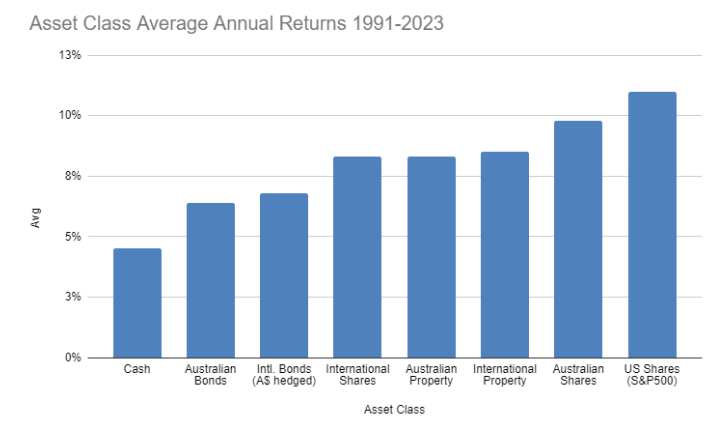

According to Vanguard, here’s what the various asset class returns look like since 1991:

Kind of what you’d probably expect; the further you move up the ‘risk spectrum’ the better the average returns.

Sure, the differences don’t appear huge, but they add up over time.

But you know this. It’s no doubt part of the reason you’re here.

So this isn’t another sermon on the merits of long-term equity investing. In fact, let’s try and take a more realistic look at things.

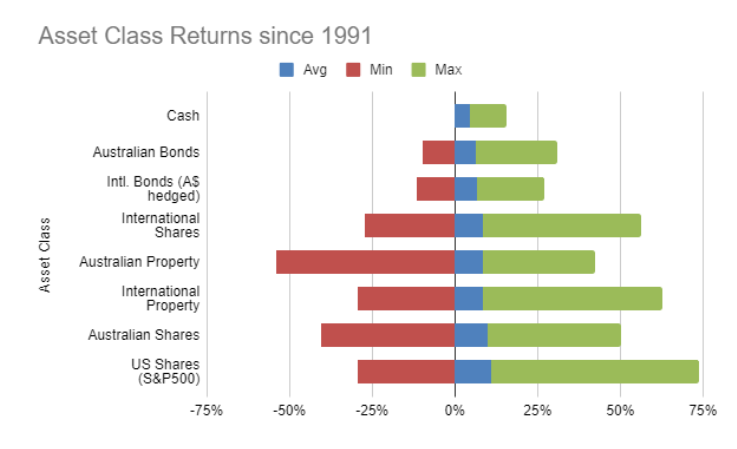

The truth is that the superior returns offered by equites come at a cost.

(Before any property people get upset, please note that Vanguard is using the S&P/ASX Listed Property Trust Accumulation Index for Aussie property.)

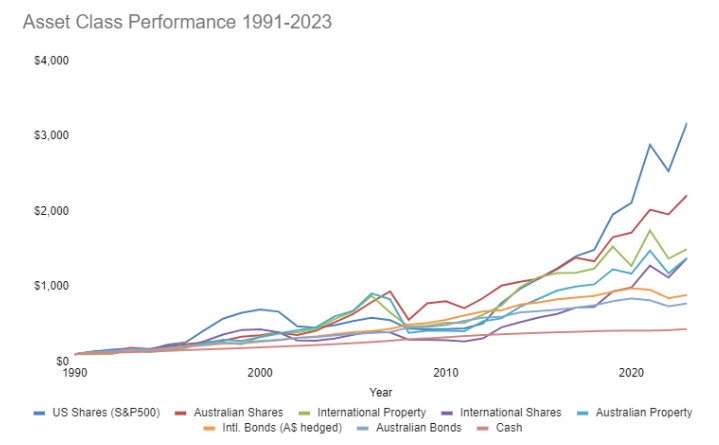

This is the same data, from the same source, just presented differently. And it’s worth noting we’re looking backwards from a vantage point of being very near record highs.

Also, even though we’ve just looked at the extremes with this chart, the standard deviation for the various equity classes was between 16-20% over the period. Which is just a fancy way of saying that you need a big range to capture most of the data points.

In fact, less than one in five years saw a return that was within 2% of the long term average. So while you may be reasonable in targeting a ~10% average annual return, you’ll rarely score that in any particular year.

You’ll also find that when you do suffer a drawdown, it can take a long time to get back to the highwater mark. And this can cause a huge knock to your confidence.

I’ll use myself as an example here:

My Strawman portfolio is down no less than 35% from the 2021 highs. Ugh..

Yes, things have been good over the last year, and the long term average is something I’m proud of, but it’s been a very rough ride with a lot of soul searching along the way.

The crazy thing is that if my ‘since inception’ returns were lower, but my portfolio was currently at a record high, and still ahead of the market average, I’d have a much happier view of things.

Intellectually I know that the blue line is the better path, but part of me would prefer if I had instead followed the red line — even though I’d be poorer as a result.

It messes with your head. Then again, that’s what markets do.

Anyway, Vanguard is right to highlight the superior long term returns that equities offer. If you’re investing for any reasonable period of time you want to make sure you have a lot of exposure here.

Just know that it will be anything other than smooth sailing, and in any given year your returns are unlikely to be anything like what long term averages may suggest.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.

| Privacy Policy | Terms of Service |

ACN: 610 908 211