

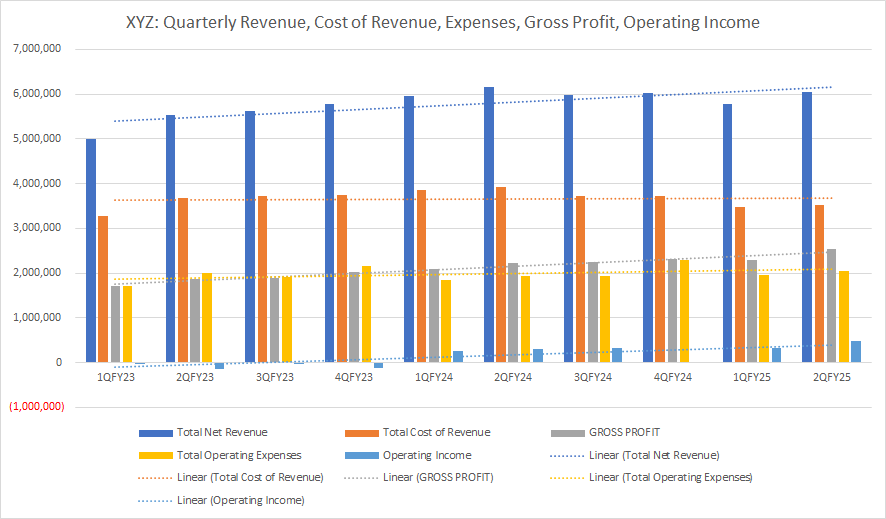

The following 4 quarterly charts from FY2023 tell the high-level story at a glance. Will need to have a good read of the 10-Q report to get into a bit of the weeds, but these basic charts gave a good feeling of where things are heading.

The initial overwhelming feeling is that it feels like operating leverage is kicking in nicely.

- Revenue - growing nicely

- Cost of Revenue - flattish

- Gross Profit - growing nicely as revenue grows against flat cost of revenue

- Operating Expenses - also flattish

- Operating Income - growing

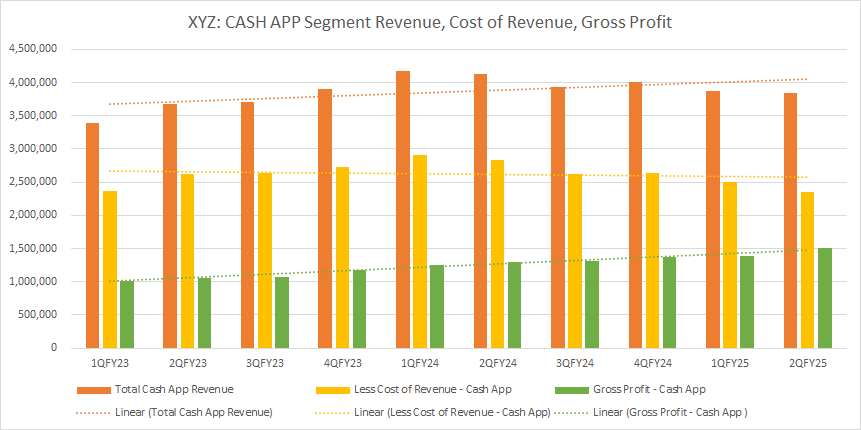

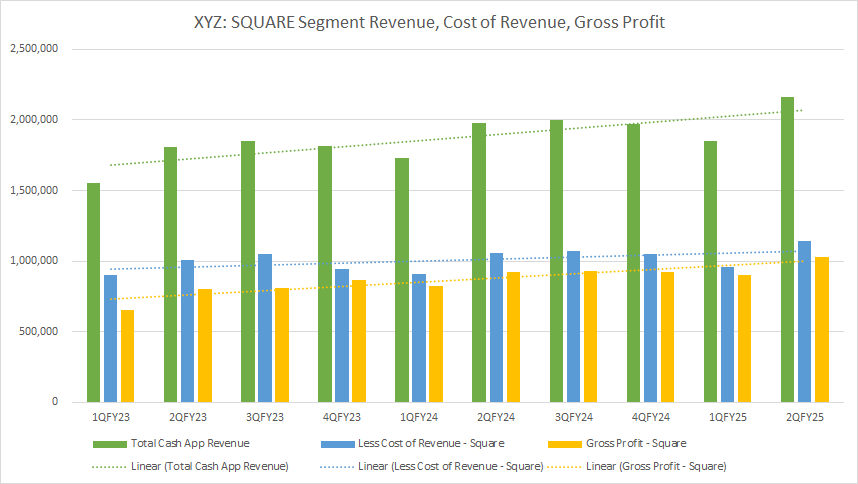

Same clear trajectory in the 2 XYZ Segments, Cash App and Square:

- Revenue - growing

- Cost of Revenue - declining for Cash App, marginally rising for Square

- Gross Profit - rising for both segments

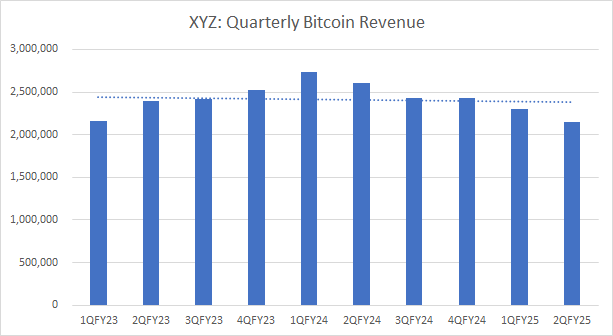

This may well be my proxy to gaining exposure to BTC .... revenue trend is flat to down-ish

Discl: Held IRL

Extract from motley fool:

Q2 guidance beat

Block share price jumps on results day

- Gross profit up 14% to US$2.54 billion

- Operating income up 58% to US$484 million

- Adjusted earnings per share up 31.9% to 62 US cents.

What happened during the quarter?

For the three months ended 30 June, Block was on form and reported a 14% increase in gross profit to US$2.54 billion. This was ahead of its guidance and driven by a 16% jump in cash app gross profit to US$1.5 billion and an 11% lift in Square gross profit to US$1.03 billion

Management notes that it outperformed its gross profit guidance thanks partly to the launch of new products across Square and Cash App to sustain strong growth at scale.

It also highlights that it drove year-over-year improvement across all key profitability measures and outperformed its profitability guidance in the second quarter of 2025. Operating income was US$484 million while adjusted operating income was US$550 million.

XYZ Friday at close of trade:

Return (inc div) 1yr: 45.01% 3yr: 2.42% pa 5yr: N/A

Disc: RL

"The Path to 2024 Earnings Recovery " Webinar = Westpac with parteners Sandstone

SQ2, 52 week low, any future here?

More from Sandstone: Sandstone Insights ( 15 day free trial)