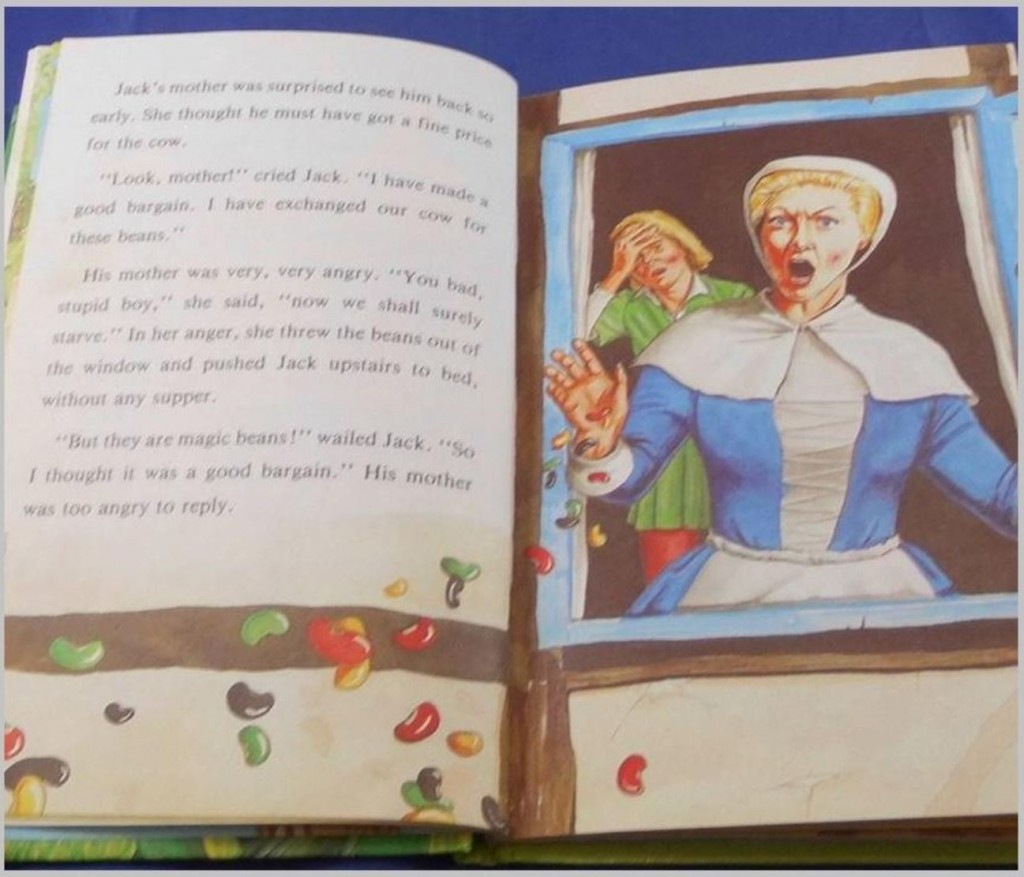

I remember being read the story as a kid. I could tell even from the pictures that Jack was in all sorts of trouble just for accepting those jelly beans from a complete stranger. The accompanying narrative confirmed this, and Mum must have been really fond of that cow too. I didn’t have the cynical vocabulary at the time, but I intuitively knew that Jack had been a bit of a tool and in that moment I pitied him. Silly Jack…but really he was just a kid, and maybe he should have still been at school and Mother should take a bit more adult ownership of the household finances?

A few decades later and I’m only just realising that the four year old me was smarter than I am now in some pretty crucial ways. It has only now dawned on me that I have been buying Magic Beans. And as a retail share investor in Australia I have been far from alone in this pursuit.

You see, it has only been recently brought to my attention, on this very forum in fact, just how important it is to establish a real (and very unmagical) numerical dollar value for any share you choose to buy, sell or hold. A value independent of its present market value.

All of us, at some point along the line, have decided to put some of our hard-earned cash out there and swapped it for something with a bit more colour – exchanged boring old ‘Bessie’ the cash cow for something that promises a bit more growth and better returns. But to the extent that those of us don’t commit to understanding the fundamentals of value investing that’s where those beans retain too much of their mysterious and magical properties for my current liking.

I haven’t been flying completely blind mind you, but I’ve definitely been navigating the financial world the hard way. It’s a world of scary bone devouring giants and the temptations of golden egg-laying geese. In this fantastical realm not all the laws of physics and nature are suspended however. Even without a precise and formulaic calculation of ‘fair value’ you can still make comparisons of the relative values between two different sets of Magic Beans. You can make educated and reasonable guesses about macro trends for Magic Bean futures or dabble in researching predictive weather patterns for optimal beanstalk growth. However, for as long as you do this without being able to calculate your value of your shares you are allowing yourself, at some level, to be in the Magic Bean business.

Not knowing your systematically calculated value of your shares means you could be more prone to paying top dollar for beanstalks that won’t grow, or – perhaps worse – selling yourself short and cutting down your beanstalk before it reaches the heights of giants.

Fundamental analysis demystifies. It takes the magic out of the beans and standardises your comparisons. Think of fair value as the financial equivalent of calories per hundred grams on the back of your baked beans can. It allows you to see just how much sugar someone is adding to the sauce and accurately measure its nutritional value compared to that can of sauce-free ‘four bean mix’. If you, like me, find yourself putting in a forecast on Strawman and writing nothing in the notes then you may just be my Magic Bean brethren. And if you are interested in learning more on the topic I would refer you to Strawman’s own Forum Post (How Do You Value a Share?) during which he posted a link to Rask Finance. There are some free video tutorials there that I am still working through, but so far they are the single easiest practical resource that I have come across to learn the professional magician’s tricks when it comes to counting those beans.

My plan is to stop being that guy who is merely happy with taking a not unreasonable guess of the number of jelly beans in the jar. When it comes to my investments I now want to be the nerd who looks at the type of jar, finds a similar one, takes it home and – armed with pen, paper, spreadsheet models and a small pack of lollies from the chemist – wastes much of his Saturday before getting back out to that school fete and wins his kid that prize by guessing the number of those beans to within the smallest margin possible. That bloke might not always enjoy it, and if he talks too much about this hobby he’s not getting invited to too many parties anymore, but man does he get results. Kind of like Dirty Harry…but also really, really not.

Article first published on Strawman forum 22/09/2018

Return to the Strawman Platform here

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223