Herbert Stein, an American economist, once observed that if something cannot go on forever, it will stop.

That’s hardly a groundbreaking insight. But just because something is self-evident doesn’t mean it’s widely understood.

Indeed, much of modern economics and finance is predicated on the belief that the future will largely mirror the past. To be fair, that’s not a terrible heuristic; a simple extrapolation of recent trends can serve as a useful guide for what comes next.

It’s just that long-lasting trends often end abruptly and without much warning. When a paradigm shifts, it usually does so violently.

Financial history is full of such examples.

Japanese property prices plummeted in the early 90s after a decade of incredible, seemingly unstoppable growth. A decade later, most tech stocks fell off a cliff following a long period of rapid expansion. Even the housing market in the U.S. — once considered too vast to experience a coordinated and aggressive slump –crashed under the weight of massive, unsustainable debt.

In all these examples, and many more besides, the trends were long-lived and considered something of a “new normal.” Those who questioned them were seen as cynics or even crackpots — a perspective that gained merit each day their predictions of doom and gloom failed to materialize.

And yet, in all cases, the naysayers were simply observing the unsustainable nature of things. They were, eventually, right. Of course they were — trees simply do not grow to the sky!

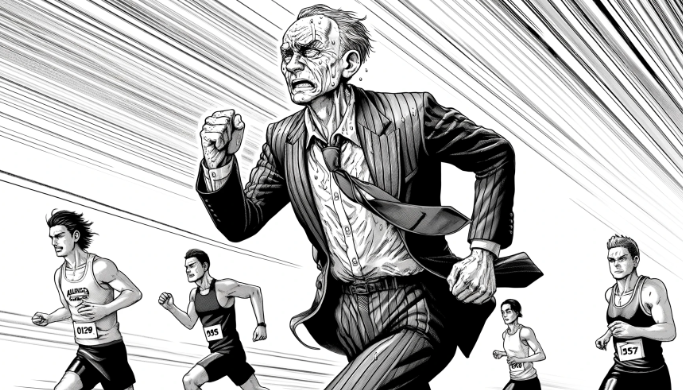

Their error was not in their conclusion but rather in their timing. They failed to account for Pepper’s Law, which, in essence, suggests that unsustainable trends almost always last longer than expected.

It’s a recognition of the human tendency to underestimate the endurance of unsustainable situations, particularly in markets or political environments. It suggests taking any estimate of how long something can last and then doubling it.

A great example at present is the U.S. debt and deficit situation. It’s simply a matter of logic and basic arithmetic that the world’s largest economy is on an entirely unsustainable path — but that has been the case for a long time. This particular can could well be kicked much further down the road before there’s any real reckoning.

We also see examples of Pepper’s Law in small-cap stocks all the time. How often have you looked at a cash-burning, dumpster fire of a “business,” only to watch its share price continue to soar? And then, just when it seems like the madness has reached its limit, the share price doubles again!

Conversely, you may find a wonderful little business that continues to execute brilliantly and trades at a ridiculously low multiple, yet its share price seems to go nowhere, sometimes for years.

So how does a practically minded investor square this circle? How does one reconcile Stein’s observation with Pepper’s Law?

Market timing is the easy answer. You simply participate in the market’s folly but make sure to get off the train before it crashes. The only trouble is that no one in history has ever managed to do that with consistency.

You could instead choose to sit on the sidelines until rationality returns, but you could be waiting a long, long time. The opportunity costs could be massive.

No, the sensible approach, in my opinion, is to optimize for endurance and be highly selective.

You should never do anything that represents an existential threat, no matter how enticing the rewards may seem. If there’s a potential — even a remote one — of something wiping you out, stay away. You can always recover from a loss, even a big one if it’s part of a broadly diversified (and uncorrelated) portfolio.

Recovering from zero is a totally different matter.

And remember, you have the luxury of choice and can be very fussy with what you choose to invest in. Even in the most euphoric and irrational of bull markets, you’ll still find pockets of sanity and value. Likewise, even in a dire economy, there will be businesses in rude good health.

You’ll still face periods of underperformance. Not every investment will work out. But you’ll stay in the game, and over time, as things mean-revert to a more sensible footing, your discipline and patience are likely to be very well rewarded.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.