Big technological and structural shifts tend to hide in plain sight. When they do finally draw some attention, they tend to look like exaggerated hype. And most of the time that is exactly what they are.

Even when a genuine shift is underway, progress feels painfully slow. The promise is always a touch out of reach. Something shinier shows up, headlines move on, and the thing you thought would change everything looks like it has stalled.

And then one day, without a single defining moment, the world has changed.

Someone born in 1890 watched their life move from horses and lanterns to cars and electricity in a way that must have felt like both rapid and inevitable, at least in hindsight. That’s something that probably resonates for many of us that lived through the internet and smartphone revolution.

There’s a retrospective time compression, of sorts, which distorts our sense of how quickly change unfolds.

Behavioral psychologist Daniel Kahneman draws a distinction between the “experiencing self” and the “remembering self.” The experiencing self lives through a slow and often frustrating grind, while the remembering self looks back and turns that grind into a neat story that creates an illusion of speed and clarity.

Our sense of time just gets bent out of shape when we look back.

There are lessons in all this for investors, especially if you like to play in the worlds of tech, growth and disruption. These areas can be insanely lucrative when you get them right, but they are also crowded with false starts and convincing head fakes.

If that is where you like to dabble, here are a few things that can help you stay on the right side of history.

You don’t need to get in early

Transformative shifts take time to reveal themselves. The experiencing self sees years of trial and error, while the remembering self later edits that chaos into a tidy highlight reel. That little trick of memory makes it easy to believe the real money went to the people who jumped in at the start.

In reality you can miss the opening act and still capture most of the upside. Buffett didn’t touch Apple until 2012 and only this week added Alphabet (Google). Time will tell how the latter plays out, but the Apple trade turned out rather well.

Leaping at every shiny new story is an excellent way to exhaust your capital. It is usually wiser to let things mature, wait until the trend is close to undeniable, and then back the players who are clearly pulling ahead.

Be slow to sell

Once you hitch your wagon to a disruptive technological change, try to avoid the itch to lock in profits too early. Doubling your money in a few years feels pretty good, until you look back a decade later and realise you cut short what might have become generational wealth.

That is not to say you never sell. You still need to think about portfolio weightings. But the real money tends to be made in the waiting, not the trading.

Avoid the fake outs

Even the most legitimate game-changing technologies, and the companies riding them, never take a straight path to dominance. There are always speed bumps and blind alleys that will test your resolve.

History makes that painfully clear. The eventual winners often endure brutal drawdowns on the way up. Amazon, Netflix and Nvidia all handed shareholders multiple but temporary crashes. Even Berkshire Hathaway, hardly a poster child for tech disruption, has lived through three drawdowns of 50% or more.

If you panic sell on every wobble, you will almost certainly regret it. The real skill is learning to tell the difference between normal volatility and genuine deterioration in the business.

Spread your bets, a little

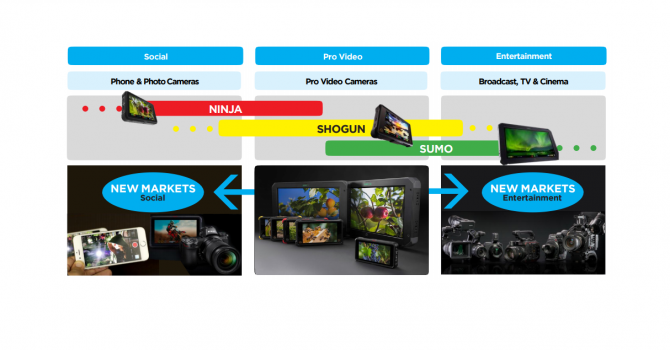

Technological mega-trends are rarely owned by a single player. You don’t need to cram all your eggs into one basket to benefit from a big shift. Several companies can, and usually do, thrive as a new ecosystem forms.

At the same time you don’t want to spread yourself too thin. Where network effects are at play, the landscape usually tilts toward a winner takes most dynamic. The art is holding enough names to stay alive, but few enough that the eventual leaders can actually move the needle for you.

Ignore the sceptics (mostly)

Every major technological shift has had to overcome a mountain of fear, uncertainty and doubt. There is always an army of well-credentialed experts ready to explain why the whole thing is a bubble that will never amount to much. And the incumbents with the most to lose rarely miss a chance to throw a bit of shade.

That doesn’t mean you ignore good faith pushback. You absolutely want to understand the bear case and test your assumptions. Just remember that the biggest and most important changes almost always look unlikely at the start, which is why independent thinking matters so much.

Be extremely patient

This is probably the most important part, and definitely the hardest.

Big changes take a long time to play out. At least, long by the standards of our experiencing self.

Once you have a clear and high conviction view of the future, you tend to assume everyone else will grok it soon after. And when they don’t, it can be extremely frustrating. But shouting at a flower will never cause it to boom — you just have to let time do its work.

Final thoughts

Big shifts usually start slow and look unimpressive. Tinkerers tinker, markets wobble and early adopters complain. It feels like a lot of work for little progress.

But if the tech solves a real problem and strengthens with each user, novelty can quickly turn into inevitability.

If you notice an acceleration in adoption and signs of genuine product-market fit, the advocates stop needing to push because the world starts to pull. The value becomes so obvious that not opting in becomes more than inconvenient. It starts to look more like self harm.

Importantly, none of this is about trying to predict the future in any precise way. It is about spotting when the present has already started to shift.

It will be painful as hell for your experiencing self. But in the years to come your remembering self will smile, nod and pretend it all felt obvious.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2025 Strawman Pty Ltd. All rights reserved.