Shares in water treatment specialist Fluence (ASX:FLC) have surged over 11% higher in afternoon trade, extending gains from the last two weeks to an impressive 50%.

So, what’s going on?

The business

Fluence develops and manufactures modular water treatment plants which are used by a variety of industries including municiple, industrial, mining, power & agricultural.

Combined through the 2017 merger of ASX-listed Emefcy and US-based RWL, Fluence’s solutions are based on a patented Membrane Aerated Biofilm Reactor (MABR). They are fast to install, cost effective to run, and highly reliable.

The company claims a huge addressable market, and to be a global leader in this niche. China especially represents a significant market opportunity given the country’s 5-year plan has provided US$15 billion in funding for rural wastewater treatment. With some early traction in this large and growing market, Fluence looks well positioned.

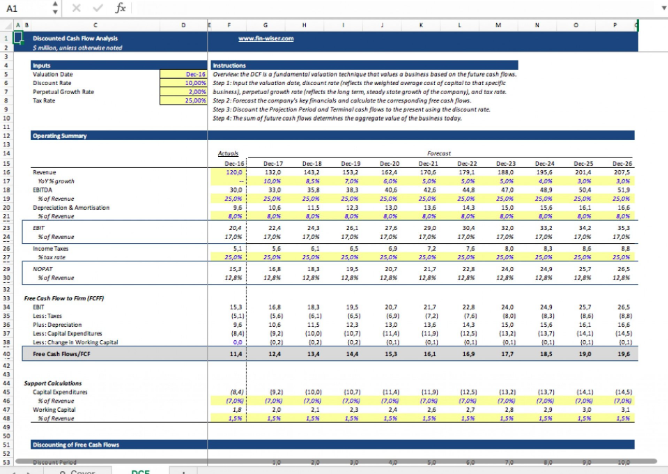

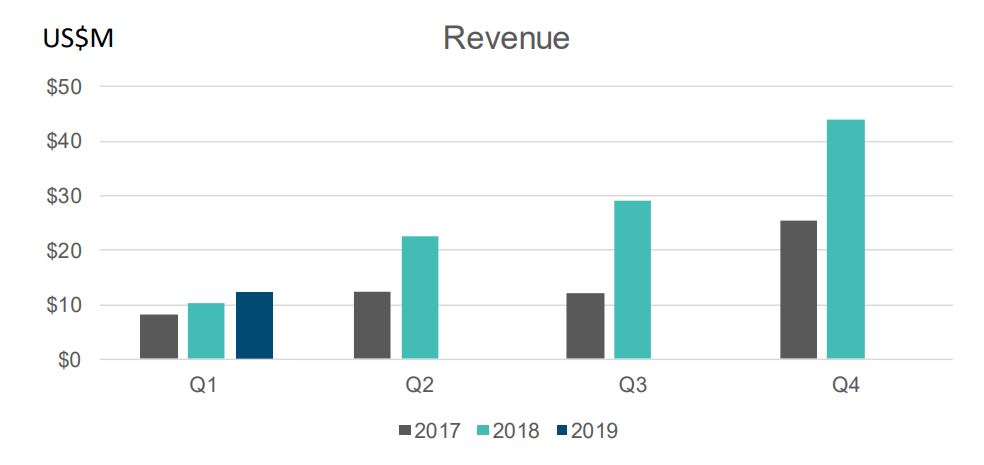

Although the business is still loss making, it has around US$24 million in cash and is on target to generate a positive operating profit (EBITDA) on a quarterly basis by the end of the current financial year. Fluence’s smart products solutions is expected to double revenues this year and it has secured some large contracts in the more traditional custom engineering segment.

What’s moving the market?

A 50% gain in a couple weeks is impressive, but there’s been no new news from the company. Indeed, shares tend to be rather volatile, with shares having more or less tracked between 40c – 50c for much of the past 18 months.

Indeed, it was only as recently as April when shares were last at these levels, before being sold off to a low of 36c.

With shares reporting on a calendar year basis, investors can expect a half yearly update prior to the end of August.

Should you buy?

With sales growing around 74% in the last full financial year, and the company fast approaching breakeven, a price to sales ratio of ~3 seems rather undemanding.

That being said, Fluence is not a software company and investors shouldn’t value it like one. Indeed, as of the last full year, gross margins are around 34%.

Nevertheless, if the business can pass the breakeven inflection point and continue to grow its base of recurring revenue, shares will likely trade at a higher valuation in the future. Especially given the very significant growth in the sector.

Ranked #48 on Strawman, shares are presently trading below the community’s consensus valuation. Click below to learn more.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223