I know a lot of people swear by them, but I think stop-loss orders are dumb. In fact, I’d go so far as to label them dangerous.

For those that aren’t familiar with these wretched things, they are simply a type of sell order designed to ‘stop your loss’ by automatically selling your shares if they drop below a pre-determined level. For example, you could buy shares at $1 and set a stop-loss at 90c, which instructs your broker to sell your shares — automatically — if ever the shares fall to that price or lower.

Promoted as a ‘get out of jail free’ card, they promise to limit your losses while still giving you exposure to all the potential profits. In other words, all the gain with hardly any pain.

It sounds too good to be true — because it is.

In reality, all they usually do is force investors to lock in regular losses while (severely) limiting their potential returns. Oh, and they significantly increase trading costs (which is why brokers love them so much).

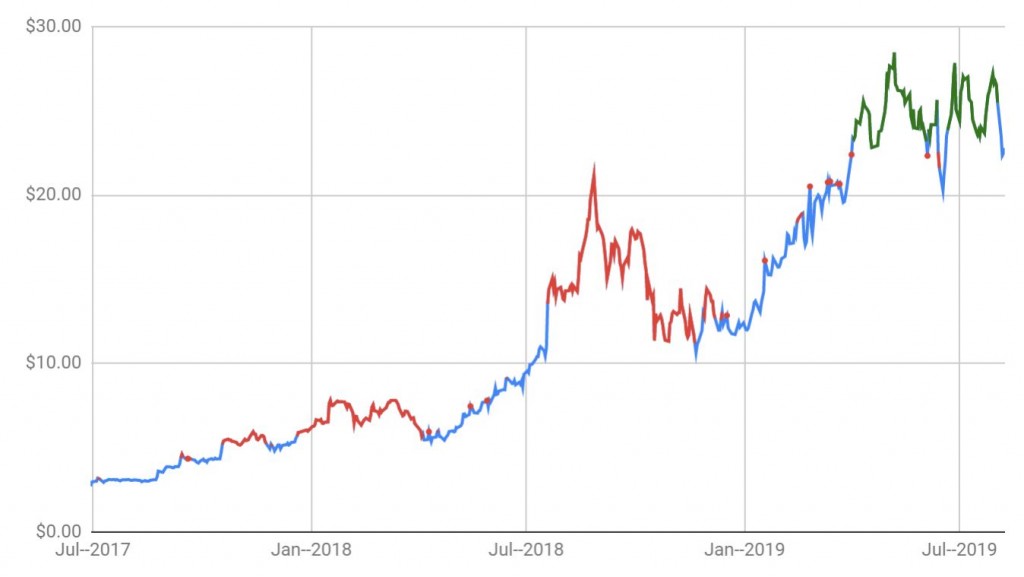

Consider the experience with AfterPay (ASX:APT); a stock that has climbed over 740% in the past two years. Had you purchased at any point within that period, and set a stop-loss 5% below your buy price, you’d have been stopped out a total of 312 times or 58% of the time.

On no less than 75% of those occasions, all you would have done is sell out at a price that was below the current one. The forgone profit, in most cases, would have been substantial.

Red highlight represents entry points where a 5% stop-loss was the wrong move. Green is where it helped prevent further loss

The only instances that worked in your favour were those triggered recently, and even those may ultimately prove to be a mistake. Time will tell.

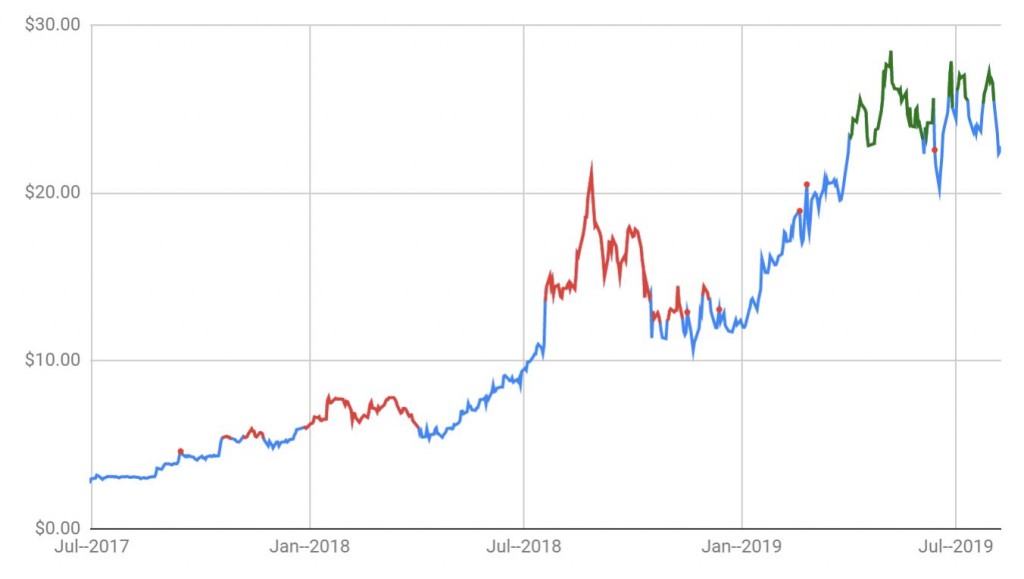

I know, advocates at this point will be screaming that I set the stop-loss “too tight”. Well, if i set the sell at 10% below the trade price, the story is about the same. You’d still see a forced sell 244 times, and 85% of the time it would prove a poor move.

Red highlight represents entry points where a 10% stop-loss was the wrong move. Green is where it helped prevent further loss

Whatever AfterPay’s long term fate may be, the fact is that all of the best long-term gains come in spite of volatility, not in its absence.

The great irony here is that in an effort to avoid losses, we instead locked them in. And, to rub salt into the wound, we missed out on some spectacular longer-term gains in the process

Of course, there are instances where a stop-loss may prove worthwhile — but they are the exception to the rule. In general, the only time a stop-loss works out is when the falls are significant and lasting. And even then investors can still get caught out.

It’s important to stress that stop-loss orders are not guaranteed. If your broker cannot find a willing buyer at your pre-defined sell price your order may never get filled. For the truly big disasters, the very ones you’re trying to avoid, prices tend to ‘gap down’ — there are simply no buyers at or near your pre-set sell price.

Just look at Rural Funds Group (ASX:RFF), which this week saw shares drop 42% in one day after the release of a damning (but as yet unsubstantiated) short report. The fall was so quick it would have been impossible for most stop orders to be filled.

I know that many people swear by them. I’m expecting plenty of people to disagree with me. But for my money, they are the antithesis of sensible long-term investing.

Now maybe — maybe — they have a role to play for those that like to speculate using short-term, highly active trading strategies. If ever I meet a successful practitioner of such an approach I’ll ask them. But for the long-term investor, they should be avoided like the plague.

A decision to sell shouldn’t be predicated on an abstract price level, specified well in advance of any news that may induce a drop in the share price. The fact is that shares often fall because of unrelated issues. They are simply volatile by nature. Even when there is specific and negative news, the market has a tendency to overreact.

Deciding to sell before you are aware of any facts, based entirely on an anchoring of your purchase price, is ludicrous. Call me crazy but, to my mind, selling is a decision that requires careful reflection.

Remember, volatility is par for the course. It’s the unavoidable price of higher long-term returns. Indeed, risk in general cannot be avoided, and no one will ever find a solution that insulates the investor entirely.

There’s just no such thing as a free lunch.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223