High growth gas producer Senex Energy (ASX:SXY) today announced that its major investment Project Atlas is now operational, after first lease was granted in March 2018.

Senex partnered with major energy infrastructure provider Jemena to build, own and operate a 15 petajoule per annum (40 TJ/day) gas processing facility. Natural gas from Project Atlas will supply major Queensland manufacturers including CSR, Orora and O-I.

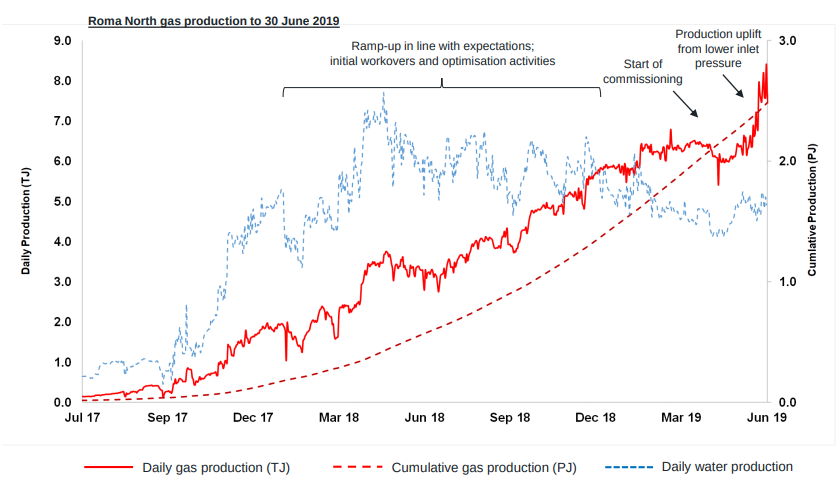

Since July 2017, Senex has ramped up gas production significantly in its Roma North fields and has cumulatively produced 2.5 petajoules of gas, reaching 8 terajoules per day at the end of FY19.

With the addition of gas from the Project Atlas site, management’s target of delivering a Surat Basin gas production rate of 18 petajoules per annum by the end of FY21 seems achievable – and signifies immense growth in the top line. As with many mining and energy businesses, however, costs must be watched with a hawks eye. Cash presently sits at $12.7 million, although it would appear the majority of high CapEx new projects have passed.

Is Senex a buy?

After increasing revenues 34% to $94.1 million and operating cash flows from $5.3 million to $44.5 million in FY19, it would seem the current market cap of $516.9 million is still pricing in a lot of further growth.

Senex, like many other energy and mining companies is not a widely held position on Strawman, sitting at #140 in the company rankings. This may be for good reason, as this industry typically requires very high upfront costs, involves significant execution risks and margins are at the mercy of commodity pricing.

However, with many of the early stage hurdles now cleared, it could be worth a closer look.

Strawman is Australia’s premier online investment club. Join for free to access independent & actionable recommendations from proven private investors.

Disclaimer– The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at admin@strawman.com.

This Service provides general financial advice only, and has not taken your personal circumstances into account. Strawman Pty Ltd operates under AFSL 501223 . For more information please see our Terms of use. Please remember that share market investments can go up and down and that past performance is not necessarily indicative of future returns. Strawman Pty Ltd does not guarantee the performance of, or returns on any investment.

© 2019 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service | Financial Services Guide |

ACN: 610 908 211 | Australian Financial Services Licence (AFSL): 501223