We often use capital as a synonym for money in markets. We talk of capital raising, capital structure, capital adequacy… but that’s not what capital is. Not really.

So, at the risk of getting a little philosophical, I wanted to frame capital in the proper context. Partly because it’s interesting, but more so because a clear conception of capital gives us, as investors, the right lens through which to judge value. Or, more precisely, the potential for value creation.

Capital is better thought of as tools. Things that amplify human time and energy, and which, when combined with intent, form the foundation of our shared prosperity.

A saw, a furnace, or a line of code are entirely useless in and of themselves. You can’t consume them. It’s what they allow us to do that makes them valuable. And they, like all forms of capital, are the result of previously invested time and energy. They allow us to use our current time and effort in far more efficient and productive ways.

As Hernando De Soto puts it in his excellent book The Mystery of Capital (strong recommend, by the way), capital is economic potential energy.

In this way, we can understand money as a type of capital. It is, at its core, a tool. One that vastly enhances our ability to cooperate, coordinate economic activities, and store the fruits of past efforts. Money is capital. But capital is more, much more, than just money.

Capital doesn’t even need to be tangible. Computer code, as mentioned, qualifies. But so do knowledge, contracts, brands, and all manner of intangible IP. These are tools, and therefore capital. In fact, we ourselves are a type of capital — human capital — something that can be directed toward the production of other things.

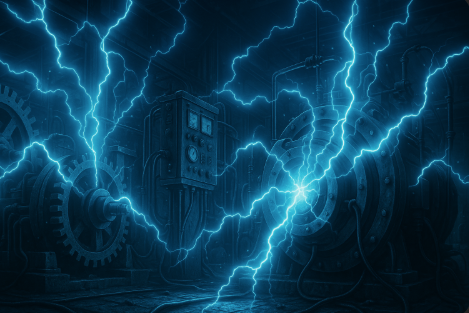

What makes capital truly extraordinary, and what blows my mind, is its ability to compound. Capital isn’t just the crystallisation of past time and energy. It is stored leverage, something that allows each new act of creation to build on the last. A blacksmith uses his forge to make better tools, which then help others build machines that create even better tools. Over time, this recursive improvement transforms what a society can do with a single hour of human labour. Civilisations rich in capital aren’t just those with more stuff. They are those where time and energy are continuously arranged in ways that make both more valuable.

Modern microchip fabricators, billion-dollar machines elegantly choreographed in form and function, trace their origins back to a monkey chipping rocks to make a sharp edge.

What a mind blow.

But this process is not automatic, and we shouldn’t take it for granted. Capital must be tended, directed, and renewed. It can decay if neglected, or worse, be misused in ways that destroy more than they create. That’s why the institutions and norms surrounding capital matter so deeply. When a society respects property rights, honours contracts, and rewards genuine innovation, it preserves the conditions in which capital can flourish. When it favours speculation, short-termism, or political favouritism, it quietly eats away at the very foundations that made it wealthy in the first place.

I’ll avoid going too far down that rabbit hole and instead bring it back to something more practical for share market investors.

The best businesses aren’t just those that possess capital, but those that transform it in novel and productive ways. If you want positive returns, they must generate real value for others. You and I might possess the same tools and knowledge, but what we manage to do with them can vary enormously.

What you want is a company that takes human creativity, tools, raw materials, and time, and arranges them in a way that amplifies output and strengthens the system around them. A company that builds capital leaves behind a larger and more capable productive base than it started with. It refines processes, deepens relationships, and compounds knowledge. Each success raises the probability of future success because the tools it has built make the next creation easier and more efficient.

Consider that almost all of the world’s largest and most profitable companies didn’t give us any new scientific or technological breakthroughs. What they did do was combine existing tools and know-how in new and interesting ways, producing outcomes that were far greater than the sum of their parts.

Amazon assembled logistics, software, and computing infrastructure into a self-reinforcing network of capital. Each component made the others stronger, allowing time and energy to flow more efficiently through the organisation. The result wasn’t just growth. It was accelerating growth, the hallmark of true capital formation. And what Amazon now offers serves as a substrate on which others can innovate.

When you see it, it makes perfect sense why progress seems to be accelerating. (Despite the ignorance and self-interest of too many of our elected leaders.)

That’s what equity investors are really searching for, even if they rarely phrase it that way. A company that compounds capital is a small civilisation in motion. It channels the time and energy of its people into structures that endure, adapt, and expand. It’s living proof that the system is working. That effort today can make effort tomorrow more productive. More valuable.

The hard part is that, from the outside, the successful orchestration of capital can be hard to see. In fact, capital destruction can look like progress when viewed myopically through short-term financial metrics.

Cash flows can rise (for a while) via the reckless financialisation, or even consumption, of the capital base. Revenues can grow as the underlying foundation quietly decays due to underinvestment in maintenance CAPEX, let alone growth CAPEX. Debt can prop up results via buybacks or acquisitions, without actually improving the quality or productivity of the business.

Ironically, companies working to strengthen their capital base often show poor surface metrics. Investment defers cash flows that might otherwise reach shareholders, but it’s a non-negotiable requirement for future growth.

That’s why metrics like Return on Invested Capital (ROIC) can be more informative than revenue or earnings growth alone, especially when measured over meaningful periods. Likewise, though harder to quantify, a management team’s philosophy toward capital is hugely telling (which is why I usually ask them about it). I’m far more bullish on a CEO who talks about how they create value, and how they plan to create more, than one who simply recites total addressable markets and revenue projections.

Understanding this helps you see through the noise of markets and narratives. It shifts the question from “what will go up” to “what will build effectively.” Because in the long run, value flows to those who compound capital. Those who make tools that make tools, and in doing so, keep civilisation’s flywheel turning.

When we, as investors, allocate wisely, we participate in something important. Capital allocation. One that, appropriately, rewards us when we do it well and punishes us when we don’t.

And here you thought you were just trying to make a bit of money.

You’re welcome, civilization 😉

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2025 Strawman Pty Ltd. All rights reserved.