“10-baggers” — stocks that appreciate ten-fold in value — are the stuff of dreams. Especially when the gains are delivered in a relatively short space of time.

Sure, they don’t come around too often, but they’re perhaps not as rare as you might think: according to S&P, there have been no less than 52 stocks on the ASX that have experienced a 1000% capital gain at some stage over the last 5 years.

Some familiar names include Wisetech (ASX:WTC), Biome (ASX:BIO), Droneshield (ASX:DRO), Nuix (ASX:NXL), Vysarn (ASX:VYS) & Lovisa (ASX:LOV). And, as you may expect, a bunch of miners that struck proverbial (or literal!) gold.

We all look on these with envy and silently despise those that were fortunate enough to hitch a ride on these rockets. But while it’s true there is always a degree of luck, these returns were anything but easy.

Some research from Adam Parker at Trivariate is illustrative. He conducted an analysis of 84 stocks with a market cap greater than $2 billion and trading over $30 million in average daily volume that had appreciated by 10x or more within a rolling five-year period. The conclusion? Almost all experienced brutal and long-lasting drawdowns along the way.

In fact, on their way to the moon these stocks, on average, suffered drawdowns of 48% which lasted an agonising 114 days.

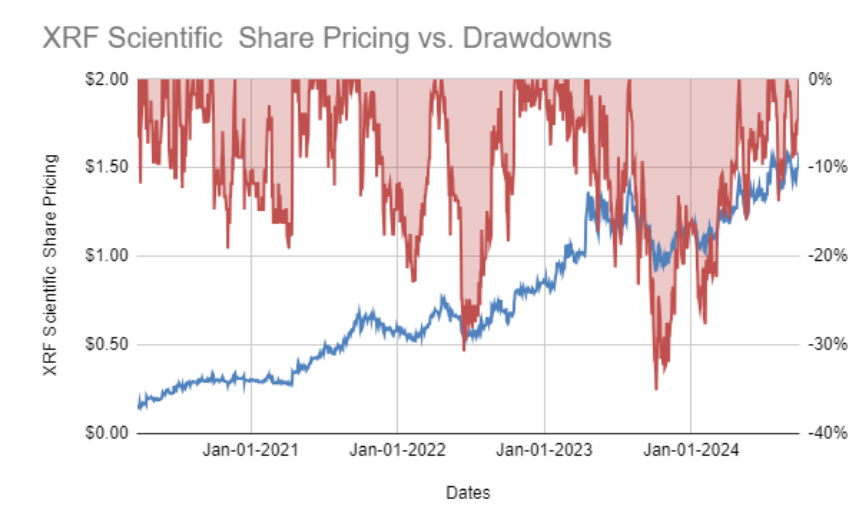

XRF Scientific (ASX:XRF), presently ranked #4 on Strawman, offers a good illustration. Between March 2020 and today, shares have gone from 14c to $1.60:

Zoomed out, the price history (blue line) makes the journey look somewhat straightforward. The percentage drawdowns (red line), on the other hand, paint a very different picture.

There were loads of ~20% pull backs and even a couple of 30% drops from previous highs. As is the case for all stocks — even those that have delivered exceptional long-term gains — most of the time XRF shares traded below a previous all time high.

And, as you can see, the time between old and new highs was often many months. At one point, it took nearly a whole year before shares were able to surpass a previous high.

Intellectually, that’s not a long time. In practice, it can feel like an eternity.

As hedge fund manager Clifford Asness has said:

“You look at most of the historical drawdowns…and say “yeah, of course, I would’ve stuck with that.” Well, maybe. But those 18 months of horror and 5 years or so of drawdown weren’t 18 months and 5 years to you. We have long borrowed a term from physics for this effect: time dilation. That 18 months and 5 years for you felt like forever, and many who look at the backtest and think they could’ve taken it, even added to it, really couldn’t have (partly as they are often simultaneously looking at the fact that it ended up fine, something not available real-time).”

Those who have endured such struggles know that while there’s always some degree of luck involved, these gains are very much earned. The cost being many a sleepless night agonising over whether it’s time to take the money and run.

The “so what?” here is that you’ll never enjoy a 10-bagger if you panic at every (inevitable, and often sizeable) pullback. And you’ll never yield the full benefit if you’re continually ‘taking profit’ and ‘resizing’ along the way — not that that isn’t often a sensible thing to do, but you have to be careful not to overthink it, especially when the underlying business is continuing to deliver.

Mainly, though, the lesson here is that volatility is your constant companion, even for those businesses that are ultimately destined for greatness.

Success is never a straight line.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2024 Strawman Pty Ltd. All rights reserved.