IT services specialist The Citadel Group (ASX:CGL) revealed a rather large drop in profit for the last financial year, with post tax earnings coming in 43.8% lower at $10.9 million.

Still, this was largely expected with both revenue and operating profit (EBITDA) coming in almost exactly at the mid-point of company guidance. As telegraphed back in May, the business was impacted by customer-controlled project delays and the ongoing transition to a recurring subscription model.

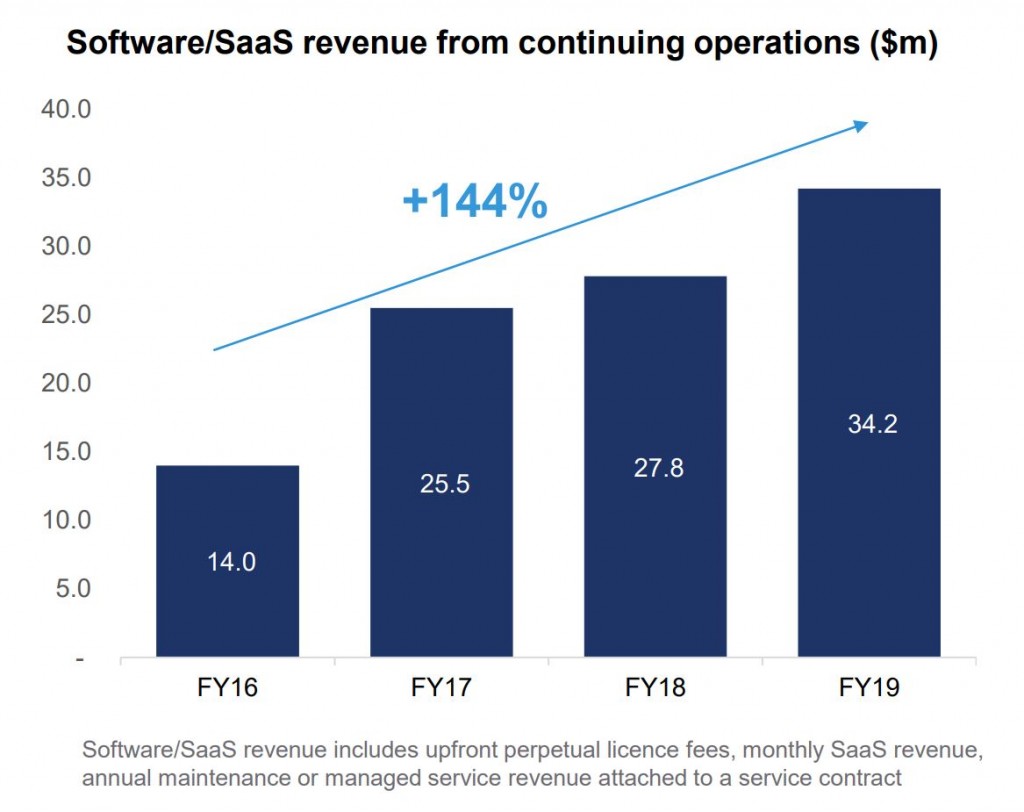

Indeed, software as a service (SaaS) recurring revenues — which improve visibility and lifetime customer value at the expense of near term sales — saw a 23% improvement from last year. With a significant ongoing R&D investment and strong customer growth momentum, this figure is expected to continue increasing in the years ahead.

Another silver lining was a flat read on selling, general & administrative costs, despite ongoing investment in team capabilities and growth initiatives. The company also managed to further reduce its debt, which dropped $5.8 million to $12 million, and is more than offset by a healthy $14 million cash balance.

Despite the drop in profits, the company rewarded shareholders with a steady dividend of 10.5 cents (fully franked) for the full year. At the current price, Citadel is trading on a yield of 2.5%, or 3.5% grossed up.

Management did not provide specific guidance for the current year, other than to say that they were targeting a return to growth and expected all segments show an improvement.

It’s been a difficult year for shareholders, with shares down over 40% in a market that has been rising strongly — especially tech oriented firms. The real question, of course, is whether these latest results are a sign of further troubles ahead, or just a blip on an otherwise impressive track-record and reflective of the strategic change to a superior revenue model.

For those that take the latter view, shares may be worth a closer look. Based on the latest results, shares are presently on a P/E of 19.4. Given the operating leverage typical of such businesses, it wouldn’t take much of an improvement at the top line to really boost profit in the coming years.

On the other hand, as we’ve just seen, services businesses tend to be rather sensitive to customer demand and a return to growth is far from certain in the short to medium term.

Ranked #27 on Strawman, The Citadel Group remains below the community’s consensus valuation. Click below to discover more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223