There’s plenty to love about medical imaging software powerhouse Promedicus (ASX:PME).

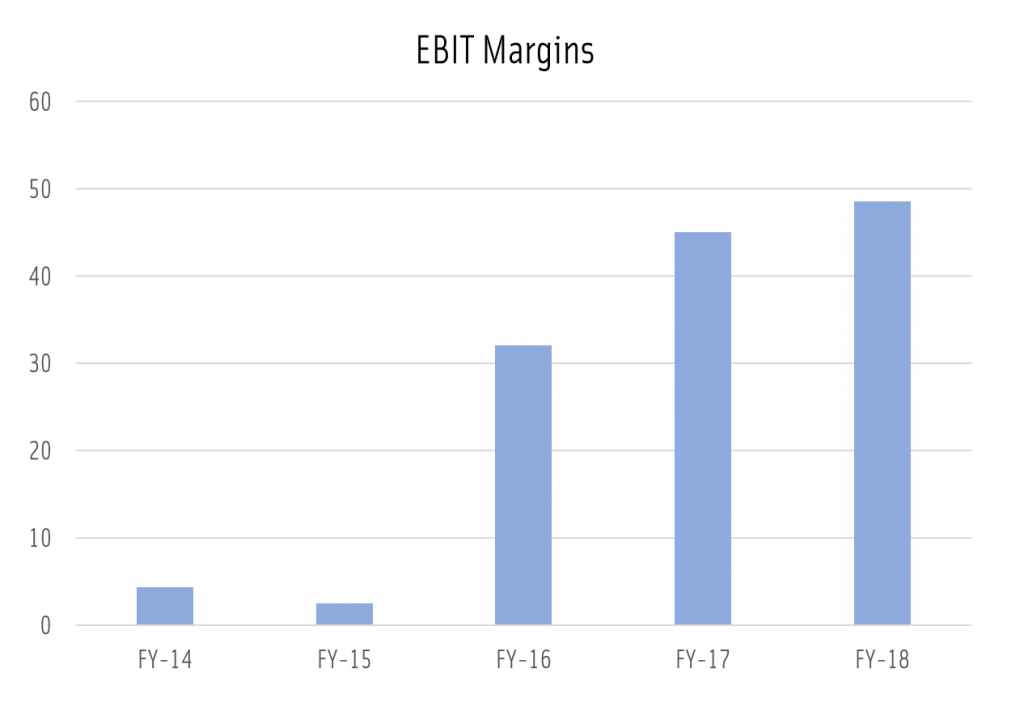

A founder led, highly profitable disruptor in a large and fast growing market, the business enjoys potent network effects and high switching costs. The balance sheet is rock-solid, costs are well managed and the business should continue to scale well as sales rocket higher. Just look at these mouth watering margins:

Given the structural change within the industry, which is still in the early stages, and the business’ clear dominance, there’s still a long way to run. And given the extremely defensive nature of revenues, the business is about as recession proof as you can get. Heck, you can even throw in the current hotness of AI, which in this case is more than just hype.

Yes, Promedicus sure does tick a lot of boxes. All except one…

Value.

Following the latest surge in price, shares now sit at roughly 70 times forecast sales for FY2019. The forward PE is around 182! (For context, the long-term market average is around 16.)

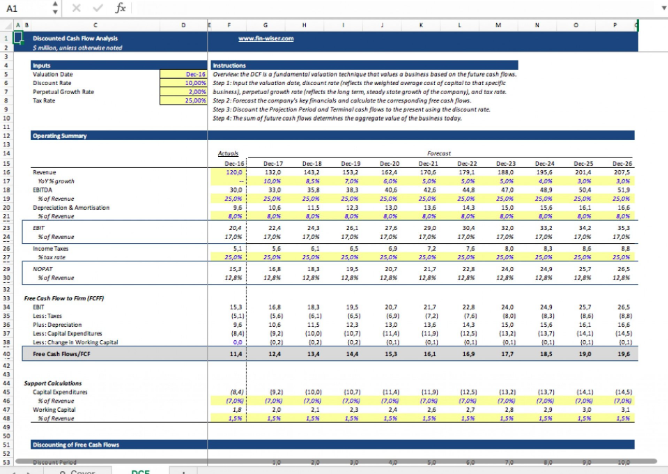

Of course, sales are growing rapidly — likely around 40%-plus for FY2019 — and we’ve already seen how the strong operating leverage is causing margins to explode. Promedicus should be able to sustain high rates of growth for a good while yet; analysts are assuming top-line growth of at least 25% per annum over the next 5 years.

Being too fussy on price for high-quality, fast growing companies is a definite mistake. Nevertheless, no business is worth an infinite amount and therefore, by definition, it is entirely possible to pay too much and achieve disappointing returns — or even losses — despite continued strength in the underlying business.

The global imaging market is worth around US$2 billion, and is growing fast. If Promedicus ends up with the lion’s share, and maintains strong operating margins, then the it’s possible to make an argument for value. But there’s very little margin for error.

Promedicus has been a longtime favourite in the Strawman community, but has dropped down the rankings in recent times on concerns over the valuation. Now ranked at #40, shares currently sit almost 30% above the consensus valuation.

Click below to learn more…

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223