Shares in digital audio networking supplier Audinate (ASX:AD8) have taken a dive recently, on the back of a protracted period of no significant news. Already on a sky-high price-to-earnings multiple of over 750 at the time of writing, is the drop justified or is this a buying opportunity?

What does Audinate do?

Audio visual (AV) signals have traditionally passed through cables and equipment as analogue signals, however Audinate is looking to reset the standard to digital.

OEM partners embed Audinate’s ‘DANTE’ hardware and software technology suite within their own products which are easily recognised and ‘meshed’ together as a network. It’s a distinct improvement on what historically has been a very time consuming and difficult task in the days of analogue configuration.

After a number of years fending off other competitors, Audinate has now developed a market leading position and looks set to establish a powerful moat. In fact, some major competitors have reportedly admitted that Dante is looking more and more likely to become the industry standard world-wide.

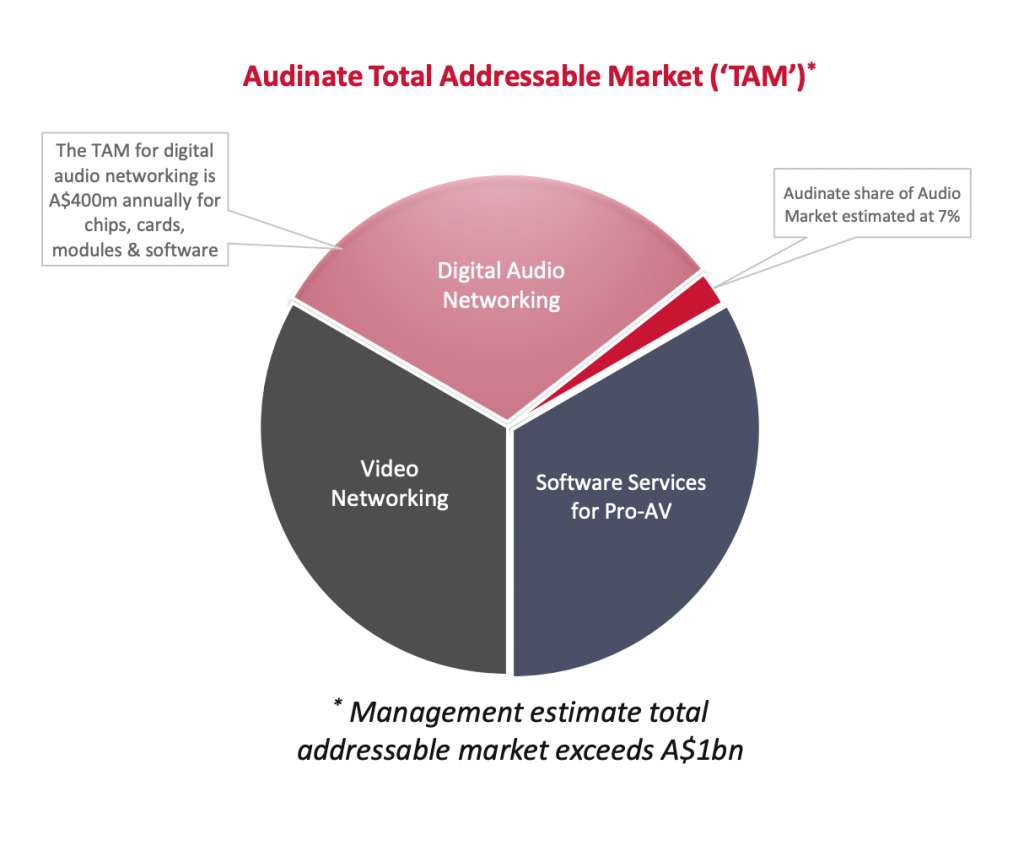

Because the total addressable opportunity, estimated by management at over $1bn, is in theory all Audinate’s to capture (or indeed lose) it has understandably driven some investors to consider shares cheap.

Is the moat really that good?

Even so, the high price-to-earnings means that execution is critical, and any missteps will be treated by the market with impunity. Long term, there is the additional risk that more dominant brands, such as Yamaha, Sennheiser or Sony for example, will reject Dante and muscle their way in by spending big and grabbing market share with their own standards.

If this were to happen, the relative minnow Audinate may be in for difficult times, but so far none of the big names have made any serious attempts to supplant them.

Should you buy?

In FY19, Audinate booked a profit after tax of only $600k, (FY18 $3.3m after tax losses were brought forward) which although small relatively speaking, continued the upward trajectory that doesn’t look like slowing down any time soon.

With the half year report due any week, any sign of weakness may see its multiple come crashing back down to earth. However, if management are to be believed then we can expect revenue growth in FY20 of between 26% and 31%, which when coupled with historically impressive gross margins, should see much of the revenue flow straight to the bottom line. Furthermore, the balance sheet remains healthy, with a recent capital raise likely being the last one needed in the medium term to fund growth plans.

A Strawman favourite, Audinate is still undervalued by the community and might be worth a closer look.

Ben Stevens is a Melbourne-based private investor and Director of design studio Blendid. He specialises in working with passionate founders from innovative companies to establish their brand, find their voice and ultimately drive results.

Follow him on Strawman, or on twitter.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211